Adam O’Dell’s Wednesday Windfalls makes bold claims. According to its pitch, you have the potential to make “10 years’ worth of gains in a single 48-hour trading window”.

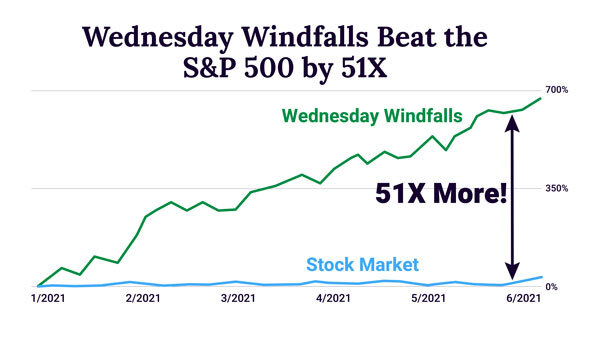

In the aggressive marketing materials of the service, there is even a claim that O'Dell beat the market 51 times over the last six months. This is an outstanding figure, if true.

According to Money & Markets, this has never been seen in the past. But this time, you will not only see it. The publisher is confident that everyday investors like you may actually experience such phenomenal gains.

“It is the perfect strategy”. This is how John Wilkinson, the Director of Research Services at Money & Markets, describes it.

Why?

Imagine getting profits like this within only a matter of minutes. Others can only dream about this, he says. But you can achieve this, so you need to take advantage of their limited offer.

Once you follow their easy steps, you will be on your way to hitting even “triple-digit gains every 12 days on average”. You may even “make trades like 440% in two days” through the “Rebound Pattern”.

The ultimate goal here is to give you financial freedom and not just instant wealth. According to the advisory's editor, this has always been his advocacy. You need to take control of your investments so corporate America will not be able to enslave you.

According to Wilkinson, this take is among the biggest reasons why O'Dell is “one of the best options traders in the world”. He looks at profits and money from a higher perspective.

Because of all these, new and veteran investors will definitely find Wednesday Windfalls intriguing. But according to the editor, all its claims are certainly possible.

Of course, we will not take such claims at face value.

In this review, we will take a look at what he says and what he really means. It would be worth examining, for sure, how he intends to deliver on such promises.

So do read until the end and tell us what you think. Let's talk in the comments section.

Overview

- Name: Wednesday Windfalls

- Editor and Chief Investment Strategist: Adam O'Dell

- Publisher: Money and Markets / Banyan Hill

- Website: www.moneyandmarkets.com

- Service: Weekly Options Trading Advisory

- Cost: $ 2,495 annual fee

Once you experience the profits of the investment research service, Wednesday will be your new favorite day of the week.

This is how confident the team behind the advisory is.

Basically, Wednesday Windfalls is an options trading advisory that promises to give you three trades every week.

Adam O'Dell, its editor guarantees that his system is accurate. With his recommendations, you can experience triple-digit winners when you cash out his trades every Wednesday. Get in on Monday at 2 PM, then get out by 2 PM Wednesday.

It's as simple as that, O'Dell claims. His publisher, Money & Markets is also all-in on this strategy as its team members have experienced it first hand. We will talk more about that later when we discuss the strategy's mechanics.

According to its pitch, if you followed every trade recommendation of the service in the last six months, “you would have made 51 times more money than investing in the U.S. stock market”.

So obviously, such a potent strategy would cost a lot, right? Well, according to the publisher, after a heated argument where O'Dell wanted more readers to benefit, they reached an agreement.

Instead of the original price of $10,000 annual fee, which it said is already a steal, Money & Markets is now offering the service for $2,495 per year. The catch, though, is that only 500 investors will be allowed to avail of Wednesday Windfalls. So this is the cue for you to immediately grab the opportunity and register.

But don't register just yet. You know that we always advise our readers at Green Bull Research to take their time in finding out more information about advisory services.

Most of the time, such “limited” offers and deadlines are mere marketing tactics. These are meant to pressure readers to register ASAP. Later on, most of them regret their decisions as they learn more about newsletters.

It would be good if the refund policies are clear and the processes are easy. But we all know the hassle and inconvenience of asking publishers to return your money once you have given them a check or your credit card details.

Remember, we are talking here about thousands of dollars per year. So it wouldn't hurt if you would research more before taking the plunge.

At the very least, finish our review first.

What is Money and Markets?

According to its website, Money & Markets is a company that specializes in providing “financial news, commentary, and actionable research advice”.

As a publisher in the finance industry, it is an advocate for free markets. They make this position clear and add that it opposes government restrictions on the “economy, stock market, and personal liberties”.

There are currently three top experts in the firm. These are O'Dell, Charles Sizemore, and Matt Clark.

O'Dell is in charge of four services in the company. These are Green Zone Fortunes, Wednesday Windfalls, Home Run Profits, and 10X Profits.

Sizemore, meanwhile, is Co-Editor of Green Zone Fortunes and Clark is the Chief Research Analyst of the publishing house.

We have already written about the firm in the past. You may refer to our Money & Markets review if you want to know our initial impressions of the company.

When we looked at its fine print, we learned that it is directly under Banyan Hill, and therefore, a part of The Agora.

If you are interested to learn about the other services of Banyan Hill, we have a few here at Green Bull Research. We have already written about two of Ian King's services, Strategic Fortunes and New Era Fortunes.

There is also an article on Charles Mizrahi's Alpha Investor. In it, we asked if he is a source of crazy claims or legit advice. Do read our past articles so you will have a better sense of the publisher's reputation.

Who is Adam O’Dell?

Adam O'Dell says that even he did not expect to end up where he is right now.

According to him, grew up in a small town called Huntington. His parents were the first in their families to go to college. Eventually, O'Dell's mom became a special education teacher and his dad, a lawyer.

Early on, he thought his future was to be a doctor. This is why he was building towards a career in medicine since he was young. It also helped that he loved learning and was a natural in math and science subjects.

Eventually, he graduated from Elon University with a Bachelor of Science degree in Biology/Chemistry. Though he admits that getting into med school was challenging, he managed to enter the University of Phoenix.

While a freshman, he worked as an admissions counselor. What he and his colleagues did then was to assist other students in adjusting to college life. The work was fulfilling for him as O'Dell says he loves helping other people.

At that point, though he loved the science and people part of medicine, he felt he was trapped. His creative juices did not have an outlet in the field. Everything he did was routine and he got bored.

As a result, he shifted gears and enrolled in a Masters in Business Administration, Finance, and Economics course in the same university.

Since part of his interests were research and helping people, MBA was a perfect fit. A successful business student would need critical and analytical skills. S/he must be familiar with scientific methods and statistics to solve complex problems.

He knew that these were within his competencies so he became more excited about his new passion.

When he graduated, he worked as a financial advisor for Ameriprise Financial Services, Inc. The company, O'Dell says, is a Fortune 500 financial advisory firm. At first, he thought he already had his dream job.

But later on, the advisor realized that he was merely selling the company. Since he worked an average of 80 hours a week, there was also no personal freedom.

In addition, during the financial crisis, the firm's advice to its clients was to just stay put and do nothing. This was a position that did not sit well with him personally.

So he moved on from the company. His new job placed him in a more active role in investment management as he traded global currencies for a multimillion-dollar firm.

In this role, a typical workday lasted 12 hours. According to him, he realized this was “a one-way ticket to a heart attack by the age of 30”.

At this point, the trader felt miserable. He was overworked, underpaid, and exhausted. The firms he worked for also did not put the clients' best interests at heart.

Something must change. It was clear to him that he must take control of his personal and financial freedom. This epiphany of sorts led him to the world of financial research.

This field is a better fit for his personality and skill set, he says. In his new role with Charles Street Research, he worked on a Systematic Investment Approach. This, he believes, solves a lot of problems investors face every day.

So what constitutes the strategy?

First, there is a conscious use of scientific methods and statistical analysis. These are the building blocks to a “bulletproof investment strategy”.

Second, it involves the use of a predictable formula. This just removes all subjective guesswork and emotional decision-making. Most investors have problems with these.

Third, the strategy emphasizes the need for strict discipline. Once you start on a strategy, follow it and live your life.

According to O'Dell, these steps helped thousands since he taught them in 2012.

In everything he does, the strategist always goes back to the main point. We must take charge of our investments to gain financial freedom. You should take the lead, not corporate America or Wall Street.

Once we achieve this, reaching our aspirations and dreams will be effortless.

In 2020, he joined Money & Markets as its Chief Investment Strategist. The publisher now markets him as among the best investments analysts and options traders in the world.

O'Dell is also a Chartered Market Technician (CMT) with the Market Technicians Association, Inc.

What is Wednesday Windfalls?

It is an options trading advisory that is being built up as a “breakthrough” from Adam O’Dell. The team behind says that the goal with Wednesday Windfalls is to “create the preeminent trading research service in the world”.

Indeed, Money & Markets believes that it has a top-notch product. It continues to emphasize that its “strategy has thumped the market by 51X over the last six months”.

Now this is a ballsy claim. 51 times.

Do we think this is accurate? Is this something that can really be done? Will you be able to actually experience this once you subscribe to the service?

For sure, we have a lot of doubts and questions. With such a claim, we were looking for more evidence that would show how O'Dell was able to achieve this. However, there were no substantial clues available apart from the usual sales talk most publishers use.

Remember, investment research advisories should not mislead their subscribers. Publishers may face legal repercussions if they are not careful with their claims.

In our article on Raging Bull, we discussed why the company got in deep trouble with the Federal Trade Commission (FTC). Misleading and unsubstantiated claims are serious issues.

Do the current claims of Wednesday Windfalls fall (pun intended) in this category? Well, we are neither part of the FTC nor are we lawyers, but our pushback is for Money & Markets to provide more clarity about this.

In addition, when people see the number 51, most neglect the number 6 on the claim. According to O'Dell, this was actually only for a six-month period. That's convenient.

True, it is a new company so they still have not logged years of track record. But still, it can be misleading as potential subscribers may interpret it as indicative of future performance as well.

So don't easily believe such sky-high promises. When it comes to these claims, if they are too good to be true…

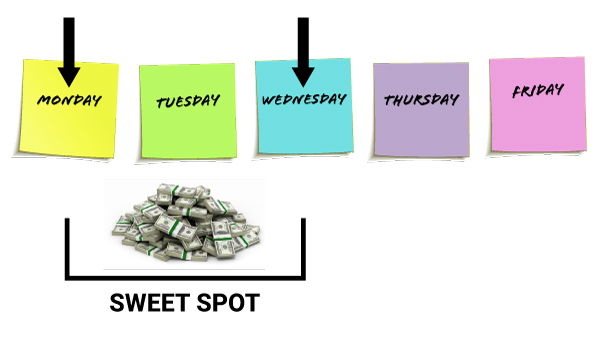

Anyway, back to the advisory's specifics, it says that when you avail of the service, you need to remember two days of the week. Get in during Mondays and get out on Wednesdays. It is as simple as that and can be done in minutes.

The publisher says that all kinds of investors will benefit from the ease with which they set it up. Most people are intimidated by options and O'Dell wants to reassure them that these are good types of investments.

To help readers understand better, he gives an example.

The editor tested the strategy on the publishing team. He sent an alert on a Monday at 2 PM that contained instructions on a “sixty-second trade”. By Wednesday, he once again gave instructions on how to close the said trade.

With these steps, the team had the chance to make 440% with what he recommended. He claims that a $1,000 investment has turned into $5,400.

Again, this is what he calls easy and simple steps. You can make these trades on your laptop, desktop, phone, or even smartwatch.

According to the former hedge fund manager, this does not mean everything will be 100% perfect. As with any investment, there are serious risks involved.

In fact, he warns that “if a trade goes south, it typically goes south quicker than a stock trade”.

We find this honesty refreshing. Often, such disclaimers are only in the fine print. But with O'Dell, he makes multiple caveats on his main pitch. So this is a bold act that we want to see more editors do.

Other newsletters that give options trading recommendations are Jay Soloff’s Options Floor Trader PRO and Jeff Clark Trader. We recommend that you read our past reviews so you can weigh your options, literally.

How it Works

As we proceed, though we want you to have you own appreciation of the process, remember that these are developed alongside copywriters expert at marketing.

So as we read, let's also ask questions and not get easily swayed. But for the sake of fairness, we will narrate what O'Dell says is the X factor in his service.

The editor says that he has always been interested in statistical analysis, data, and scientific methods. This is why his service works.

He did not just invent a system out of thin air, it is based on research and experience. In fact, the team tested it extensively, with their own money, he claims.

So they saw first-hand how great it was. O'Dell claims that no one in the team has seen such an effective strategy that can be applied in only a matter of days.

With Wednesday Windfalls, you do not even have to shell out so much money to earn massive profits. Even a small amount will do, as long as you follow and trust the system.

What most investors usually make in a decade, you can gain in just two days.

Why does it work so well?

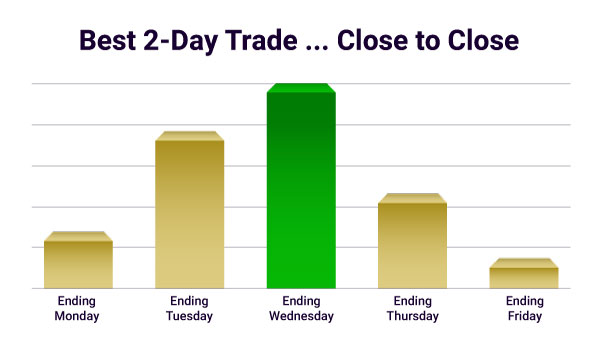

First, O'Dell says he only trades during the “best time” of the week. According to his research, this is holding a trade from 2 PM on Monday to 2 PM on Wednesday. Statistically, this is where winning trades happen, he claims.

The Chief Investment Strategist adds:

In fact, on average, the stock market gives you 2.6X more return during this 48-hour period than any other during the week.

Unfortunately, only less than 1% of investors know about this sweet spot. So he is on a mission to help people know about it and understand its potential for their finances.

What do you think about his claims so far? Do you believe that you can gain in two days with this advisory ten years worth of gains? Sounds like hyperbole, right?

But did he convince you with his first trade technique?

Second, he only looks at the “best companies” to invest in during that window.

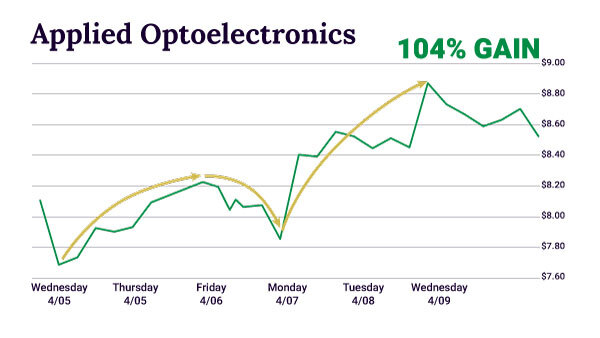

As further proof, he cites the following winning trades:

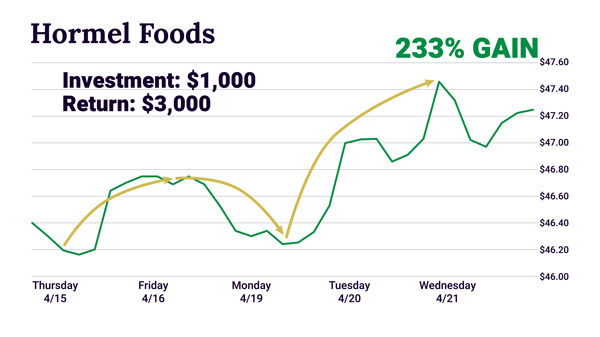

NKLA — 439% in 2 daysXLE — 388% in 2 daysXLI — 197% in 2 daysXLP — 179% in 2 daysXLU — 234% in 2 daysTTM — 400% in 2 daysAAOI — 104% in 2 daysIWM — 104% in 2 daysHRL — 233% in 2 daysJD — 241% in 2 daysGE — 309% in 2 daysSPWR — 134% in 2 daysTLRY — 191% in 2 daysIQ — 191% in 2 daysUBER — 178% in 2 days

According to him, the average is 235% in two days. You will also get a chance to get “a triple-digit winner every 12 days on average”.

He determines this by researching deeply and by using tools, techniques, and software that only hedge funds previously had access to.

Through these, he figured out what he calls a “Rebound Pattern”.

To get a winner from Monday to Wednesday, you need to study which stocks are up the previous Friday but are down on Monday morning.

See his example below:

A lot can be asked about the companies he mentions here. Are these all his picks or are these just handpicked winners? What percentage of the overall picks are these companies?

Even with fancy terms, if there are no proof that we can verify independently these mean nothing. If the publisher is confident about the service, it would have released more data.

Third, he only buys the “best option” on the stock.

Why options? He believes these best give you the potential for huge gains even from small movements in the stock. This is what he calls “Profit Acceleration”.

This, he says, is the secret behind his claim of “up to 10 years’ worth of gains in a single 48-hour trading window”.

The editor also looks at mispriced and explosive options as these have the most potential for high-profit margins.

In summary, these are the main reasons why he believes he can deliver on his promises. Wednesday Windfalls:

- Only trades during the best time slots

- Picks only the best stocks

- Buys only the best options

At this point, the editor also emphasizes that there will also be down weeks. This is the reality with all investments: not all trades are winners.

So if you are the type of investor who might be too scared at this prospect, he admits that the service may not be for you. He is honest about this, he says, as he wants you to know the pros and cons of Wednesday Windfalls.

As we have mentioned, since O'Dell is already being honest with the risks involved, we would have appreciated more transparency in his recommendations' performance as well.

Sadly, there seems to be an expectation that subscribers would just accept every claim as gospel truth.

What You Get

The $2,495 annual subscription will entitle you to:

- Weekly Trade Alerts where he sends his top three trade opportunities

- Weekly Trade Wrap where he explains key details of relevant trades

- “3 Simple Steps to Banking a Windfall Every Wednesday” video series

- Members-only website so you can access all available resources for subscribers

- VIP concierge service that will assist you with your every concern

- Free Apple watch so you can get notifications more easily

Cost and Refund Policy

Cost

According to Money & Markets, it intended to ask for $10,000 per year from its subscribers. The publisher believes the quality of the advisory warrants such a price.

But after a discussion with O'Dell, the team decided to bring it down to $2,495.

Refund Policy

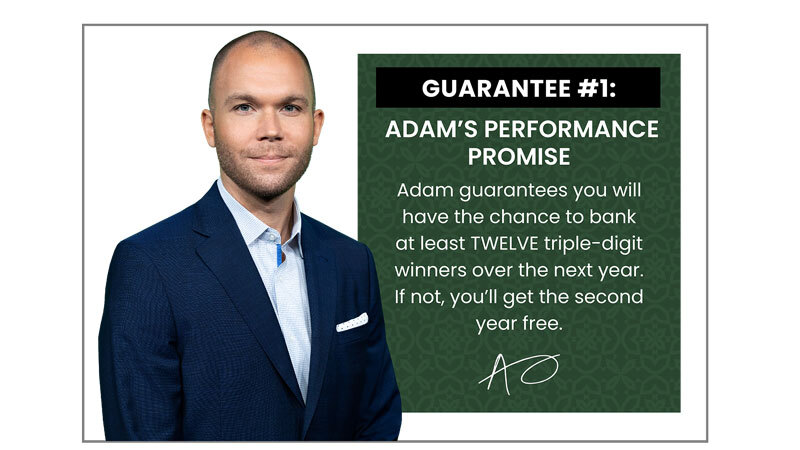

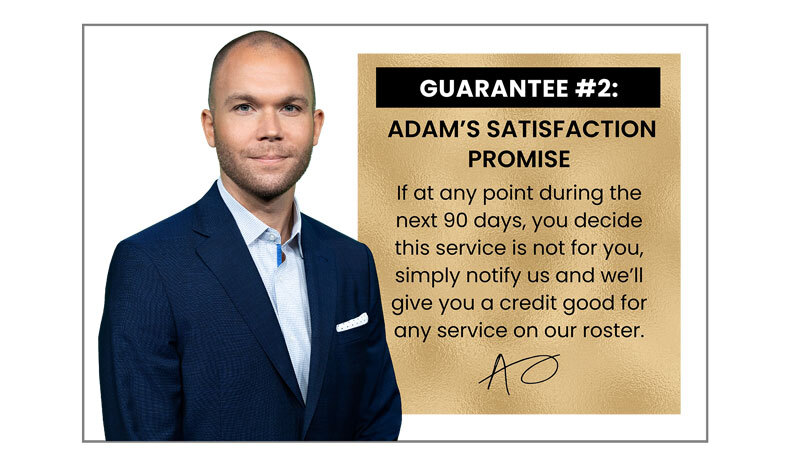

Wednesday Windfalls offers two performance guarantees to its subscribers.

First, you will get a free second-year subscription if you do not get 12 triple-digit winners. O'Dell is confident that this is an attainable number. Based on his computation, his recommendations average three winners per month.

Second, if within three months, you are not satisfied with the service, call them and they will give you credits for other services. This is already their counterpart for a refund policy.

Obviously, it is not the real thing. We always prefer an opt-out for subscribers, so it is a miss for Wednesday Windfalls.

Track Record and Reviews

Since it's still a new service by the time we publish this article, there have not been significant reviews on Wednesday Windfalls yet.

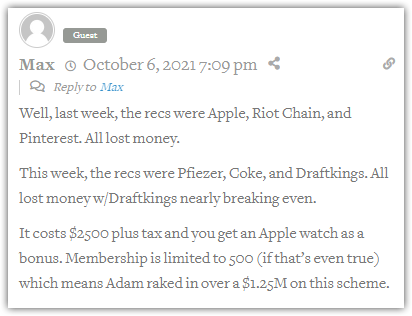

But we found one insightful comment on Stock Gumshoe. The subscriber talked about the specific recommendations of Adam O'Dell.

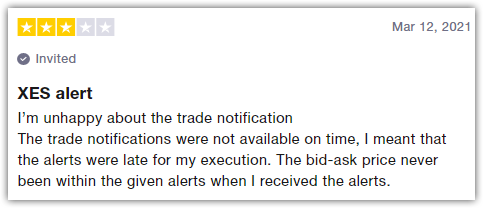

Even on the Trustpilot website, we only found publisher reviews for Money & Markets. The company has a 4.5/5 rating from around 30 readers.

Though no comment was about Wednesday Windfalls, there were positive reviews about the company and O'Dell. We believe that though indirect, these also say something significant about the editor's current service.

One negative comment that we saw was about the timing of the recommendations. If this applies to Wednesday Windfalls, it can be disastrous. But we assume this is the reason why the publisher decided to give away Apple watches.

At least with them, you would learn about the trades more easily since these can come in through your watch.

But is the fancy watch enough to salvage a bad service? Of course not. We are not saying that Wednesday Windfalls is bad, you should make that determination based on your own experience.

What we want to emphasize is that timing is a usual pain point for subscribers. By the time they get in, they are already too late and the prices are already too high.

So publishers and editors must be upfront about this reality. Minimizing timing issues is a disservice to paying customers.

Take note that the comments we have posted here are mere samples of actual subscriber experiences. Learn insights from them but do not base your judgment solely on these.

Pros v Cons

Pros

- Clear explanation of what the strategy is

- There is potential for high returns with options when done strategically

- O'Dell's background and narrative for his strategy is compelling

Cons

- Expensive annual fee

- No money-back policy

- Some claims are too good to be true

- Timing is a usual pain point with options

Conclusion – Will Wednesday be Your New Favorite Day of the Week?

Although the promises are sky-high, we do commend the effort of O'Dell to temper the expectations of his subscribers. He explicitly says that there will be terrible days. His investors will experience bad trades, even.

Only when they accept this reality will they experience the kinds of numbers he is promising. In fact, he even says that the service may not be for you if you think it will be 100% perfect.

But he really believes in his strategy with his Monday to Wednesday window. “Profit Acceleration” and “Rebound Pattern” both work, he claims, because these are science-based.

There are reasonable explanations for his claims, O'Dell says. But are we inclined to believe one can make “10 years’ worth of gains in a single 48-hour trading window”?

We understand that this is an obvious marketing ploy to get your attention. Making 51 times more gains than the market is a huge claim.

Though the fine print always makes disclaimers that past performance is not always predictive of future gains, it would have been a responsible thing to explain better what the details are.

It would be more believable if Money & Markets has given us more data and proof than claims and promises.

In the end, it is up to you if you will entrust your $2,495 to Adam O’Dell’s Wednesday Windfalls. But at least now, you have more information to make a better decision.