Can Keith Kohl really magically transform your $500 into $1.5 million? Our Technology and Opportunity Newsletter review will equip you with enough information so you can determine if this is indeed possible.

Obviously, there are a lot of claims out there. Our goal is to help would-be subscribers discern which ones are legit. So do continue reading as we discuss the ins and outs of the newsletter.

Overview

- Name: Technology and Opportunity Newsletter

- Editor and Investment Director: Keith Kohl

- Publisher: Angel Publishing

- Website: www.angelpub.com

- Service: Investment Research Advisory

- Cost: $249

Angel Publishing presents Keith Kohl as its newest editor of Technology and Opportunity. The newsletter provides monthly investment recommendations on major market trends.

To maximize the profits of its subscribers, the advisory aims to spot little-known companies that have huge potential in the future.

Kohl says that he has intel from the company's “network of aerospace engineers, biomedical Ph.D.’s, CEOs, physicists, and military insiders”.

Such insider info sets him apart from other financial research editors.

What is Angel Publishing?

Angel Publishing makes its investing approach clear on its website. As a research company, its aim is straightforward:

Our goal is simple: to give our readers the tools they need to gain their financial freedom.

To do this, it offers particular techniques on “finance, markets, human nature, and obscure financial trends”. According to the publisher, what sets them apart is their “unconventional moneymaking strategy”.

Part of the company's edge also is its panel of experts who excel in various fields. Their specializations are:

-

Investment research

-

Technical analysis

-

Knowledge in the energy, technology, biotechnology, and financial sectors

Further, it seems like Angel Publishing is focused on three major things. These are technology, energy, and biotechnology.

Moreover, the website highlights its investment point of view. The company adheres to the principles of the Austrian economics school of thought. This means that their experts believe in the free market.

They espouse an economy with “strong property rights”. For them, this is the “key to peace, prosperity, and greater wealth”. Part of this thinking as well is the mindset that the future is unpredictable.

Because of this, they consider themselves mainly as speculators. Their investments are partly based on political and market factors.

So they do acknowledge that geopolitical events heavily affect investments. So the team makes sure everyone is always updated on governmental issues across the globe.

Further, the publishing house states that its team follows a “contrarian investment strategy”. It clarifies that its approach is not to join the bandwagon. Angel Publishing does not automatically invest in what's currently profitable.

Instead, what their experts do is look at companies that may have been overlooked. They then study these and get in early before everyone else. This strategy results in huge investment gains.

Of course, they have standards for stocks that they pick. To be chosen, a company must have:

-

A solid management team

-

Innovative products

-

Efficient processes

-

Good profit margins

Through the years, experts at Angel Publishing have helped thousands of investors already, as per their claims.

One of the reasons why they are good at what they do is because they travel a lot to get on-the-ground insights on the economy. Because of their analyses, major media companies also guest them to get major updates.

Some of their appearances have been in Business News Network, Yahoo!'s Daily Ticker, Fox Business, CNBC, Bloomberg, the Wall Street Journal, and CNN.

So who are the leaders of Angel Publishing?

Brian Hicks

-

Known as the original “Bull on America”

-

Shows investors how to profit from America's innovative and information-based economy

Christian DeHaemer

-

Uses a specific catalyst he calls “The Hammer, Trigger, and Spark System” to ensure rapid profits

Jeff Siegel

-

Spots the most lucrative alternative energy companies in the world

Alex Koyfman

-

Has expertise in high-upside, development-stage technology, and biotech companies

Keith Kohl

- More on him later

Jason Williams

-

Shares upcoming breakout stocks so investors can gain huge profits

Angel Publishing has a total of 15 premium services and 2 free newsletters. These are:

Premium

- Green Chip Stocks

- Technology and Opportunity

- Main Street Ventures

- Bull and Bust Report

- Launchpad Trader

- Energy Investor

- The Wealth Advisory

- Alpha Profit Machine

- Microcap Insider

- IPO Authority

- First Call

- Weekly Score

- Topline Trader

- Real Income Trader

- Wealth Trust

Free

- Wealth Daily

Who is Keith Kohl?

Keith Kohl is Jason Stutman's successor in Technology and Opportunity. Before Stutman, it was Christian DeHaemer who was in charge of the newsletter.

It appears that Kohl's expertise is in energy, biotech, and technology. According to his profile, 300,000 people subscribe to his newsletters.

Aside from Technology and Opportunity, he is also the editor of Energy Investor and Topline Trader.

Further, his profile claims that he “has called practically every major tight oil play” way before traditional media noticed them. This is a major part of his twenty years of experience in the field, he says.

On top of his success in the energy sector, he also claims success in the tech sector. In fact, according to him, his subscribers experienced up to triple-digit gains in the latest tech trends.

He says he manages to be ahead of everyone because of his keen research skills. He gets advanced info on the groundbreaking efforts of almost 1,000 biotech companies.

According to Kohl, he is confident he can give you profitable stocks so you can prepare for a comfortable retirement.

Such confidence is also evident in his previous teasers. We have written about his teasers on a “Project Talos” and a “TriFuel-238” discovery. Read our reviews to know what we think about them.

What is Technology and Opportunity?

This is a monthly newsletter that promises to give you investment opportunities mostly in the tech sector.

Its editor, Keith Kohl, says that he is always on the lookout for companies that are still under the radar. Because of this, you have a chance to invest in them before everyone else.

According to him, when you get in early, you will see high profit margins when these companies finally make it big. This is what Angel Publishing means when it says they are “getting ahead of the curve”.

Areas where they see future high returns are robotics, AI, 5G, and virtual and augmented reality.

How it Works

So how does Kohl know which small companies are about to experience a breakthrough? Well, part of it is instinct developed through twenty years in the industry, he says.

But a major component here are his research abilities and connections. According to him:

His network includes hundreds of experts, from M.S.s and Ph.D.'s to lab scientists grinding out the latest medical technology and treatments.

The relationships he has built with them give him a front seat to the latest developments in the tech sector.

Unfortunately, apart from these, there is no deep explanation of a process we can examine. Since the claims are huge, including turning $500 into $1.5 million, we expected more.

As we have mentioned in the past, other editors might get away with it. Sometimes, for editors who have developed quite a reputation, their names are enough.

We are not saying that their prominence excuses them. But we also can't deny the fact that some big names already carry with them a brand. Often, because of it, people already know what they are about.

In this case, though, Keith Kohl still has not earned such name recognition. So we still expect him to provide more details on his process.

What You Get

Kohl currently offers three add-ons to entice readers to subscribe to his monthly newsletter. These are:

-

Free Investment Dossier: The #1 Stock of This Generation: How You Could Ride the End of Aging to Enormous Stock Returns

-

Bonus Report #1: The Robot Revolution: Three Stocks Poised for Massive Returns

-

Bonus Report #2: Space Billionaires: The #1 Stock to Own for 2021 and Beyond

-

Bonus Report #3: Ultranet Profits: Top 3 Stocks for Riding the 5G Revolution

These are on top of the regular newsletter features most publishers offer.

-

Technology and Opportunity investment newsletter

-

24/7 access to your custom web portal

-

“Special Situation” updates

-

Free Subscription: Wealth Daily

-

VIP Member Services Team

Cost and Refund Policy

Cost

A one-year subscription to Technology and Opportunity costs $249.

Refund Policy

To further convince subscribers, Keith Kohl offers what he calls a “Double Guarantee”.

First, he offers a free subscription on your second year if he is “wrong”. For us, the terms seem vague here. Take a look at his wording yourself:

I think that you will have the opportunity to grow ludicrously wealthy once this company announces its anti-aging breakthrough to the world.But if for some crazy reason I’m wrong…And this company doesn’t begin to take over the $15 trillion health care sector…Then all you have to do is call my member services team, and we’ll give you an entire extra year of Technology and Opportunity for free!

So what does this mean, exactly, in operational terms? To us, this further opens doors for misinterpretations. It can result in subscribers opting out for various reasons.

Of course, since it is unclear, Angel Publishing can also refuse to fulfill its promise based on its interpretation.

Second, the company also says you have up to six months to change your mind. If you feel dissatisfied, you may call them. After informing its agents, they will return your subscription fee.

These two make up his “Double Guarantee” scheme.

Track Record and Reviews

Travis Johnson of Stock Gumshoe wrote a commentary about a teaser released by Technology and Opportunity.

In it, he talked about “The #1 Stock of This Generation: How You Could Ride the End of Aging to Enormous Stock Returns”.

The first thing he did was critique the typical playbook of the newsletter. He said some of the phrases the copywriter used are just recycled from traditional promotional materials.

As proof, he cited concrete sentences as examples:

- First, there is always a bandwagon pitch. The writer always says that prominent people are already in on it.

-

“Jeff Bezos, Peter Thiel, and the Rockefellers are betting a colossal nine figures on: The #1 Stock of This Generation”

-

- Then, this is followed by a tease saying the editor is already holding a key piece of information.

-

“Inside this folder are 140 patents that will soon alter the very fabric of the world as we know it.”

-

- Another bit always present is a suspenseful line similar to “you are not going to believe this…”

-

“They’ve been quietly filed over the last three years by a secretive company…

-

“In this nondescript office park…

-

“On the outskirts of San Francisco.”

-

- To complete the script, there is also a compelling back story that ties everything together.

-

“Outside of the company’s engineers, only a few people have been allowed to witness this technology for themselves.

-

“In 2017, Jeff Bezos was given a ‘demo’ and immediately dipped into his own pockets to write a check for $116 million.

-

“In 2018, Peter Thiel, the billionaire PayPal founder, was invited to visit this company’s headquarters…

-

“And shortly after he walked out, Thiel’s investment fund wrote them another eight-figure, multimillion-dollar check.”

-

According to Johnson, he is pointing this out because of a key observation. The ad is too similar to a teaser touted by Jason Stutman just a few months before this new teaser.

Stutman is the former editor of Technology and Opportunity who promoted Unity Biotechnology (UBX).

According to Johnson, almost everything is the same. Some sentences seem to just have been paraphrased. Aside from this, the same stock was also pitched by another editor from inside Angel Publishing.

Jeff Siegel apparently used it also as a teaser for his Green Chips Stocks newsletter. However, his spin on it was called “Day Zero”.

So there seem to be three issues here.

One is the “rewriting” of a previous teaser from a different author. Although they belong to the same company, something about it is distasteful.

Yes, it is true that Kohl is the successor of Stutman. But for sure, he is a different person. Naturally, this would mean a different way of looking at investments and markets.

So why would Kohl have a pitch that's practically a copy of Stutman's? Even if one argues that they are promoting the same newsletter anyway, it's still off.

To us, what this appears to mean is that the editors do not have full control. If all they seem to do is sign on the newsletters, do copywriters control the agenda, then?

We are all aware that the common criticism of newsletters is that their marketing is too aggressive. Some would further say that this is fine, as promotions is a separate department.

Even James Altucher dismissed criticisms on aggressive marketing schemes. We talked about this in our review of Altucher's Secret Income.

In our articles, Altucher said he was not bothered by complaints about Agora's advertising style. He focuses on writing and leaves the promotions to the publisher.

But what about this case here? It seems that the marketing department is the one in charge.

Did Kohl just sign his name on the bottom of the ad? Or did he even add new insights based on his so-called expertise? We also want to know what his contribution is to the previous work of Stutman.

All of our comments thus far are still on the first issue.

The second point is just as interesting, though. How come the same stock is also promoted by another newsletter under the same publisher?

For Johnson, this arrangement is a “little unusual”. Why do both Kohl and Siegel tease UBX?

On this point, we agree with him. Sure, other editors from various publishers are also in on UBX.

But don't the editors at Angel Publishing talk amongst themselves? Can't they decide who among them would best promote the stock? Is there a shortage of stocks or companies to promote?

In this case, it would be normal to ask: If I believe in the stock being teased, to whom will I entrust my subscription? To Kohl or Siegel?

Now, can you see the issue here?

Our third and most important point is on the performance of UBX according to Johnson.

His article claims that it has not performed well. In fact, Unity Biotechnology's first drug failed in its clinical trials. This is the one injected in the knee to help with osteoarthritis.

In addition, the company has also undergone restructuring, which is just a fancy term for layoffs.

Well, this is alarming considering that Kohl promised he can “turn every $500 invested into $1.5 million”. Is this a classic case of overpromising?

However, to be fair, Johnson's article was written in March 2021.

Those who have invested in the company can breathe a sigh of relief, though. At least for now. A more recent update seems to be a positive one.

A Unity Biotechnology press release in October 2021 has this headline:

UNITY BIOTECHNOLOGY ANNOUNCES POSITIVE 12-WEEK DATA FROM PHASE 1 CLINICAL TRIAL OF UBX1325 IN ADVANCED VASCULAR EYE DISEASE

According to the company, their treatment for diabetic macular edema and wet age-related macular degeneration seems to be working.

In their own words, they said the first half of their trials showed “initial evidence of efficacy”.

So this is good news. The immediate effect that we can see here is that this will give them more leverage to raise more money.

Does this mean that Angel Publishing was right all along, then? Well, it's too early to say. A lot can still happen. There are just too many surprises in this field and predicting what will happen is always next to impossible.

But can the company really end aging? When you invest in it, can your $500 actually grow into $1.5 million?

Although skeptical, Johnson withholds judgment and says he is not an expert on the topic. But he made it clear that he will not be investing in UBX given what he has seen so far.

For our part, we think Technology and Opportunity's projections put too much faith in the company. The evidence at hand does not warrant such optimism. At least not yet.

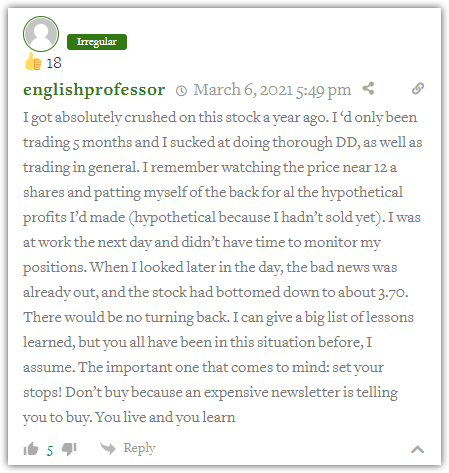

In addition to Stock Gumshoe's official review, we also constantly look at the comments section. The feedback from subscribers often gives us additional insights.

In this case, we found two opposing views that look interesting.

As you can see, the commenter with the englishprofessor username lost money. Meanwhile, MsS had the opposite experience.

But looking at both comments, one thing is clear. Since investing is risky, the lesson here is that you must be both diligent and focused.

Moreover, the newsletter was able to get 3.3 out of 5 stars on Stock Gumshoe's review page. About 130 people gave their insights on Technology and Opportunity on the website.

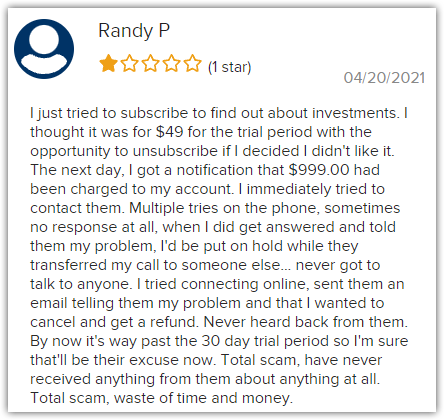

When it comes to the Better Business Bureau, there was no specific page for the advisory service. There was one, however, for Angel Publishing.

As of this writing, it has a 2.33/5 rating. Six people provided reviews and of the 24 complaints, 14 have been closed in the last year.

We would like to note that most of the negative reviews are on credit card charges. An example is this one:

Any person would feel irate because of such a mistake. Imagine expecting a $49 charge and seeing $999 on your credit card.No matter how good an investment advisory is, such an error is a deal-breaker. There is also no excuse for the pathetic non-replies for the subscriber.

We feel strongly about this because we know that most victims are elderly people.In fact, even Johnson of Stock Gumshoe mentions this in passing. He says that the key demographic of advisory services are those in their 50s onwards.A lot of them are not as tech-savvy as younger generations. So it is easy to get confused with what they click online.We admit that it is not entirely the fault of publishers, of course. But it wouldn't hurt them as well to make things easier for their subscribers.

This is by no means a complaint unique for Angel Publishing, so our commentary is on the investment advisory industry as a whole. In this specific case, unfortunately, there has been no update yet on the complaint by the time we publish this article.

Pros v Cons

Pros

- Developments in the tech industry offer promising future gains

- The strategy of getting in early could lead to high investment yields

Cons

- Not too many details are available

- Speculation can be risky

- Complaints about fraudulent credit card charges

Conclusion – Is The Newsletter Too Good To Be True?

Keith Kohl says “you can get in on the ground floor alongside Jeff Bezos, Peter Thiel, the Rockefellers”. A further claim is that once you subscribe, he can open the doors for a historic opportunity for you.

In our write-up, we discussed the newsletter, its editor, and its publisher. You have seen us give our fair take on various aspects of the advisory.

So is it worth $249? Well, that's really up to you, since you are the one paying the actual amount. But we hope that you were able to get valuable insights from our review of Technology and Opportunity Newsletter.