Avi Gilburt's Elliot Wave Trader is a subscription based analytical service and the disclaimer is stated very clearly that it is not a trading recommendation or advisory service. The offering is very extensive in its range of trading market coverage. The more, or lesser controversial attribution of market trends to human impulse and sentiment (as it complies with Elliott Wave Trader theory) rather than more objective and increasingly automated review methods, is one of the Elliott Wave Trader's main marketing features.

The main rational behind subscribing to a service like this is to acquire information that allows us to trade more profitably, does this service enable that? This Elliot Wave Trader review sets out to address these questions; what you get, pros v cons and more.

Overview

- Name: Elliot Wave Trader

- Type: Elliot Wave based investment analytical service.

- Website: ElliotWavetrader.net

- Founder: Avi Gilburt

- Services: Live trading room and training material with specific reference to the Eliot Wave theory.

The Avi Gilburt's Elliot Wave Trader system is a propriety, market analytical service provided by a 17 person strong team of analysts led by Avi Gilburt. The Elliot Wave Trader similarly to Andrew Keen's Project 303, is but one of an exponentially growing number of similar services offering a ‘live trading room'.

Trading has become, in no small part due to the coverage and reach of the internet, a popular and possibly over promoted means of catapulting moderately resourced ‘Joe Soap' to a position of transformational wealth. There are well documented cases of traders accumulating enormous wealth from well placed trades, but the vast majority of these claims are unsubstantiated and or exaggerated. The trendy ‘work smart and not hard' ethos is fed by extravagant claims of traders accruing massive profits while needing to only spend a few hours a week executing trades based on information obtained from subscription services like Avi Gilburt's Elliot Wave Trader.

The live trading room provides subscribers with live data viewable in the virtual trading room. In the increasingly competitive realm of subscription based trading advisory services, it is becoming more and more challenging for advisory services to differentiate their offerings from their competitors. The Elliot Wave Trader analytical theory is certainly a differentiating factor, whether this theory with its attendant market analysis and interpretations is a reliably better way to trade markets is the subject of this review.

I signed up for the 15 day free trial period in order to get an authentic look at and feel for the offering.

What is Avi Gilburt's Elliot Wave Trader?

Avi Gilburt's Elliot Wave Trader is a trading analytical service that provides subscribers with access to a virtual live trading room where specialist market analysis across a range of market sectors is made in real time. The analysis is based on Elliot Wave theory.

Elliot Wave theory works on the premise that public sentiment and mass psychology moves in a wave pattern that can be read and used to analyse market behaviour. At the core of the theory is the view that positive public sentiment moves in 5 wave sets and when this cycle of public sentiment is completed, then a subconscious reset of sentiment occurs resulting in a shift in the opposite direction. This is supposedly attributable to natural human behavioural patterns and not the product of extraneous news events.

Avi Gilburt asserts that no less an economic luminary than the former Chairman of the US Federal Reserve, Alan Greenspan subscribed to the Elliot Wave Theory. Mr. Greenspan famously told the Joint Economic Committee that the stock market is “driven by human psychology” and “waves of optimism and pessimism. Mr. Greenspan may well have spoken those words but Avi Gilburt's interpretation is patently subjective.

Avi Gilburt postulates the theory that man's progress and regression, advances in the sequence of three steps forwards and followed by two steps back. Referenced reading is, Elliot Wave Principle by Frost & Prechter.

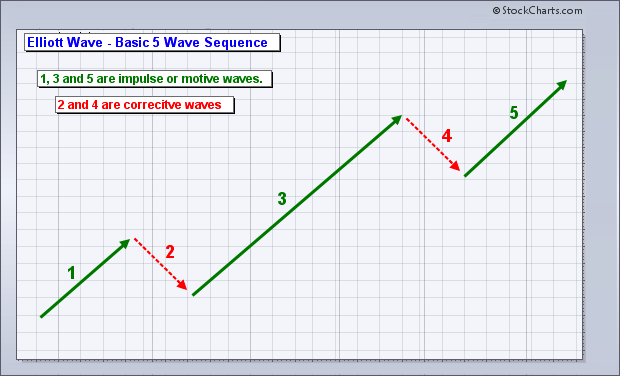

When analysing the basic five or three wave trends, the (dominant) moves in the direction of the overall trend are referred to as the impulsive or motive waves and the moves that are counter to the overall trend are corrective waves.

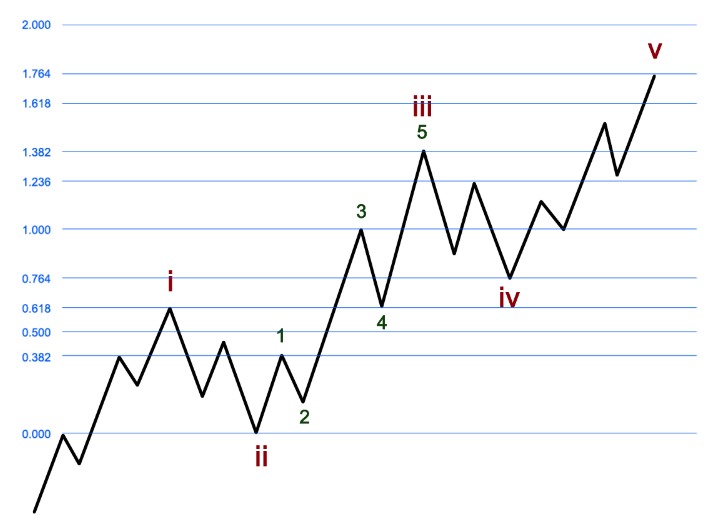

Avi Gilburt digs down deeper into the Elliot Wave theory and theorises that each impulse wave subdivides into five sub-waves and that this subdivision occurs infinitely. His interpretation and implementation of this deeper analysis is what Avi Gilburt “lovingly” calls his Fibonacci Pinball.

In an expansive and detailed explanation of his Fibonacci Pinball strategy, Avi Gilburt illustrates the efficacy of the methodology in determining when to take profits or points at which to set stops. The graph below illustrates the sub-waves in the impulsive waves (five phases) and the corrective waves (three phases).

Who is Avi Gilburt?

Avi Gilburt is a trained accountant and lawyer. A top academic achiever, he graduated with economics and accounting majors and passed the entire CPA exam shortly after graduation. He obtained a Juris Doctorate from the St. John's School of Law, New York and later obtained a (LL.M.) masters of law in taxation from the NYU School of Law.

Avi Gilburt co-founded ElliotWaveTrader.net in September 2011 with Richard Hefter and Advice Trade. Prior to starting his trading career, he was a successful lawyer, working as a partner and national director at a major national firm. In the course of his legal career he steered several major acquisitions with values ranging from millions to billions. This background has given him a thorough grounding in assessing the workings and valuation of businesses.

Forced to withdraw from his accounting and legal practice by the serious illness of his second wife, he initially started day trading to supplement his household income. In the pursuit of his hobby' of researching various methods of stock market analysis, he arrived at the conclusion that Elliot Wave theory was the only analysis method that made sense to him. He formed an alliance with Harry Boxter of TheTechTrader.com and became a subscriber to the sight. Members of the sight and Harry Boxter noticed his top and bottom target recommendations for stocks and equities were quite accurate.

Harry Boxter encouraged him to establish his own advisory service and live trading room, he introduced him to Richard Hefter, who despite initial scepticism regarding the concept of Elliot Wave trading was convinced to get on board with the establishing of the ElliotWaveTrader.net and the development of the platform.

Other FAQ's

Is The Avi Gilburt's Elliot Wave Trader legit?

The short answer to the above question is a conclusive yes. Avi Gilburt is a highly respected analyst with an extensive and credible track record. The list of specialists contributing to the ElliotWaveTrader.net analytical service is comprised of more than fifteen highly accomplished analysts. The ElliotWaveTrader.net service has existed since 2011 and has a growing membership of more than 5000 subscribers, many of whom give glowing testimonials as to the service's accuracy. There is an extensive reference library of past ElliotWaveTrader.net market analysis and the quality of this analysis can be back-checked in terms of actual market performance.

Can You Trust Elliot Wave Trader recommendations?

The numerous positive testimonials from subscribers are not independently verified but there is much information to support the claims made by ElliotWaveTrader.net . Examples are given of past instances where the service has made accurate analysis in periods of real and predicted economic upheaval. The July 2011 prediction made by Avi Gilburt that the US$ would stage a multi-year surge from 74 to a target of 103.53, was realised in January 2017 when the US$ reached 103.82 before receding, again as predicted.

When the 2016 US presidential election was looming there was much apprehension among many investors, concern was rife that the market would crash if Donald Trump won the election. Avi Gilburt correctly predicted that the election outcome would not impact stock market trends.

Past predictions by him can be found online on MarketWatch and NASDAQ websites. There are numerous testimonials by both subscribers and free trial users, many of them commenting that extensive back-checking of his analysis with actual market events, revealed a great degree of accuracy.

As is the case with many trading advisory services, the analysis of Avi Gilburt's Elliott Wave Trader cannot offer an ironclad guarantee as to the accuracy of the analysis. The declaration that the service is analytical and not an advisory service may well be intended as a disclaimer of sorts.

Trading Strategy

The ‘recommended' trading strategy is based on Elliott Wave analysis and the deeper application of Avi Gilburt's Fibonacci Pinball analysis.

The Specialist Advisors

The trend towards large numbers of varied, added value offerings and teams of eminent analysts and advisers as utilised by other trading advisory services is also a feature of the ElliottWaveTrader.net.

- Avi Gilburt: The founder of the Elliott Wave Analysis, Avi Gilburt is both a trained lawyer and accountant. He is known for developing and implementing an interpretation of the Elliot Wave theory that he calls the Fibonacci Pinball Strategy.

- Zac Mannes: Co-host of the Stock Waves service in the ElliottWaveTrader.net trading room that provides alerts and trade set-ups for individual stocks. Zac Mannes also co-hosts the mining stocks portfolio service and the site's weekly Beginners Circle Webinar.

- Garrett Patten: Fulfilling the role of EWT's chief educator, Garrett works on the development of an educational course on Elliott Wave analysis and co-hosts the weekly Beginners Circle webinar. He is the host of his own World Markets service and is the co-host of Stock Waves, the Mining Stocks Portfolio and Avi & Garrett's Live Video.

- Arkady Yakhnis: A graduate of Moscow State University, he has experience managing private accounts at an investment consulting firm. He also worked in the induction heating industry before joining Elliott Wave Trader. He was one of the first analyst at EWT.

- Mike Golembesky: Michael came to EWT with extensive experience in the fields of real estate, ES Trade Alerts service, investing and finance. He contributes frequently to Avi's Markets Alert service and also hosts the VIX trading service.

- Larry White: Larry comes from a background of executive roles at Toshiba, ISOETEC and Panasonic. He joined EWT in October 2012 where he focused on mining stocks as well as the GDX and GDXJ mining ETFs.

- Victor Nguyen: Victor has been trading since he won his first stock trading competition in the 5th grade. He hosts the the Index Quant Signal service within the EWT Trading room. This service generates signals from an automated system using an algorithm developed by Victor.

- Princely Mathew: The second place finisher in the 2015 World Cup Championship of Futures Trading, Princely has been actively trading since 2003. He hosts The Smart Money service in the EWT trading room, he provides analysis in U.S. equity indexes as well as miners and crude oil.

- Ricky Wen: Trading professionally since 2009, Ricky Wen has focussed primarily on stock options and the ES futures. He hosts the ES Trade Alerts service at EWT, his other contribution is his E-mini S&P 500 analysis which features on Avi's Markets Alert service.

- Harry Dunn: A veteran Wall Street trader, Harry Dunn authors Harry's expanded Dunn Weekend Report. Individual stocks analysis by Harry can be found in the EWT Stock Waves service.

- Dr. Cari Bourette: The eminently qualified Dr. Cari has PsyD clinical psychology, MS in Geoscience, MS in counselling and BS physics. She has developed a ‘Market Mood Indicator to forecast daily S&P 500, crude oil, gold, and USD trends. Her research which reaches back to 2006, converts social mood information into numerical data and factors this along with internet search data to identify market trends.

- Luke Miller: An associate Professor of Economics & Business at St Anselm College, he earned the Gilbreth Memorial Fellowship, as the top PhD student in the U.S. in 2003. Luke is the Bayesian timing specialist at EWT. Luke Miller provides consulting services to Bluechips like Morningstar, Amazon, UPS, Verizon and Oracle.

- Ryan Wilday: The EWT in house Cryptocurrency specialist, Ryan Wilday has more than seventeen years of experience in trading equities, futures and options. He has traded cryptocurrencies since 2013 and these days aligns his considerable knowledge of the sector with the application of Elliott Wave Theory and Fibonacci Pinball analysis. His Cryptocurrency Trading Service on EWT was launched in August 2017.

- Leo Valencia: The developer of the Gamma Optimizer tool, Leo Valencia is the host of the Gamma Optimizer service at EWT. An electrical engineer with a PhD in Physics from Stanford University, Leo has more than 20 years of research and development experience. He has developed a Deep Learning Algorithm which guides members with options trading recommendations. Leo is also the options educator at EWT.

- Carolyn Boroden: Carolyn started her trading career on the floor of the Chicago Mercantile Exchange in 1978. Regularly featured on the Off The Charts segment of CNBC's Mad Money with Jim Cramer. A highly regarded specialist in the area of Fibonacci price and timing analysis, Carolyn joined the EWT team in December 2019. She authored Fibonacci trading in early 2008. Carolyn Boroden's Fibonacci Market Analysis is a contributor to the ElliottWaveTrader Trading Room.

- Lyn Alden Schwartzer: Lyn has a Bachelor's degree in electrical & electronics engineering and a Master's degree in engineering management. Lyn provides macroeconomic analysis in Avi's Market Alerts service. Her work has been featured widely in the financial media.

- Jason Appel: A financial markets veteran, Jason started his career on the floor of the Chicago Board of Trade in the early 2000s. He holds a BSC in Economics from DePaul University. Jason has been applying his mind to and using Elliott Wave and Fibonacci Pinball analysis since 2014.

What You Get

- Access to the Live Trading Room with Elliott Wave based market analysis.

- The Market Update, this is a nightly analysis of the S&P 500 by Avi Gilburt and the team.

- Analysis over a time horizon of days to several months covering U.S. and world equity indices, stocks, bonds, resources, cryptocurrencies, energy and forex.

- Interaction and Insights from and between members in the interactive virtual room.

- Analysis led by Avi Gilburt and his team of seventeen prestigious specialist advisors, most of whom are regarded as thought leaders in their respective niches.

- Access to the Education section which features articles, videos, suggested reading lists and an expansive glossary of Elliott Wave terms and abbreviations commonly used in the Trading room.

- Posting privileges in the Trading Room.

- The following service options

i) Flagship Service – S&P 500, Metal, Energy, USD, Bonds & More

- Avi's market alerts covering U.S. equity indices, bonds, precious metals, energy & U.S.$ plus market sentiment analysis.

ii) Flagship Add-Ons

- Avi & Gareth Patten's live video providing interactive webinars three times a day covering wave counts and key charts.

- Harry's Hot Corner, spirited commentary from the veteran Wall Street analyst Harry Dunn. Opinion on U.S. indices, precious metals and bonds.

- Ricky Wen's Intraday entry / exit alerts for day trading the Emini S&P 500.

- Mike Golembesky's trade set-ups in ETFs and options related to the VIX and equity indices.

- Bayesian Analysis, Luke miller's propriety analysis of Avi's SPX and GDX charts.

- Bayesian Signal Alerts, this is an add-on to the Bayesian Analysis Service, provides ETF swing trade signals on U.S. indices, energy, metals & more.

- Princely Mathew's, The Smart Money provides directional analysis and trade signals mainly on the U.S. Equity Indices, GDX and USO. The analysis is based on Princely's propriety range of indicators.

- Victor Nguyen's, Index Quant Signals that are the product of a propriety quantitative algorithm, analysing day & swing trades in ES, gold & equity indices / ETFs.

iii) Fibonacci Analysis

- Carolyn Boroden's advanced Fibonacci time & price analysis spotlights high probability U.S. stocks and indices.

iv) Stocks

- Stock Waves, an extensive analysis of U.S. stocks by Zac Mannes, Garrett Patten, & Lyn Alden Schwartze, comprising watchlists, nightly videos and earnings calls.

- Mining Stock Portfolio, by Avi Gilburt, Zac Mannes and Garrett Patten. This is an intermediate-term model portfolio and watchlist of gold stocks that includes entry / exit alerts and trackable performance. There is no free trial available of this feature.

v) Options & Commodities

- The Gamma Optimizer, recommends options trade set-ups and features Leo Valencia's propriety tool for selecting optimal strike & expiry dates for options trading.

- Larry's Live Trading, Larry White focuses on oil, miners and other commodity classes, issuing intraday trade alerts and live streaming threads.

vi) Currencies & International

- World Markets is hosted by Garret Patten and provides coverage of ten international markets. The covered indices are the FTSE100, DAX, Euro STOXX 50, Nikkei, Hang Seng, India's Nifty 50, Mexico's IPC Index, Brazil's Bovespa, Australia's ASX 200 & the Shanghai Composite.

- Forex, Afkardy Yakhnis provides coverage of major and minor forex pairs, the main focus being on the six majors; EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD and AUDUSD. Arkady Yakhnis also provides analysis of metals and crypto trading pairs.

- Cryptocurrency Trading, hosted by Ryan Wilday, analysis and trade alerts focused on the likes of Etherium and Bitcoin.

vii) Additional Features

- All the above services include e-mail and text alert options. The display options in the live trading can also be customised.

- The New Member Weekly Webinar on a Wednesday which is a guide as to where to find and how to interpret analysis that is of interest to the subscribers.

- The Education Section which features articles, videos, suggested reading and an extensive glossary of Elliott Wave terminology & common abbreviations used in the trading room.

Costs & Refunds

There are several different subscription options. A 15 day limited free trial period is available. The paid options start at $99.95 per month and $275 per quarter. There are longer term subscription options available in the form of $525 for what is termed a semi-annual subscription and $1000 for an annual subscription.

While EWT outlines various scenarios under which they may unilaterally terminate the service, no mention is made of a refund policy.

Pros v Cons

Pros

- The advisory team is comprised of academically accomplished contributors.

- There is a comprehensive library of educational material explaining Elliott Wave Trading and Fibonacci Analysis.

- The live trading room facilitates exchanges between analysts and members as well as member to member interaction.

- The initial 15 day free trial membership, though limited in access, does allow one to investigate the EWT offering before committing to a paid subscription.

- Recent 2020 member testimonials attest to the accuracy of the analysis during market turmoil related to the Covid-19 crisis. It must be noted that these testimonials are unsubstantiated.

Cons

- The apparent lack of a refund policy may be problematic for many prospective subscribers.

- There are numerous complaints from subscribers about poor levels of communication when contacting EWT, this in spite of claims by EWT to offer timely response to all queries.

- In as much as there are numerous recent positive testimonials as to the accuracy of the analytical content on EWT, the lack of independent verification is problematic.. There are many, many online reviews pre-dating 2020 where the quality of the analytical output is widely criticised. One can speculate as to whether the recent positive testimonials are the result improved analysis or merely the result of a marketing thrust.

- Some of the free services appear to be not actually free as members have complained that their access to these free features are withdrawn when they cancel their subscriptions.

Quick Recap & Conclusion

The Avi Gilburt's Elliott Wave Trader analytical service is an offering that has unique features not offered by the myriad of other trading advisory services. The underlying theory of Elliott Wave Trading applies a wave pattern to interpreting the effects of human sentiment as it manifests in trading patterns. EWT emphasise that their offering is a market analysis and not a trading advisory service. The Elliott Wave Trading system and the further developed Fibonacci Analysis are complex analytical methodologies that require a studious approach to gain an effective understanding. If the offered analysis is used in combination with other market information sources it is probably of significant value.

The EWT analysis in utilising the expertise of it's large group of specialist analysts, covers an extremely wide range of the trading spectrum. This extensive range of analytical information is in all probability beyond the needs of most individual traders.

Worth Subscribing To?

For the serious or more established trader who is prepared to put in the effort required to understand the Avi Gilburt's Wave Trader and Fibonacci Analysis, the service is probably worth including as part of a trader's wider information portfolio.