Collecting royalties is one of the best and easiest ways to earn passive income.

In this regard, former hedge funder Whitney Tilson has found a “Chaffee Royalty Program” Stock that he says could net us 10x our money in the next 12 months, through a combination of both capital appreciation and dividends.

The Teaser

What do Paul McCartney, former President Trump, and boxing great George Foreman all have in common?

Whitney Tilson is a polarizing figure in the investment community. Some applaud his value investing stance, while others deride him for seemingly wavering from it whenever it seemed convenient to do so. We have taken an in-depth look at the man, myth, and legend here at Green Bull, and also reviewed and revealed many of his recent picks, like his AI Companies.

To answer our previous question, the thing McCartney, Trump, and Foreman all have in common is that they all make substantially more from royalties (songs, books, and the Foreman Grill) than they ever did from their primary professions (musician, President, boxer).

These are what Whitney calls “traditional royalties.” But what he's describing here is a different kind of royalty opportunity, something called the “Chaffee Royalty Program” after the man who first discovered it, a former schoolteacher and self-made millionaire by the name of Jerome B. Chaffee.

The Chaffee Royalty

Jerome Chaffee was a regular guy that many of us could identify with.

He was a schoolteacher that wasn't happy with his meager salary. So he became a sales clerk instead and made enough to buy a store of his own.

After that, he packed his bags and went to Colorado in 1860, which was and still is mineral rich. Despite knowing next to nothing about mining, he saw the opportunity and started snapping up “royalty rights” on as many gold and silver claims as he could afford.

Every time one started to pay off, he bought more. Soon, he was making about $15,000 a month from his mineral interests or the equivalent of about $450,000 a month in today's dollars.

Like many nouveau rich at the time, Chaffee eventually took up politics, and in 1872 he helped create legislation called the General Mining Act. This helped pave the way for the creation of mineral royalty trusts we see today, which is what Whitney is talking about in this presentation.

“Chaffee Royalties” let you tap into rich mineral rights much more easily than what was available to investors in years past and Whitney has found one that we can't miss.

The Pitch

Tilson has put all of his analysis on this opportunity in a new report called The New “Chaffee Royalty Program” That Could Pay 10x in 12 Months.

All we need to do to get our hands on it is try out Whitney's newest trading advisory service, Empire Insider Alert. The service comes with a 30-day money-back guarantee and costs $1,495 for 12 months. This includes full access to the Empire Insider Alert advisory service, immediate access to three special research reports, including, The New “Chaffee Royalty Program” That Could Pay 10x in 12 Months, and at least 24 trade recommendations over the next year.

The Low-Risk Road to Energy Riches

If nothing else, the timing of this pitch is in a word, perfect.

America is staring down a banking crisis and the world is also facing an energy crisis from the war in Ukraine at the same time.

This means there are shortages of much-needed resources like natural gas, oil, and other commodities. All the while, the crisis across the bank sector has caused banks to pull back on lending, including loans to resource producers.

In response, large resource companies like Newmont and Barrick Gold, are turning to royalty companies instead, so as to avoid spending their own capital to take up the slack.

The Best Time in History to Own Royalty Rights?

Instead, resource powerhouses are providing smaller mineral explorers with the cash they need today in exchange for a stream of future profits on the huge piles of resources they are digging out of the ground.

As long as the oil, gas, and minerals keep coming out of the ground, royalty rights holders and their shareholders get rich, without owning a single well or worrying about doing any actual drilling or mining. It's a win-win for everybody.

The most famous management consulting company in the world, McKinsey, concurs with this:

“Streaming-and-royalty financing is poised for strong growth over the next decades. For investors, royalty companies are increasingly attractive, because they provide exposure to the underlying commodities and price movements (with) lower risks. “

One small company based in Texas is best positioned to collect royalties from some of the world's most resource-rich areas. Let's find out what it is.

Revealing Whitney Tilson’s “Chaffee Royalty Program” Stock

We are given precious few clues about what this stock could be. See for yourself:

- It is a mineral royalty trust (oil/natural gas) that trades for around $16 per share.

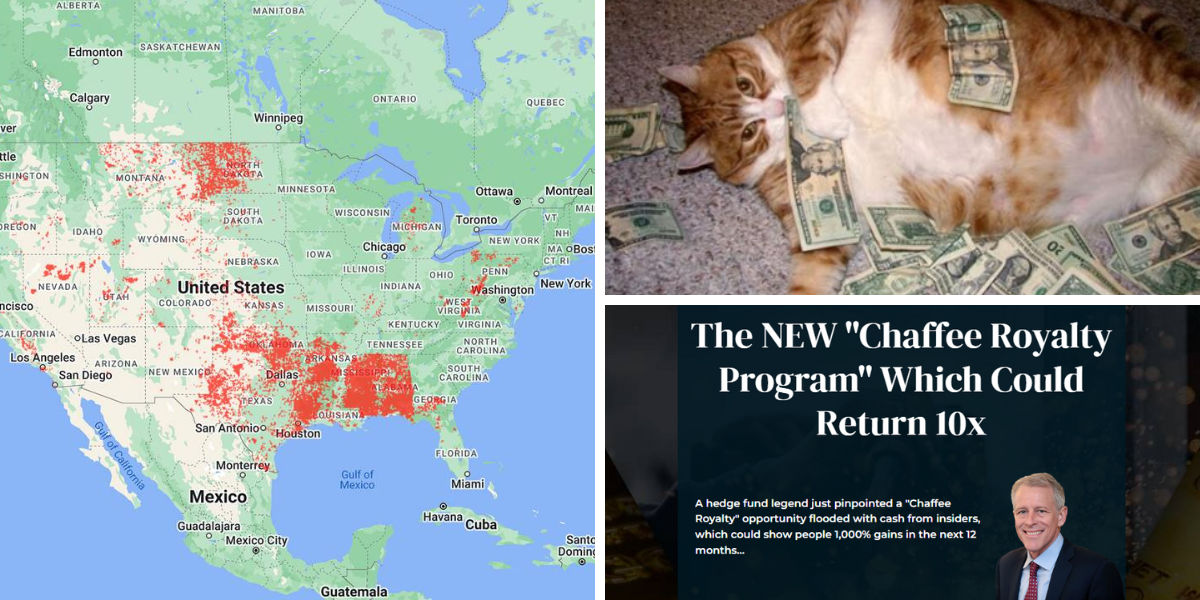

- Owns royalties on 20 million acres of energy in total.

- In 1987, a man named Tom took over his father's lumber company. Tom proceeded to sell off all the timber assets and focus exclusively on getting mineral rights to oil and gas interests. Today, Tom runs his royalty company with only 98 employees.

So, what Texas royalty play is Whitney talking about here? It's Black Stone Minerals L.P. (NYSE: BSM). This is how the clues come together:

- BSM trades for $16 dollars and change today

- The LP owns mineral interests on roughly 20 million acres in 41 states.

- The company was originally founded as W.T. Carter & Bro., a lumber company, in 1876 by current CEO Thomas L. Carter, Jr.'s great-grandfather.

Make 1,000% in Only 12 Months?

Whitney's reasoning for the big gain over the next 12 months is due to one reason – insider buying.

13 company insiders have scooped up shares over the past 5 months, including the CEO Thomas Carter himself, the President, the CFO, Vice President, and several key members of the board of directors.

Insider buying isn't a bad buy signal, but what else does BSM have going for it?

Well, the company isn't resting on its laurels, which would be easy to do at this point. It recently secured royalty rights in potentially one of the most lucrative natural gas finds in recent history, the Haynesville Shale play.

This is a big deal because right now we are seeing Liquified Natural Gas (LNG) take off and Haynesville's location is everything.

It is situated right near the Gulf of Mexico, only about 135 miles away. Since it's difficult to take natural gas and put it in pipes to get to the LNG facilities on the Gulf to ship out. Haynesville drillers can skip this step, get LNG to terminals on the coast, and off it goes to Europe.

BSM owns approximately 57,000 net royalty acres in the core of the Shelby Trough region of the Haynesville/Bossier play.

A couple of catalysts for near-term price appreciation are in place, a low absolute valuation of less than 9x current free cash flow, and an 11% annual yield. Whitney didn't disappoint with this one.

Quick Recap & Conclusion

- Former hedge funder Whitney Tilson has found a “Chaffee Royalty Program” Stock that could net us 10x our money in the next 12 months.

- We learn that “Chaffee Royalties” are actually mineral royalty trusts. So named after Jerome B. Chaffee, who helped create the legislation that made them possible.

- Whitney has found one opportunity we can't miss and he has put all of his analysis on this opportunity in a new report called The New “Chaffee Royalty Program” That Could Pay 10x in 12 Months. Although the service comes with a 30-day money-back guarantee, it isn't exactly cheap at $1,495 for 12 months.

- Fortunately, one specific clue gave it away and we were able to reveal Whitney's royalty play for free as Black Stone Minerals L.P. (NYSE: BSM).

- BSM is one of the largest owners of oil and natural gas mineral interests in the United States, it is diversified and has long-lived assets. Not a bad pick at all.

Do you own any mineral royalty trusts, how have they fared for you? Tell us in the comment section.