Michael Robinson once recommended buying Bitcoin when it traded for only $300. Now, he's identified another potentially game-changing opportunity.

A secret new FedNow “Bitcoin Killer” being launched by the U.S. government that could make every cryptocurrency obsolete.

The Teaser

This isn't about some new form of cryptocurrency created by a shadowy figure whose name no one knows. I'm looking at you Satoshi Nakamoto or whatever your name is. Instead, it’s a groundbreaking transformation that will revolutionize every single U.S. dollar globally.

Michael Robinson is a 36-year market veteran and a Green Bull veteran whose teasers we have consistently covered here, including his “PVAB” Companies and “iPhone Killer”, most recently.

Michael says this transformation will bankrupt some business models, give rise to new ones, and lift others, such as fintech.

TechCrunch thinks the “Bitcoin Killer” is about to “unlock fintech investment opportunities“ and Michael's own research indicates the market could experience 1,400% growth in the near term.

This is exactly what happened during the last three money transformations of our lifetimes:

- The introduction of credit cards in the 1950s

- The untethering of the dollar from gold in the 1970s

- And the rise of online banking and bill pay in the 1990s

Each produced quadruple-digit gains for early investors and the fourth and final dollar transformation will do the same.

So what exactly is it?

It’s called FedNow and it's a radical new payment processing system developed by the Federal Reserve.

A Digital Dollar?

Many believe this is the precursor to a full Central Bank Digital Currency (CBDC) and it may very well be, time will tell.

But for the moment, FedNow is ‘only' meant to replace the current payment processing system here in the U.S., which is more than 50 years old.

Under the current clearinghouse model, transactions take at least three days to clear, which is glacially slow by 21st-century standards. It can also wreak havoc with making payments on time if you're waiting on cash to clear.

FedNow is purportedly here to fix this.

FedNow payments are processed instantly, which is a huge upgrade and one that requires a lot of computer processing power to pull off.

From computer chips to fast new servers and fiber optic cable that can carry data at lightning speed, each one of these things gives us an opportunity to profit from this upgrade and Michael has a few recommendations to help us pocket massive gains.

The Pitch

After months of research, he reveals five Fintech opportunities for us to invest in that are profiting from the FedNow trend in The Instant FedNow Portfolio special report.

If we want to get our hands on the report, we will need a subscription to the Digital Fortunes research service. The standard price for a one-year membership is $995, but a special 3-month trial is being offered for $99.

This includes The Instant FedNow Portfolio report, a second bonus report called The #1 FedNow Moonshot, full access to a model portfolio, and instant email updates on open portfolio positions, among other perks.

FedNow A Bitcoin Killer?

The biggest threat to the dollar over the last decade has easily been cryptocurrencies.

There are two primary reasons for this:

- The instantaneous speed of crypto

- Anonymity

Like a frightened, cornered feral possum, the government has become aware of this and spent billions of dollars creating an alternative – FedNow, which is now live.

FedNow duplicates one of the two features that make crypto so popular, instant payment settlement, which it hopes will be enough to win over consumers.

Real-time Payments Taking Off

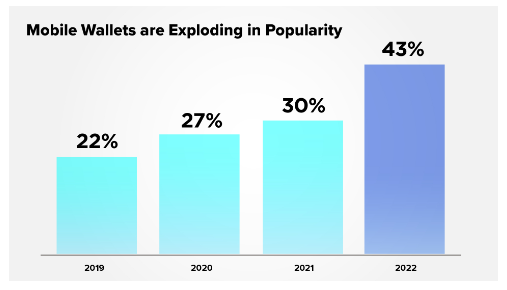

According to a recent ACI survey, the number of people using mobile wallets has doubled in only 3 years:

Combine this with real-time transactions in North America being expected to triple over the next few years and we could have a market with 10x growth by the end of the decade.

For investors, this means we're just in the first inning of a long ball game and the biggest upside is yet to come.

As of today, only 57 financial institutions have been cleared to use the new FedNow instant payment system. By December, Michael estimates this figure could explode.

When an industry goes through a rapid growth spurt like this, the only thing left to figure out is which companies to avoid and which ones will compound our capital.

Michael has a few suggestions in this regard, including a “small-cap gem” that he believes is one of the most exciting stocks in the market.

Revealing Michael Robinson’s FedNow “Bitcoin Killer” Company

A major focus of this company is serving the “unbanked” and “underbanked” communities and we get a few other clues about it too:

- This little-known company’s stock trades for less than $25 per share.

- It has already established itself as a payment partner with Uber, provides payment services for tax refunds from TurboTax, and is forging partnerships with both Apple and Amazon.

- FedNow could serve as the catalyst that helps this company provide instant payments.

All clues point to this company being ACI Worldwide Inc. (Nasdaq: ACIW). Here is why:

- ACI shares have traded just under $25 since May.

- The payment software provider is one of only three TurboTax payment partners and it provides payment solutions to more than 80,000 brands around the world.

- It is also one of the initial 57 member firms of the FedNow Pilot Program.

Michael also provides scant details on three of the five stocks he originally teased, but they aren't nearly enough to venture even wild guesses on:

“A company that provides software to the financial services industry and specializes in specific fintech markets like insurance and pension funds.”

So let's see if ACI is really the best way to invest alongside the FedNow trend instead.

5x Gains Over the Short-term?

Let's just say FedNow is no Bitcoin killer and ACI stock leaves a lot to be desired.

Regarding the FedNow instant payment service, it frightens me and I wish I could unsee it.

Besides providing the exact opposite of anonymity, the combination of it with a CBDC, and a crackdown on cryptocurrencies, would give the Fed even more control over the money supply than the monopoly it currently enjoys. Truly, the worst thing to happen since the final episode of The Sopranos.

As for ACI, it is a well-established business with some underwhelming economics – a 5% profit margin, a 6% return on equity, and a current price/earnings of 33x. This is to say nothing of the company's huge $1.1 billion debt load (its entire market cap is $2.29 billion).

The sole bright spot has been growing earnings per share over the past four years, but if FedNow cannibalizes the payments business of banks, I don't believe a direct contract with it would entirely make up for this loss.

I would not be surprised if ACI stock not only fails to deliver the short-term gains advertised here but stays flat or even declines going forward.

Quick Recap & Conclusion

- Longtime market vet Michael Robinson teases a secret new “Bitcoin Killer” being launched by the U.S. government, which could make every cryptocurrency obsolete.

- We come to learn that the “Bitcoin Killer” is the Federal Reserve's brand new instant payments service – FedNow, which promises to create a once-in-a-generation opportunity for investors.

- Michael reveals five Fintech opportunities for us to invest in that are profiting from the FedNow trend in The Instant FedNow Portfolio special report. The report is complimentary to subscribers of the Digital Fortunes research service, which costs $99 for a 3-month trial.

- Tangible clues were only provided for the main pick, which we were able to reveal for free as ACI Worldwide Inc. (Nasdaq: ACIW).

- ACI is an underwhelming stock. It is stuck under a mountain of debt and FedNow cannibalizes part of its financial institution customer base, so besides being a FedNow contractor, I don't think it will benefit much.

How will FedNow impact Bitcoin and other cryptocurrencies? Let us know what you think in the comments.