Nomi Prins says America’s nationwide EV rollout is doomed without one incredible “EV Master Key” Company.

Whether you own an EV, plan on buying one, or wouldn’t be caught dead inside one. A fatal flaw inside America’s electric vehicle market is opening up a new money-making opportunity for all.

The Teaser

Thanks to a new emissions law, U.S. carmakers will be required to sell 10 times more EVs by 2030. This is currently impossible.

Nomi Prins is a former Goldman Sachs managing director and best-selling author who mainly follows the government money trail when it comes to stock picks. I have previously reviewed her #1 Gold Stock and $4 “Liquid Energy” Company teasers.

As I type this, only 2% of Americans drive an electric vehicle.

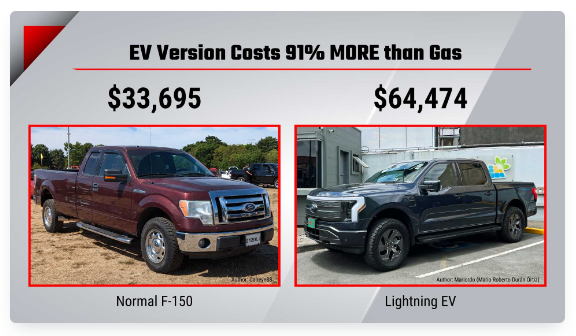

Nomi confides that she has had analysts dissect what exactly goes into these two seemingly similar vehicles and the key difference is the battery.

Inside the gas-powered vehicle is a standard 12-volt battery. It weighs about 25 pounds, is made up of lead and sulfuric acid, and it’s cheap. Totally different story when it comes to the EV.

You’re looking at a mix of the most expensive, hard-to-get minerals on the planet. Not to mention some of the most environmentally toxic to mine.

64 pounds of nickel, 22 pounds of manganese, 18 pounds of cobalt, and 13 pounds of lithium, to name a few. It all adds up to a cost of up to $20,000 or 133 times more expensive than a standard volt battery.

That’s about one-third of an electric vehicle’s total cost!

As I have said here before, EVs needing hundreds of pounds of expensive raw materials that are in extremely short supply is a huge, huge problem.

The “EV Master Key”

One company believes it has the fix that could unleash the first rollout of affordable EVs in America.

It all has to do with a secretive meeting at a Florida hotel, battery resources, and a form of lithium experts simply call “LFP” or “forever lithium.”

The Pitch

Nomi has compiled a special report that reveals the entire story. It is called: The EV Master Key: The #1 Easiest Way to Profit from “Forever Lithium”

Inside, the name, ticker symbol, and analysis of this miraculous firm are revealed. The catch is, that it's only available to those who agree to take a risk-free subscription to Nomi's Distortion Report newsletter. A one-year subscription is only $49 for a limited time.

The offer includes three special reports, including the flagship report being promoted here. Twelve monthly issues of the newsletter packed with energy, precious metals, and artificial intelligence picks, as well as a 60-day money-back guarantee.

What is the “EV Master Key”?

According to Nomi's sources, executives from Tesla, Ford, Mercedes, Jaguar Land Rover, and GM were all recently spotted filing into the Diplomat Hotel in Hollywood, Florida.

The reason? Soaring demand for EV battery resources has sent auto firms scurrying to secure their supply.

As the CEO of Jeep-maker Stellantis Carlos Tavares puts it – “You have to secure your supply, if not, you're out of business.”

But despite all the cash being thrown at this problem, we’re only seeing a trickle of new EVs available for sale, and auto execs are getting nervous.

Nomi says one company that’s a fraction of the size of the big automakers has emerged with an ingenious solution.

Forever Lithium

The ingenious solution is a battery innovation powered by a new type of lithium called “LFP” or “lithium iron phosphate.” This is the EV “Master Key.”

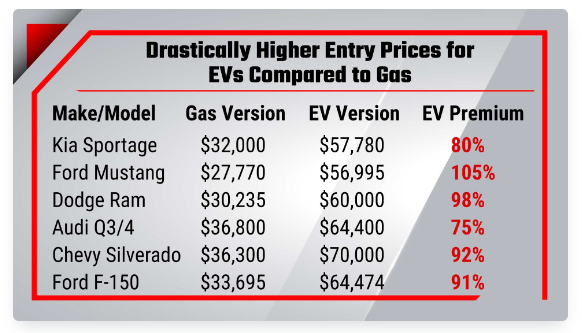

See, 60% of EV batteries are currently made using nickel, manganese, and cobalt, or NMC for short. This has long been the standard for EV batteries.

Pop the hood of almost any EV right now and you’ll find an NMC battery. The problem is NMC batteries are bleeding automakers dry due to the rising cost of raw materials.

With resource prices on the rise, the world’s biggest carmakers are switching their battery chemistry to LFP. This includes Ford, Rivian, and Volkswagen.

It's not just cost either, LFPs are far less likely to catch fire than a nickel-based NMC battery and the final kicker is that LFPs can be charged to 100% without degrading battery life; compared to just 80% capacity for “old lithium.”

That allows 5 times more charge cycles and a battery that lasts up to 5 times longer.

Mining.com says, “superior fire safety, longer life, and lower cost,” makes LFP the obvious choice for automakers.

Today’s company, which we can buy with any standard brokerage account, holds the “key.”

Revealing Nomi Prins' “EV Master Key” Company

What do we know about the company behind the “Master Key” technology?

- Yahoo Finance calls this stock “a favorite amongst the big guns”, with big money managers holding 85% of shares.

- The company is about to roll out America’s first & most critical LFP battery factory.

- The company’s CEO says: “His batteries will be lower cost and have twice the lifecycle of an NMC battery.”

- Nearly 88% of Cummins stock is held by institutions, compared to only 25% for ICL.

- Cummins is a 30% partner in a joint venture that will build a $3 billion, 21-gigawatt hour (GWh) factory to produce lithium-iron-phosphate (LFP) batteries.

- The quote above comes from Cummins CEO Jennifer Rumsey, who said LFP batteries produced by the JV “will be lower cost and have twice the life cycles of an NMC battery.”

The Key to Generational Riches?

Is buying Cummins stock going to be like buying into Rockefeller’s Standard Oil before the world realized the full potential of oil?

Not quite.

Cummins is primarily an automotive components maker, with the vast majority of its revenue coming from the sale of axles, brakes, and such. Only a tiny fragment, just over 1% comes from its technology segment.

It is also only a 30% partner in a JV focusing on lithium-iron-phosphate (LFP) battery technology for commercial battery-electric trucks. This is a much, much smaller market than the commercial passenger vehicle market.

The company itself doesn't look like a bad investment at only 11x current earnings, a debt/equity ratio of under 1, and a return on assets of over 7% (good for a manufacturer). It's just that the hype doesn't match the reality.

Thus we arrive at a common theme among pitched stocks – the expectations created exceed the economics of the business, which are decent, but not “next Nvidia” level by any means. But I guess saying that doesn't sell newsletter subscriptions.

Is Cummins likely to become a trillion-dollar company and deliver generational riches, no. Can it deliver decent returns if bought at the current price and held over the long term? Sure.

Quick Recap & Conclusion

- Nomi Prins says America’s nationwide EV rollout is doomed without one incredible “EV Master Key” Company.

- What Nomi calls the “EV Master Key” is actually “forever lithium” or lithium iron phosphate batteries and one company controls the tech to make them a reality.

- The name and ticker symbol of this firm are only revealed in a special report called: The EV Master Key: The #1 Easiest Way to Profit from “Forever Lithium.” It is ours with a subscription to Nomi's Distortion Report newsletter for $49 for the first year.

- If you read till the end, you don't need to do this, as we were able to reveal Nomi's “master key” pick as Cummins Inc. (NYSE: CMI).

- Cummins is a decent business with good underlying economics, but there is nothing about its tech that would make me say it's the next big thing.

Are lithium iron phosphate batteries the key to EV proliferation? Let us know what you think in the comments.