different class of share – “Wall Street's Best Kept Secret”

can upgrade regular shares of a company into “Q shares” and make more money than they normally would

can make 27 times as much money with these

nearly 1,000 companies are offering these “supercharged” shares

“want to do it as soon as possible”

all it takes is a few minutes and a few clicks of your computer mouse

claims Bill Gates and Warren Buffet are both capitalizing on this lucrative opportunity

Enter your text here…

Enter your text here…

Enter your text here…

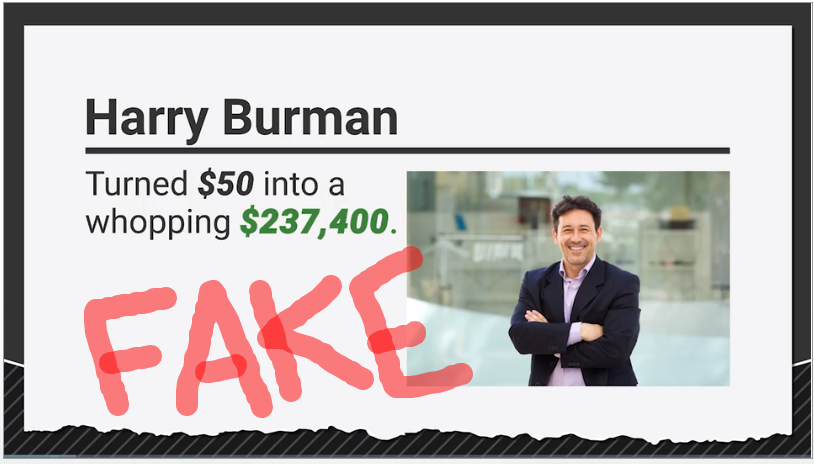

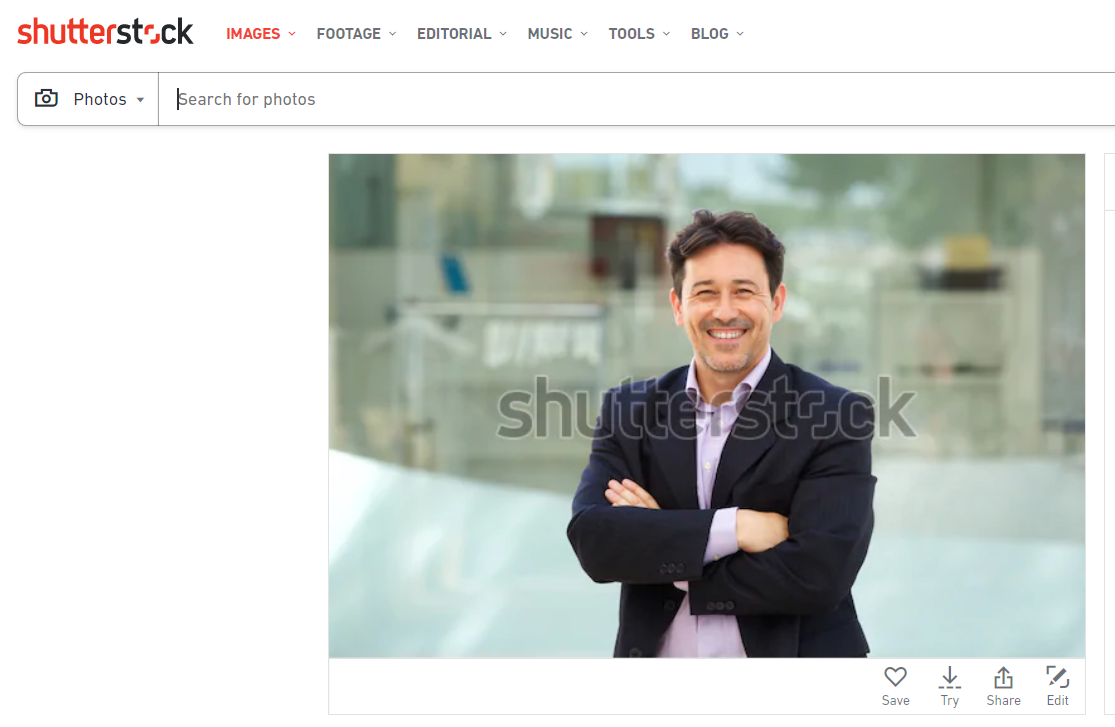

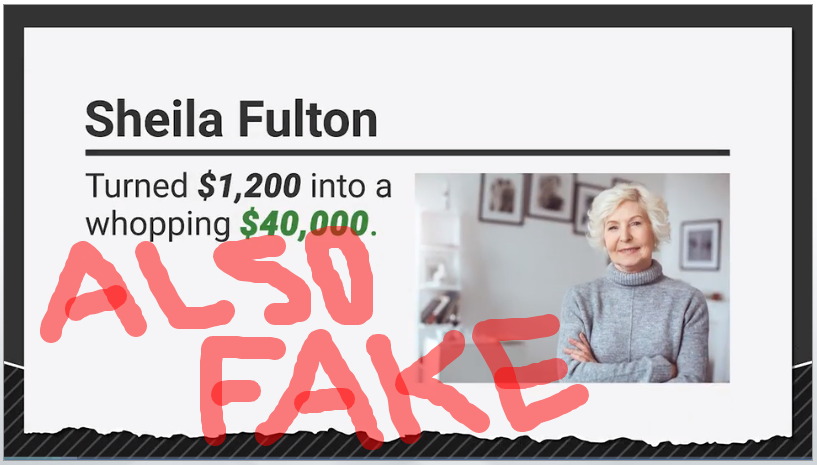

shows a bunch more people too – all fake

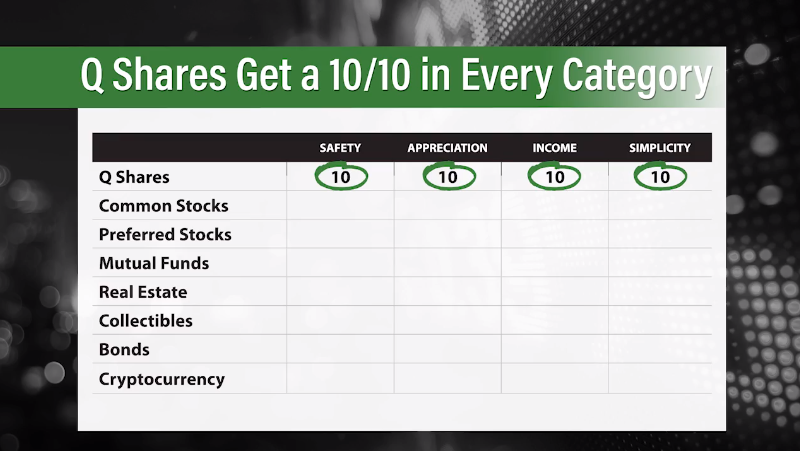

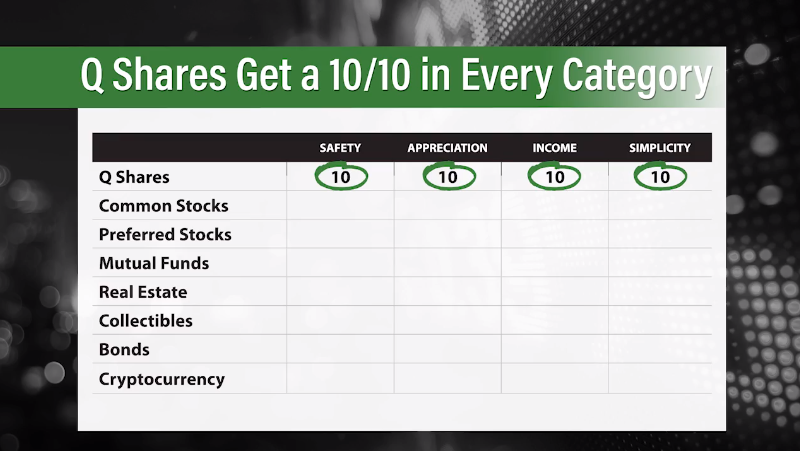

claims that Q shares are the safest, have the highest appreciation value, income value, and are the simplest of all investment forms

At one point in the presentation, Jeff has an intern of his, named “Tom”, buy Q shares for the first time. Of course it's easy to do and only takes a few minutes… but this is incredibly misleading.

Of course it's easy to invest… BUT IT'S ALSO EASY TO INVEST IN BAD COMPANIES AND LOSE MONEY!

has found “the company with the best Q shares” – claims it took 52 weeks for him and his team to find this incredible opportunity

“No. 1 Q Share Company”

“free” report

a list of the 1,000 companies that offer Q shares

What Are “Q Shares” Really?

DRIP and DSPP investing

returns will compound

Who Is Jeff Yastine?

Fox Business News, Nightly Business Report, Business Week

has been quoted in Forbes, Barron's

The Reason You May Have Not Heard of Them

Jeff Yastine actually mentions it in the video and isn't fibbing here. The reason is because the SEC made it a law that companies cannot market these investment opportunities to non-shareholders.

And on the other hand, brokers aren't likely to tell investors about them either because they eliminate the middle-man, which is the broker.

What's His “No. 1 Q Share Company”?

*Note: He also mentions 2 other companies that have good opportunities in this area, but there isn't enough information given out about them to try to figure out what he's talking about so we'll just expose his “No. 1” company.

Some of the clues about this company include that it…

- is headquartered on the West Coast

- is a small company valued at around $600 million

- is in the AI industry and is focused on using it to improve healthcare

- has collaborations with National Institutes of Health, National Cancer Institute, and just entered into a 5-year partnership with the FDA

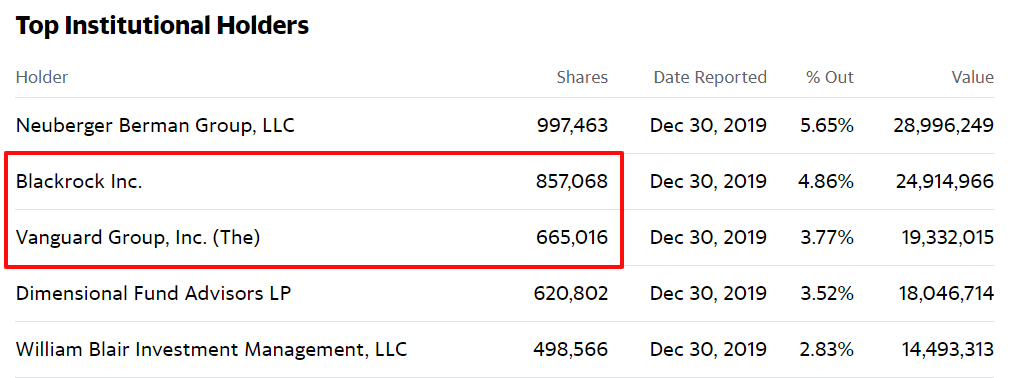

- Vanguard and BlackRock own a combined 1.5 million shares of the company

Simulations Plus (SLP)

- Yes, Vanguard and BlackRock are two the top institutional holders and own about 1.5 million shares combined – according to Yahoo Finance…

- Yes, Simulations Plus has partnerships with NIH and NCI, and just entered a 5-year partnership with the FDA in July of 2019

Heading H2…

Enter your text here…

Heading H2…

Enter your text here…

Heading H2…

Enter your text here…

Heading H2…

Enter your text here…