If you have heard about the service and are asking what Monument Traders Alliance War Room is, read on.

In this review, we will discuss what it specifically does and what's unique about it.

As usual, there is much hype in their claims, but we will see if there is a basis for them.

Overview

- Name: The War Room

- Founder and Head Trade Tactician: Bryan Bottarelli

- Co-Founder and Head Fundamental Tactician: Karim Rahemtulla

- Publisher: Monument Traders Alliance

- Website: www.monumenttradersalliance.com and www.warroomtrader.com

- Service: Investment research advisory and online sharing platform for traders

- Cost: One-year subscription – $2,500 (from $4,997), Two-year subscription – $3,500 (from $9,994)

Monument Traders Alliance seems to add innovation and creativity to the investment research industry.

Instead of giving weekly or monthly reports, it invites you to an online platform. Inside, it will provide daily trade advice in real-time.

Aside from this, the team also allows for interaction among its members. This way, the platform will feel like a community of traders sharing insights, analyses, and trades.

Based on this information alone, we think this is a promising proposition.

First, since trading requires urgency, the setup can prompt timely actions. The problem with other services is that by the time a subscriber gets updates, a lot has happened already.

Second, the interactive format could mean immediate feedback from subscribers. If they feel some recommendations do not make sense, they can say so. Hopefully, the head traders would address their concerns.

Third, if a genuine community will arise from the platform, it could translate to successful trades. But this is only possible if the traders inside are legit.

So far, these are our initial impressions given the general information we presented. How about you? What are your thoughts on these?

To understand what the full scope is, we will examine its details further.

What is Monument Traders Alliance?

Monument Traders Alliance is an investment advisory publisher from Bryan Bottarelli and Karim Rahemtulla. On their well-made website, they advertise that their focus is on speculating and trading.

On this site, we have already talked about speculation in our article on The Casey Report. The newsletter claims that its editor, Doug Casey, is the authority on “rational speculation”.

Basically, a speculator is an investor who predicts future market movements. Based on his/her projections, s/he will then invest in stocks that may skyrocket in the future.

As you can see, this is an example of a high-risk investment. Speculators want to outperform traders who are involved in more traditional and longer-term investments.

Monument Traders Alliance claims that it can help you get higher yields on your investments. How? All you need are their “tools, market intelligence, and real-time, actionable advice”.

This method also follows the speculation playbook. The company assumes and suggests that people allocate 90% to 95% of their investments on something safe. Ideally, these should still outperform S&P 500.

The rest, it suggests, should be in speculative investments. The reason is simple. With this strategy, there is potential for yields that can even be higher than your 90% to 95%.

For the publisher, the beauty of speculation lies in the potential high rewards.

But such a tactic should be executed well. The company insists that they only use intelligent, calculated, and precise methods. You can be confident of this, it says, as this has already worked in the past.

To emphasize further, the goal is to invest ahead of others. While most are just hearing about lucrative companies, you are already reaping rewards.

All this information is under their page on Restoring the Lost Art of Smart Speculation.

So far, Monument Traders Alliance has three services to deliver on their promises. The flagship service is the subject of this review, The War Room. We will discuss more of this in the next section.

Meanwhile, the two other services are Trade of the Day and Trade of the Day PLUS.

The former is a free e-letter the company delivers every 5 PM from Monday to Friday. It contains summaries of trades and strategies the company has its eyes on. It also includes:

- Daily Trade of the Day Updates

-

Contains an interesting investing strategy, trading technique, or unique concept we’ve seen in the market

-

- Trade Talk Tuesdays Videos

-

Entertaining and informative special video episodes about the ins and outs of the market.

-

- Free Reports

-

Complete, one-stop introduction to the options world

-

Contains calculated, precise strategies that have proven to be successful – and enormously profitable

-

- Hot Stove Analysis

-

Reveals profitable technical formations in trading

-

Meanwhile, Trade of the Day PLUS offers its “best-timed play every single week”. It includes strategies on when to buy and sell, all for $79.

In addition, subscribers will get:

- Weekly Video Trade Updates

-

Includes top plays of the week on Large-cap stocks, small-cap stocks, or even Long-Term Equity Anticipation Securities (LEAPS)

-

Gives specific recommendations, including the ticker symbol and action to take

-

- Library of Investor Reports

-

Thoroughly researched insights into some of our best strategies and historic wins

-

- Training and Strategy Videos

-

Includes eight-part video series: Wall Street’s Most Treasured Secrets… UNCOVERED!

-

In a legal note on the website, Monument Traders Alliance wants to clarify what their role is. Compared with other investment research firms, this disclaimer is not hidden in the small fine print.

Since legal issues are surrounding other publishers, this could be a preemptive action from the company.

According to the letter, Monument Traders Alliance only acts as a financial publisher. It states that it “does not act as a broker, dealer or licensed investment advisor”.

In addition, it clarifies that people should not regard bulletins as “personalized investment advice”.

There is also an emphasis on the risks inherent in investments. Further, the publisher asserts that past performance does not guarantee future results.

Although we know that these are standard stipulations, we still find these iffy.

Marketing materials of investment research companies, including Monument Traders Alliance, obviously do not follow these.

It is clear that they do promote their services as advice. They even tell would-be subscribers to follow their recommendations.

In addition, they do trumpet past results and guarantee that subscribers will also achieve such yields.

Any honest, objective assessment would lead to the same conclusions.

But then, as we have said, this practice seems like an open secret.

This, we believe, is the reason why subscriber complaints abound. Publishers and editors say one thing and then they do the opposite.

It's as if the disclaimer only exists as a weapon they can use whenever convenient.

So unless we see convincing punishments from law enforcement agencies, this practice will continue. Truth is, companies take this risk because they see a low probability of prosecution.

As a result, we are left on our own. All that we could do for now is continue complaining about subpar services. By doing this, we are holding the line for all regular investors.

So let us press on. Let's continue informing each other of the truth behind glossy marketing pitches. After all, every one of us wants to make educated investments decisions.

What is The War Room?

900 wins!

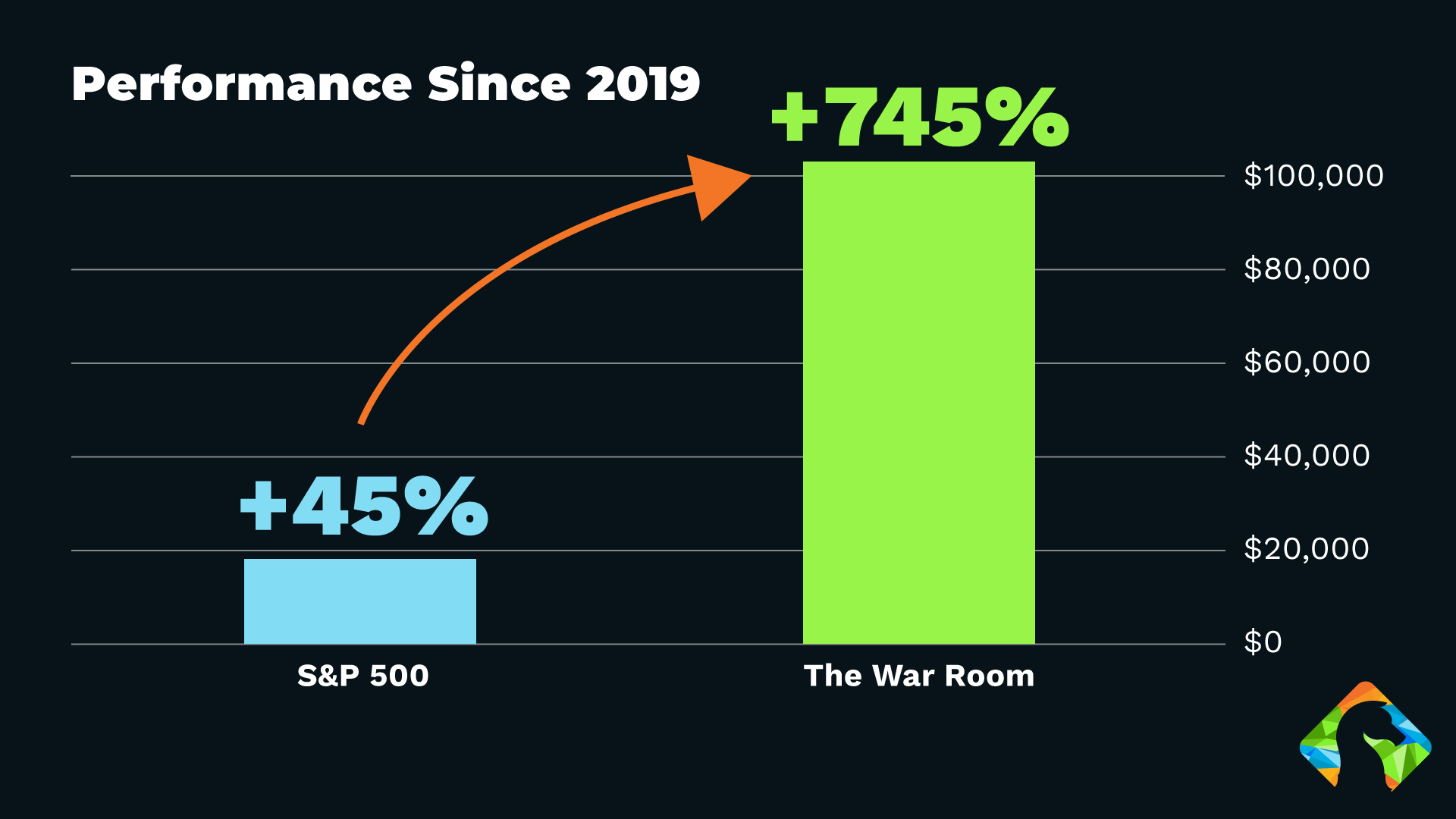

This claim will greet you once you click on the official sales page of The War Room. It pertains to the number of winning trades Monument Traders Alliance has had since opening in 2019.

For the company, this should convince you to sign up for its premier service.

But before you subscribe, you may be asking yourself, what exactly is The War Room anyway?

According to Bryan Bottarelli, he founded the platform to be an online community. However, what's unique here is that people will only share ideas about trading, markets, and investments.

Basically, it is an “interactive market research center”. This is in line with the company's mission to make “Main Street people trade like the pros”.

On this point alone, we do find this approach innovative. Whereas all the others seem to copy-paste strategies, this is different.

For reasons we have already mentioned, if and when done right, this could be a game-changer. But, as we have said, it should be backed by reliable data and strategies.

Based on its marketing page, The War Room's recommendations are varied. They can be on stocks, options, or anything else. As long as there is profit potential, expect their hands on it.

Moreover, noobs do not need to fret as they are clear in their step-by-step instructions. For investing veterans, meanwhile, the publisher makes sure it can provide useful expert advice.

Who are the People Behind The War Room?

Bryan Bottarelli and Karim Rahemtulla lead a group of individuals steering Monument Traders Alliance and The War Room. These include:

-

Chicago Board Options Exchange (CBOE) traders

-

Hedge fund managers

-

Technical charting experts

-

Volatility experts

-

Retired CEOs

-

Researchers

-

Analysts

-

Entrepreneurs

-

Expert premium sellers

-

Retired professional athletes

Still, the bulk of the weight goes to Bottarelli and Rahemtulla.

Byran Bottarelli, a graduate of Indiana University Kelley School of Business, is the group's Founder. As Head Trade Tactician, he is in charge of and moderates The War Room.

His training comes from the years he spent as an options trader at the CBOE. According to Bottarelli, he was in the thick of things during the technology boom. As a result, he got an invaluable career and life training.

However, his entrepreneurial spirit just keeps coming out. Thus, he set up Bottarelli Research in 2006. It was an “independent trading research service” that catered to an exclusive and select clientele until 2018.

According to his profile, he is a “play tactician”. Being one means using his on-the-ground experiences in building profitable strategies for investment growth.

Bottarelli says that he can increase profits while limiting risks. This is a result of the mentoring he received as a floor trader.

Meanwhile, Karim Rahemtulla boasts three decades of experience in international markets and options trading.

He was “one of the youngest CFOs of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s”. This information is from the Monument Traders Alliance website.

Moreover, the Co-Founder and Head Fundamental Tactician of the company is an investment research veteran. Rahemtulla was also Co-Founder and Chief Options Strategist of Wall Street Daily.

Further, he was also the editor of Automatic Trading Millionaire.

According to him, he specializes in “smart” trading. This uses “volatility and proprietary probability modeling” to predict risks and rewards.

Among his strategies are “LEAPS trading, spread trading, put selling and, small-cap investing”.

In addition, Rahemtulla wrote “Where in the World Should I Invest?”, a book about global investing opportunities.

When we looked at the Amazon page for it, we saw an interesting piece of information.

Bill Bonner wrote the Foreword. Okay, great.

As you know, we have already written a review on Bonner's The Agora. In the article, we asked the question “The Agora – Scam Company or Legit?”.

You may read about the various issues of the company in that write-up.

Going back to the book, we got curious about the connection between Bonner and Monument Trading Alliance. So we checked.

Though they say that they are an independent publishing company, we found this:

We are part of a larger publishing group known as The Agora Companies (“group companies”). You can learn more about Monument Traders Alliance in the “About Us” section of our Website.

In the beginning, we were hopeful about the prospects of the company. It seems to be innovating the investment research field. But this association caused us to look deeper in assessing the firm.

It isn't personal, but companies linked with Agora are replete with complaints. These range from fraudulent credit card charges to false advertising.

We are not saying all the accusations are true. You know that we always explain that subscriber reviews show only a partial picture.

However, we also will not invalidate legit experiences of paying consumers. We empathize especially with elderly subscribers who have a hard time getting their issues resolved.

But then, we still want to be fair. We will continue to review The War Room and its publisher on their own merits.

What about you, our readers who know about Bonner's group, what do you think about this connection?

How it Works

In essence, The War Room is still similar to other research advisory newsletters. It also provides investment guidance to paid subscribers. So-called experts are still at the helm of the service.

However, the editors here give daily and real-time advice. They can do this through their online platform. In this space, subscribers can also share trading insights.

This is the unique selling proposition of this service.

Aside from this, they also say that their recommendations have three categories. These are:

- Overnight Trades

-

Helps you make money even when the markets are closed through options trades

-

- Sniper Trades

-

Looks for patterns that show a stock poised to quickly gap up or gap down

-

Recommends options trades to capture the price move

-

Asks you to set up the trade to automatically close once the profit target is hit

-

- Market Swing Trades

-

Gives you the chance to profit on any market swing – whether up or down

-

Uses QQQ, a special options play on the Nasdaq.

-

Moreover, since The War Room is into trading and speculation, let us discuss what makes a successful speculator.

Doug Casey, who calls himself a “rational speculator”, is the editor of The Casey Report. Our review of his newsletter discusses key aspects of this process, so do check it out as well.

For him, speculators must not only make wild predictions. They need to have an intelligent basis for their investments.

An article on the Nasdaq website details the factors involved to succeed in the field. The write-up, How to Speculate Your Way to Success, lists eight considerations.

- People

- Look at the competence and track record of the people who lead the company

- This is the single biggest factor for success

- Property

- Examine what properties a company has and plans to buy

- Phinancing

- Check how much cash a firm has

- Paper

- Look at the share structure

- Promotion

- Determine if a company has the resources to get its message out regularly

- Politics

- Analyze how governance issues affect market performance

- Push

- Anticipate upcoming milestones that can push share prices higher

- Price

- Examine a company's market capitalization

Subscribers will be able to get all these strategies anywhere they wish. All they need to do is simply enter the online portal.

What You Get

Once you subscribe, the publisher offers these:

-

12 months of research and trade recommendations in The War Room

-

Access to the War Room chat room

-

War Room Report No. 1: “Getting Started as a War Room Trader”

-

War Room Report No. 2: “Developing the Winning Mindset of a Pro Trader”

-

The War Room Push Notification System

-

War Room Video No. 1: The Earnings Strangle: How to “Hack” Earnings Season and Make 188% Overnight

-

War Room Video No. 2: Fade the Public: Beat the Crowd and Make Windfall After Windfall With This Elite Technique

-

War Room Video No. 3: The 3-Minute Chart: Using the Pro Trader Tool to Spot “W” and “M” Patterns Every Single Day

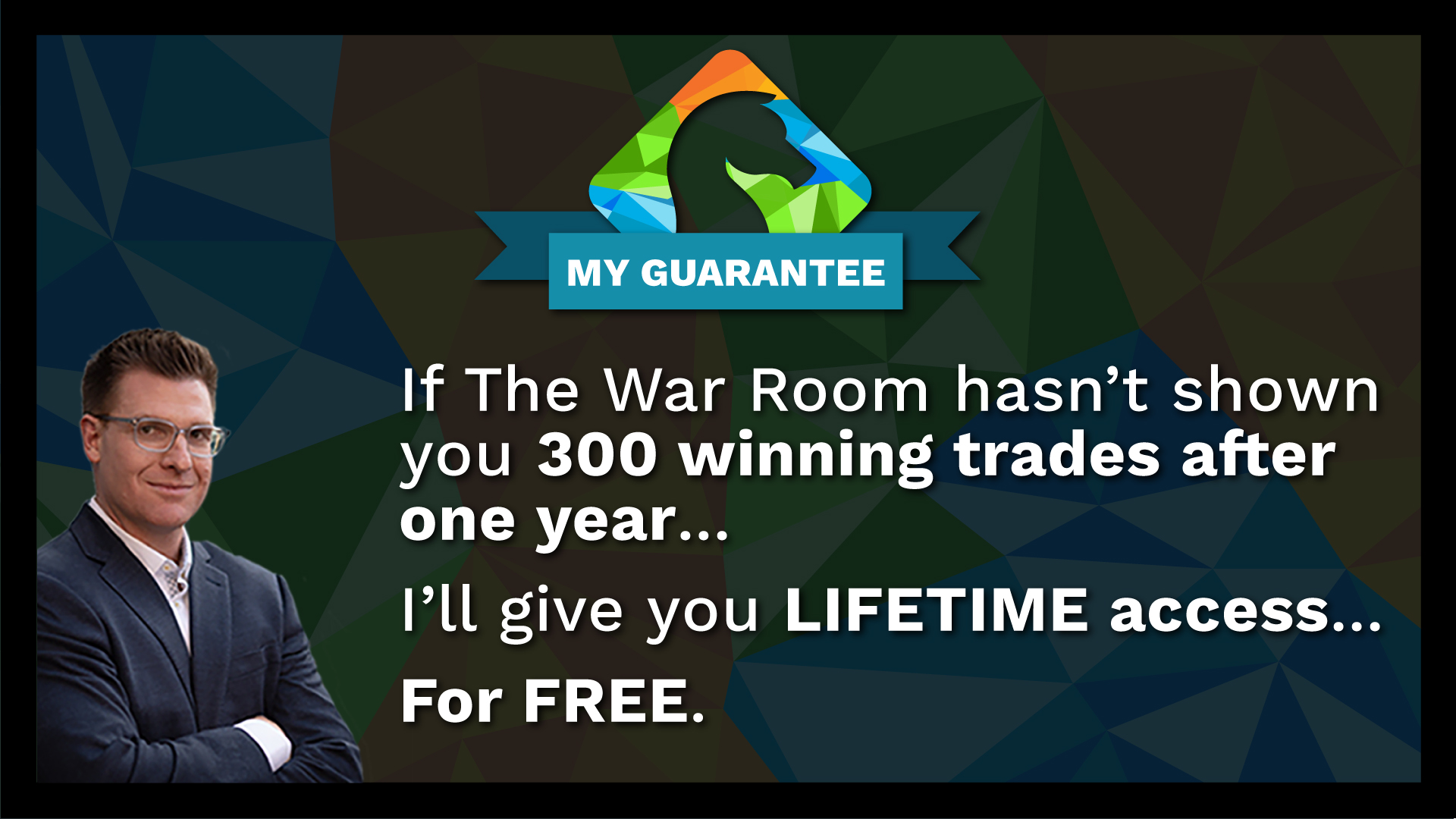

To further hook potential subscribers, Bottarelli offers a guarantee.

According to him, he is that confident in his methods. If he fails, he will end up losing around $10 million due to hundreds of free lifetime subscriptions.

What do you think about this? A ballsy move or a cheap gimmick? Tell us your thoughts.

Track Record and Reviews

The War Room offers plenty of proof that its system works.

Since 2019, Bottarelli claims that they already had 900 winners and have 79% win rate.

The sales page is peppered with testimonials of successful trades. Along with this are actual names of companies and their gains.

According to the moderator, even during crashes, his recommendations will make money. A case in point is Clorox during the Coronavirus crash in February 2020.

While everyone else was in the red, he said The War Room opened 13 trades who turned out to be winners.

Since he recommended Clorox to his readers, they made gains of up to 89%.

There are a lot more examples, especially under Bottarelli's three categories.

Of course, this is expected from promotional materials. So we also want to know what subscribers think, even if the comments are not representative of all users.

Monument Traders Alliance got an impressive 4.71 out of 5 stars in Better Business Bureau. The rating was an average from the feedback of fewer than 20 subscribers.

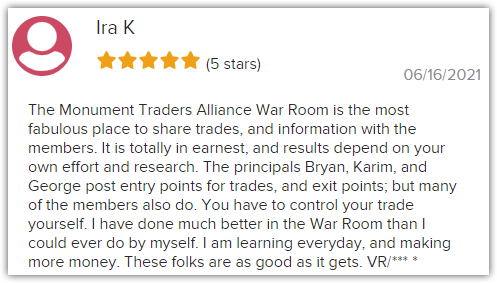

The comment below is a good summary of the other reviews. It highlights the community aspect of the platform. At the same time, the reviewer also acknowledges the efforts of the moderators.

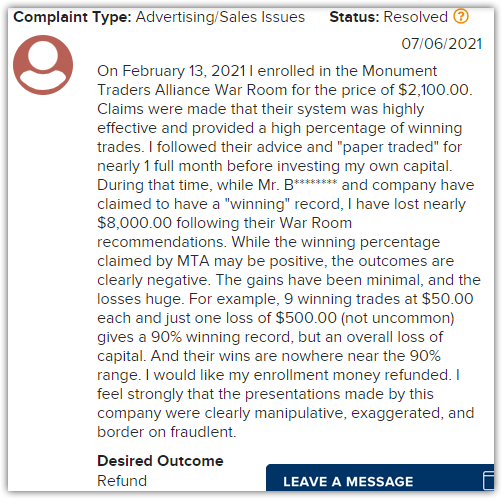

Of course, there still are negative reviews like the review here:

The complainant apparently lost money and believes The War Room's claims are overhyped.

In total, the publisher has received 17 complaints since 2019.

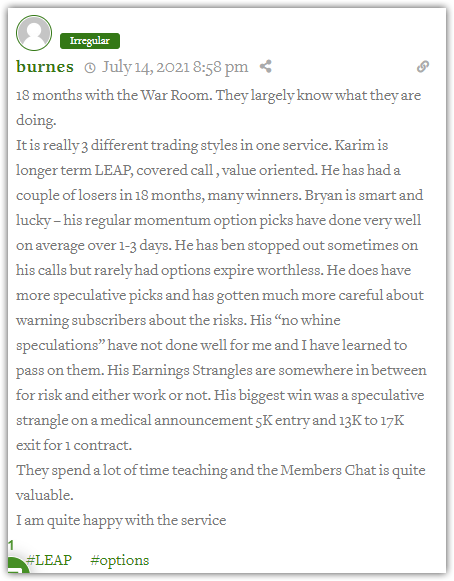

As of this writing, only one person has given the service a rating on Stock Gumshoe.

He gave it 4 stars for Investment Performance and Value for Price. The platform got 5 stars for both Quality Of Writing/Analysis and Customer Service.

There was also just one comment on the review page. We believe it is a comprehensive and fair assessment of The War Room.

Cost and Refund Policy

Cost

- One-year subscription – $2,500 (from $4,997)

- Two-year subscription – $3,500 (from $9,994)

Refund Policy

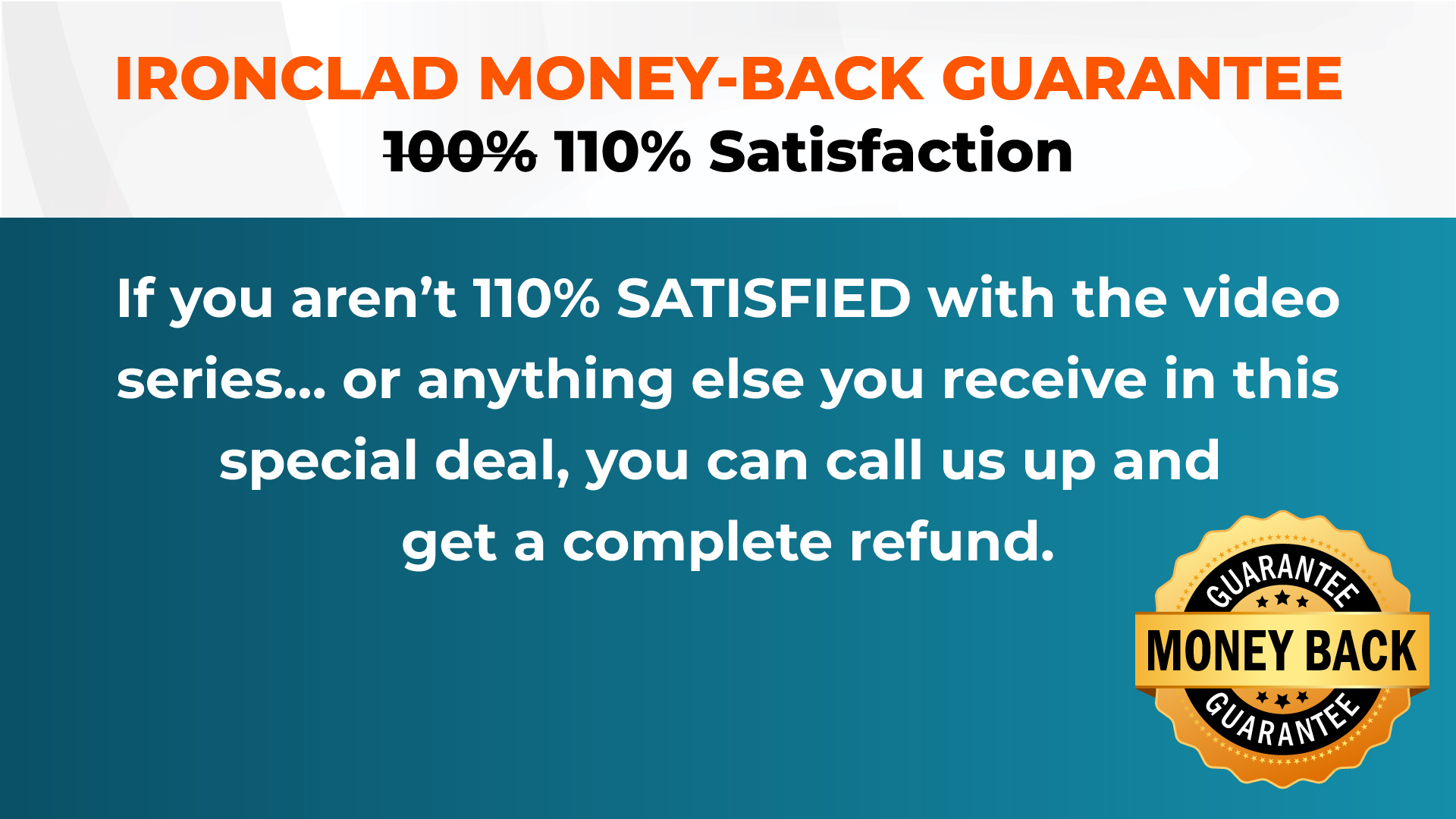

The publisher boasts of an “ironclad money-back guarantee”.

It seems straightforward and works like most policies. You just need to inform them if you feel the service did not meet your expectations and standard. They will then return your money.

What's missing here, though, is the vital piece of information about its validity.

We all know that different publishers offer varying timelines. Others give you three months. Some, meanwhile, allow subscribers to cancel for up to within a year. So this is not a clear point.

Further, they add that you do not need to return their special add-ons when you request a refund. For us, this policy is well-appreciated as it sides with consumers.

Pros v Cons

Pros

- Daily, real-time recommendations

- Accessible online platform to get investment advice

- Members can exchange trading ideas

Cons

- Tendency to overpromise

- Speculation as a strategy is risky

Conclusion – Will the Innovation Make You Money?

Bryan Bottarelli and Karim Rahemtulla may be on to something here.

They have created an online platform where subscribers can get real-time trading advice. In addition, they may also interact with others and share their insights.

As usual, the claims tend to overpromise potential yield. But so far, the reviews we have seen have been positive. As usual, we want to clarify that positive reviews also do not reflect all subscriber experiences.

So, what is Monument Traders Alliance War Room? We hope you got a clear sense of what they are about in this article.