Buried in the fine print of new Congressional legislation is something called “Law 45Q”, which is creating one of the biggest profit opportunities in U.S. history.

Alex Boulden says it incentivizes billions of dollars to pour into one particular sector and one carbon capture company at the heart of it stands to overflow with profits.

The Teaser

Massive government handouts have been distorting markets for centuries, the Inflation Reduction Act is just the latest in a long line.

As the founder of Insider Stakeout, Alex Boulden gave readers insight into stocks with the most momentum and as per its name, insider buying. He's now joined the dark side and writes for Angel Publishing. Speaking of Angel Publishing, we have reviewed plenty of their teasers as of late, including Keith Kohl's “Nvidia Killer” and Jason Williams' “Robot Royalties” among others.

Alex says it's not electric vehicles, renewable energy, nuclear power, or even the artificial intelligence market that this new law is affecting.

Instead, it is giving birth to an entirely new market.

That market is something called Carbon Capture Storage (CCS).

Natural resource investors know CCS isn't new, as the natural gas industry has been using carbon capture technology for nearly half a century to remove C02.

What is new, however, are the financial incentives behind the tech.

From Financial Burden to Highly Profitable

Despite carbon capture technology being proven, adoption has proved elusive.

Simply put, the costs associated with the installation and upkeep of carbon capture systems have often exceeded the benefits.

Thanks to “Law 45Q,” this all changed.

Before the passage of the Inflation Reduction Act, companies could qualify for a tax credit worth up to $50 for every ton of carbon they capture. Now, with the introduction of “Law 45Q,” that credit has increased from $50 to $85 per ton, doubling the government’s financial support for emission reduction.

This has been enough to get some major players like ExxonMobil, Shell, and Occidental Petroleum on board.

For one cutting-edge carbon capture technology company, it means its stock could go to the stratosphere.

The Pitch

This company’s name and stock ticker symbol are revealed in a special report called: “The Carbon Capture King: The Tiny Tech Firm Pioneering a New $4 Trillion Industry”

Alex will send the report to our inbox…if we agree to test-drive his advisory service, Insider Stakeout, which is now part of Angel Publishing's Outsiders Club. A one-year membership costs a hefty $499 and includes weekly alerts and updates, a free subscription to Wealth Daily, and a 90-day money-back guarantee.

How to Profit From Government Intervention in the Market

Many businesses have been built almost entirely on generous government handouts.

Here are a few notable examples.

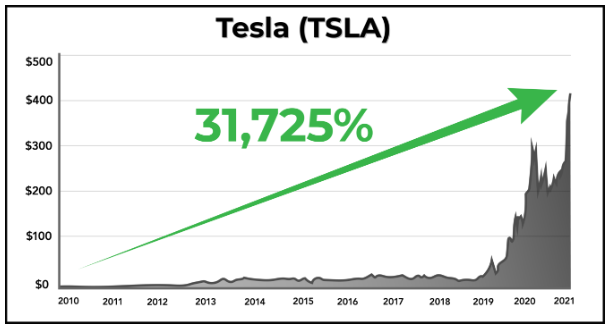

First up is Tesla, who according to an investigation by the Los Angeles Times has over a billion dollars in government aid.

The result?

Tesla’s stock price exploded from $1.28 per share to over $400 for a 31,725% gain over the course of a decade.

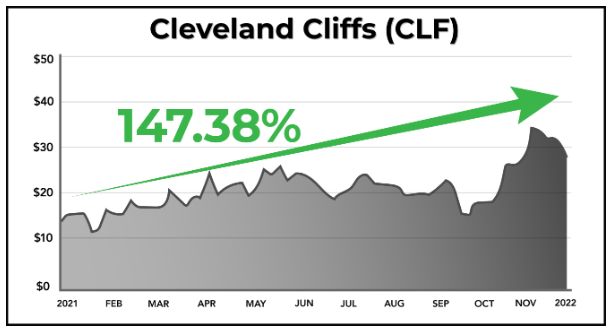

Next up is Ohio-based steelmaker Cleveland-Cliffs (NYSE: CLF), which profited big from the Bipartisan Infrastructure Law the government passed in 2021.

This $1 trillion law funneled hundreds of billions of dollars into various infrastructure industries and kickstarted CLF stock from $13.34 to $33 in a single year!

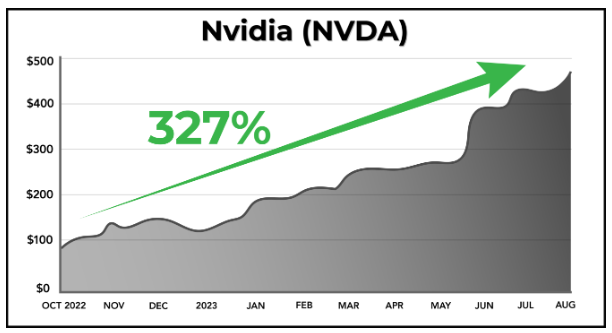

More recently, the CHIPS and Science Act of 2022 is yet another example.

The act provides billions of dollars to support the domestic production of semiconductors and one of the biggest beneficiaries has been chipmaker NVIDIA.

Its stock has exploded from $112 to $480 in only 10 months.

I could go on, but you get the point.

Government intervention in the private market has handed a select few companies huge wins on a silver platter.

This is now happening again thanks to “Law 45Q.”

What is Law 45Q?

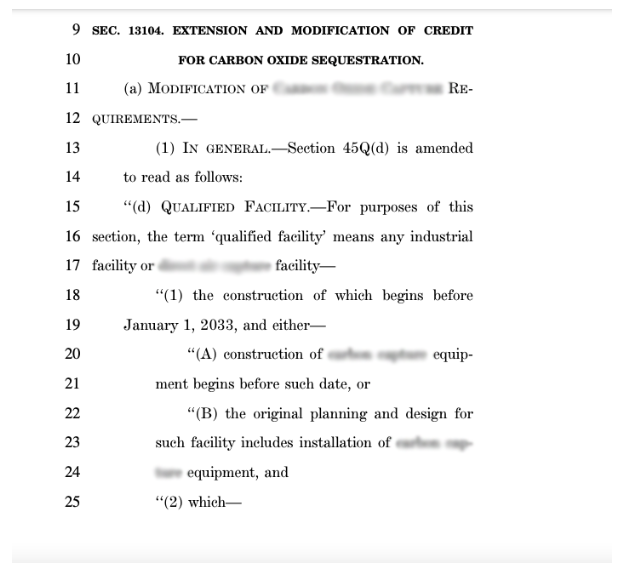

What Alex calls “Law 45Q” is actually Section 45Q of the Inflation Reduction Act.

It states that tax credits on lax qualifying terms will be awarded to carbon capture projects initiated before January 1, 2033.

Tax credits are a big deal for megacorps, as even a relatively small credit can mean millions of dollars added to the bottom line.

This is giving rise to the carbon capture industry, which Forbes forecasts could grow into a $4 trillion market in the coming years.

Time Magazine has also called the legislation a “carbon capture bonanza“ and the company Alex teases here looks poised to eclipse the returns of previous government largesse recipients.

Revealing Alex Boulden’s Carbon Capture Company

Clues are sprinkled throughout the presentation about this “tiny firm” like a trail of gingerbread crumbs.

Here is everything we know:

- The company has already forged partnerships with the likes of Saudi Aramco and Microsoft, who have adopted its carbon capture technology.

- Ahmad Al-Sa’adi, the executive vice president of Aramco, said “The partnership will support our efforts in developing and deploying cutting-edge technologies in the area of carbon capture.”

- Its stock hovers around $1.

Based on these clues, Alex's carbon capture pick is Aker Carbon Capture ASA (OTC: AKCCF). This is why I am so sure:

- Aker has collaborated with Microsoft and Saudi Aramco to demonstrate its proprietary carbon capture technology.

- The quote from Aramco VP Ahmad Al-Sa’adi is from this past summer when Aker signed an MOU with the Saudi-owned oil company and it is proudly displayed on Aker's website.

- Shares of Aker are currently selling for $0.97.

Pioneer or Flash in the Pan?

Much of the push for carbon capture stems from the infamous Paris Agreement.

This treaty signed by 195 members of the United Nations Framework Convention on Climate Change in 2015, states that emissions should be reduced as soon as possible and reach net zero by the middle of the 21st century (2050).

It's the same agreement former President Trump withdrew the United States from in 2020, only for Biden to rejoin it in 2021.

The kicker is, that if Trump were to win a second term in 2024, he may withdraw the U.S. from the Paris Agreement again, which wouldn't kill the Inflation Reduction Act and its carbon capture facility tax breaks. But it would make the underlying reason for them obsolete and stop the growth of the carbon capture industry dead in its tracks.

Would some companies continue to implement carbon capture tech solely for the tax benefits? I'm sure they would. However, with no political pressure to cut emissions, many would likely opt to invest in more profitable projects that net an immediate return on invested capital.

Even if this scenario doesn't play out and things continue as they are now, it will be years before Aker becomes a profitable business, if it ever does.

The business isn't going anywhere anytime soon with a cash and cash equivalents balance that covers all liabilities 1.4 times, but its high sales and project tender activity, North American market entry, and R&D activities will keep capex elevated for years to come, while sales growth could be highly volatile depending on which way the political winds blow.

Quick Recap & Conclusion

- Angel Publishing's Alex Boulden says something called “Law 45Q” is creating one of the biggest profit opportunities in U.S. history and one carbon capture company at the heart of it stands to overflow with profits.

- What Alex calls “Law 45Q” is Section 45Q of the Inflation Reduction Act, which doles out tax credits to carbon capture projects initiated before January 1, 2033. One cutting-edge carbon capture technology company could see its stock go to the stratosphere as a result.

- This company’s name and stock ticker symbol are only revealed in a special report called: “The Carbon Capture King: The Tiny Tech Firm Pioneering a New $4 Trillion Industry.” Getting our hands on it means taking Alex's advisory service, Insider Stakeout, for a test drive at a hefty price of $499 for the first year.

- Fortunately, you can skip this step altogether, as we were able to reveal Alex's “Carbon Capture King” pick for free as Aker Carbon Capture ASA (OTC: AKCCF).

- Aker isn't going to go belly up tomorrow, but it also isn't going to turn a profit anytime soon either, and growth could be choppy depending on the political climate.

Is Carbon Capture a viable industry over the long term? Let us know what you think in the comments.

Sounds like another high flying bust to me!

It seems that the carbon capture industry is a small at 6.2% of the attempt to capture carbon. Compare that with the effort to reduce Carbon from all other sources of pollution. It is true that it helps but will not be as explosive in growth as the rest of the industry’s efforts to de-carbonize our atmosphere. His offer is not worth $499

This AKCCF stock’s average volume is under 20,000 and lately has been around 10,000.

Thank you for your thoughtful review of this company and where it’s going.

Does everyone understand that without CO2, nothing will grow and we humans r dead without CO2??? Does anyone have Tikka Tiwari’s latest 5 altcoins to Palm Beach Pioneer..??? His free give away is LINK-Chainlink, today is $15.37. All of Wall Street will be using Chainlink as clearing house directly, without regular in between guy-faster, cheaper..!!! 🤗💰

I do not see enough info as to what akccf is actually doing to capture carbon, just that they have a signed agreement with Saudi to use “it”. There are a number of companies with quite clever prototypes for capturing carbon, and they are working to scale up. The enormous excess needs to be reduced so it likely is an up and coming industry.