Dylan Jovine calls this the biggest opportunity he's seen in 75 years.

He's talking about a Rare Earth Metal that is so valuable, it's being stored in a brand-new facility that’s as secure as Fort Knox. One tiny company has an exclusive contract to secure this critical material and the gain could be massive.

The Teaser

The Rare Earth Metal in question is being loaded onto trucks like the one in the image below around the clock and the Pentagon is having these trucks sent to Texas.

This lets us know right away that this mystery material is a matter of national security.

Dylan Jovine is the founder of the Behind the Markets newsletter service and a veteran of the game. Having previously started and sold Tycoon Publishing to Agora Financial. I've reviewed some of Dylan's picks here before, including his “War Games” Weapon Stock Picks and CRISPR Stock – A “Living Software” Company.

We're told that without this material, our fighter jets wouldn’t fly…

Our tanks wouldn’t move

And our missiles wouldn’t shoot

Not only this, but the material is needed for every single cellphone, satellite, battery, and car of the future.

If I were to venture an early guess, this material could be Nickel, Lithium or Neodymium. But it's too early to tell.

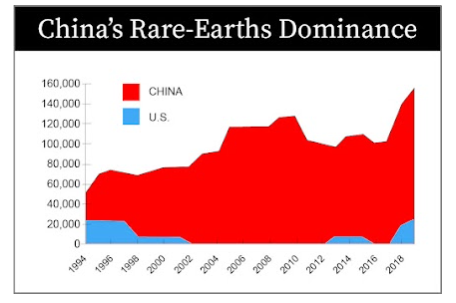

The Country that Controls 80% of the World's Rare Earth Metals

The very Rare Earth Metals that are critical for much of the military’s arsenal, are 80% controlled by China.

They also own almost all of the Rare Earth mines around the world.

For example, nearly half the world’s supply of Cobalt can be found in the Congo. But China controls 15 of its 19 Cobalt mines. If they were to cut the U.S. off from its Rare Earth Metal supplies, it would be ruinous.

A recent EU Commission report confirms this, stating “Rare Earth Metals will soon be more important than oil.”

This is the primary reason why the Pentagon is backing the company Dylan is teasing here. The military desperately needs an alternative supply of Rare Earth Metals to continue to build its weapons. If we know its name, Dylan says we'll be able to “book gains as high as 8,990%.”

The Pitch

The only to find out the name and ticker symbol of Dylan's pick is by getting a copy of Unfair Advantage: This Rare Earth Stock Just Got Hired by The Pentagon.

For this, we'll need a subscription to the Breakthrough Wealth research service. The cost for this advanced, specialized service that profits from Dylan's network of Wall Street connections? Just $997 for a limited time. It comes with a 30-day money-back guarantee, 1-2 new recommendations each month, sell alerts to maximize profits, and more.

The Rare Earth Metals Critical for Over 200 Products

Dylan says we're at the early stages of something huge.