Is Matt Badiali's “Simple 3-Step Process for Identifying Stocks Positioned to Go up 100% or More” legit? Can you trust what you hear about this? Will this make you rich?

In this review we'll be going over what exactly this “simple 3-step process” is and what's really going on here.

The Teaser:

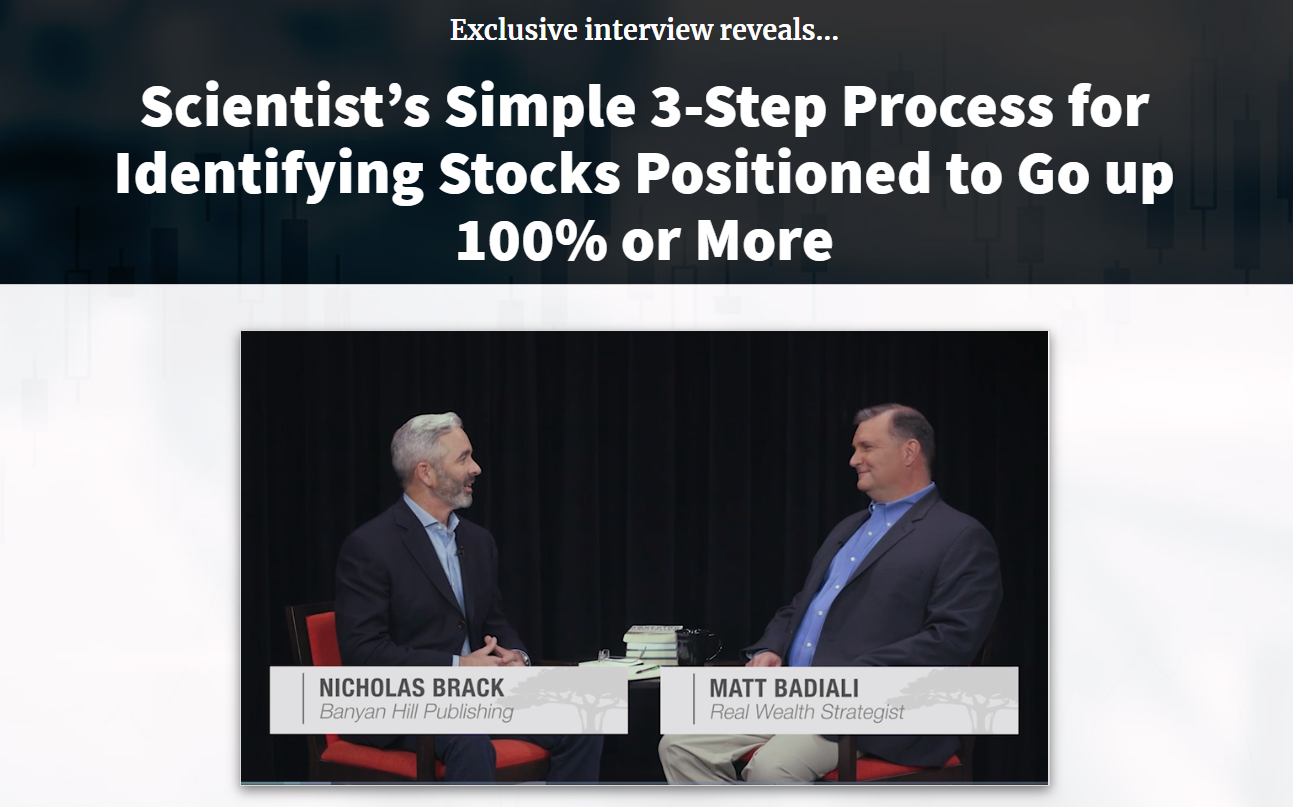

There are likely multiple teasers for this, but what we came across was an interview presentation with Nicholas Brack (from Banyan Hill Publishing) and Matt Badiali…

Now of course it's set up to look like some sort of news interview, but the reality is that both guys work for Banyan Hill Publishing and this is just a promotional video to lure in new subscribers for Matt Badiali's advisory service… it's all marketing here.

But anyways, in the presentation Matt talks about how he started off investing soon after leaving university and claims to have “made every mistake in the book”… mistakes that are typically made by retail investors. Eventually he learned to apply some of the tools he had learned being a scientist to the world of investing, and this is when he started making good profits.

He claims that most investors get terrible information, and their portfolios reflect this… and this is exactly why he says he did so poorly when he first started out.

What changed, and what is responsible for his success, as he tells us, is that he developed a “proprietary investment process” that “can double your money over, and over, and over again” and allows him to come up with “hedge-fund quality ideas”.

We'll be going over this process shortly so you get a better idea of what the heck he's talking about.

Also, in the presentation he teased his top 3 stock picks for the year, which are “positioned to potentially double your money”. This is also something we'll be taking a look at.

Who Is Matt Badiali?

Matt Badiali is an ex-geologist, but is still fairly active in the field. He got a BS in Earth Sciences from Penn State and a Masters in Geology from Florida Atlantic University. His work history includes working for a drilling company and for an environmental company as a consultant. With his knowledge and experience, he even went on to teach the subject at Duke University and the University of North Carolina.

Right now he's employed by Banyan Hill Publishing, the investment advisory company behind this promotional content we're reviewing here today. At this publishing company he edits several investment advisory newsletter services, such as Real Wealth Strategist, Front Line Profits, and others, where he provides subscribers with investment recommendations regularly – and one thing that is worth mentioning is that he travels all over and gets boots-on-the-ground information, putting a lot of effort into providing subscribers with good recommendations.

The “Simple 3-Step Process”

Matt takes a top-down approach to investing, which is what a lot of people do. In a nutshell, he starts with a big idea and narrows it down to a single company to invest in.

Step 1: Look at Big Picture Sectors

The first step is to look at the big picture and find sectors that have big potential moving forward. In particular, Matt likes to look for sectors that have been receiving negative media attention or that have been forgotten, because these are often completely overlooked by most investors… and stock prices of companies in these sectors often trade for cheap.

One of the examples he gives us is the Gold sector back during the 2008 financial crisis. During this time many people were selling their stocks in gold mining companies, causing stock prices to drop and showing the negative sentiment towards the gold mining sector. However, the actual price of gold didn't fall much and this indicated a sector that was being hated and undervalued.

Step 2: Research Companies In Hated Sectors

The next step is to look at individual companies in these sectors, preferably hated and overlooked by most investors.

Matt looks at price to earnings ratios, price to book ratios, and dividend payout ratios among other metrics… and claims that him and his team spend over $100k a year on research tools that help quickly analyze the numbers.

After the automated tools he uses provide him with the stocks that have favorable stats, the next step is good old fashion reading… quarterly reports, annual reports, earnings calls, etc. And the numbers aren't all that's important here. Of course things like management, vision, etc. are also taken into consideration.

Eventually there is only a small number of companies that pass all the tests and only the best of the best are chosen as investment recommendations.

Step 3: Exit Strategy

Equality important to investing in a stock is knowing when you should pull your money out. Most people don't know when to get out, and as Matt has started… “stocks don't go up forever”.

One thing we know he uses to plan an exit strategy is the ATR Formula, which is a technical analysis formula that is used to measure volatility. That said, this seems a bit strange because this formula is usually used only to measure volatility, not to predict the direction of future prices… but this is what he uses.

He did mention a bit about how he uses this formula to “lock in” gains as the stock price increases, which could mean that as the volatility increases he begins to decrease position size – makes sense.

In a perfect scenario he would be buying a stock in a hated and overlooked sector and then selling out of it when the mainstream media catches on… after the big price jump from all the mainstream investors piling in.

Sounds easy, right? After all, this is called a “simple” 3-step process..

Now this all sounds great on paper, and it sounds super simple. The problem is that someone who is new to investing can read all the quarterly reports and look at all the numbers available, but making sense of it all and seeing the big picture is where things get tricky. Not only that, but having a professional geologist that travels the world and gets front-line information on mining companies and whatnot is definitely a safer bet… at least for the average investor.

Matt's Top 3 Stock Picks

There is a lot of teasing going on for Matt's top 3 stock picks for the year, which he tells us are all in hated sectors that he expects to turn around any day.

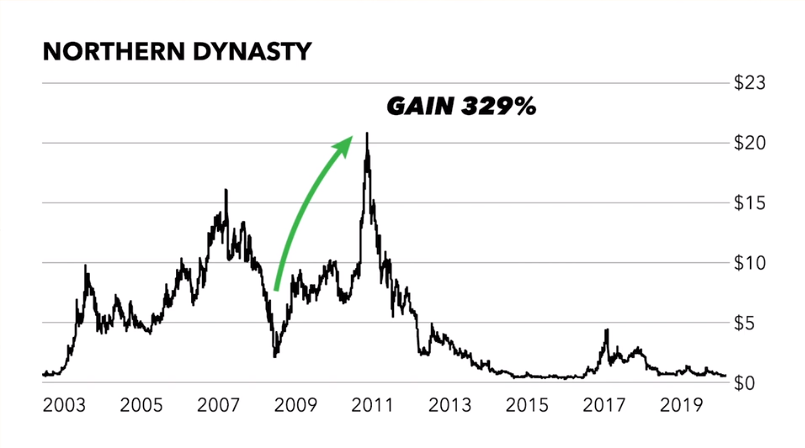

According to the claims, these could all double in money, and he says he wouldn't be surprised if they are bigger than Westshore Terminals or even bigger than the gains seen from companies like Northern Dynasty, which increased 329% from the time he recommended it.

These top 3 stock picks can all be found in the “free” reports that they are giving out…

However, in order to get these free reports you first have to subscribe to his Real Wealth Strategist newsletter service. This is the same tactic that is usually used to bring in new subscribers… like that seen in our review of Paul Mampilly's 100X Club.

Normally we'd expose the stocks right here for free, like how we exposed his “magic metal” teaser to be for a company called Hudbay Minerals Inc… but unfortunately there isn't any information provided on them. If we were given some hints we could… but they're weren't any.

*If you have any information on what these 3 stocks are, let us and other readers know in the comment section below this post!

The Sales Pitch

As you already know, the entire presentation is just a sales pitch. This is just another way to lure in new subscribers.

Real Wealth Strategist, which is the subscription service people are being lured into, supposedly normally costs $199/yr but is discounted through this particular sales funnel down to $47/yr. That said, we've seen it discounted other times before as well… and it seems to almost always be discounted in some way.

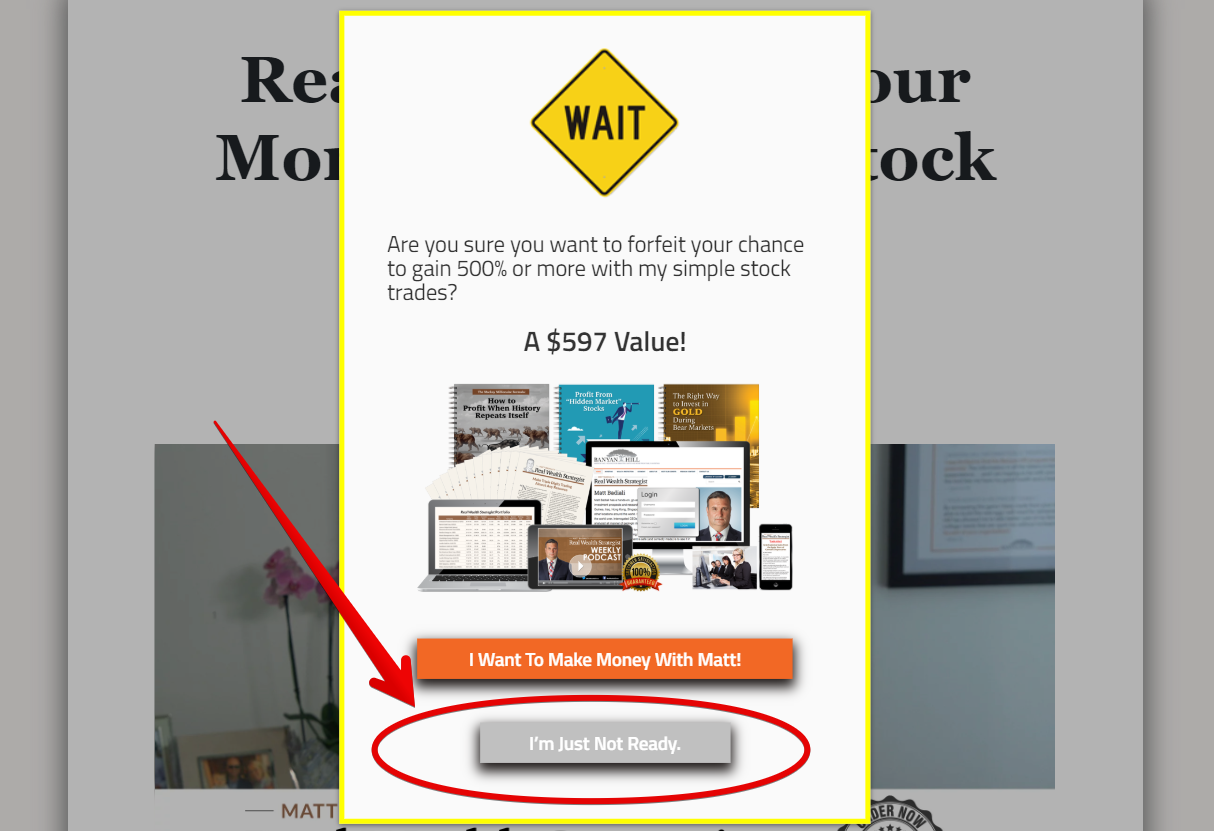

*Note: If you go to the checkout page and then proceed to exit the page, you will see a popup like that shown below. If you click on the button in the popup you will be taken to a page for an 80% discount. This might only happen if you're using a desktop computer however.

Recap

- Matt Badiali claims to have a 3-step process for identifying stocks that are set to increase in price by 100% or more

- The presentation on this process is set up like a news interview but is really just a promotion by Banyan Hill… both guys work for the company

- Matt's investing approach is to start broad and narrow it down. He begins by looking at a sector, and then analyzes companies within that sector – and he also has an exit strategy in place

- His top 3 stock picks are teased but there isn't enough information provided on these picks to find out what they are… and in order to find out you have to subscribe to his Real Wealth Strategist newsletter to get the “free” reports

- If you do want to subscribe then we recommend following the little trick mentioned above to get an 80% discount

We hope this review has helped you out and provided some value. If so, please share it to help spread the word.