Up until now one of the world's largest supplies of battery-grade lithium has been just out of reach.

Alex Koyfman believes a small technology company is about to change this, as it has perfected a way to extract high-grade lithium directly from a unique source resulting in something called “Black Lithium.”

The Teaser

There is a movement afoot in northwest Alberta that in the next few years could completely change the face of modern lithium battery production.

Alex Koyman describes himself as a guide, from whom readers can learn how to get in on the ground floor of overlooked and under-bought stocks. We have reviewed how he's doing in this respect as well as some of his most recent picks, like the “Solar Tower Vertical Energy Company.”

Our movement starts with one of the biggest lithium resources on the planet, which sits underneath an equally massive 430,000-acre property in Alberta, Canada.

For 40 years, a privately held energy company has been drilling for oil on it.

In that time this company has pumped hundreds of millions of barrels of oil and filled hundreds of wastewater ponds with brine.

This is where our story gets interesting.

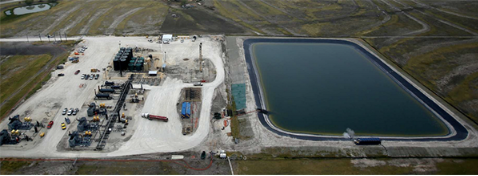

A Huge Supply of Salt Water

Brine is basically a high concentration of salt in water.

This is important because a little something called lithium can be found in continental brine and almost 100 billion barrels of this brine are on our Alberta property in wastewater ponds just like this one:

Each barrel is chock-full of what some have called the most important element of the 21st century. The only problem has been that up until recently, there has been no known extraction method that could effectively clean the brine and filter out the lithium.

That's where Alex's “black lithium” company comes in.

Given management's prior experience in the petrochemical industry, they knew the value of the brine pits, so they signed an exclusive deal with the oil company to process these brine ponds.

A pilot program, which started earlier this year, has already proven that the company's proprietary technology can remove lithium from the brine at up to 93% efficiency.

Alex says it's a revolution in lithium extraction and things are moving so fast that the company is scheduled to be in commercial production later this year.

The Pitch

The company could see a 100x to 220x gain in its market capitalization by the time full-scale production is achieved and the only place to get its name is in a report titled: “Black Lithium: A World-Changing Revolution for the Global Battery Industry”

We can get our hands on the report by taking a trial run of the Microcap Insider newsletter, which Alex founded and edits. The cost to do so is $1,999 per year and includes weekly issues of the newsletter, specific entry, exit, and target prices for recommendations, as well as two bonus reports – “Lithium Independence: Cutting China out of the Battery Business” and “Penny Stock Quick-Start Guide.”

How the World's Exploding Lithium Demand Will Be Met

At the rate lithium is being produced today, there's no way to continue meeting the EV and wireless device-driven demand for the energy metal.

A single chart makes this abundantly clear:

What we're looking at is about 40x growth over 40 years.

While supply and demand are just about balanced today, demand is set to explode in the coming years. According to the International Energy Agency, a Paris-based intergovernmental organization, by 2040, we're going to need 6 times as much lithium each and every year.

Where is all this battery-grade lithium going to come from?

The Lithium Triangle

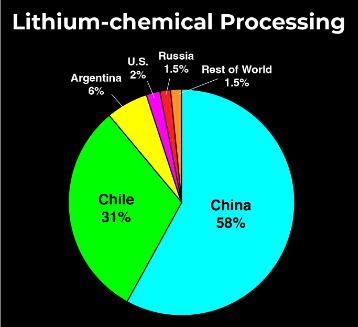

An easy answer to the above question is China.

They are currently the top dog (or panda) in all things related to lithium-ion battery production and distribution.

It has even expanded its influence in the ‘Lithium Triangle' as part of a broader campaign to construct a near-monopoly in the global lithium market.

China has been working toward achieving a monopoly on lithium processing and battery production since at least the late 1980s, so what we're seeing now is just the result of all that planning.

To this end, Alex's 100% Canadian-owned, development-stage lithium company is a far more welcome alternative.

If we crunch some numbers, this company estimates that it can employ its proprietary technology to extract approximately 20,000 tonnes of lithium per year at a cost of $3,000 per ton from its 671-square-mile Alberta property.

At today's lithium prices, that boils down to over $1.4 billion of profit per year. Let's find out its name.

Revealing Alex Koyfman's “Black Lithium” Stock

We get quite a few clues about this one, just the way we like it:

- The company's current market capitalization is only around $20 million.

- It has exclusive mineral rights to extract lithium from a 430,000-acre oil-producing property in northwest Alberta.

- This company's proprietary process is as efficient as industrial-scale lithium production can be. Up to 20x as fast as traditional methods.

Without a doubt, the stock Alex is teasing here is Volt Lithium Corp. (TSX-V: VLT.V). The clues line up like shoppers on Black Friday:

- Volt's current market cap is nearly $40 million, up 3 times since the start of the year.

- The company's total land position covers 430,000 acres and features over 1,300 producing wells near Rainbow Lake, Alberta.

- Its proprietary Direct Lithium Extraction (DLE) technology is focused on having a high lithium recovery rate with the lowest costs.

Enough to Turn Every $1,000 Invested into $226,000?

With the rising popularity of smartphones and tablets along with electric vehicles becoming more and more prevalent, lithium is the key to all of it.

One of the only caveats to this assumed demand and Alex's return projections is that they are all mostly based on the IEA's net zero by 2050 scenario.

I explained in a prior review why this scenario is unlikely, but even if we take it at face value (which we shouldn't), how likely is Volt to meet its production targets?

We know commercial production has already been pushed back from Q4 2023 to mid-2024 and the company recently appointed a new board chair. Both things that make you go hmmm.

However, looking at its most recent technical report from May of this year, the inferred mineral resource estimate is approximately 15.7 billion cubic meters (m3) of brine with a total lithium tonnage of 4.3 million tonnes of lithium carbonate equivalent (LCE).

This tonnage has an average lithium concentration of 51 mg/L, which is commercially viable, but it isn't high-grade, and only certain areas of the property have high-grade concentrations of 101-121 mg/L. Still, even if we assume Volt's high-grade lithium resources are only 100,000 tonnes. At $40,000/tonne, this is worth far in excess of the current market value of the business.

Quick Recap & Conclusion

- Alex Koyfman says a small technology company is about to become an energy giant, as it has perfected a way to extract high-grade lithium directly from a unique source resulting in something called “Black Lithium.”

- Based on a pilot program started earlier this year, the company has proven its proprietary technology can remove lithium from the brine at up to 93% efficiency.

- It could see anywhere from a 100x to 220x gain in its market capitalization if full-scale production is achieved and the only place to get its name is in a report titled: “Black Lithium: A World-Changing Revolution for the Global Battery Industry.” The report is complimentary only to subscribers of the Microcap Insider newsletter, which costs $1,999 per year to join.

- Fortunately, we were able to reveal Alex's pick right here for free as Volt Lithium Corp. (TSX-V: VLT.V).

- Volt owns a 100% mineral interest in its 430,000-acre property near Rainbow Lake, Alberta, which has significant commercially viable lithium resources below its surface. At a current market cap of only $40 million, the long-term risk/reward is in our favor in this early-stage resource play.

Is salable lithium extracted from brine viable as a high-grade lithium source? Tell us in the comments.