In financial investment circles, a mere mention of his name would elicit varying reactions. While it is true that he has quite a reputation as a force in investing, he has also faced controversies. Thus, a closer look at Louis Navellier's track record would be helpful.

If you are in the know, you would be aware of his vast experience in investing. Various media agencies regard him as a go-to guy on market issues and movements.

In 2020, he lost a much-hyped court case against SEC.

Despite this, he seems to still enjoy the trust of many in the industry. His newsletters and services are still up and running. In addition, people still listen to his ideas.

So in our discussion, we will probe key milestones in his life and career to get a better grasp of his background. Why? When we know more about a person, we can get a good sense if we are to trust him or not.

Before we proceed, we would like to know what you have heard about the guy. Tell us in the comments section and we would be happy to chat with and learn from you.

Praise Releases

His newsletters and profiles are peppered with supposed commendations. Unfortunately, most of them would be hard to verify. We know how editors are known to enhance their public persona.

Nevertheless, we are publishing them here for your reference as it is central to his brand and track record.

- An icon among growth stock investors – New York Times

- One of America's best-known investors – New York Times

- Most money managers could only dream of having as much success as him – The Wall Street Journal

- The earnings whisperer – CNBC

- (He has the) most enviable long-term track record – Steve Forbes

- King of Quants – Forbes

- The one advisor whose track record sits at the very top of the long-term performance ratings – TheStockAdvisors.com

- A wunderkind – MarketWatch

- The man who recommended Google before anyone else – MarketWatch

Again, not all sources on these are available, as most results come from praise releases from Navellier himself.

To provide balance, we are providing just one long quote that is also material in assessing Navellier's record. This is from a federal district court in Massachusetts.

-

The court determined, the defendants continued to sell the Vireo AlphaSector investment strategies despite their knowledge that representations about the strategies were false and misleading.

-

In addition to enjoining the defendants from violating Sections 206(1) and 206(2) of the Advisers Act, the final judgment entered on June 2, 2020 also orders defendants jointly and severally to pay disgorgement of $28,964,571 including $6,513,619 in prejudgment interest…

-

…as well as civil penalties against Navellier & Associates in the amount of $2,000,000 and against Mr. Navellier in the amount of $500,000.

What exactly happened here? Read further as we will discuss this in detail in the next sections.

Introduction

Consistent with other newsletter editors, Navellier is not a bashful person.

Hi, my name is Louis Navellier. And I’m a one-percenter.

I own a multimillion-dollar estate on the South Florida coast, in one of America’s most exclusive neighborhoods. My home is just down the street from Donald Trump’s Mar-a-Lago Club resort.

Up the street, my neighbor is the most famous motivational speaker on the planet. I’m sure you’ve seen him on TV.

At my private country club, I rub elbows with PGA greats, titans of business, Hollywood celebrities, and D.C. power players.

I own a fleet of luxury and high-performance automobiles, including a Porsche 911 GT2, Porsche 918 Spyder, and Ferrari 488 Spider.

I own five Audis, including the new all-electric e-tron, two Audi R8 V10s, and an RSQ8. Also, a Maybach 57S, which, to be honest with you, is a “land yacht.” My children, who are now grown, attended only the best private schools. When we took family trips to Cabo or the Virgin Islands, we only flew in our private jet.

This guy is loaded.

He may not be the best example in humility, modesty, and frugality, but he is rich. And he wants you to know it.

The transcript above is a verbatim account of his introduction in his newsletter pitch for Growth Investor.

Before you judge him as an arrogant you-know-what, he says there is a reason for enumerating these. It is not just to flaunt his possessions. He is not out to impress, as he has nothing left to prove.

Well, the verdict is still out on that point. We know how narcissistic such people are, so self-praise and bravado are not surprising.

However, he claims he has a bigger purpose. That purpose is to show that even if he is above all of us, he has a heart.

His compassion for regular Americans drove him to share his investing secrets so more people will be wealthy. He wants us to be just like him.

The reason I have all this wealth is what makes me uniquely qualified to deliver a hugely important – and urgent – message.

I’ve broken ranks from the “one percent” to warn everyday Americans about a significant event set to take place in our country’s very near future.

I’ll show you how to be prepared, stay ahead – and potentially capitalize – on all the tremendous growth happening right now.

I'll show you some new and incredible opportunities to make money now and as the Technochasm kicks into high gear.

So there you have it, there is context to his litany of properties.

In addition to his defense, he mentions the term technochasm. This just refers to the growing divide between the rich and the poor due to technological disruptions.

Essentially, all the benefits of tech advancements do not reach the poor. They stand no chance at earning from them because they do not know about navigating in this development.

He further says that the already large gap is only going to get larger. If you want to cross over to his side of the fence, you need to believe and trust him. In short, you need to subscribe to his services.

Roots

Before we venture further, we need to know where this man came from.

According to him, he grew up living a life far from what he is used to today. The town he grew up in was a quaint, humble western town. His father worked as a bricklayer and relied on this one job to try to sustain their family.

Early on, he already knew that business was his calling. It is for this reason that he attended the School of Business and Economics at Cal State Hayward.

At 20 years old, he already graduated from the public university with a B.S. Finance degree. A year after, he got his MBA in 1979.

His education proved to be a key phase in his business life. As a teenager then, he worked on research that tried to mimic S&P 500's performance.

As a result, he gained a better grasp of fundamental and quantitative analysis. Using these, he learned of ingenious ways to beat the market, based on his claims.

This became the foundation of his colorful career.

Newsletter business

One year after getting an MBA, he started publishing his investment newsletter, MPT Review. This makes him among the pioneers in this industry.

From there, a few more transitions took place until he renamed MPT Review into Emerging Growth, and now it's called Breakthrough Stocks.

According to their Wikipedia page, Emerging Growth was declared as the top-performing newsletter from 1985-2005. The Hulbert Financial Digest also estimated that the advisory's gains from 1985-2008 were at 2,156%. This is way above the 869% of the S&P 500 index.

Today, Louis Navellier is at the helm of his money management firm, Navellier and Associates. The company says they manage investments amounting to around $2.5 billion.

InvestorPlace publishes his five newsletters:

- Growth Investor

-

provides an expert’s take on the latest market trends and opportunities

-

FOCUS: Stocks (Mid- to Large-Cap)

-

INVESTOR PROFILE: Conservative

-

FREQUENCY: Monthly trades

-

You may further read about his two teasers promoting Growth Investor on our website. We have already written about his “Netflix of 5G” Stock and 5G Turbo Button Stock.

- Breakthrough Stocks

-

looks at high-quality small caps

-

FOCUS: Stocks (Small to Mid-Cap)

-

INVESTOR PROFILE: Moderate to Aggressive

-

FREQUENCY: Monthly trades

-

- Accelerated Profits

-

identifies High Velocity and Ultimate Growth Trades

-

FOCUS: Stocks (Large-Cap)

-

INVESTOR PROFILE: Aggressive

-

FREQUENCY: Weekly trades

-

- Power Options

-

provides an expert’s take on options trading

-

FOCUS: LEAPS Options

-

INVESTOR PROFILE: Aggressive

-

FREQUENCY: Weekly trades

-

- Platinum Growth

-

combines the top-notch investing strategies of Growth Investor and Breakthrough Stocks with the faster pace of Accelerated Profits

-

FOCUS: Stocks

-

INVESTOR PROFILE: Conservative to Aggressive

-

FREQUENCY: Weekly and monthly trades

-

Performance (According to Him)

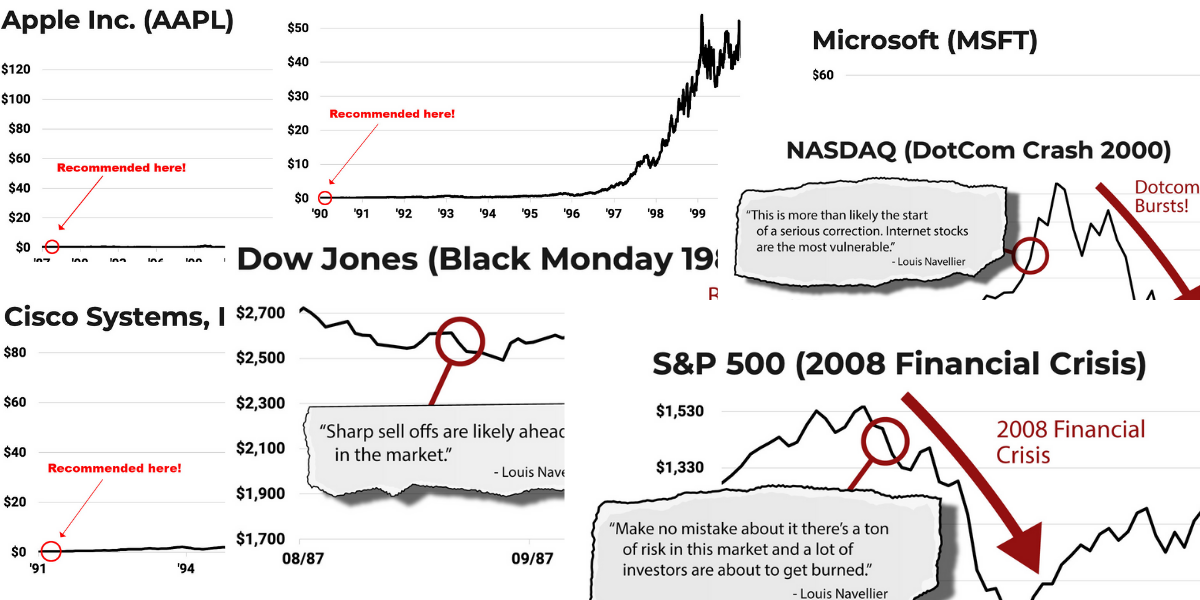

Navellier seems to have a crystal ball of sorts when it comes to his market insights. He claims to have made early calls on crucial events.

When it was just $1.49 per stock, he says he has already been recommending Apple. Also, in 1988, Navellier was among the earliest to see Microsoft when it was only trading for 39 cents.

Further, the man often cites MarketWatch who supposedly acknowledges him as the first to see Google's potential.

In addition, he called early such events as the 1987 Black Monday Crash, 2000 dot-com crash, and the 2008 financial crisis.

However, he is not involved in magic. It is his expertise in behavioral finance that allows him to see these trends way before anyone else.

So though he wants to clarify that he is not a sorcerer of some sort, Navellier wants you to know he is just a simple guy. A simple genius.

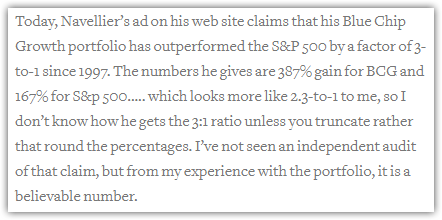

Because he is all that, his Breakthrough Stocks newsletter beats the S&P 500 by 3 to 1 and even up to 6 to 1. Growth Investor, meanwhile, beats S&P by 3 to 1.

Of course, these are all based on his claims.

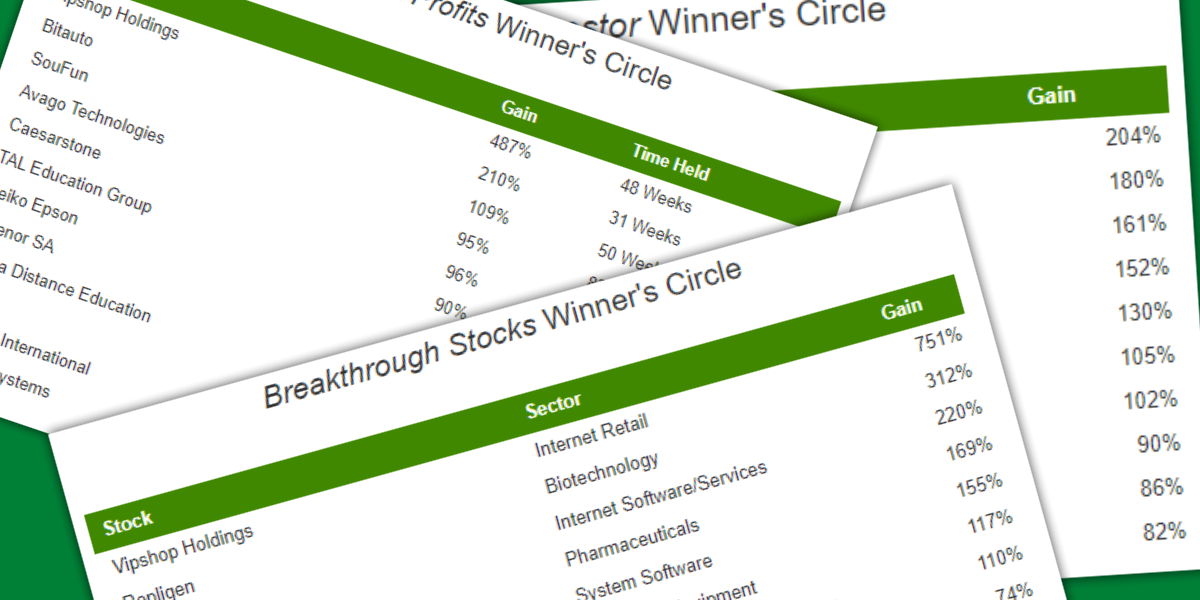

But these do not stop there. If you are an investor who wants to see his performance, he has a web page just for you.

However, you will only be able to see the good stuff, what he calls the Winner's Circle.

In the tables he provides, gains of specific stocks he recommends are prominently displayed. Their gains are all positive, from 46% all the way to 751%. If true, these are amazing gains.

But how many of you would agree that absent actual proof, these are mere numbers typed on a page?

Well, why would we expect to see losses on a sales page, right?

Track Record (From Other Sources)

By now, we know what he thinks of himself and his performance. In the process, we have seen that much of the so-called proof relies on marketing.

It seems that formal references and sources are not common in this kind of trade. So we cannot verify 100% all claims and evidence.

So we tried to turn to other sources to give you some level of objective or at least a third-party assessment.

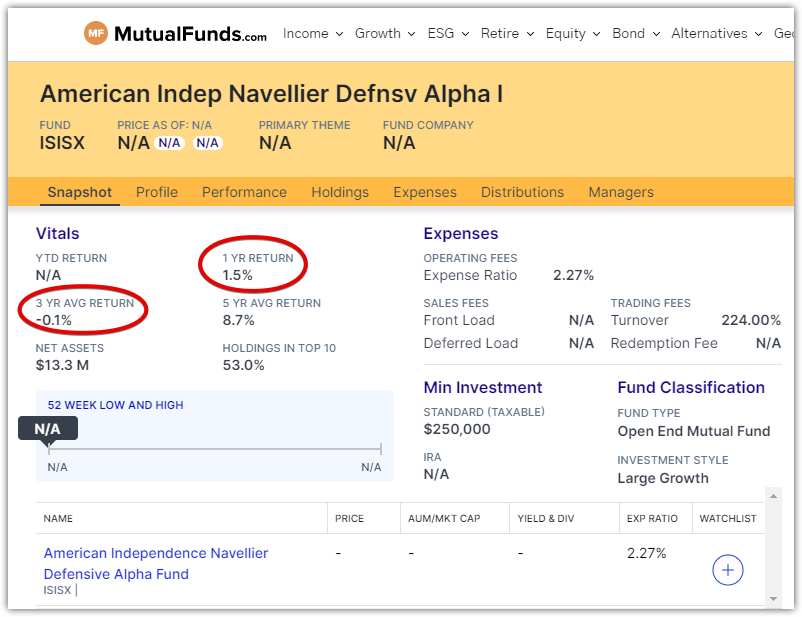

We found one mutual fund under Navellier's name in MutualFunds.com. According to them, the website is “the premiere mutual fund research site for financial advisors and individual investors”.

Now, regarding the fund:

The Navellier Defensive Alpha Portfolio is a concentrated stock portfolio that attempts to grow client assets while at the same time helping protect portfolio value during prolonged market downturns.

Now, look at the screenshot below. Would you say that this is an impressive showing? Moreover, is this consistent with the image Navellier projects?

What do you make of this information? Tell us your thoughts and let's talk below.

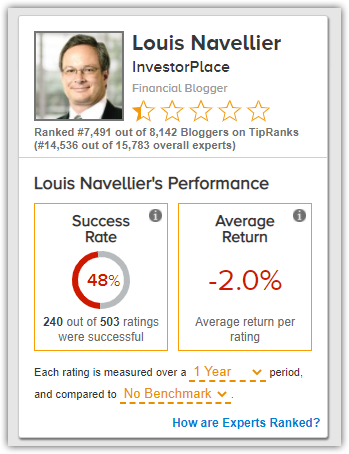

In addition to this, we also looked at TipRanks. As per their description, they are:

a comprehensive investing tool that allows private investors and day traders to see the measured performance of anyone who provides financial advice

As we have mentioned in our review of Jim Woods' Eagle Eye Opener, he took pride in his TipRanks showing. He is either the number 1 or number 3 financial blogger in the world, depending on the profile you read.

As for Navellier, here is what we found on TipRanks:

Although we intend to say more, we believe the Latin phrase res ipsa loquitur would suffice. In English, this means the “thing speaks for itself”.

One may argue that these are not reliable gauges of performance. Further, some may say that the data MutualFunds.com and TipRanks rely on may be inaccurate.

We leave that to your discretion. However, we want to show you as many sources as we can.

This may not even have been necessary if Navellier himself showed his references. But we are where we are, and we aim to provide you a rich picture of the man and his record.

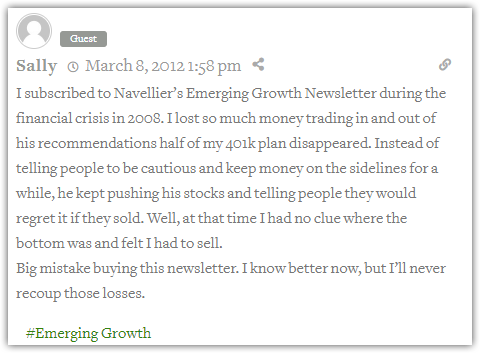

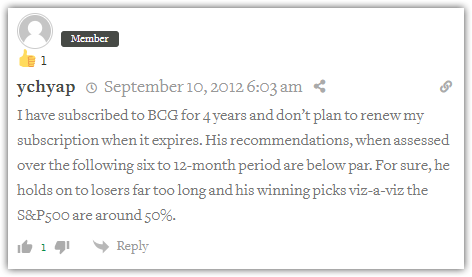

Feedback from Subscribers

Another avenue of assessing an investor or a newsletter is by looking at user feedback.

Sure, these are very subjective and do not reflect a scientific representative sample of all subscribers. But the insights from honest feedback are also helpful. Often, they give refreshingly honest reviews.

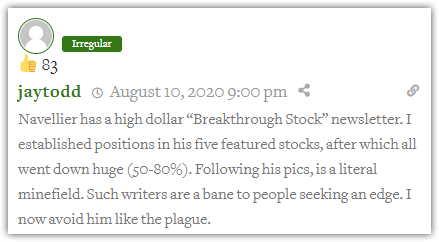

For example, in Stock Gumshoe, 15 voters' feedback yielded 2.7 stars out of 5 for Navellier's Accelerated Profits Newsletter as of this writing.

Meanwhile, his Growth Investor got a better rating. From around 450 voters, it was able to get 3.7 stars out of 5.

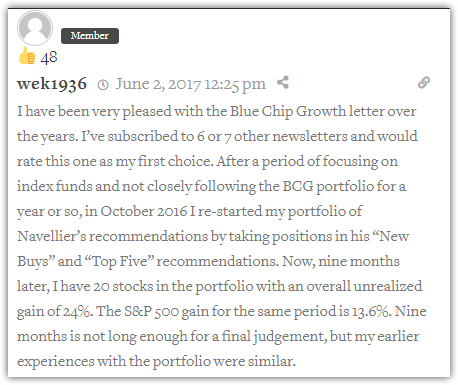

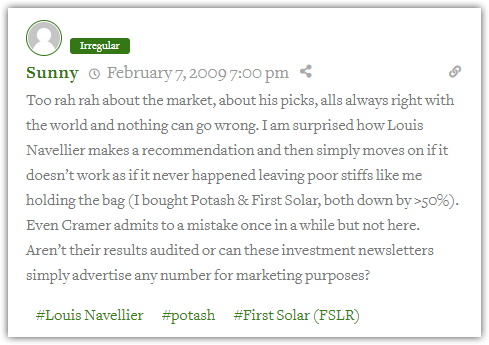

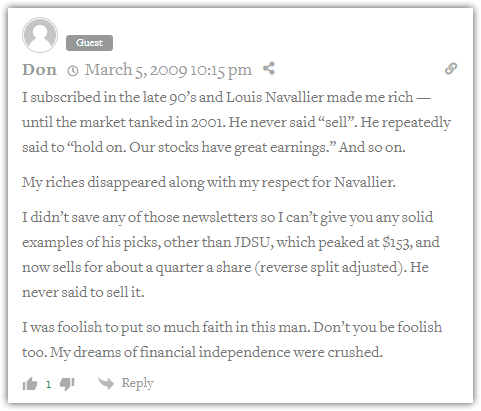

To give context, we lifted the comments below as they are insightful. They provided very useful information about Navellier's performance record.

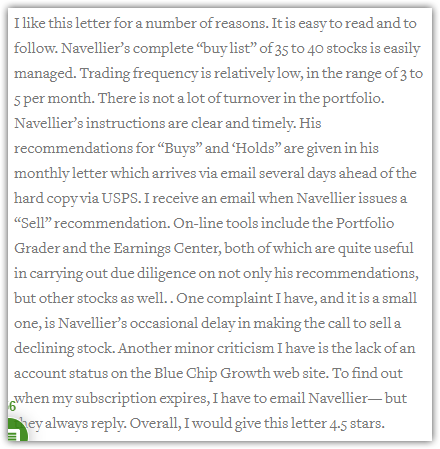

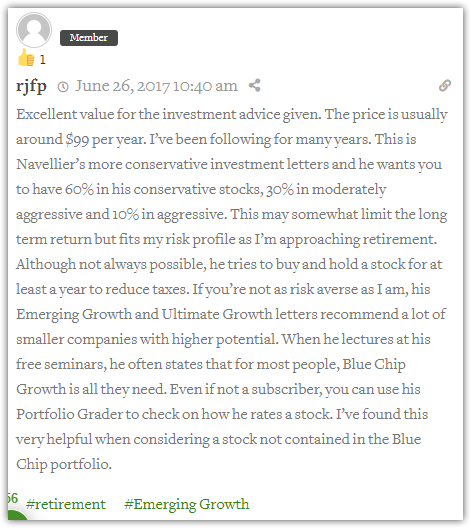

In fact, the commenter below details why s/he is satisfied with the newsletter (Blue Chip Growth is the former name of Growth Investor). Her/his comment gives specific numbers, which will give you a better idea of his experience.

Meanwhile, the next subscriber commended the fund allocation and strategy of the investor.

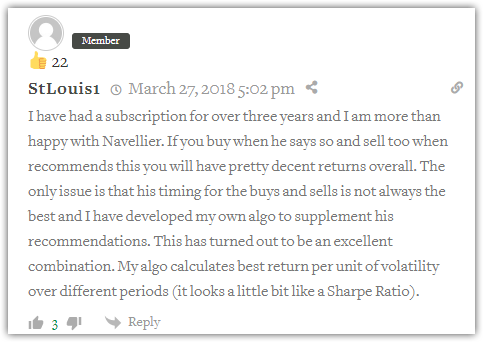

Another example of positive feedback is the one below. For the subscriber, the best strategy is to have a personal scheme as a way to supplement Navellier's.

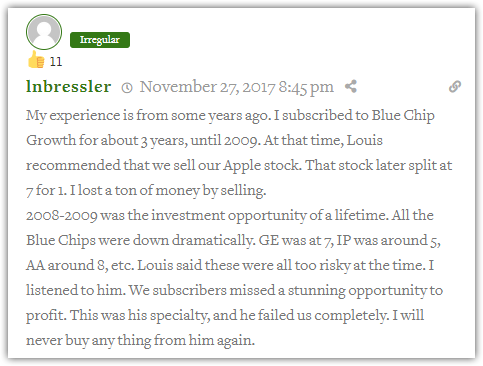

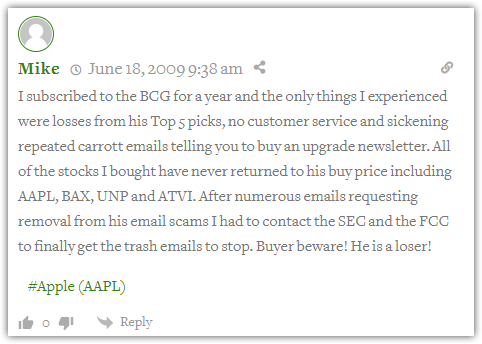

In contrast to the comments above, the next ones are heartbreaking. These subscribers followed his advice but lost significant amounts of money.

One also lamented the poor customer service while another took further actions to stop spam emails.

In addition, a common sentiment about the guy is his rosy picture of the market. We have seen comments like the one below from others also.

Unfortunately, not being realistic about gains makes real people lose real money. Read this comment from a person who feels s/he may have trusted Navellier too much.

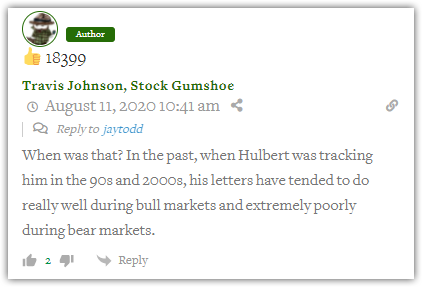

From another thread, we saw one interesting reply from Travis Johnson of Stock Gumshoe. We think this is a fair assessment of Navellier on bear and bull markets based on available data.

In another discussion, Johnson mentions how Navellier failed in his past mutual fund accounts.

We have already discussed one mutual fund we have researched on, which is the American Independence Navellier Defensive Alpha Fund.

The others he could be referring to may be the American Independence Navellier Large Cap Growth Fund and the American Independence Navellier International Fund.

We could no longer search for these on the MutualFunds.com website and the Internet.

There is an American Independence Large Cap Growth Fund there, but it does not bear the name of our man of the hour.

We have also seen a 1997 article in the New York Times that might be related to this. According to the write-up, Navellier was ousted then as manager of the Navellier Aggressive Small Cap Equity fund.

At that time though, he still had the Navellier Aggressive Growth fund.

SEC vs. Navellier

In 2017, The U.S. Securities and Exchange Commission sued Louis Navellier and Navellier & Associates. According to the agency, the company was actively misleading its clients about its track record.

Allegedly the evidence pertinent to the case reveals that this has been going on from 2010 to 2013.

The lawsuit alleged that Navellier & Associates ignored red flags showing the investment strategies had not performed as advertised and instead re-branded the strategies as “Vireo AlphaSector” and continued to recommend them to clients.The firm also distributed advertisements about Vireo AlphaSector that were materially false based on information originally obtained from the strategies’ model manager, the now-defunct F-Squared Investments Inc, the lawsuit said.

Later on, even if they found out that there was a fraud, they continued to profit from the business.

At the time he was sued, Navellier was confident that he did nothing wrong. According to him, no investor was put at a disadvantage. Further, he claimed he was working within legal parameters.

Apparently, before this case, F-Squared was already in hot water.

F-Squared in 2014 agreed to pay $35 million to settle SEC charges that the Wellesley, Massachusetts-based investment adviser defrauded investors by making false performance advertising claims.The SEC separately at that time charged Howard Present, F-Squared’s co-founder and former chief executive, with making false and misleading statements to investors. He has denied wrongdoing and is scheduled to face trial on Sept. 11.

By June 4, 2020, the SEC released a press release about the case.

The Securities and Exchange Commission has obtained a final judgment and more than $30 million in monetary relief in its action against Navellier & Associates, Inc., a Nevada-based investment advisory firm, and its founder and chief investment officer, Louis Navellier, of Florida.

The court determined that they were aware that they had deceptive assertions in their marketing materials. Despite this, they continued to peddle their lies to their clients.

In fact, they still sold the Vireo AlphaSector investment strategies though they knew the so-called tactics were false and misleading.

So, how much money are we exactly talking about here? Here is the actual line from the SEC complaint:

At the time of sale, Vireo AlphaSector had approximately six thousand accounts valued at approximately $1.4 billion.

Again, in plain language, that's six thousand victims, 1.4 billion dollars. Let that sink in.

On June 9, meanwhile, Navellier & Associates announced that they will appeal the court decision. They said it had no legal or factual basis.

According to their official statement:

Clients received exactly the strategy and investment advice they hired NAI to provide – in fact, Navellier & Associates generated approximately $278 million in profits for its clients as a result of strategies the SEC wrongly claims were misleading.

Before we proceed, how do you feel about this so far? Let's talk in the space below.

Conclusion – Is Navellier a Proven Fraudster?

Well, if the district court in Massachusetts is to be believed, the answer is clear.

However, it is also true that the company in question has appealed the decision.

It is also worth noting that despite this, the man continues to be a resource guest on outfits like Fox Business and Bloomberg. So it seems the business community still considers him a credible market source.

It could be that in his half a century record, the reputation he built is still there, despite the case. Although for sure, it is a significant dent on his record.

And we believe the SEC case should be raised whenever his name is mentioned.

In the end, since he is still offering investment advice, trusting him with your money is your decision. But we hope our scrutiny of Louis Navellier’s track record has helped you.