Will this newsletter service really give you “safe, rising income streams”? Will you earn more profits from the investor’s “best high-yield recommendations”? Our Bryan Perry's Cash Machine review will provide you with all the details you need to know. The promotional materials of this service promise a lot. So you deserve to know if there is merit in enrolling in this investment research advisory. Let’s dive right in.

Overview

- Name: Cash Machine

- Publisher: Eagle Financial Publications

- Website: www.bryanperryinvesting.com

- Editor: Bryan Perry

- Service: Monthly newsletters

- Cost: Annual subscription – Tier 1 Gold Subscription ($49.95), Tier 2 Platinum Subscription ($77), Tier 3 Diamond Elite Subscription ($149)

Bryan Perry’s Cash Machine is an income-investing-only monthly research advisory. This is his unique selling proposition. The goal is to help you build a portfolio that will generate regular income for you. In general, the income from this type of investment comes from interest payments, dividends, and bond yields. Brian Perry’s newsletters typically feature four portfolios to give you the best exposure for your money. We will discuss these in detail in this review.

Who is Bryan Perry?

Like most newsletter service providers, Bryan Perry’s background is in Wall Street. He spent 20 years of his career advising big firms like Paine Webber, Bear Stearns, and Lehman Brothers. In the past 10 years, however, his focus has been on helping regular people. He offers his expertise to those who subscribe to his monthly newsletter service, Cash Machine. According to him, he has already helped them earn millions. For the regular reader, this is an enticing proposition. But if you are already familiar with these kinds of sales tactics, it pays to be skeptical.As an investor, he claims that he is an expert in high-yield investments and trading. This has landed him a gig as a co-host of a Bloomberg affiliate radio network from 1997 to 1999. Forbes, Business Week, and CBS’ MarketWatch often quote him as an expert.

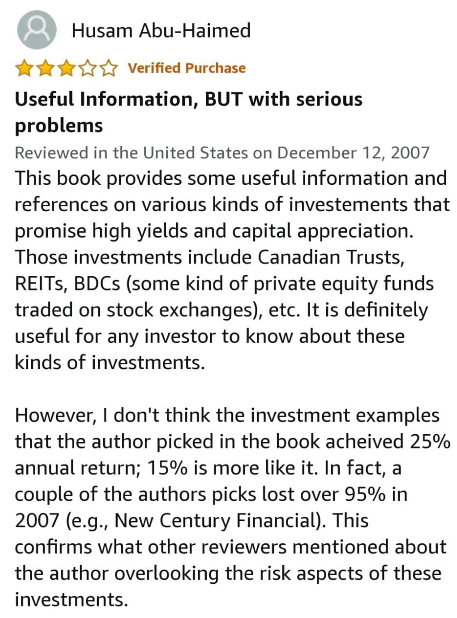

He is also a regular contributor to MoneyShow, a global financial media company involved in investor education.Perry likes to think of himself as the regular person’s investor. He has been building a reputation as someone who breaks down complex strategies into understandable ideas. In his blog, he often writes about topics accessible to new investors. He uses these articles to promote his newsletters, of course. But there is useful and up-to-date information in there as well.Besides Cash Machine, the investor also has an upgraded service called Premium Income. Here, he reveals additional strategies to make more money.The other services he promotes are Quick Income Trader, Breakout Profits Alert, and Hi-Tech Trader services.In the past, Perry called his newsletter service 25% Cash Machine. His promise then was you can earn a 10% dividend yield plus 15% in capital gains “without taking any wild risks”.He even published a book about it in 2007 titled The 25% Cash Machine: Double-Digit Investing. It has a 4 out of 5 rating, with a majority rating it 5 stars and 3 stars in Amazon. It is a pretty decent showing.

Some personalities gave the book glowing reviews and recommendations. Dan Frishberg, the CEO of BizRadio Network, endorsed Perry and said he has been using the investor’s ideas for years.A cofounder of the website www.optionmonster.com, Jon “Doctor J” Najarian, says that the book is a “must-read”. Saying that Perry has the “knowledge, experience, and integrity to generate a 25% cash machine”, Steve Crowley also recommends it. He is the Executive Producer and host of American Scene radio.Gabriel Wisdom is a syndicated radio host of Business Talk Radio Network. He is also the founder of American Money Management LLC. According to him, many people were able to achieve what Perry promised.Why are these relevant? Well, they seem to suggest that his previous system worked. So I am curious about why Bryan Perry seems to be distancing himself from the former name. One would think that he would also tout a book that gathered positive reviews on Amazon. But there is no mention of it on his current website and in any promotional materials. He could have easily said that he is also a published book author. This type of information boosts one’s credibility. So there is reason to ask why this is so.Is 25% a promise too hard to fulfill? Too good to be true? Some commenters from Amazon and stockgumshoe.com seem to think so.

How it Works

Cash Machine is an investment research advisory launched in 2015.

According to its promotions, it is unlike other newsletters. Bryan Perry offers “safe and rising income streams and huge capital appreciations in any market environment”.You will find this service useful if you are looking at getting passive income. Perry’s expertise is to give you a steady financial source based on your investments.Income investing works this way. Say you and your partner both work. So you have a combined income. Suddenly, you win $1 million in the lottery. Instead of getting all that money, you could invest the $1 million and just get a percentage of it at regular intervals.You can then use the percentage earnings for your daily sustenance, on top of your income. It is like a new salary.Retirees who do not earn anymore or earn little benefit from this type of investment. The yield may not be too large, but it is reliable and requires very little work.While this has benefits of liquidity, it also has a downside. Essentially, you are forfeiting the perks of long-term compound interest because you are not reinvesting your money.

In general, monthly payouts and promises of income are very enticing for investors. That is why you should be extra diligent when dealing with such propositions.Cash Machine says they will handle your portfolio to maximize your investment.He says he can do this through companies that have:

- Rock-solid financials

- Expert management

- Growing market share

- A commitment to shareholders to preserve and protect their dividends

Here is what will happen. Based on his proprietary sector rotation system, Perry will give you his stock picks. These will be from his three portfolios:

- Safe havenThese are steady stocks that still pay above-average dividends, usually up to 5%.

- Accelerated incomeStocks here are high-yield, lower-risk investments offering yields of 5-10%.

- Extreme Income This is for the more adventurous investor. These are high-yield, higher-risk investments offering yields of 10-20%.

Like other newsletters, Perry provides you with what you typically see elsewhere. There are monthly reports, up-to-date alerts, and a website, among others, similar to our recently reviewed Alpha Investor and Flow Matrix Alert.To add more value to his offers, he does add his special research reports. To help you decide, here is a detailed breakdown of what you will get when you subscribe.

1. NewslettersThe discounted rate of $49.95 (from $249) will give you access to monthly investment advisories. According to their promotions, these will reveal Perry’s top stock recommendations. In fact, Cash Machine claims that their readers were able to get up to 17% yields from his picks.2. Four Proprietary PortfoliosThis is a neat configuration of options. This shows respect to you as an investor as it factors in how aggressive or risk-averse you are.

- Extreme Income PortfolioThis is for the aggressive and risk-takers. The portfolio includes stocks with sky-high double-digit yields. You must proceed with caution when choosing the items here.

- Accelerated Income PortfolioThese are high-yielding but with lesser risk than the Extreme Income Portfolio. If you are willing to risk but not go all in, this is for you.

- Safe Haven PortfolioOf course, there are people among us who are conservative investors. The key words for these investors are safe and secure. Items in this portfolio will reportedly boost incomes more safely compared with the others. The promise, though, is that they will still yield double and triple than that of bonds and T-bills.

- 3. Additional High-Yield Income Recommendations Every MonthTo sweeten the deal, Perry says he will add 1 to 2 more bonus stock picks. You can then decide for yourself what you intend to do with them.4. Weekly News Alerts and Hotline UpdatesThis is important for investors who wish to get more regular and up-to-date information.5. Weekly Portfolio UpdatesWaiting for a whole month is too long at certain times. This is why he offers weekly updates on the four types of portfolios he offers.6. Unlimited VIP Access to the Private Cash Machine WebsiteOn the exclusive website, you will be able to see current information. A good feature in this is your access to the archives if you want to study trends and projections.7. On-Call Personal Investor Relations Staff During Market HoursCash Machine offers assistance from 9 am to 5 pm during days when the markets are open.In addition to the usual features, Bryan Perry lures you into his newsletter service with two special reports.Take note that such bonus features change often to give relevant information. What's important about these is that you get to learn how different investors think.

First Bonus Report: Banking on the Biden Boom: 5 Ways to Make 200% in the Next YearBecause of what he describes as President Joe Biden’s “radical reset of the economy”, five investments will boom during his term. These are:

- Green Energy

- Artificial Intelligence (AI)

- He will teach you how you can profit through these in the report.Second Bonus Report: The Biden Blacklist: 99 Investments to Dump NowThis report, meanwhile, lists companies that will lose money. If you plan to invest in these or you have them, his advice is to ditch them. Of course, you have to subscribe before he reveals these investments.What’s good about Cash Machine and these reports is that Bryan Perry tackles head-on what a new administration means. This does not mean he is getting political. In fact, he says that it does not matter whether you agree with the political leaders or not.His point is that a new president will have new policies that will differently affect various companies. And the purpose of any investor is to study which of these will benefit you.

In addition to all the inclusions in the Gold Subscription, you will receive these special reports:1. My Top Quarterly Dividend Payer for 20212. 5 Best Income Stocks to Own Now3. Cashing In with Covered Calls: The Safest Way to TradeAccording to Perry, these three reports are worth $844. This is also worth noting. In one of the promotional pages, 5 Best Income Stocks to Own Now is the bonus report in the basic package instead of Banking on the Biden Boom: 5 Ways to Make 200% in the Next Year.If you plan on getting the tier 1 subscription and have a preference for the bonus features, check first. Some links lead to each option.

The highest level Cash Machine newsletter service includes all the features of Gold and Platinum. Apparently, what makes this special is Perry’s report on “fat, juicy yields reserved only for the ultra-rich”. 3 “Backdoor” Bonanza Plays to Retire Faster and Richer has a value of $100, according to the website. This special report details how even a regular investor will be able to get extra thousands each month. This is a huge price difference over the platinum subscription. It would be reasonable, then, to expect a lot from this bonus report.In one of the promotional materials, the bonus report in Diamond is entitled Two-Way Winners: 4 High-Yield Investments with Money-Doubling Potential.There is no other information about this, so I am not entirely sure if this is just a variation of the title or a different one. This is common with some investment newsletters and their bonuses. It is easy to get confused with the offers and bonus reports.

Cost and Refund Policy

There are three tiers of an annual subscription to Cash Machine. The first and most basic is Gold and it costs $49.95. According to them, this is already discounted from the regular price of $249.The upgraded package is the Tier 2 Platinum subscription which costs $77. Bryan Perry's highest package for Cash Machine is the Diamond Elite Subscription. This costs $149.The advisory service also calls the fee a risk-free trial subscription. This is because you may cancel at any point within the first 30 days. They will give you a 100% refund right away.

Track Record

Brian Perry’s claim is bold. According to him, investors who followed his advice have “NEVER missed a payout on any” of their holdings. The word “never” is capitalized as is on his website. As I said, that is a strong statement.Further, he says that “the average high-yielding investment in our Cash Machine portfolios pays a whopping 10.15% annual yield”.According to him, they were able to pinpoint companies that maintained their dividends. This, despite a very chaotic environment in 2020.He was able to recommend such companies listed below:

- The 5.68% yielding closed-end fund with a 72% gain

- The 5.99% paying global medical REIT with a 75% gain

- The 5.81% natural resources MLP with an 83% gain

- The 8.9% global REIT with $1.5 billion market capitalization

- The 10.65% energy company with a 14% increase in cash flow in 2020

- The 16.15% energy infrastructure MLP with a 126% gain

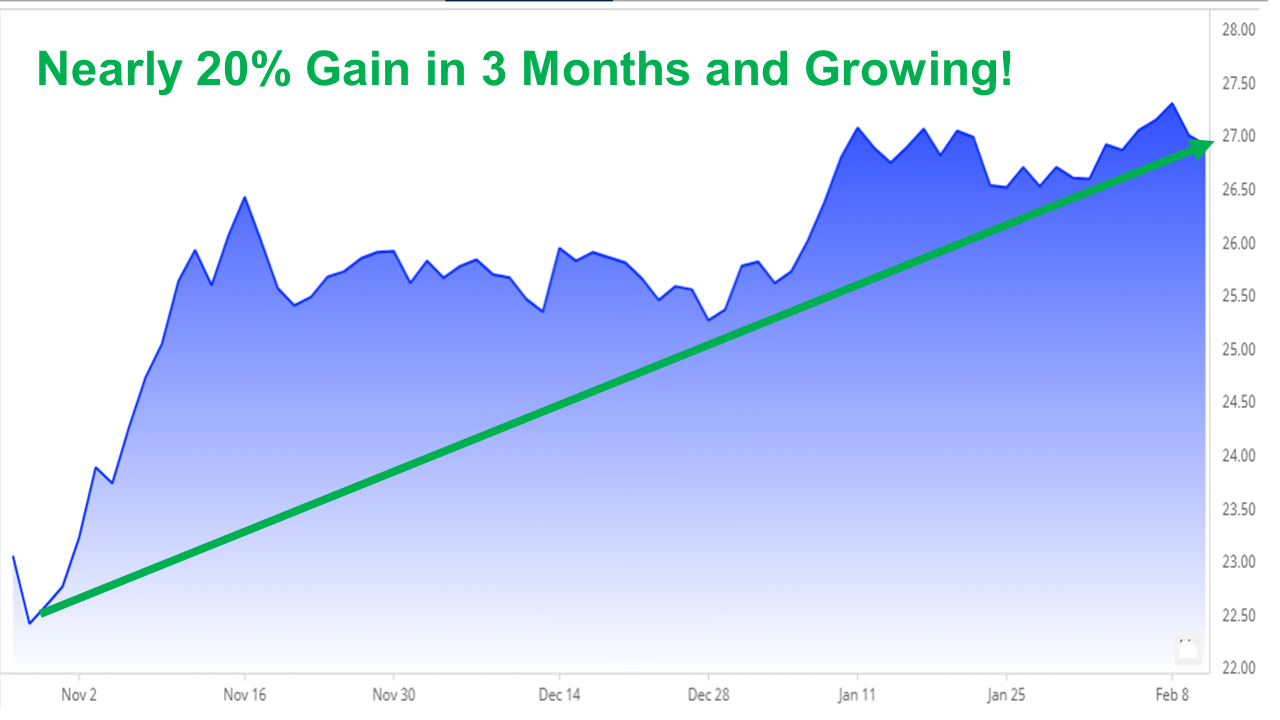

These numbers are pretty good, not gonna lie.He further explains that since 2015, his subscribers have earned safe annual yields of up to 17%. Also, they have “piled up 63 double- and triple-digit winners”.While these numbers can be impressive, we are still looking for verifiable proof we can see for ourselves. This does not at all mean that we do not trust Perry.However, as discerning investors, we do want to study for ourselves if his claims hold water. What we want is to provide you, our readers, with an honest assessment. Sadly, there is very little information on the funds’ records apart from their press releases.Of course, we do not expect him to reveal the secrets of the trade. He wants you to subscribe to his service, after all. But won’t you agree that even one or two giveaways will entice you more?To be fair, he does let you in on how his process works. He goes on a lengthy discussion on the five sectors he believes will boom under the new Biden administration. Further, he says that he has “uncovered an opportunity that invests in value stocks of infrastructure companies all across the U.S.” In fact, since November 2020, it had already grown 20% in the following three months.

He projects that it will continue to grow and his one-year estimate for 2020 to 2021 is 200% or more. It also pays a 7% yield monthly, according to his calculations.On top of these explanations, he also maintains regular columns on his website and on moneyshow.com. This way, we can see how he perceives developments in the investment world.

Pros v Cons

Pros

- The price is affordable

- The investor regularly posts his analysis on current trends in publicly available websites

- Bryan Perry has a solid track record

- You will get a full refund if you cancel within 30 days

Cons

- There is a limited number of bonus materials in the packages

- It is not risk-free as he claims

- Since this is among the oldest newsletters, there are very few updated reviews about the service

Conclusion – A Genuine Cash Machine?

So what is the bottom line?When you subscribe, will you really be able to rely on high-yield monthly income? Can you trust the 10-Point Must System of Perry? Is his system really “10 times tougher than those of Moody’s, Standard & Poor’s, Dun & Bradstreet, or Fitch Ratings”?Well, we can start with Bryan Perry. He has a combined experience of 30 years both as a Wall Street executive and a financial advisor. That counts for something, for sure.You only need to look at his regular columns online to figure out that he knows what he is talking about. If you are new to income investing, there is value in having someone like Perry guide you. Money Machine’s most basic package will give you regular updates exclusive to its subscribers. That alone is better than having none at all.However, we do understand that such a portfolio is crucial for many people. Some rely on their income from these investments for their monthly sustenance. So we will leave it to your best judgment if you are willing to part with $49.95 for one year’s worth of this income-investing-only monthly research advisory.As with any decision, there are always risks. The risks are higher when you make financial decisions, so it is better to look at a wide array of options. An advantage of this service is that you can cancel within a month. You will get your money back, no questions asked.This Bryan Perry's Cash Machine review has just given you all the information you need. Our goal here at Green Bull Research is to provide you with our observations and research so you can make a wise investment decision. Are you inclined to subscribe to his service? Tell us your thoughts in the comments section below.