Oil is back from the April 2020 abyss when it dropped below zero.

The commodity is already up big since that dark time and Charles Mizrahi says we may be in for another 10x boom over the next five years. But we shouldn't just buy any old oil company to profit, as there's a “#1 Oil Stock for 2023” that could make us historical gains.

The Teaser

If you thought oil prices were high when oil hit $120 per barrel last year, you better buckle up, because we could be amid another 1,000% surge in oil prices.

“My first week was a positive experience adding 7.8%.” this is a customer testimonial about Charles Mizrahi, the kid from Brooklyn who spent 37 years on Wall Street before blessing us with his experience in investment newsletter form. We have reviewed Charle's investment services in-depth here at Green Bull and also revealed some of his previous stock picks.

The reasoning behind such a sharp increase is several-fold.

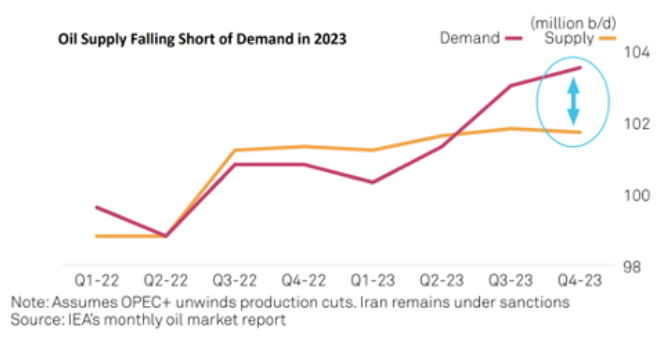

For starters, the Biden administration's stifling energy policies have caused production to seriously lag behind demand at the worst possible time. According to the International Energy Agency (IEA), the world will consume upward of 104 million barrels of oil each day by the end of this year and production will fall short.

America is perfectly capable of becoming a net energy exporter.

After all, it did become self-sufficient with net energy exports in 2019. But if production isn't allowed to grow or worse if it is cut, then worldwide supply is going to be seriously handicapped.

And Economics 101 tells us exactly what happens when soaring demand meets shrinking supply…

10x Oil Boom

We need fossil fuels to supply our energy.

Oil still fuels 97% of the world's transportation. Even if we mined all of the earth's known minerals to manufacture batteries and build solar panels, it still wouldn't be enough to completely replace the role fossil fuels play today.

Since the world's population is increasing, it won't be enough in the future either. This is why Charles says he hasn't seen a more obvious investment opportunity in the last several years and after screening hundreds of stocks, he's found his top pick.

It’s a company with easy access to hundreds of millions of barrels in proven reserves and it could be the best investment of the decade.

The Pitch

This company is revealed in a special report called Buffett's First Choice: How to Make 1,000% Gains on Oil's Next Rise.

The report is ours if we become members of Charles' 8-figure Fortunes small-cap research service. How much does this research service cost? $1,495 for the first year, with a 12-month 100% satisfaction guarantee, which is commendable. For this price, we would also be getting timely trade alerts, a model portfolio, and weekly market updates on things that could affect our investments.

Buffett's Second and Third Top Oil Stocks

In 2022 Buffet made two huge oil investments:

- Occidental Petroleum (NYSE: OXY)

- Chevron Corp. (NYSE: CVX)

Berkshire Hathaway is now the single largest owner of OXY and Chevron is the mammoth holding company's third-largest holding overall. But Charles says neither of these stocks is Buffett's preferred oil play.

Instead, it's a relatively small oil producer with a market cap of around $3 billion, that is aggressively returning cash to shareholders while paying down debt and growing its business.

The only reason Buffett and Berkshire cannot buy this stock is because it is simply too small to make a difference to its gargantuan $322 billion investment portfolio. As a former Berkshire shareholder, I can tell you this is correct and the man himself has admitted as much in the past:

See, back when he was first starting out and running an investment partnership in the pre-holding company days, Buffett was largely buying intrinsically undervalued, small/mid-cap stocks and holding them until they became overvalued.

Small is Better?

When it comes to investing at least, small-cap stocks, defined as businesses with market caps between $300 million to $3 billion. Have outperformed their large-cap counterparts, especially during recessions.

According to a recent study, small-caps have generated better returns during tough economic times, like the kind we're in now, since the late 1980s.

Combine this with recent production cuts from multiple OPEC nations and the emptying of half of the U.S. emergency oil supply, and we have all the pizza toppings necessary for a markedly higher oil price.

So what is the best small-cap oil company to buy right now?

Revealing Charles Mizrahi's #1 Oil Stock for 2023

We're fed quite a few clues about Charles' top pick, including:

- That it owns 2.5 million acres of drillable land.

- It has more than 650 million barrels in reserves under its land.

- It generated $600 million in operating cash flow in fiscal year 2022.

- The company has raised its dividend six times over the last 18 months.

- The producer has also spent another $104 million returning capital to shareholders by way of a special dividend.

The oil stock Charles is teasing is here is California Resources Corp. (NYSE: CRC). Here is how the clues match up:

- CRC owns the largest privately held mineral acreage position in California, with approximately 1.9 million net mineral acres.

- As of last year, CRC's estimated proved reserves totaled more than 500 million barrels of oil equivalent (boe).

- Generated a record $690 million in operating cash flow in fiscal year 2022.

- Has a two-year track record of increasing dividends.

- Returned more than $370 million in total to shareholders last year through dividends and share repurchases.

1,000% Gain Over the Next 5 Years?

As we already know oil prices are going higher over the long term and by the looks of it, over the short term as well. Is CRC the best small-cap oil play for our bucks?

I did find out that the company filed for bankruptcy protection back in 2020, during the great oil collapse of that year. But this helped it more than it hurt.

The oil producer got to restructure and reduce its debt load, which now sits below $300 million and by doing so, also raise its margins. Which are now 33% and the highest since the company's inception in 2014.

With an estimated $330-$440 million in projected free cash flow in 2023 and no need to reinvest the majority of it back into looking for more oil given its already large proven reserves, it will almost certainly return more cash to shareholders. This will push the stock price up and if the price of oil also materially goes up, as it is already doing. We may not have to wait five years for CRC stock to rocket.

California Resources Corp. should be a holding in any basket of small/mid-cap oil producers, as barring a complete collapse of oil prices a la 2020, the intrinsic value of the business is more than its current market cap.

Quick Recap & Conclusion

- Charles Mizrahi says we may be in for another 10x oil boom over the next five years and there's a “#1 Oil Stock for 2023” that could net us historical gains.

- This is an oil stock that Warren Buffett would buy if not for the humungous size of Berkshire's portfolio and all the macroeconomic stars are lining up behind it right now.

- The name and ticker symbol of this company is revealed in a special report called Buffett's First Choice: How to Make 1,000% Gains on Oil's Next Rise. We can get our hands on the report by becoming members of Charles' 8-figure Fortunes small-cap research service for $1,495 for the first year, with a 12-month 100% satisfaction guarantee.

- The oil stock Charles is teasing is here is very likely California Resources Corp. (NYSE: CRC).

- CRC owns the largest privately held mineral acreage in California, has estimated proved reserves totaling more than 500 million barrels of oil equivalent (boe), and throws off lots of free cash flow that it regularly returns to shareholders. There is a lot to like here, as its asset base easily covers its liabilities and exceeds its present market value.

How high do you think the price of oil ultimately goes? Give us your best guess in the comments section.

If you run across someone mentioning a beryllium stock I think it is MTRN. Bill Carlson

Thanks, I’ll check it out…I enjoy your detective work.

“Has a two-year track record of increasing dividends.”, and it pays a whopping 2.88%. I think that I will pass.

I think a large deposit of graphite on the Perian basin in Texas has been verified? Any comments on that? Thank you.

Nadine Meade…….. nadinemeade1@yahhoo.com

Could you identify the 5 stocks Tim Melvin is teasing in his MVP Letter? Here is the link: https://www.investorsalley.com/landing/join-the-mvp-letter-today/?a=9042&t=mvpdedjoemvp1melvin040923

Thanks!

Here is a hot, important new one. Anders, are you on this? Enrique’s at it again:

https://secure.empirefinancialresearch.com/?cid=MKT729984&eid=MKT731544&step=start&plcid=PLC176395&SNAID=SAC0030611228&encryptedSnaid=b0dKKejE%20WAu31BZFErgwt58rPr7X0HAhcj10NsdrAE%3D&emailjobid=5330440&emailname=04.16.23%20EEG%20Chat%20GPT%20Ded%20-%20EFD&assetId=AST294677&page=2

I can’t help but consider Marc Lechtenfeld’s pick, PBT, a royalty company that pays from the whole of the Permisian Oil Basin.