Our work here at Green Bull Research exposes us to many research firms. So we know our way around the industry. From time to time, readers ask us about specific services and people. This article will answer if there should be a Roger Scott scam alert that subscribers must be aware of.For sure, we do not want to defame anybody. But the truth is, there is an interest in Scott as he is somebody who puts himself out there. We know how it goes. The more popular you are, the more people will ask about you.And such queries are legitimate. After all, he advertises himself as a go-to guy for investment advice. If people will listen to him, it could make or break their financial situation.So what we want to do is to go deep into his services. We want to examine what he promises in each of them and how he claims to fulfill them.Further, our research will explore his persona: his educational background, career path, and professional affiliations.All these should add up. Each element is crucial in determining if he is indeed the investing authority he claims to be.

Published Background

Scott says that he has almost three decades of experience as a hedge fund trader and commodity broker. Within that time frame, name it and he has traded them: from corn futures to stock options and ETFs.Another claim he makes is his collaboration with two Ivy League economists. These apparently have also been consultants to different White House administrations. What we find interesting is that he does not divulge their names. If, as he says, his first fund is with these advisors, that’s a plus to his credibility. He and other newsletter editors are experts at name-dropping, so this is a weird situation.In the case of “Trading Turtles” though, he mentions the name of Richard “Prince of the Pit” Dennis. He proudly says he ran one of his funds.To let you know how good he is, he dangles a piece of eye-popping information.

Over a 10-year stretch, my strategies turned $20 million into roughly $740 million. At one point, I had some $900 million under management.

Then, in 2008, he first started exploring the world of financial investment advisory services. Further, his interests revolve around “advanced technical analysis, risk control, and money management and systematic trading”.According to him, CNBC, CNN, and Forbes, among others, have already featured him.

Controversies

Examining his claims

We mentioned in a previous article on WealthPress that his biography seemed very one-track.As a result of our curiosity, we were able to find more intriguing information about the man of the hour.In 2019, TradingSchools.org has written a no-nonsense review of Scott and his services.But we wanted to know first what the website was all about. This is what their website says:

TradingSchools.Org was founded in 2013 as a review website that provides unbiased and honest reviews about all sorts of investment products. We write about trading educators, newsletter providers, trading software, live trading rooms, brokers, etc.We dig up the dirt and relentlessly search for the truth.

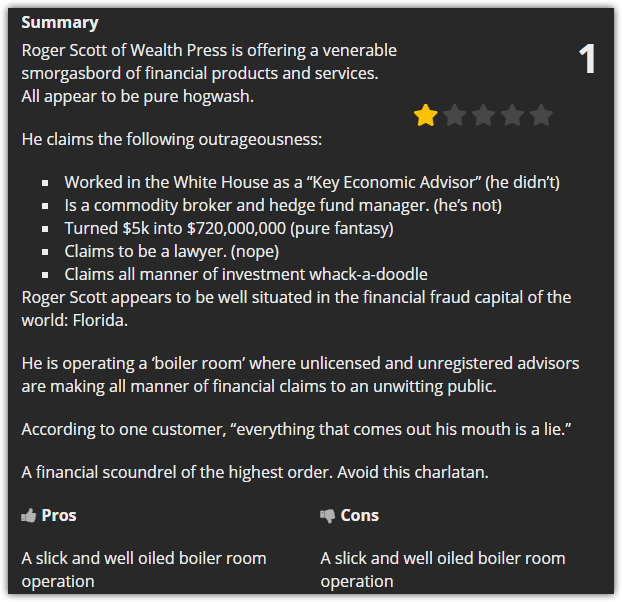

Scott gets only one star in Honesty, Quality, Cost, Support, Verified Trades, and User Experience.To summarize, here is their art card:

The article zeroed in on Scott and the claims he makes. These include him being a lawyer, a hedge fund manager, and a licensed commodity broker. According to the legal team of the website, no “Roger Scott” is in any State Bar registry. They also add that they were not able to find any photo or website that mentioned an attorney with his name.The next organization they turned to is FINRA. According to its website:

FINRA is an independent, non-governmental regulator for all securities firms doing business with the public in the United States. We are authorized by Congress to protect America’s investors by making sure the securities industry operates fairly and honestly.

No Roger Scott appeared on their database, which seems to belie his other claims.Even in their research on the National Futures Association, “Scott” did not appear at all. The group “manages Commodity Trading Advisors, Futures Hedge Funds, and Futures brokers”.TradingSchools.org also called the “boiler room” advertised by the investor. In the call, the staff admitted that Scott was not a lawyer. At most, he was able to attend some classes. Of course, this account was from the reviewer so we cannot verify the conversation’s accuracy.Although the review was very direct, here is the website’s disclaimer on their articles:

We are not here to hurt anyone. If we write a negative review, this is because we genuinely feel that the product is poor. And we will gladly rewrite any negative review if the vendor makes positive and reasonable changes that bring value to the consumer.

What’s in a name

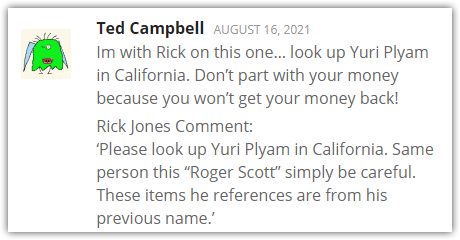

Also, we were able to find a comment in the article that made us even more curious.

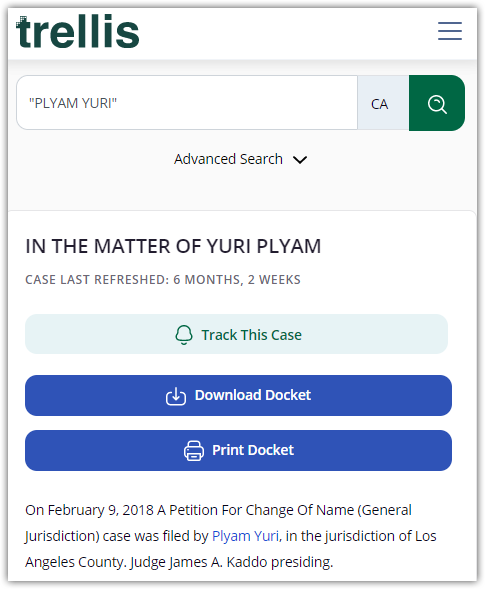

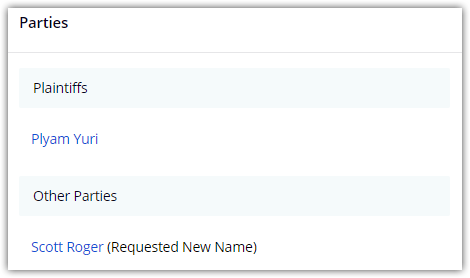

This was juicy, so of course, we had to know more.We checked an online resource called Trellis. It is a “comprehensive AI-powered state court research and analytics platform built by litigators”.Indeed, we were able to find a name-change petition filed by a man named Yuri Plyam.

What is his requested new name?

Just like that, we are now in Mr. Roger’s neighborhood, Roger Scott that is.So in fairness to the guy, this could be the reason why there were no results in his name. All issues and problems solved, right?Well, not so fast.The logical question with this information on hand is this: WHY?If his former name, Yuri Plyam, carries all his credentials, why change it? In the investment research industry, your name is your main selling point. You would want people to search online for you.So what is in his old name that he may not want people to discover?

The cult connection

Well, this might be one of those.

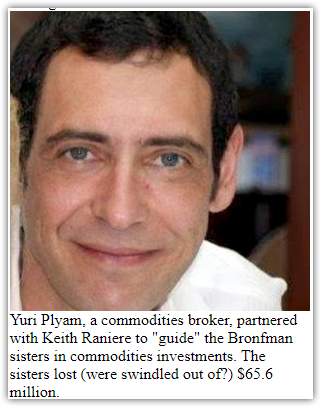

This photo is from a December 2015 article at the Niagara Falls Reporter. Its headline was “Cult of NXIVM Series Part 5: Bronfman Sisters Join NXIVM and Lose Millions of Dollars”.If you are having difficulty reading the caption on the photo, here is what it says:

Yuri Plyam, a commodities broker, partnered with Keith Raniere to “guide” the Bronfman sisters in commodities investments. The sisters lost (were swindled out of?) $65.6 million.

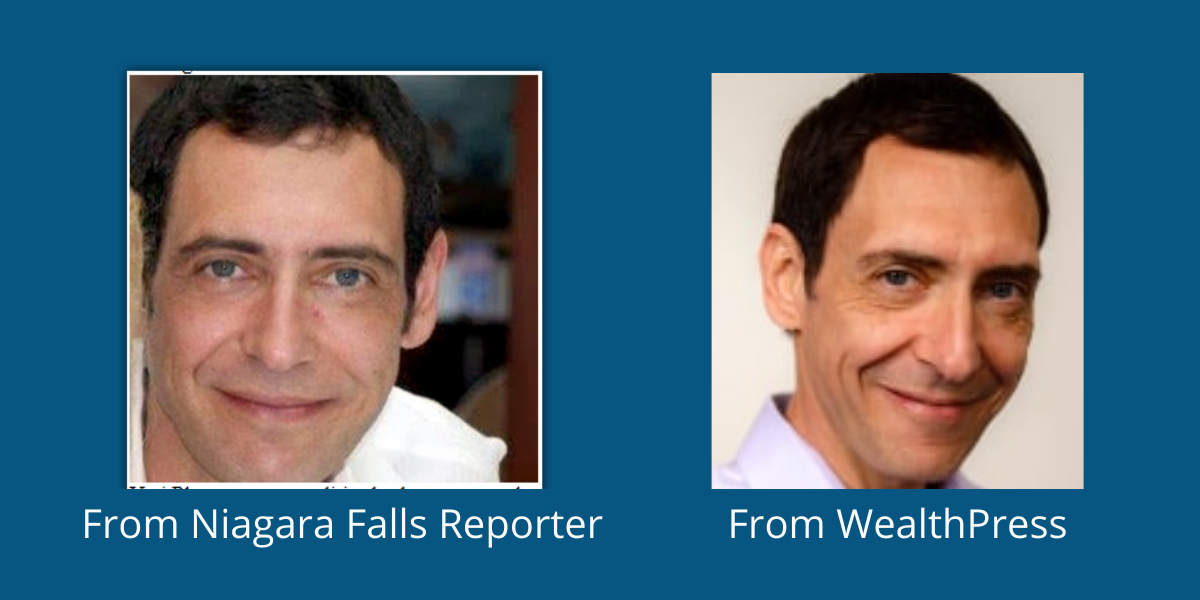

Here is Plyam’s photo side by side with Scott’s:

The investment issue discussed above caused quite a stir. According to the article, a man named Keith Rainere (more about him later) hired Plyam. The latter “operated his own brokerage firm, Castle Trading, in Los Angeles”.Their collaboration did not end well. Rainere claimed to have lost $69 million in commodities. He then asked Seagram heiresses Clare and Sarah Bronfman to “cover $65.6 million of it, which they did”.So what’s the fuss about? Rainere is not a good person, to understate it.Here are the opening paragraphs of a BBC article:

The US leader of a sex cult has been sentenced to 120 years in prison.Nxivm founder Keith Raniere was convicted last year of racketeering, sex trafficking, child pornography possession, and other crimes.As leader of the group he recruited women as slaves and forced them to have sex with him.

Among the alleged victims of the cult leader are the Bronfman sisters. The article also alleges that Plyam was directly involved in fraud.

After I learned about the commodities losses, I was asked to become involved with the Los Angeles real estate investment and quickly discovered fraud by Plyam. I stopped the wholesale stripping by Plyam of the Bronfman sisters’ fortune within days of finding out.”Bouchey, who left NXIVM in the wake of my discovery of fraud by Plyam, and possibly Raniere, claims that Clare Bronfman and Raniere had “two sets of books”.

A Vanity Fair write-up that talks extensively about the Seagram heiresses also says this:

According to the lawsuit, filed in Los Angeles Superior Court, the Plyams had diverted for their personal use part of the $26 million the Bronfmans had given them to develop real estate in Los Angeles.

We do not wish to render judgment on Yuri Plyam and/or Roger Scott. These are complicated matters. Further, they involve a lot of back and forth between the persons involved.But we want to present this so you can factor these things in before subscribing to his services.We understand that to some people, this is a deal breaker. However, we also recognize that others would be willing to overlook this. After all, no one is beyond redemption right?If Scott and his recommendations now are legit, “all’s well that ends well” might apply.So, what newsletters is he offering and how are subscribers responding to them?

Services

The very moment the word “investing” crosses your mind, expect a deluge of newsletter advertisements.

You will see them on the websites you visit. Suddenly, there will be non-stop email marketing letters in your inbox.Such is also the case with Scott as well, as we have noted in our review of WealthPress.

WealthPress

Even if he is not the Founder or the Publisher (it’s Conor Lynch), Scott is the most high-profile member of the team. And this is not without merit. After all, he is the Head Trader of the investment research company.This role carries with it not only prominence but a great deal of responsibility. It also signifies that he is the most experienced and credible among the team. Additionally, it could also mean that as the leader of all the other traders, he has oversight over other editors.This obviously adds more weight to his words.

If you were given a choice on who to pick as editor, he would be number one.This could also be the reason why he handles the most paid services in WealthPress.

Further proof is that the next editors with the most newsletters are Lance Ippolito and Jeff Zananiri. While they only have four each, Scott has eight.For your reference, here are the services of each editor in the company:

- Roger Scott:

- Alpha Rotation

- Overdrive Profits

- First Strike Portfolio

- Nasdaq Titan+

- VIP Trade Rooms

- Precision Profits Elite

- Roger's 12 Week Bootcamp

- Microburst Profit Alerts

- Lance Ippolito:

- Blockbuster Breakout Calendar

- 3D Profit Surge Alerts

- 2 Click Profits

- Sweet Spot Stocks

- Jeff Zananiri:

- Monthly Money Flows

- Monthly Money Flows Elite

- Money Link

- Burn Notice

- Adam Sarhan:

- Alpha Trade Alerts

- Kingmaker Alerts

- Infinity Profit Plays

- Chuck Hughes:

- Trophy Trade Alerts

- Profit Generator Club

- Matt Warder:

- Disruptor Digest

Also, since WealthPress has free newsletters, most of them also handle one. The main difference is that Scott’s newsletter is his namesake.

That is a big deal. He really sounds like Mr. Big Shot over there.Here are the free newsletters:

- WealthPress Hub

- Roger Scott

- Joy of the Trade from Jeff Zananiri

- Early Bird Trades from Tom Busby

- Future of Wealth from Lance Ippolito

- Alpha Intel from Adam Sarhan

- Fortune Research from Matt Warder

Scott’s services

Now, let us go back to our star player and look at his specific offers. We will take time to review these as they give valuable information on Scott as a “guru”. Alpha RotationThis service explains how to profit from the market's naturally occurring sector rotations. Such arise as money moves from one sector of the market to other areas.Also, he identifies and analyzes each market sector's exchange-traded funds (ETFs). By investing in many firms, his readers receive exposure to a wide range of markets. This way, they avoid the risks associated with investing in single companies.To take advantage of both bull and bear markets, traders can also use both call and put options.

- Holding period: 2 Weeks

- Portfolio size: $5,000

- Alerts per month: 8-10

- No. of positions: 4

- Trading: Sector ETFs

Overdrive ProfitsInspired by his “3D Printing” strategy, this is a discretionary trading service. Scott designed it to take advantage of volume spikes.

- Price: $7 a month (as part of the “V-Bounce” offer)

- Holding period: 1-2 Weeks

- Portfolio size: $1,000

- Alerts per month: 8-10

- No. of positions: 2-3 at a time

- Trading: Longer-term stock trades and short-term options

First Strike PortfolioThis is a weekly trading service. First Strike Portfolio concentrates on large-cap companies or “STORM” stocks.As part of his rating system, it selects the Top 4 large-cap stocks to be in the Portfolio.It also provides profit goals and stop-loss updates every evening.

- Holding period: 1 Week

- Portfolio size: $10,000

- Alerts per month: 4-12

- No. of positions: 5

- Trading: 4 of the strongest stocks in the Nasdaq 100

Nasdaq Titan+Scott designed this as an option and stock trading service. You may also use this tool to find out which large-cap Nasdaq stocks are trending.In this strategy, you will have three large-cap stocks with strong momentum. Additionally, there will be a 3x leveraged long bond ETF that protects you from market downturns.

- Holding period: 2 Weeks

- Portfolio size: $10,000

- Alerts per month: 1.5

- No. of positions: 4

- Trading: Large-Cap Tech Stocks

VIP Trade RoomsThis is a somewhat unique service as it features a live VIP Trade Room. Here, viewers will hear about the newest financial happenings, as well as how to profit from them.In addition, Scott presents his list of the Top 20 stocks that have the greatest short interest in the session.Members may also listen in to his daily Roger's Proprietary Stock Scan program.A special member's portal allows them to see recordings of his live sessions if they are unable to attend. Scott also provides a monthly market review.

- Holding period: 1-2 Weeks

- Portfolio size: $1,000

- Alerts per month: 30

- No. of positions: 1-3

- Trading: Trading stocks that have recently pulled back

Precision Profits EliteCapturing pullbacks in high-velocity transactions is the thrust of this discretionary service.Moreover, the relative strength index, sector performance, and Bollinger Bands are among the factors Scott considers when selecting companies.

He also sends out urgent alerts on suitable deals. Thus, there are no set days for trades to go out.Members of this service also receive access to Roger's VIP Trading Room.

- Holding period: 1-2 Weeks

- Portfolio size: $2,000

- Alerts per month: 30

- No. of positions: 1-3

- Trading: Stocks with potential volume spikes in the future

Roger's 12 Week BootcampThis is like a Master Class. Here, Scott exposes all the money-making techniques he's learned throughout career. Should you avail, you will get 12 sessions and 14 video training series.For each of his lectures, the program offers a downloadable slide deck. He also adds in a series of 13 videos that provide in-depth answers to questions. Membership includes Roger's weekly market analysis and his VIP Trade Room events.

- Alerts per month: 20

Microburst Profit AlertsTo identify the next market winner, this service scans through 2,990 of the world's fastest-growing small-cap stocks every day.This uses a combination of institutional volume accumulation, high price momentum, and volume-weighted intraday price analysis.

- Holding period: 1-2 Weeks

- Portfolio size: $4,000

- Alerts per month: 4-16

- No. of positions: 1-2

- Trading: Smaller stocks that have room for big growth

What seems to be lacking

Obviously, the man is a prolific service provider. He seems to cover a lot of ground and has several tricks in his bag for every type of investor.But, there is a drawback. Aside from these service descriptions, there is no deep-level information available. If I click on one of these, I would need to give my email address first. Of all these except for one, we do not even know how much they cost.That is basic information consumers need to know upfront. So it is kind of sketchy for Scott and WealthPress to employ this strategy. Moreover, we know how valuable our email addresses are. Once they (or any company for that matter) get a hold of it, expect non-stop emails.

Track Record and Reviews

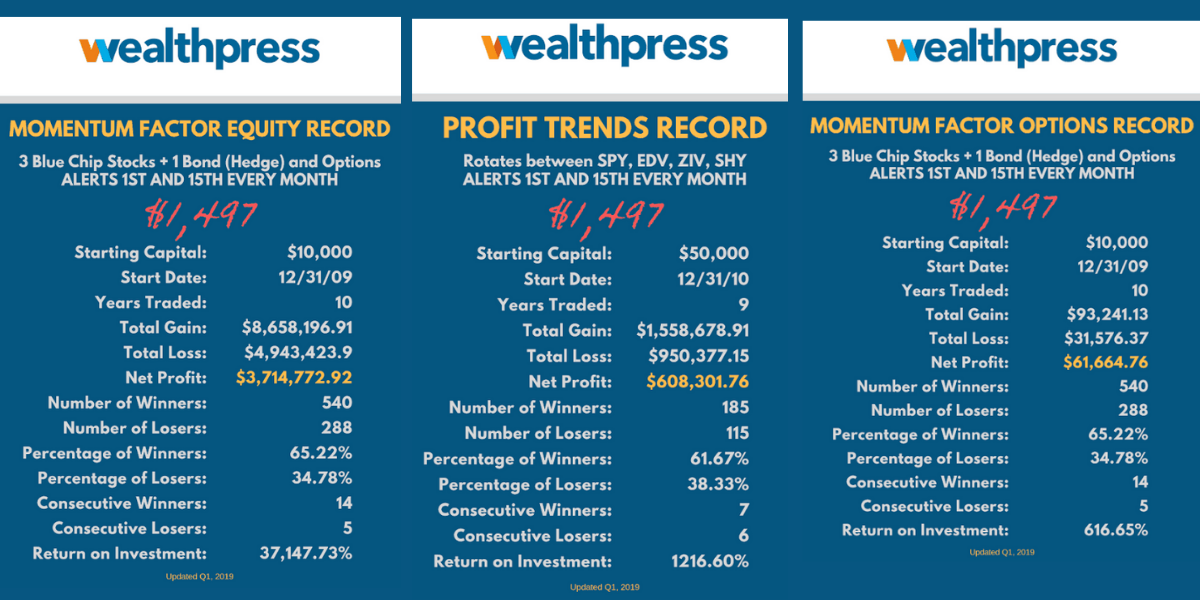

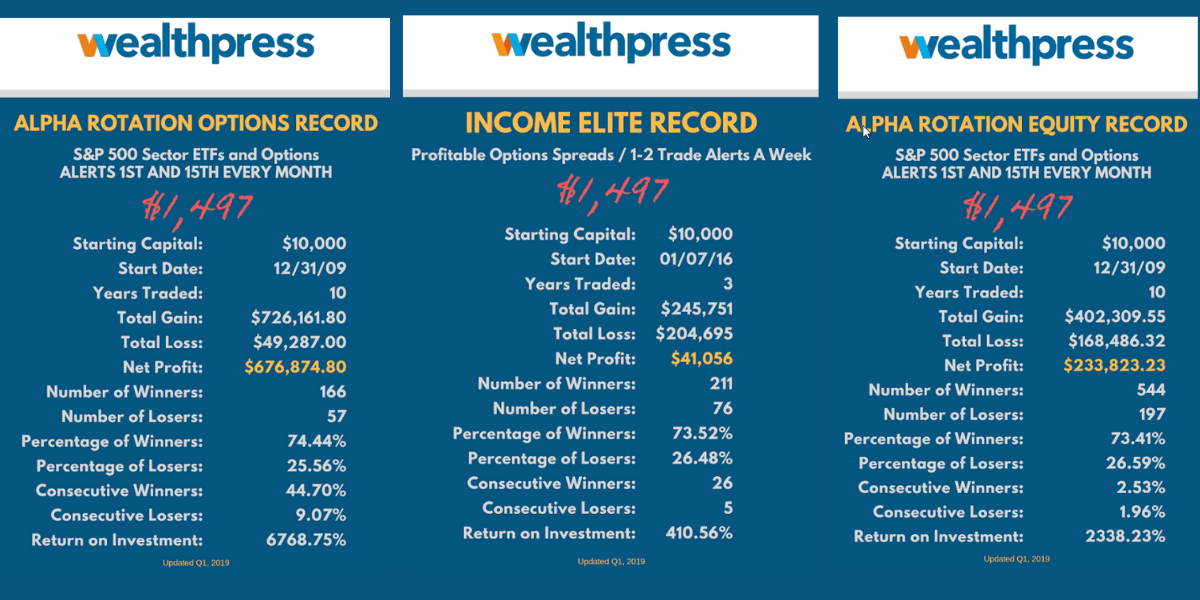

Truth is, there seems to be no shortage of investment gurus out there. Everyone claims to have had decades of phenomenal gains and successes. Naturally, there are genuine practitioners and there are pretenders.An assurance of the reliability of the gurus would be real-world examples of success. However, we found scant information on the topic. Sure, there was a lot of talk about “success”, “gains”, and “returns”. But what we need is actual proof.In the review from TradingSchools.org, they noted the attempt of WealthPress to substantiate their claims.When they asked about evidence of Scott’s success, here is what the staff sent the reviewer.

Here is what the reviewer said about these:

Imagine carrying this “proof” into a local bank and trying to get a loan? It’s just laughable. Who would be stupid enough to believe this nonsense?

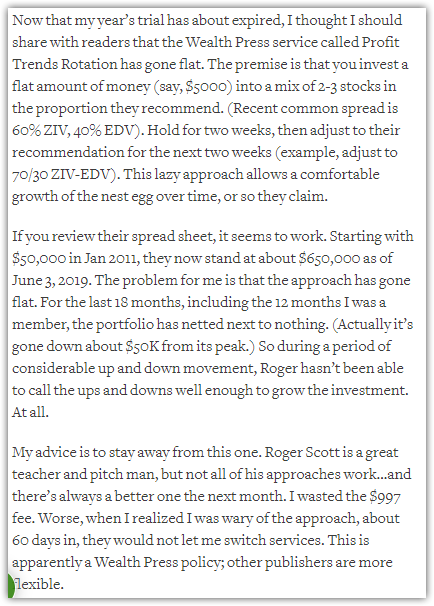

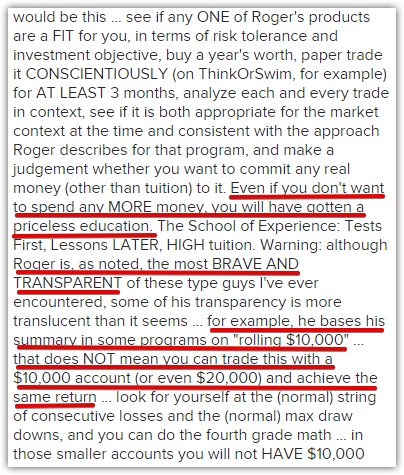

To add depth to our profile of the investor, we also turned to the ever-reliable Stock Gumshoe. We found credible comments from users.

As an example, this person talked about his negative experience and added his advice.

Some other comments also mentioned the Head Trader in a negative light.

Meanwhile, WealthPress got 2 out out 5 stars on the Better Business Bureau website. More than 30 people registered their opinions on the company.

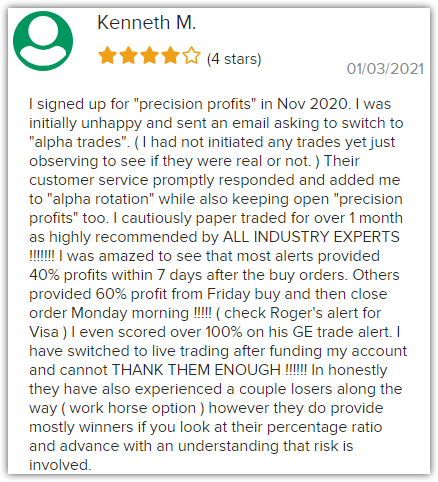

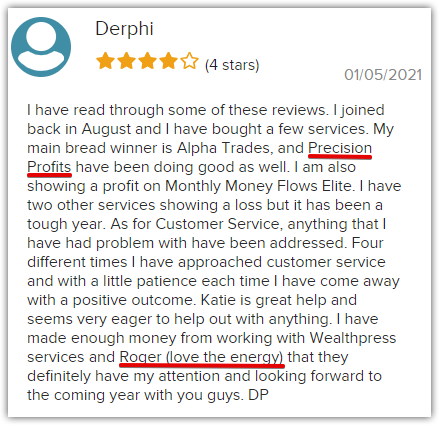

Although there were negative reviews, we were also able to see good comments about Scott and his services.

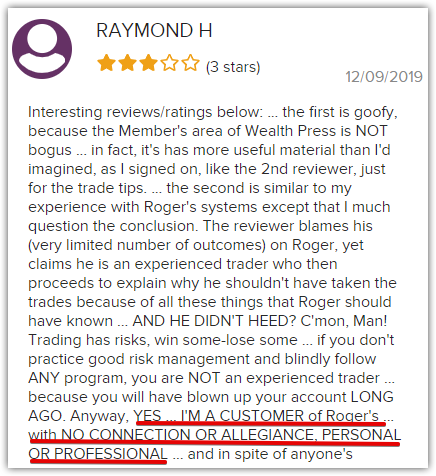

There was even a lengthy comment from a subscriber who makes a strong case defending Scott.

Once again, we would like to reiterate that online ratings are generally more skewed towards negative reviews. Naturally, those who feel aggrieved to talk about their issues. Meanwhile, satisfied subscribers will just continue paying for their newsletters.

Conclusion – Is Scott the Real Deal?

It would have been better if Scott was more transparent. But his situation is understandable.We are not saying his actions are justified, but we see why he did what he did. In this industry, your name is your brand.So it would mean the world to have a name that would be associated with the word “trust”. But the question remains: should you trust Roger Scott?In this article, we explored various aspects of the Head Trader’s background and services. These are meant to help you decide how you feel about the man and his investing skills.He is also not the only controversial investor out there. In support of this, you may read about our article on Whitney Tilson here at Green Bull Research.Now, do you think it would be apt to have a Roger Scott scam alert? Or is he the real deal? Tell us please in the comments section. We would love to talk to you.