Chris Hurt is here to tell us that he “loves America”. One of the reasons for his adoration is because “There are more ways to get rich in America that you can shuffle a deck of cards”. But despite this love and affection for country, he says that “WE'VE ALL BEEN DECEIVED”.

If you are as angry and confused about the deception as Chris is, then he has a solution that every American is entitled to. It's called “a financial fast pass that for once, pushes you to the front of the line” and empowers you to make exponentially more money than everyone else. Chris Hurt is not talking about stocks, options or cryptocurrencies here, so what is he talking about?

The Teaser

Right off the bat, we are brought in with exclusivity. As Chris says “99.999% of Americans know absolutely nothing about this fast pass”. Of course, the mainstream media is not helping matters either. As they continue to hide the truth from us.

There isn't much too much information available on Chris Hurt, but we do know that David Forest (is in the teaser screenshot above), Doug Casey and the rest of the team at Casey Research have been helping self-directed investors earn superior returns through innovative investment research designed to take advantage of market dislocations, for the better part of 30 years. We have covered our fair share of click-bait titles in the past, including America's Boldest Financial Experiment and Buffet's #1 Private Investment.

Rewind back to 2020, some of the few people who got their hands on these fast passes…saw “peak gains of 2,800%, 8,620%, and — get this — 8,900%”. Yet how many people heard about any of these windfalls being made? Few are making any effort to inform people that these so-called fast passes even exist.

This begs the question, if these “fast passes” are so good, then why don't more people know about them? Apparently, it is because these are private financial incentives. They are distributed by a private network of around 700 private U.S. businesses and “controlled exclusively by the private citizens who run those private businesses”.

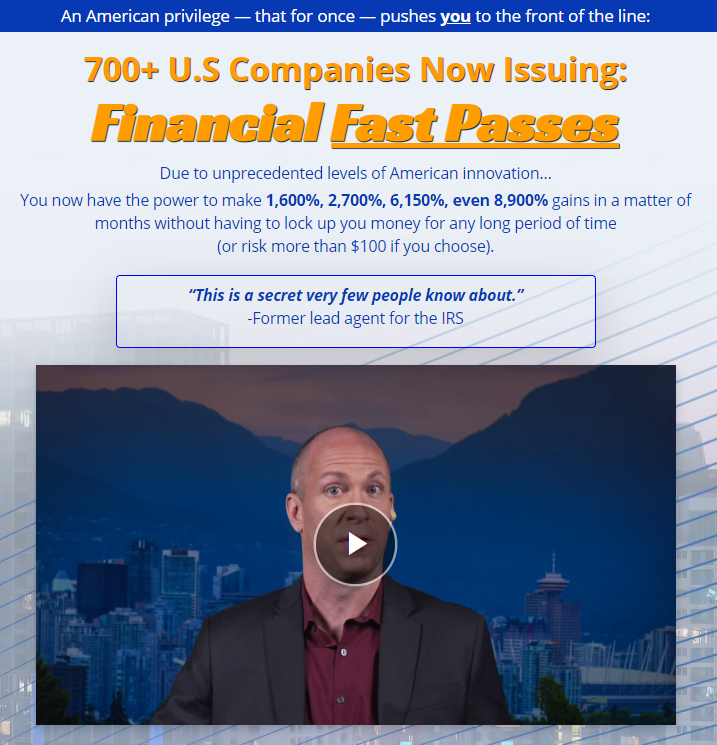

The Financial Industry Regulatory Authority of America (FINRA) even uses the word “privilege” when describing these fast passes. It's under bylaw 11840.

The underlying problem is. Unless we read every page of every public filing, we are NEVER going to know who is issuing fast passes, and when. This tips us off to the fact that “fast passes” are nothing more than public company issued security instruments. But if they are not stocks or options, then what type of security are they?

Ladies and gentleman, what these “fast passes” actually are is Warrants and David Forest has some recommendations for us about which companies' warrants we should be buying.

The Sales Pitch

This is what we have to fork over some money in order to find out. The entire teaser is a pitch for the Strategic Trader newsletter, which normally costs a small savings per year of $4,000. But for a limited time, we can get a subscription for half the price or “only” $2,000 for the first year.

Included along with the Strategic Trader subscription is David Forest's Warrants Master Course for free. Along with several special reports, including The Complete Guide to Warrants: The World's Most Explosive Securities and access to a complete archive of research.

What are the Best “Fast Passes” to Buy?

Since we now know that “fast passes” are simply stock warrants, which are often just as easy to buy as a stock and also usually cheaper than a stock. What companies are issuing the most lucrative type of warrants to buy into?

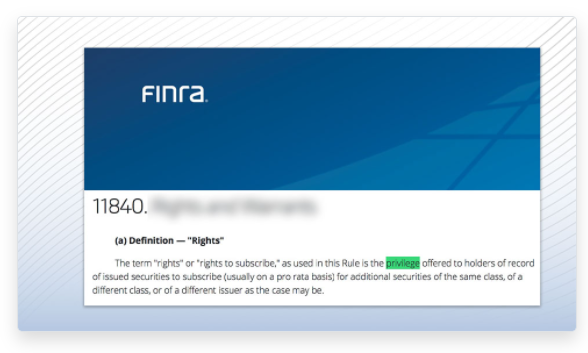

Dave tells us that “the majority of warrants today are issued by what are known as SPACs (Special Purpose Acquisition Companies)”. As most regular readers will already know, SPACs are shell companies that raise money to take private businesses public.

Problem is, from 2015 to July 2020, 89 SPACs have taken a company public. And out of those 89, the average return was a negative 18.8%. In fact, only 26 of these SPACs delivered any positive returns.

To drive the point home that SPACs suck, Dave tells us that “there are approximately 732 warrants issued right now and 569 of them are being issued by SPACs”. Leaving us with exactly 163 warrants to choose from. This is because he only recommends warrants issued by “real businesses with real sales, real products, and real growth”. A sound choice.

We are next told that Skillz Inc. is one of these businesses. Since I have personally never heard of this business before now, I was a bit surprised to learn that they have developed around 100 games for smartphones (think Angry Birds, but just not as popular). Not only this, but they have created a platform where people can literally enter gaming tournaments and win money. The stock itself is up by as much as 340% since July of 2020.

As you might be able to guess, Skillz has also issued stock warrants. Info which was buried in their 10-Q (quarterly report filing) from May 7, 2020. These warrants have gone up by an unreal 1,600% in the past eight months.

But this is just one example, with many more out there just like this one. In this instance, we would have to concur with the author. At the end of the day, warrants are just one more way for businesses to raise money. Something which the majority are and always will be looking to do, in this respect we shouldn't experience any shortage of warrant-buying options. So what other warrants does Dave recommend buying?

The Three Warrant Plays Set to Triple

Dave admits that it has taken him about ten years to figure out his warrant investment criteria, which returned him 250% in 2020 alone. He says a warrant needs to meet three conditions before he will consider trading it:

- Time (expiration date)

- Underlying stock

- Volume

Granted these are broad and some additional insight is warranted (see what I did there,) In regards to the first point, Dave “only recommends warrants that are expiring three to five years from now”. Secondly, the stock has to have incredible upside potential, and lastly, if there aren't at least 10,000 warrants trading per day on average, in terms of volume, Dave “would not recommend it to anyone, not even his own mother”.

With this out of the way, what are the actual warrant recommendations? Well, this is where details are not even scant, but non-existent. Unfortunately, there is little else to reveal other than a warrant picking criteria, some past examples, and a testament to Dave's performance utilizing this system.

Can you Make 2,700% with Warrants?

Is it possible, sure, anything is. Is it likely? No. As Benjamin Graham put it in his investment tomb Security Analysis “convertible issues are like any other form of security, in that their form itself guarantees neither attractiveness nor unattractiveness. That question will depend on all the facts surrounding the individual issue”.

So, while warrants are neither good nor bad in and of themselves. Convertible issues can be thought of as the worst of both worlds, in that they offer less income than non-convertible fixed-income securities (such as bonds) and less potential for capital appreciation than regular common shares.

Quick Recap & Conclusion

- Chris Hurt and Dave Forest are here to tell us about a financial “fast pass” that can make us rich.

- According to Chris, “99.999% of Americans know absolutely nothing about these fast passes”.

- We learn that “fast passes” are actually Stock Warrants and Dave Forest has some recommendations for us about which companies' warrants we should be buying.

- Of course, in order to find out what these are, we must subscribe to the Strategic Trader newsletter, which normally runs $4,000. But for a limited time, we can get a subscription for half the price of “only” $2,000 for the first year.

- Unfortunately, no warrant recommendations were forth coming. Just some warrant buying criteria, some previous examples of warrants that appreciated in value, and Dave Forest's track record.

- In the end, warrants are not guaranteed lottery tickets or bad as a security form in and of themselves. But we would not recommend them over simpler security forms which are also undervalued, such as common stocks.