Oil and Gas have had a good run over the past two years, outperforming the S&P 500 and the Nasdaq. Keith Kohl thinks this is just the beginning.

Due to the convergence of three powerful economic triggers, we may be on the cusp of a new multi-year bull market in oil and Keith has a “#1 Oil Stock of the Decade” which he is going to reveal.

The Teaser

This “perfect storm” is unlike anything we’ve seen in decades, with stocks in previous, lesser bull markets popping for 20x returns in only a few years.

At this point, Keith Kohl is like a family member who comes over for Thanksgiving dinner and whispers a “hot stock” tip in your ear. We have reviewed some of these picks here at Green Bull, including Keith's “Nvidia Killer” Company and his LNG “Black Winter” Stocks.

We have seen historic oil bull markets at least twice in our lifetime.

With multiple oil and gas stocks netting gains of over 1,000% regardless of inflation, a recession, and even a stock market crash.

There are signs that it’s happening again right now.

For starters, a bunch of billionaires have been loading up on oil stocks. This includes Bill Gross, Paul Tudor Jones, Ray Dalio, Jim Simons, and the biggest whale of them all, Warren Buffett.

Oil stocks currently make up just over 8% of Berkshire Hathaway's massive $358 billion portfolio. The largest concentration outside of financials or stocks not named Apple.

To his credit, Keith also correctly called the historic melt-up in oil prices in 2007 that few people saw coming.

Five months later, as he predicted, oil prices soared above $100 per barrel for the first time in history.

Today the media are pushing a new narrative about the “end of oil” and misleading millions of Americans. But once again, they’re dead wrong.

After 20 years of forecasting the energy sector, Keith says he is sure about one thing:

Oil is not going anywhere, not in our lifetimes.

This much I am in agreement with, so what are the three economic factors triggering a new oil boom and what stock(s) do we need to buy in order to cash in on it?

The Pitch

Fear not, because Keith has put together a special report with everything we need to know. It’s called “Hidden Gems of the Permian: 3 Little-Known Oil Producers Set to Soar in the New Bull Market.”

Names and ticker symbols are revealed inside the report and it is ours with a risk-free trial subscription to Keith's premium research newsletter, Energy Investor. The normal price for a one-year subscription is $249, but there is a special promotion running and we can claim a membership for $99.

Every month, we would get a brand-new issue of Energy Investor in our inbox, two additional bonus reports are also included, as is access to a model portfolio, and a members-only web portal with a full library worth of past material.

The 3 Economic Triggers for a Multi-Decade Oil Bull Market

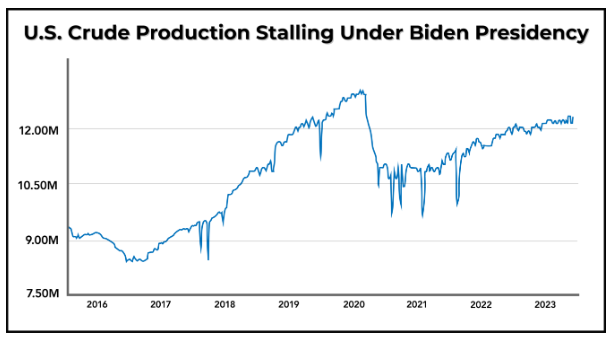

#1: Biden Declares War on American Oil

This sounds extreme, but one chart tells us all we need to know:

In 2019, U.S. oil production hit a record 13 million barrels per day.

Four and a half years later, under Biden’s presidency, oil output still hasn't recovered to these levels.

Falling production only tells part of the story.

Last year, Biden drained more oil from our Strategic Petroleum Reserve (SPR) than any other president before him combined!

As I write this, the SPR now sits at 348 million barrels, the lowest level since 1983. That's only 18 days’ worth of emergency supplies left.

With crude oil production falling and reserves at record lows, Biden has set us up for a massive supply crisis or at the very least some uncomfortable times.

Either way, it's not good and that is why it's the first trigger of a new oil bull market.

#2: The Global Power “Reset”

Most Americans don’t realize it yet, but power over oil prices has shifted away from the U.S., and back into the hands of a global cartel.

That cartel is The Organization of the Petroleum Exporting Countries, known as OPEC, which controls 40% of the world's oil supply and 80% of the world’s oil reserves.

Unfortunately, the Saudi Arabia-led organization has a long track record of weaponizing its oil production to keep prices high so it can maximize profits.

In the past 12 months alone, OPEC+ has slashed 5% of the world’s oil supply, as it prepares for another major event to take place.

#3: The Biggest Demand Surge in History?

Right now we are witnessing the biggest surge in oil demand in modern history.

It's all coming from one place: China.

See, after China reversed course and ended its disastrous zero-COVID restrictions, it broke daily oil consumption records…twice.

In March, China consumed 15 million barrels of oil per day for the first time in history. One month later, it hit 16 million barrels for the first time.

That rate of consumption is completely unheard of and when combined with the other factors just mentioned, it could create a perfect storm to send oil prices higher.

In previous oil bull markets, the biggest gains didn't come from “big oil.” Instead, they came from smaller, under-the-radar oil producers, like the kind Keith is teasing here.

Revealing Keith Kohl’s “#1 Oil Stock of the Decade”

Keith says one supplier is perfectly positioned to profit from soaring oil prices.

Here is what we know about it:

- It sits on one of the biggest oil patches in the world, with 2.2 trillion barrels’ worth locked under the ground.

- The company is trading near its lowest valuation while having the strongest balance sheet it has ever had.

Keith generously reveals the name of his #1 oil stock of the decade as Cenovus Energy Inc. (NYSE: CVE).

- Cenovus is strategically located in the bitumen and oil-heavy Alberta Oil Sands, which is the world's largest deposit of oil sands.

- The oil producer currently trades for less than 12x earnings with a debt/equity ratio of 1.5

Also mentioned in passing are three small-cap Permian Basin oil producers and three “pipeline tollbooths” (oil and gas pipeline) stocks to own during the coming oil surge.

Sadly, no additional info is provided on these picks, but here are a few large pipeline stocks that fit Keith's description:

- Pembina Pipeline Corp. (NYSE: PBA). Pembina owns about 18,000 km of conventional, transmission, oil sands, and heavy oil pipelines throughout North America and it pays an annual dividend of close to 6%.

- The Williams Companies, Inc. (NYSE: WMB). The group's network of pipelines transports 30% of the natural gas in the U.S.

- Energy Transfer LP (NYSE: ET). This limited partnership transports almost one-third of the United States petroleum and natural gas and it also carries a 9% annual dividend yield.

Is A New Oil Bull Market Upon Us?

The first of Keith's economic triggers for a new oil bull market is a little outdated.

U.S. crude oil production is now headed toward a record high in 2023. Does this break the bull market thesis?

Not entirely.

OPEC+ is still keeping a tight lid on oil production and China's demand for crude is still growing, albeit not by as much as at the start of the year.

In short, over the near term, oil and gas will continue to be as volatile as ever. But over the long term, the demand curve only goes one way – up!

Even the U.S. Energy Information Administration projects that oil will still be our No. 1 transportation fuel by 2050 and owning a piece of the production and infrastructure behind liquid gold will literally pay dividends.

Quick Recap & Conclusion

- Keith Kohl says three powerful economic triggers are converging to create a new multi-year bull market in oil and there is a “#1 Oil Stock of the Decade” we must own to profit from it.

- Keith's three economic triggers are 1. Disincentives against American oil production 2. Oil prices controlled by OPEC+ 3. China's growing appetite for crude.

- Our man Keith has put together a special report with everything we need to know to profit from the new oil bull market. It’s called “Hidden Gems of the Permian: 3 Little-Known Oil Producers Set to Soar in the New Bull Market.”

- The #1 Oil Stock of the Decade” teased at the onset is revealed to us as Cenovus Energy Inc. (NYSE: CVE), while the three little-known oil producer stocks are not, with no clues to go on either.

- The resource space is notoriously volatile over the short term. However, over the long term it will only grow more valuable, as essential commodities become more scarce and we can profit if we take the long, scenic approach to invest in it.

Will oil continue to be the dominant global energy source for the rest of our lifetimes? Let us know your thoughts in the comments.