The Stansberry Innovations Report is a subscription based trading advisory newsletter that broadly focuses on investment opportunities presented by companies bringing cutting edge, transformational and market disrupting products and services to the world market. In a world where the status quo has been largely compromised by the upheaval and disruptive impact of the Covid-19 debacle, there exists a need for informed navigation of the unfolding world economic reality.

The editor, John Engel, has vast experience in the bio-tech sector and is subsequently well qualified to comment on and advise on investment opportunities in this and other innovation driven offerings.

The Covid-19 pandemic and the devastating effects of the worldwide lockdown have given cause for increasing numbers of forecasts, from a multitude of sources, predicting market crashes in the near future. The Stansberry Innovations Report is one of many similar services offering their subscribers advice on how to avoid the fallout from negative market developments and how to choose profitable investment opportunities.

Overview

image source: Stansberry Research

- The Stansberry Innovations Report is in the main focused on trading recommendations as relating to investment opportunities offered by innovative products and disruptive services. The recommendations are based on thorough research conducted by specialist analysts. The Stansberry Innovations Report is but one of the very extensive list of publications from Stansberry Research.

- Stansberry Research has been delivering financial research since 1999. Stansberry Research produces a deliberately diverse range of advisory newsletters referencing a broad spectrum of trading categories

- Mention is made of focusing on “unloved, ignored or unknown” investment opportunities. These lesser known opportunities are focused on because they apparently offer the “best risk-to-reward potential”.

- John Engel is the editor and chief writer of the Stansberry Innovations Report. Before taking up the editors post, John Engel worked as the in house biotechnology analyst at Stansberry Research, making regular contributions to the Stansberry Venture Technology newsletter and the Stansberry Investment Advisory newsletter, their flagship newsletter.

- John Engel holds a master of science degree from the prestigious John Hopkins University. His work experience includes several years as a bench scientist in a research role for one of the largest pharmaceutical companies in the U.S.

- The Stansberry Innovations Report newsletter falls under the umbrella of Agora Inc which is by all accounts the largest publisher of newsletters in the sector.

- The stated objective of the Stansberry Innovations Report is to offer advice on early investment opportunities rooted in emerging or new technologies. The sectors covered are; biotechnology, medical sciences, software, hardware, defence and crypto currencies.

The range of newsletters, training resources, specialized investment research, advisory services and free e-mail reports produced by Stansberry Research is vast. An interesting feature is that the advisory newsletters are graded in terms of the investment risk.

Subscription based Advisory Newsletters

- Stansberry’s Investment Advisory – This is Stansberry’s flagship monthly publication. Risk index, conservative.

- True Wealth – This newsletter is published monthly and is focused on more obscure or lesser known investment opportunities. Risk index, conservative.

- Retirement Millionaire – This monthly newsletter claims to show subscribers how to live a millionaire lifestyle on a limited budget. Risk index, conservative.

- Extreme Value – This newsletter is yet another of the seven Stansberry Research monthly trading advisories. The focus here is on ‘safe’ stocks that represent good value due to their discounted pricing. Risk index, moderate.

- Stansberry Gold and Silver Investor – This advisory focuses on gold resources and the trading in associated stocks. Risk index, moderate.

- Commodity Supercycles – This monthly advisory service focuses on the energy sector and mineral resources with metals being a key aspect. Risk index, moderate.

- Stansberry Innovations Report – The main subject of this review, the focus of this monthly newsletter is advising on thoroughly researched safe or conservative investing in emerging technology. Risk index, conservative.

It is inevitable that there will be information overlap with the above newsletters, many of the Stansberry Research specialist writers are contributors to several of the various publications in their broader offering of newsletters. It is quite possible that one could garner most if not all the information on offer by making an astute selection of a few and not all the newsletters. Some of the information in the above subscription based newsletters may also be available in their free advisory newsletters. There are some genuinely useful bundles of information to be found in these free advisory publications, the information on trading gold coins is but one example.

Specialised Investment Research

- Retirement Trader – This is an advisory targeting retiaries, claiming to offer a less risky way to double or triple the gains in their accounts. Risk index, conservative.

- Stansberry’s Big Trade – A monthly advisory service that monitors credit pressured companies with an anticipated drop in share price. Risk index, speculative.

- True Wealth System – This is a product that provides access to seldom heard about advanced trading products. The trades focus on easy to buy exchange traded funds using leverage to increase returns. Risk index, moderate.

- True Wealth Opportunities: China – This is a monthly look at the best investment opportunities offered by the Chinese market. Risk index, speculative.

- True Wealth Real Estate – A novel approach for ordinary investors to get into the real estate sector. Risk index, moderate.

- Stansberry Venture Technology – Edited by Dave Lashmet, this monthly newsletter adopts a venture capitalist perspective seeking out lesser known companies bringing ‘next best thing products’ to the market. Risk index, very speculative.

- Stansberry Venture Value – This is another monthly advisory newsletter that picks micro-cap stocks with strong fundamentals. Risk index, speculative.

- Stansberry’s Credit Opportunities – This advisory service is based on advanced research into the distressed corporate bond market. Risk index, very conservative.

- Income Intelligence – This income advisory gives readers an analytical view of income markets to enable them to maximise their income. Risk index, very conservative.

- Daily Wealth Trader – A daily advisory service offering research on short and medium term trading. Risk index, moderate.

- Advanced Options – This a course that offers an in depth view of options trading combined with live trading exposure. The goal being to make intelligence directed trades that produce gains of double and triple digits. Risk index, speculative.

- Cannabis Capitalist – The rapidly evolving legal cannabis business offers exciting opportunities. This monthly newsletter focuses the spotlight on the best performing companies in the sector. Risk index, speculative.

- Crypto Capital – The realm of crypto currencies where the potential for massive earnings is exceeded only by the unpredictability of price movement. This monthly advisory provides a wealth of information on the crypto sector. Risk index, very speculative.

- Gold Stock Analyst – Stansberry claim this has been the premier advisory newsletter for the gold sector for over 25 years. The claim is made that Stansberry’s Top 10 model portfolio made an audited 922.7% return between 2001 and 2019. Despite the sensational gains claimed by Stansberry Research, it is as always, best to look at alternative sources of niche trading advice.

- Ten Stock Trader – This advisory is the project of Greg Diamond a former hedge fund trader. This service makes use of advanced technical analysis methods. Risk index, very speculative.

Bundled Memberships

This is a curious offering from Stansberry in that the membership is by invitation only. A seemingly contradictory aspect of these ‘invitation only’ memberships is that they are accessed by initially applying for them. The 3 ‘invitation only’ memberships are:

- The Stansberry Alliance

- The Stansberry Choice

- The Permanent Wealth Program

Free Resources

A realistic outlook has to question the authenticity of any free offerings. Stansberry Research has a collection of 5 ‘Free Resources’.

- Daily Wealth – This appears to be the Stansberry mouthpiece, the main thrust of which is to propagate their company philosophy.

- Health and Wealth Bulletin – This bulletin from Dr. David Eifrig is seemingly a recycling of the information shared in his “how to live the lifestyle of a millionaire for far, far less” subscription newsletter. Further exploration of this advisory and the other free resources may well reveal an alternative source for much of the information provided in the subscription based newsletters.

- Stansberry Digest – The digest is an archive of Stansberry publications and may well serve as an insightful source of information on the past research conducted. Although it does not permit access to real-time research, it could be a useful resource for back-checking past performance claims.

- Stansberry Investor Hour – This weekly publication covers current news and events as pertaining to financial markets, politics, social issues and business. Guests interviews feature with the likes of; Jim Rogers, Kevin O’Leary, PJ O’Rourke and Jim Grant.

- Stansberry Newswire – The promotion for this free resource takes sensationalism to an elevated level. “Receive up-to-the-minute news, market research and expert commentary that typically costs $50 000 a year and requires a nett worth of at least $1000 000 … absolutely free”. This beggars belief and must compromise the credibility of the Stansberry Research organisation in general.

- Stansberry Investment Hour Podcast – This podcast is known for providing forthright financial commentary and is even considered controversial in some circles. This is probably by design in order to meet the entertainment aspect characteristic of many podcasts. It can be added that Porter Stansberry is no shrinking violet when it comes to swimming against the stream.

These free advisory services may have some positive aspects and useful information but there is a lingering suspicion that the main thrust is the marketing and promotion of Stansberry Research combined with a well crafted up-sell strategy.

Given the extent of the vast range of the above offerings, one has to consider if the Stansberry Research’s primary marketing strategy is to project and attempt to substantiate the image of being the main player on the subscription based informational newsletter stage. This top-dog image approach is debatable in terms of objectively assessed credibility and must be treated with due scepticism.

The name of the Stansberry Innovations Report derives from the association with founder and former chief writer Porter Stansberry. Porter Stansberry was the first American editor of the Fleet Street Letter, which is supposedly the oldest English language financial newsletter. This was his role before he established Stansberry Research.

The Stansberry Investment Advisory is an advisory newsletter with an international reach.

Porter Stansberry is a self-styled forecaster of economic trends and downturns, some might also say a proposer of controversial avoidance strategies as advised in the Stansberry Innovations Report.

To say that Porter Stansberry is controversial would be a serious understatement, he produced the ‘End of America’ documentary / promotion of his newsletter. One of the many controversial claims made by Porter Stansberry in the ‘End of America’ is that he predicted the failure in 2008 of several companies including General Motors, Fannie Mae and Freddie Mac. An analysis of the archived Stansberry newsletters leading up to and including the 2008 meltdown by Peter Schiff, debunks this claim conclusively. Porter Stansberry also notoriously made the distasteful analogy of comparing share holder behaviour in the 2008 financial crisis with Jewish victims of the Holocaust. This regression to the use of unsophisticated scare and shock tactics to promote the relevance of his newsletter to serve as a barrier to financial misfortune, is at best an ethically questionable tactic or at worst an inclination to unrestrained manipulation of susceptible opinion.

Porter Stansberry was fined $1.5 million in 2007 having been convicted of security fraud. His problems with the SEC started in 2003, he was charged with insider trading. Porter Stansberry in his defence countered that he never owned the particular stock in question nor did he directly profit therefrom. From an informational perspective, although the timing was out, the information in the newsletter did prove accurate.

Company details

Stansberry Research was founded 1999 by Porter Stansberry. The various Stansberry newsletters are part of the Agora Inc publishing group.

Website: www.stansberryresearch.com

E-mail: info@stansberrycustomerservice.com

Address: 1125 N. Charles Street

Baltimore, Maryland USA 21201

The authoritative contributors

The list of Stansberry staff contributors is extensive, many of them contributing to several different Stansberry publications.

Christian Olsen – With a background in the biotech sector and mechanical engineering, he investigates worldwide technology investments. He also contributes to two other Stansberry Research newsletters.

John Engel – John holds a master of science degree from John Hopkins University. He uses his experience in biotechnology to assess opportunities in the sector. He also contributes to the Stansberry Venture Technology and Stansberry Investment Advisory newsletters.

Porter Stansberry – The founder of the Stansberry Research

Steve Sjuggerud, Dr. David Eifrig, Brett Aitken, Austin Root and a host of other specialist contributors.

The Teaser

The Stansberry Innovations Report market their offering as the market leader and the pre-eminent trading advisory service as relating to various new technology opportunities. Their research team boasts illustrious credentials across a wide range of specialized market niches. The claims to having predicted many aspects of the 2008 financial meltdown and subsequently developed strategies to guide subscribers in avoiding future catastrophic economic scenarios are extravagant. A declared grasp of new developments like blockchain technology, crypto-currencies, artificial intelligence and many other disruptive business models is offered as the opportunity to avail investors of the chance to make highly profitable trades.

The advisory information in the Stansberry Innovations Report is purportedly presented as a newsletter for entry level investors. This is seemingly a marketing directed attempt to broaden investor participation by bringing innovative and emerging investment opportunities into the spotlight. The extensive educational material available across a vast array of pertinent subjects is a genuinely valuable resource for subscribers.

What does the Stasberry Innovations Report offer?

Monthly Issues and Updates

- A subscription to the Stansberry Innovations Report, enables one to access the member’s only section. A new newsletter is published on the 3rd Friday of the month, there are also regularly posted updates of developing market conditions.

Special Reports

- There is a near overwhelming amount of analytical information and trading recommendations provided.

- The information is subjected to extensive analysis by specialist commentators.

- There are numerous special reports ranging across a range of topics from crypto currencies, tax efficient strategies, blockchain technology and many more.

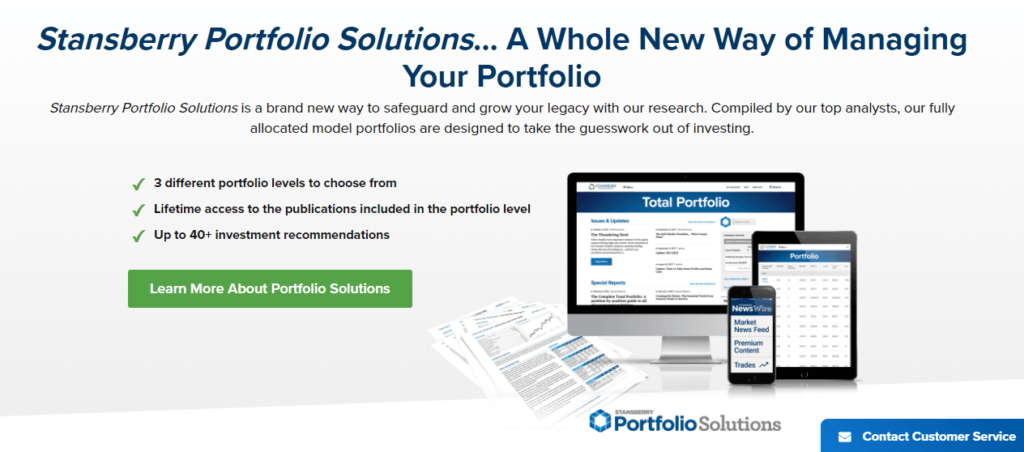

Portfolio

- Stansberry offer lists of researched portfolio recommendations. There are 3 different portfolio levels with more than 40 investment recommendations.

As with the case of most subscription advisory newsletters, verification of the claimed trading gains is largely lacking. Stansberry Research offers access to archived advisory newsletters as the means to back-check past advice. While there have been some astute recommendations, checking back through the archives has also revealed some of the Stansberry Research claims to be more than a little inaccurate.

Digital Interface

- The digital interface of the Stansberry Innovations Report is well presented and cutting edge as one would expect of a service that punts itself as a leader in the sector.

What is the price of their service and the refunds policy?

The price of an annual subscription to the Stansberry Innovations Report is a reasonable $199.00 given the huge volume of information that is accessible.

The wording of the refund policy is as follows, “And, at any time in the first 30 days, if we are not able to meet your expectations for any reason, we are willing to ‘part as friends’”.

Pros vs Cons

Pros

- The team of specialist contributors to the Stansfield Innovations Report are well qualified, many of them recognised leaders in their respective fields.

- The focus of the Stansberry Innovations Report on trading opportunities arising out of emerging technology and disruptive business models is in keeping with currently popular investment trends. The rapid development of new technology and the widespread adoption of new business models is covered in a detailed and timeous fashion.

- Many investments in the innovation sector are time sensitive in terms of the potential returns. Early or angel investors often stand to make astronomical returns from assessing and taking up investment positions early in the genesis of innovative products and services. The report's claims to be at the cutting edge of news regarding innovations appear to be valid.

- The vast amount of information produced by a team of academically accomplished advisers and field experienced researchers has to carry some weight.

- The extensive archive of advisory newsletters allows a diligent subscriber to investigate the veracity of past performance claims and scenario predictions. A thorough reading of specific newsletters compared to actual events over the identical time-frame can be a valuable aid in developing a feel for understanding how newsletter reported events manifest in the markets.

Cons

- There have been numerous reports from subscribers of unauthorized credit card payment deductions and complaints of vague sign up terms.

- Another consistently lodged complaint is the large amount of spam type e-mails that emanate from Stansberry Research.

- Much of the information provided in the many different titled Stansberry newsletters, both subscription based and free is copied across the various titles. This necessitates careful selection of subscriptions if one is to avoid duplication.

- There appears to be a significant degree of ‘factual license’ taken with the accuracy claims for past scenario predictions. This is evidenced by investigations using Stansberry Research’s own archived newsletters and advisories. As stated above, a perusal of the Stansberry Research newsletter archives by Peter Schiff, called into question and refuted Porter Stansberry’s claims to have predicted key aspects of the 2008 financial crisis.

- Porter Stansberry’s controversial reputation and maverick tendencies are perhaps not the characteristics one desires from one’s source of investment advice.

- The barely disguised attempts at fear mongering in respect of cultivating an atmosphere fearful of cataclysmic economic events on a never before experienced scale. This as a relatively crude tactic to promote their newsletters as a source of uniquely researched measures that one can implement to mitigate a forthcoming economic crash.

- The run-in with the SEC and the subsequent fine, suggest that Stansberry Research may be an organization that is prone to testing the regulatory boundaries.

Is the Stansberry Innovations report a scam?

Stansberry Research, having been established in 1999 and with a base of 500 000+ worldwide subscribers, does not fit the profile of a company that engages in scams. The innovative products and services covered in this report are at the leading edge of technological development and present significant but challenging investment opportunities. When one digs below Porter Stansberry's penchant for sensationalism and self-promotion, there does seem to be a fair modicum of substance to the report. The standard caveats do apply, the trading recommendations offer no guarantee of profits and one should not trade with funds that one cannot afford to lose.

Conclusion

The editor John Engel has a soundly established reputation and is clearly positioned to make astute evaluations and recommendations on trades in the innovative sector. Porter Stansberry may deliberately set out to court controversy but he does appear to a have a real level of credibility as a market commentator and author of trading advisories. The assembled collective of advisors at Stansberry Research and by extension the Stansberry Innovations Report, is comprised of several luminaries in the field and it is unlikely that they would align themselves with a less than credible service. The employment of less than subtle economic doomsday forecasts is unfortunate and it does nothing for the credibility of the Stansberry Innovations Report

Is it worth subscribing to?

Stansberry Research offers a truly extensive range of subscription based and free newsletters and advisory services. The Stansberry Innovations report focuses on a particularly fluid and dynamic area of the markets and thorough and intuitive analysis is essential to achieve the potentially large gains offered by the sector. Any recommendations must as always be treated with the standard caution due to any trading advise. Stansberry Research does appear to be positioned to offer largely credible trading advice. Taking cognizance of the above, along with the 30 day money back guarantee, I think the Stansberry Innovations Report offers reasonable value at the annual price of $199.oo.