Karim Rahemtulla believes China is dangerously close to monopolizing the most important technology on Earth…2-nanometer chips.

These tiny chips are more powerful than any chips the world has seen before and there's a #1 U.S. Stock that is poised to explode, regardless of what happens next.

The Teaser

It's a badly kept secret that China wants to gain a technological, economic, and military advantage over the United States.

Karim Rahemtulla focuses on “smart” trading, using volatility and proprietary probability modeling to place bets where risk and reward are defined ahead of time. We've previously reviewed the Monument Trader's Alliance – Scam or Expert Speculators? And also taken a closer look at the Monument advisory service Trade of the Day Plus.

What would it mean if China fulfilled its ambitions?

In short, our ability to generate wealth and live in a free society would come to a swift end.

It all starts with gaining a stranglehold on one of the world’s most coveted technologies. A technology that's used in practically everything from smartphones to the computers that power the internet to shipping infrastructure, and even our electrical grid.

Semiconductor Chips

All of the things just mentioned require semiconductor chips to power them.

In fact, even new gas-powered cars now have over 1,000 chips in them on average. If it's electronic, you can virtually guarantee it’s powered by semiconductor chips.

The problem is, about 92% of the entire world’s advanced semiconductors come from Taiwan.

Contrary to anything else you may read, this is the single biggest threat facing America today. Because if China invades Taiwan, it will essentially gain complete control over nearly the entire global supply of semiconductor chips.

The relatively minor chip shortage of 2021 was firsthand evidence that even a slight dip in chip availability led to mass chaos throughout the economy. According to the U.S. Department of Commerce, the shortage “shaved an estimated $240 billion off U.S. GDP in 2021.”

But this was only a mild chip shortage.

If access to new chips were to get cut off completely, it would be an absolute catastrophe. So, what can we do about it?

According to Karim, it all starts with a series of protective investments that we should move some of our money into immediately. Especially one $32 stock in particular that is primed to soar, with a “chance of hitting $200 in the next two years.”

The Pitch

How do we get our hands on this stock before the run-up? It all starts with getting a copy of Karim's latest report: “Defeating China: The #1 U.S. Stock to Soar From 2-Nanometer Chips”

The author says “this is the #1 place we’re going to want to have your money over the next two years.” The report along with much more is available to Trade of the Day Plus subscribers for only $49 per year. To sweeten the deal even more, all of it is also backed by a 100% money-back guarantee.

The Little-Known Breakthrough About to Abolish China's Plans

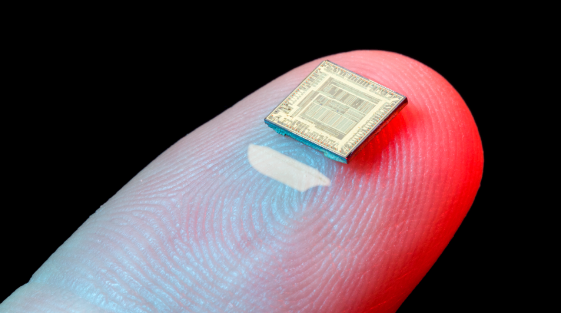

The microchips that will soon power the world are the same size as a single grain of rice.

And yet, these tiny chips consist of over 50 billion microscopic transistors smaller than the size of a single strand of DNA.

They’re called “2-nanometer chips” and Intel is expected to be the first company to mass-produce them.

The chips were actually first created using IBM's nanosheet technology, and more importantly, they are going to be produced right here in the United States years before they’re anywhere else in the world.

The implications of this breakthrough nanotechnology are far-reaching:

- Computer performance will increase by a whopping 45%

- The battery life of a smartphone is expected to quadruple (no more portable chargers necessary)

- And America will win back its competitive advantage in microchips

So, what's the catch?

It all depends on one small company and its patent-protected technology.

Where the Real Money's At

Karim believes the real money is in the smaller company that’s providing the technology that makes these chips possible.

This is because their technology will be used not just by Intel, but by virtually every chipmaking company around the world.

More than just hyperbole, this little-known company has been growing faster than other chip equipment makers over the past few years, and some analyst projections see an $800 million increase in revenue in the near future.

Since 2017, this company has beaten quarterly earnings estimates more times than Amazon, Tesla, Google, and even Warren Buffett’s own Berkshire Hathaway.

The best part, it doesn’t just supply chipmakers. It supplies other equipment makers with their own virtual monopolies.

This company indirectly touches almost every chip that is produced in the world with its technology. So, what is it?

Revealing Karim Rahemtulla's #1 U.S. Stock

We're offered some good insight into what this business is and what it does. Here are some of the biggest clues:

- A U.S.-based company that is now establishing factory locations all over the world.

- The company already has contracts with all of the major players involved in chipmaking, from TSMC to Intel, and Applied Materials.

- Several of the company's top executives come from the likes of Applied Materials and Lam Research.

- Its stock currently trades for around $32 per share

I think Karim is talking about Ultra Clean Holdings, Inc. (Nasdaq: UCTT) here. Most of the clues seem to match up with precision:

- Ultra Clean is a leading developer and supplier of critical subsystems, components, and parts for the semiconductor industry.

- It supplies top companies, including TSMC, Intel, and Applied Materials.

- The company's CEO is the former Corporate Vice President and General Manager at Applied Materials and other execs are Lam Research alumni.

- UCTT stock currently trades for just under $32 per share.

Make 525% within the Next 2 Years?

There's no question that if China were to send troops into Taiwan and it takes over its extremely valuable chip industry, there would be a bloodbath in the stock market. Any company that relies on Taiwan will take a huge hit.

The one sector of the economy that could avoid some of this carnage is companies that provide chip engineering and other solutions here in America.

Ultra Clean is one such company, but it's already been around for over 30 years. Will it surge like Karim believes over the short term? Without the China/Taiwan catalyst, no. For this reason, I would look for a better entry point price-wise into UCTT stock or another domestic semiconductor chip company.

Quick Recap & Conclusion

- Karim Rahemtulla believes China is dangerously close to monopolizing the most important technology on Earth…2-nanometer chips. But he believes there's a U.S. Stock that is poised to explode, regardless of what happens next.

- Intel is expected to be the first to mass-produce these 2-nanometer chips and it will need one small company and its patent-protected technology to do so.

- Karim reveals the name of this company in his latest report: “Defeating China: The #1 U.S. Stock to Soar From 2-Nanometer Chips.” It's ours with a $49 subscription to the Trade of the Day Plus service.

- Out of all the companies Karim's pick could be…and believe me there were a lot more than I originally expected. Ultra Clean Holdings, Inc. (Nasdaq: UCTT) is the closest match.

- Ultra Clean was founded to bring Japanese-style manufacturing to the U.S. semiconductor equipment industry.

Is there a better bet on the domestic semiconductor industry than Ultra Clean? Let us know your thoughts in the comment section below.

Foxxconn????