This is the second Luke Lango teaser in just as many months, which lets you know the man has been burning the midnight oil and hasn't taken a summer vacation.

Curiously, he's not talking about any existing stock this time around, but about what could be the biggest IPO in history – ChatGPT, and a loophole to get in now before it becomes a publicly traded company.

The Teaser

By now you have used or at the very least heard of ChatGPT, as it's at the forefront of what's being called the biggest advancement in modern history – artificial intelligence.

As a growth-oriented investor, this may be the signature Luke Lango teaser. I reviewed his last presentation – “Area 52” Quantum Microchip Company (not about aliens) and we have also looked into Luke's Fast Money Line claims in the past.

Some believe ChatGPT could end up creating even more wealth than a little thing called the internet.

This is some mighty high praise, but is it all hype or is there some substance to back it up?

The reason for all the hoopla around OpenAI (the company behind ChatGPT) is that “generative AI has the potential to generate trillions of dollars of economic value” according to legendary venture capital firm Sequoia Capital.

This is the same venture capital firm that has previously backed the likes of Uber, Airbnb, Zoom, YouTube, PayPal, and Google, among others. Quite the track record and now they've thrown their weight behind OpenAI.

Needless to say, if OpenAI is able to capture even a tiny fraction of the generative AI market, it will mint plenty of new millionaires.

So from this vantage point, I can see why people are super excited about the opportunity, heck I am too.

An OpenAI IPO?

As of this very moment, OpenAI is still a privately-held company.

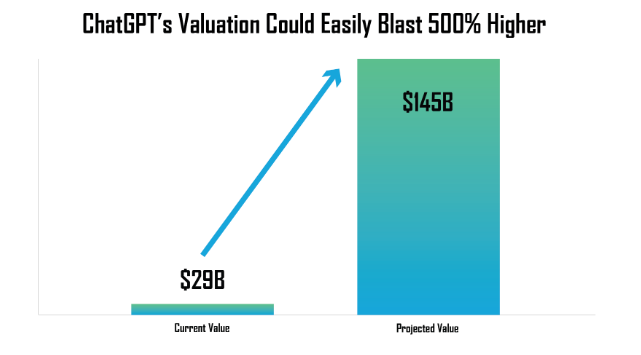

However, its valuation is rapidly growing on the private market and it recently closed a $300 million funding round at a staggering $29 billion-dollar valuation!

This insatiable investment appetite has led to much speculation about a potential initial public offering (IPO) happening sooner rather than later. Something that could send OpenAI's valuation 500% higher according to some insiders.

It does hold true that the biggest gains are typically made BEFORE a company goes public.

So how do we take advantage of the ChatGPT pre-IPO loophole?

The Pitch

Luke promises to show us how we can get started today with as little as a few hundred dollars by giving us access to a copy of The ChatGPT Pre-IPO Prospectus.

All we have to do is subscribe to Luke's daily research service the Innovation Investor. The normal going rate for the service is $199 a year, but for a limited time, we can get access for a full year for only $49.

The offer includes two additional special reports, a free copy of The VC Insider’s Millionaire Playbook, and of course regular monthly issues of the Innovation Investor straight to your inbox.

Angel Investing: How the Rich Invest

Do you remember Uber’s IPO?

Well, if you bought shares on IPO day, you probably didn't fare too well seeing as the stock only recently exceeded its original 2019 IPO price.

Meanwhile, Uber angel investors that invested pre-IPO made returns of up to 999,900%.

This is usually the rule rather than the exception when it comes to IPOs, with many new issues coming to market in the last year or so underperforming the broader indexes.

On the other hand, angel investing returns, albeit much harder to calculate. Average about 2.5x over 4.5 years according to one national study by the Angel Capital Association. The same updated study showed a median exit multiple of 1.8x in 2020.

When we factor in that angel investing is one of the riskiest forms of investing there is due to the high failure rate of startups (10% of investments provide 90% of the gains), the risk-adjusted rate of return is only marginally better.

Getting on the Winning Side of the IPO Equation

Still, given everything we've learned so far, the obvious way to play any blockbuster IPO is to get in BEFORE it goes public. But how?

Short of being an accredited investor or having some serious connections or both, there's little hope of directly getting our hands on coveted pre-IPO stock.

This is where Luke's ChatGPT pre-IPO loophole comes in.

He says “There's no time to waste” and that “No matter what happens to the stock market in 2023, OpenAI will keep blasting higher.”

Let's find out what he's talking about once and for all.

Revealing Luke Lango's ChatGPT Loophole

Although he never comes out and says so in his presentation, there's only one logical conclusion to draw from Luke's clues, if we can call them that.

- Act on this ChatGPT loophole now – straight from inside your brokerage account.

- Get started today with as little as a few hundred dollars.

Since there is no way to purchase privately-owned shares with our brokerage accounts and we wouldn't need to buy a large block of shares (get started with as little as a few hundred dollars). I'm assuming Luke is talking about purchasing the publicly-traded stock of an OpenAI investor.

To date, OpenAI has raised a total of $11.3 billion from 13 institutional investors. But only one of them is a publicly-traded company – Microsoft Corp. (Nasdaq: MSFT).

A 100x Return?

In order for a 100x return to happen, OpenAI's valuation would need to be in the trillions of dollars. Can it get there?

The answer to this question depends on two things.

First, OpenAI needs to be the clear industry leader in generative AI.

It has an early lead here, as its valuation is more than double the amount of the next 10 generative AI startups combined.

Second, it depends on its primary product ChatGPT being able to eat into the online search market share of the market leader – Google.

This is going to be much harder.

Some, like the guy who worked on the original prototype of Google AdSense believe this is a distinct possibility and even highly probable.

But a lot has to happen first to make this a reality. Such as ChatGPT's free version being able to relay timely and accurate information, instead of info that is nearly two years old, as it currently does.

If and when this happens, there must also be a monetization plan in place. As even ChatGPT's Plus version, which currently carries a monthly cost of $20 isn't nearly enough to offset OpenAI's appreciating operating costs.

Will buying shares of Microsoft net us a 100x return?

Based on its $11 billion OpenAI investment, a hyper-aggressive 100x return would mean $1.1 trillion. I could actually see this happening over the long term, but not immediately at a possible IPO date one or two years from now.

Even if it does happen (which mind you is a huge if), that still doesn't mean a 100x return for us on our Microsoft shares.

Quick Recap & Conclusion

- Growth investor Luke Lango is teasing the biggest IPO in history – ChatGPT, and he has a loophole to get in right now before a possible public listing.

- Generative AI has been called “more profound than fire or electricity” (not in my opinion), but it shows that investors are tripping over themselves to get a piece of the early market leader in the space – ChatGPT.

- We can take advantage of this with a ChatGPT pre-IPO loophole that Luke only discloses in a special report called The ChatGPT Pre-IPO Prospectus.

- Luke never reveals his loophole, but I suspect it entails buying shares of Microsoft Corp. (Nasdaq: MSFT), which directly owns a 49% stake in ChatGPT's parent company, OpenAI.

- Microsoft is already a $2.5 trillion-dollar company as I write this, so it will take a lot to move the needle. OpenAI could do it, but a 100x return is asking an awful lot, and even if it does happen, this doesn't guarantee anywhere close to such a return for Microsoft shareholders.

Would you invest in ChatGPT if you had the chance? Tell us in the comment section.