Our review of Weiss Ratings focuses on their newsletters. They say that their advisory is top-notch because they are also a financial rating agency. But despite this, people still ask if Weiss Ratings is a scam.

Naturally, this begs the question: what could they be doing wrong? At first glance, the integration between the agency and its investment arm seems sound. The logical conclusion is that they would have an elevated service due to this.

Of course, we will not allow our preconceived notions to get the better of us. Here at Green Bull Research, we want to be both informative and fair.

So let us go through the company, their services, and their team.

Overview

- Name: Weiss Ratings

- Founder: Martin D. Weiss

- Publisher: Banyan Hill

- Website: www.weissratings.com

Weiss Ratings is an agency that has been assessing financial institutions for 50 years.

In their quest to empower consumers, they have also started offering newsletters. Today, they have 20 services advising subscribers to make prudent financial decisions.

Are you looking to learn more about their investment research services? Continue reading as we explore the different aspects of the research firm.

What is Weiss Ratings, LLC?

The financial rating agency offers objectivity, ethical conduct, and a dedication to safety.

According to them, this has been their brand promise since 1971.

Further, Weiss Ratings claims to have the widest coverage and the strictest level of impartiality.

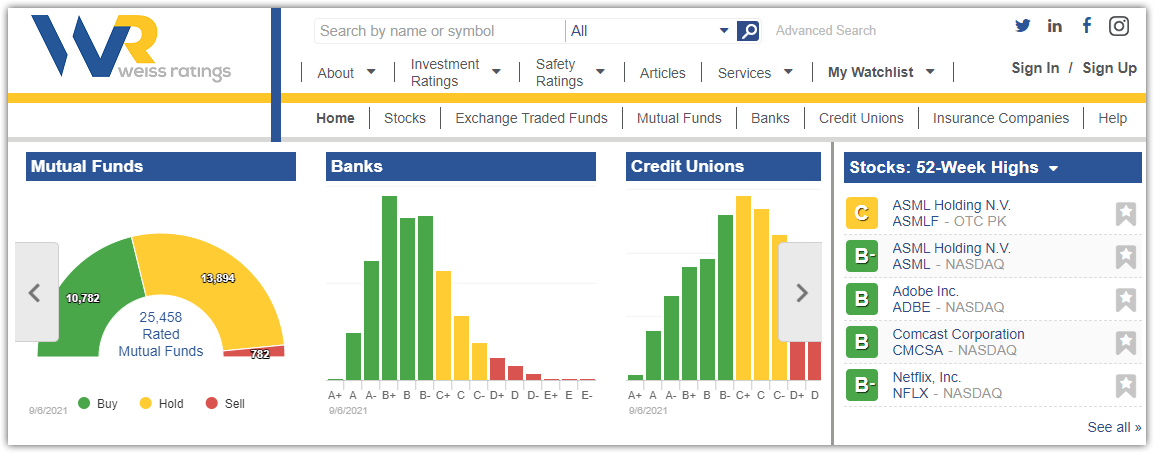

To deliver this, they evaluate somewhere around 55,000 institutions and assign each one a letter grade. Included in their roster are stocks, mutual funds, and exchange-traded funds (ETFs).

Examples of agencies, meanwhile, are credit unions, banks, and insurance entities.

Moreover, they claim that their assessments are “accurate, unbiased, and safe”.

Also, if their subscribers were to fully listen, they can minimize financial losses. How? Weiss provides an array of investing, banking, and insurance alternatives.

Further, Weiss is not compensated by those they rate. As a result, firms do not have the option of pre-viewing ratings. Additionally, they cannot prevent them from being published.

Because of this, Weiss can maintain credibility and independence.

As proof of their performance, they cite that The Wall Street Journal named them a top rating agency. In fact, they have better profit performance over others even in times of crisis.

What is the Weiss Ratings System?

So what exactly is their method that makes them stand out in the industry?

According to their website, the agency provides two kinds of ratings.

-

Weiss Investment Ratings (on stocks, ETFs, and mutual funds)

-

These are in the same realm as “buy,” “sell” and “hold” ratings.

-

They are designed to help investors make more informed decisions. The goals are to maximize gains and minimize risk.

-

Safety is also an important consideration. (Higher rating = investment will more likely be profitable)

-

But when using their investment ratings, be aware: all investments involve risks.

-

-

Weiss Safety Ratings (on banks, credit unions, and insurance companies)

-

These are similar in purpose to credit ratings.

-

They are designed to help consumers find institutions to entrust with their savings and retirement money.

-

Higher rating = institution will more likely remain financially stable/strong in any circumstance

-

Moreover, they want to mention a specific clarificatory disclaimer. We think it is a sensible point that you must be cognizant of.

Many banks and insurance firms are entities that will accept your deposits or insurance premiums. In addition, they are also under parent corporations that you may purchase shares in.

So here is their guidance:

You are to refer to the Weiss Safety Rating if you are looking at where to open your savings/checking account. Meanwhile, you may check the Weiss Investment Rating if you plan to buy, sell, hold or avoid their shares.

This makes sense, right?

Here is another example to further clarify the matter:

If you are studying which insurance policies to get, check Weiss Safety Rating. But if you want to buy shares, you must look at their Weiss Investment Rating.

This explanation, if their ratings are indeed accurate, is really helpful.

Moreover, they are also transparent about their grade scale. We are showing them to you here for your reference. Included in the discussion below are the actions one can take based on the letters.

- A = excellent

- Weiss Investment Rating: Strong Buy

- Weiss Safety Rating: High probability of stability even in adverse environments (e.g. depression or debt crisis)

- B = good

- Weiss Investment Rating: Buy

- Weiss Safety Rating: Probably stable even in an adverse business or economic environment. However, its stability should be re-evaluated at that time.

- C = fair

- Weiss Investment Rating: Hold or Avoid

- Weiss Safety Rating: Probably stable in a favorable environment. May also encounter financial difficulties in an adverse environment.

- D = weak

- Weiss Investment Rating: Sell

- Weiss Safety Rating: May encounter financial difficulties, including failure, in an adverse business or economic environment.

- E = very weak

- Weiss Investment Rating: Strong Sell

- Weiss Safety Rating: May encounter financial difficulties, including failure, even in a favorable business or economic environment.

- F = Failed

- U = Unrated due to insufficient data

- Signs:

- Plus sign (+): upper third of each grade

- No sign: middle third of each grade

- Minus sign (-): lower third of each grade

We'd also like to commend its attractive colors and design. The site fresh and appealing. This is in sharp contrast to the often boring topic of finances and investing.

Who is the Founder of Weiss Ratings?

In 1971, Dr. Martin Weiss created Weiss Research as a way to jumpstart his career. Weiss Ratings was just its subsidiary back then, before becoming a separate entity in 1994.

Since 1980, he has lived in the United States as a Fulbright Scholar. As his career progressed, he began examining banks and savings institutions.

Researchers at his firm analyze financial institutions to determine their risks. In turn, these help consumers, institutions, and the media.

The company reached a milestone in 1989 as it became the first in the country to rank insurers. In 1994, they also became the pioneers in rating HMOs. Another first in the U.S., Weiss issued the first stock safety ratings in 2001.

According to him, the company's strides in objective ratings earned him the title “Mr. Independence” from Forbes.

Consequently, he has appeared before many agencies. Congress, schools, and the media often rely on his counsel.

Further, the investor is also a philanthropist. Additionally, he has a long history of advocating for quality education.

Dr. Weiss graduated with a political science degree from New York University. For his Ph.D. in cultural anthropology, he attended Columbia University.

Weiss Ratings Team

Aside from its founder, the company claims that it has experts in investing. Each brings years of experience in various fields.

Here are the senior staff of the Weiss Ratings investment research advisory team:

Sean Brodrick, Editor

- He focuses on “small-cap values in the natural resource sector”.

- Further, The Edelson Institute counts him as their small-cap mining specialist.

Tony Sagami, Editor

- He has a technical and quantitative approach to mutual funds and stocks.

Jon Markman, Editor

- The guy is an award-winning writer on the subject of financial investments.

Mike Larson, Senior Analyst

- Weiss Ratings relies on his market forecasts and warnings.

- Also, he previously worked in Bloomberg News and Bankrate.com.

Gavin Magor, Senior Analyst

- Magor's main interests are insurance, banking, and stocks.

Mandeep Rai, Senior Analyst

- A former stock and credit analyst, he is the editor of Top Stocks Under $10.

Juan M. Villaverde, Editor

- The econometrician and mathematician's area of focus is cryptocurrencies.

Services

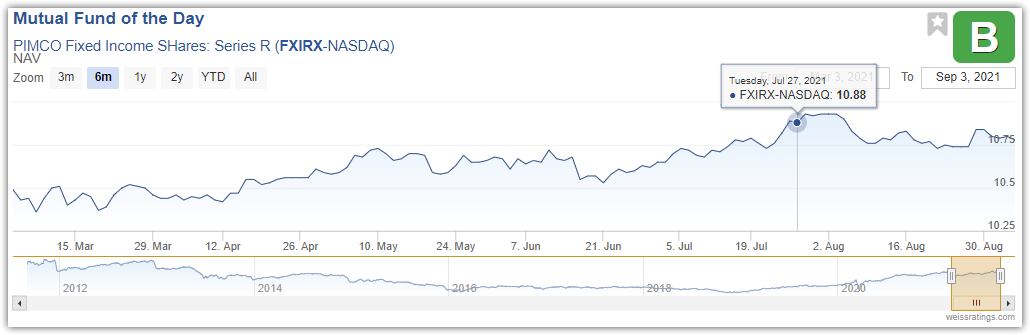

The rating agency, in addition to their main line, also offers a follow-along investment advisory.

According to Weiss, this is the main advantage they have over others. Their newsletters have a whole financial assessment company behind them.

Ultimately, subscribers do not only have editors to rely on. The full force of the agency also drives the information they give.

Generally speaking, we think this is a strong selling proposition. Data and information are worth millions today. Since they have unlimited access, this would mean excellent resources.

Their services are divided into four categories, which we will discuss below.

Newsletters

Disruptors and Dominators

- Editor: Tony Sagami

- Price not indicated

-

Has a secret weapon: Weiss Ratings’ renowned numerical analysis of every stock traded on U.S. exchanges

-

Identifies stocks dominating the economy

-

May turn every $25,000 into $592,387

Safe Money Report

- Editor: Mike Larson

- Price not indicated

-

Uses an updated “Rockefeller Recipe” investing strategy for today’s market

-

The goal is to help you turn every $10K you invest into $44,508

The Power Elite

- Editor: Jon Markman

- Price: Standard – $29, Deluxe – $119, Premium $59 (from $496)

-

Promises to reveal eight stocks in businesses that make money like clockwork year after year

Heat Maps

- Price not indicated

-

Zeroes in on today’s best stock market opportunities with unprecedented accuracy

-

Spots the landmines lurking beneath the surface

Wealth Megatrends

- Editor: Sean Brodrick

- Price: Standard – $29, Deluxe – $119, Premium $59 (from $496)

-

Will tell you “what’s going to happen in the financial markets over the next few years and why”

Premium Trading Services

Gold & Silver Trader

- Editor: Sean Brodrick

- Price not indicated

-

Access to Brodrick's powerful Gold X strategy

-

Claims 10-fold gains over the next 12 months

Marijuana Millionaire Portfolio

- Editor: Sean Brodrick

- Price: Annual fee of $2,500

-

Opportunity to turn $30,000 into $1.4 million using their Cannabis Stock Ranking Model

Markman's Strategic Options

- Editor: Jon Markman

- Price not indicated

-

Promises to turn $10,000 into $248,516 with its proven, conservative strategy

-

Claims it can help you multiply your wealth 25 times over with minimum risk

Weiss Ratings’ Quantum Trader

- No information provided

Supercycle Investor

- Editor: Sean Brodrick

- Price not indicated

-

Analyzes events to maximize stocks, ETFs, ETFs, and options

Tech Trend Trader

- Editor: Jon Markman

- Price not indicated

-

Multiplies tech stocks without exotic investments and without using leverage and big risk

Weiss Ultimate Portfolio

- Editor: Tony Sagami

- Price not indicated

-

Success of the strategy: 722% total return since 2007, averaging 67.2% per year

Weekend Windfalls

- Editor: Mike Larson

- Price not indicated

-

Opportunity to make an extra $50,000 in income in your first year

Weiss Technology Portfolio

- Editor: Jon Markman

- Price not indicated

-

Can multiply your money 25 times over

Cryptocurrencies

Undiscovered Cryptos

- Editor: Dr. Bruce Ng, Juan Villaverde

- Price: Annual Fee – $5,000

-

Blow-out profit potential in select undiscovered cryptos

Weiss Crypto Investor

- Price: Around $80 (based on the original text: “Join now for less than 22 cents a day”)

- We have already discussed one of the newsletters' pitches in a past article here at Green Bull Research.

-

Flagship cryptocurrency investing newsletter

-

Identifies the next crypto-currency investments – both coins and stocks —

Weiss Cryptocurrency Portfolio

- Price not indicated

-

Strategy based on ratings of Bitcoin, Ethereum, Ripple, and over 100 other cryptocurrencies

Weiss Cryptocurrency Ratings

- Editor: Juan M. Villaverde

- Price: Annual fee – $468

- You may read our extensive review of this specific newsletter for more details.

-

Sophisticated computer model to give you enormous profit potential in cryptocurrencies

Memberships

The 2020 Alliance

- Price not indicated

-

Ten-year subscription to Weiss Ratings’ 11 wealth-building newsletters

The 2020 VIP Coalition

- Price not indicated

-

Ten-year subscription to Weiss Ratings’ 18 wealth-building newsletters

Track Record and Reviews

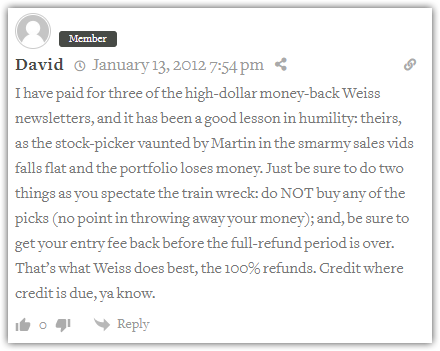

To get a better gauge of the financial recommendations of Weiss Ratings, we looked at actual subscribers.

We know that you have already been bombarded with countless unverified testimonials. You may even have grown weary of supposed proofs of success that seem unrealistic.

So in this space, we want to present experiences from consumers like you.

To help guide you, we looked for useful comments in Stock Gumshoe.

For example, we encountered a person with the username “David”, who was sarcastic in his review. We think his comment is worth noting because he has subscribed to and tested multiple newsletters.

Read his account below:

Unfortunately, despite getting information from three services, he still lost money.

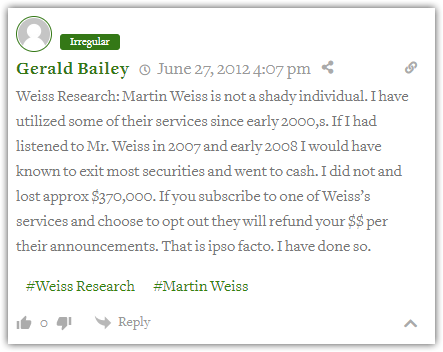

Gerald Bailey, meanwhile, gives a defense of the company and its founder. To prove his point, he even cited some evidence in his comment.

If only he listened, this was the sentiment of the subscriber above.

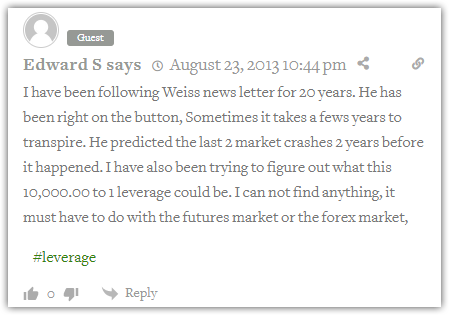

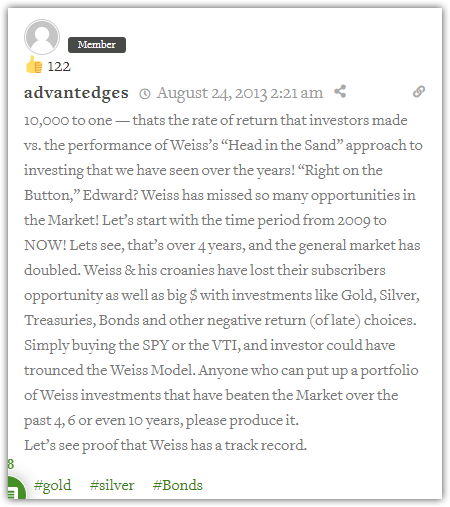

To further help you, we continued to search for substantive comments and found an interesting exchange. Edward posted a comment in one of the threads in Stock Gumshoe.

According to him, as a subscriber of Weiss for two decades, he can vouch for its accuracy and integrity.

Another commenter saw this as an opportune moment to challenge him and other commenters. He said he wanted to see proof of the company's track record.

It seems to be a hypothetical dare though, as he believes that Weiss has no credibility.

We would have wanted to see another rebuttal from Edward, or anybody, for that matter. It would have been interesting if another commenter would be able to come up with evidence or proof of success.

Sadly, there was no follow-up to the exchange.

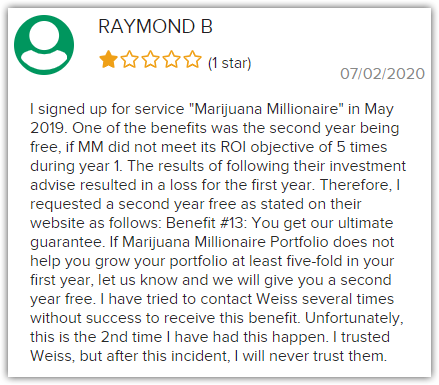

Further, allow us to show you two more comments, but this time from the Better Business Bureau.

Raymond talks about two things. Number one, the promised return was nowhere near his actual experience. Number two, he laments the bad customer service of the company.

As a result, Weiss has lost him as a subscriber.

Cino, below, also acknowledged what we said that Weiss services have a polished feel to them. Despite this, he wants potential subscribers to be cautious about the advisory company.

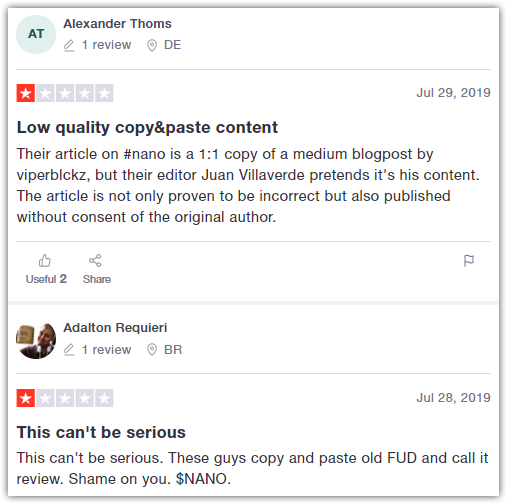

In addition to these, we want to add a concerning issue we found in some comments on Trustpilot.

Previously, we have already discussed this in our review of the Weiss Crypto Ratings newsletter.

These are only two of several comments regarding the issue. As we have said in our review then, these are serious allegations if proven true.

Do you have experiences like this with Weiss or other newsletters? Kindly tell us in the comments section.

In summary, here are the ratings the newsletter provider has received as of this writing:

- Better Business Bureau: 1 out of 5 stars (6 reviews, 81 complaints)

- Trustpilot: 1.5 out of 5 stars (71 reviews)

- Stock Gumshoe: Safe Money Report – 3.1 out of 5 stars (158 votes)

- Stock Gumshoe: Disruptors and Dominators – 2.2 out of 5 stars (19 votes)

- Stock Gumshoe: Weiss Ultimate Portfolio – 1.8 out of 5 stars (30 votes)

- Stock Gumshoe: Weiss Crypto Investor – 4 out of 5 stars (1 vote)

Before you leave this section, let us remind you of this point. Such reviews are only a snapshot of reality and only reflect a portion of thousands of subscribers.

You must still exercise wisdom and discernment when you read comments online.

Cost and Refund Policy

In today's world, it is a mystery to us why Weiss Ratings would still require you to call their number. While others offer the convenience of a few clicks, this company goes the other route.

For most of their services, you can only subscribe to and know the price of a newsletter upon calling.

We think this is a hassle and a disservice to readers. Such providers should always think about what's convenient for customers.

These are their newsletters with clear information on costs:

The Power Elite

- Editor: Jon Markman

- Price: Standard – $29, Deluxe – $119, Premium $59 (from $496)

Wealth Megatrends

- Editor: Sean Brodrick

- Price: Standard – $29, Deluxe – $119, Premium $59 (from $496)

Marijuana Millionaire Portfolio

- Editor: Sean Brodrick

- Price: Annual fee of $2,500

Undiscovered Cryptos

- Editor: Dr. Bruce Ng, Juan Villaverde

- Price: Annual Fee – $5,000

Weiss Crypto Investor

- Price: Around $80 (based on the original text: “Join now for less than 22 cents a day”)

Weiss Cryptocurrency Ratings

- Editor: Juan M. Villaverde

- Price: Annual fee – $468

Among 20 services, only six provided their price.

Granted, they have an automated bot designed to assist you. But it's still not enough as it lacks key information about the specific services.

In addition, only three services explicitly stated a refund policy. These are The Power Elite, Wealth Megatrends, and Weiss Ratings Crypto Investor.

Your first-year subscription charge is fully refundable within the first year.

Pros v Cons

Pros

- Track record as a reputable financial rating agency

- Variety of services

- Easy to navigate website

Cons

- Lacks information

- General and vague statements on their newsletters

- Accusations of plagiarism

- For most newsletters: no clear explanation of their process

- Promises too much

Conclusion – Is Subscribing a Wise Move?

Weiss Ratings offers 20 newsletters for every kind of investor. What sets them apart is their 50-year record in rating financial entities.

Also, we must point out that though they are connected, there are also divergent points in their services.

Being good at assessing stocks, insurance companies, HMOs, and banks is one thing. But dishing out investment advisory requires a different skill set.

So it comes down to the exact methods and processes the editors will employ in their newsletters. If they could show how they intend to make use of their ratings, we would be more at ease with their investing strategies.

Unfortunately, there is very limited information on this. What we mostly see is marketing language that does not enlighten potential subscribers.

This is a wasted opportunity. As we have noted above, their rating system primer is comprehensive.

So is Weiss Ratings a scam? Based on our extensive article, what do you think? Are you inclined to subscribe to their services? We hope our Weiss Ratings review has been helpful to our readers.