Wondering what Casey Research's “omega shares” are that E.B. Tucker has been teasing so much? Are they really as amazing as we are told?

In this quick review I'll be going over what we are told, the sales pitch he's throwing at us, what “omega shares” really are and more.

Some of what we are told about this investment opportunity is that these “omega shares” are…

- not stock returns, have nothing to do with cryptocurrencies, bonds, ETF's, etc.

- “have typically been off-limits to normal investors” but there is a “backdoor” access to get in on them

- are 99% cheaper than stocks

- unknown to 99.99% of investors

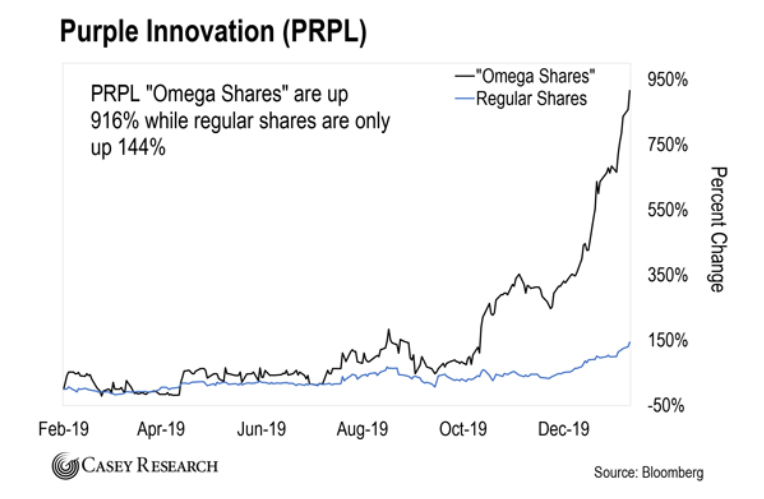

In the one teaser I came across E.B. Tucker showed a chart of a mattress company he used to work for, Purple Innovation, and showed how this company's “omega shares” outperformed their regular stock shares by a multiple of 6x…

As I'll go over shortly, the chances for high returns is what attracts investors to this opportunity, but there is also a higher level of risk in some ways.

Who Is E.B. Tucker?

EB Tucker is the guy behind the “omega shares” idea. Currently he is a senior analyst for Casey Research where he runs several newsletter investment advisory services, such as Strategic Investor and Strategic Trader, and before this he was helping edit newsletters at Stansberry Research, another investment advisory firm similar to Casey Research.

One of Tucker's specialties is his ability to spot good investment opportunities during crises, such as during 2009 when the housing bubble burst. Additionally, he is a big advocate of investing in gold and silver, but not necessarily in the traditional ways. He even helped found an investment firm, KSIR Capital Management, for investing in this sector. This makes sense because the “omega shares” he has been teasing have to do with investing in gold, as I'll explain.

The Sales Pitch

There are likely multiple funnels luring in new subscribers with these “omega shares” teasers.

The teaser I came across was to register for a webinar where E.B. Tucker would provide information on how to get in on this opportunity, but of course you'd have to subscribe to his Strategic Trader advisory service first.

Strategic Trader is a premium trading advisory service at Casey Research. Currently the cost per year is set at $4,000, and what you get as a subscriber is specific investment recommendations on a regular basis. In particular, E.B. Tucker looks for opportunities here that will be able to provide 1,000%+ gains.

*Note: There are no refunds for this subscription. All that they offer is credit towards another one of their services if you buy in and decide it's not right for you.

What Are “Omega Shares”?

The “omega shares” that are being teased have also been referred to by E.B. Tucker as “gold placements” in the past. What he's talking about here are gold royalty trusts.

A royalty trust is a type of corporation that acts as the owner to mineral rights for wells, mines, etc. These trusts are set up as a means of financing. Investors receive income generated from the mines, wells, etc. on an ongoing basis, but once the resource being extracted is depleted (gold in this case), the trust is dissolved.

It's no wonder that this is the opportunity being teased here. Gold royalty trusts have been doing well lately, and since E.B. Tucker has a background in gold & silver equities this makes perfect sense.

Good Opportunity?

Gold royalty trusts, or any royalty trusts for that matter, can absolutely be good opportunities. This form of investment didn't become possible until the late 1950's, and it wasn't until the 1980's that it become popular.

However, just because yields from royalty trusts are often higher than 10% and can be very attractive doesn't mean you should go out and invest in them right away.

Many places warn investors about getting involved in these. Why? Well, because they can be very volatile.

It's great when investors' dividend income rises in sync with the commodity prices, but it also falls in sync with these prices. This is where you have to be careful.

Quick Recap & Conclusion

- E.B. Tucker teases an investment opportunity that he calls “omega shares”, which are said to be much more lucrative than normal stock investing

- The teaser is a marketing lure to bring in new subscribers to his Strategic Trader advisory service

- “Omega shares” are just a made-up name for royalty trusts

I hope this quick review has helped clear the air on what's going on here.

Please leave any comments or questions below. We're always interested in hearing what our readers thing!