Jim Woods, not to be confused with American actor James Woods, has a simple, “fail-safe” system that has protected investors' money during every market crash over the past 45 years.

Now this same “fail-safe” system is flashing green on a trio of Exchange Traded Funds (ETFs) that money is flowing into.

The Teaser

A “fail-safe” can best be described as “a plan in case something goes wrong.” Jim asks if we have one for our investments.

Jim Woods is a bit of a Renaissance man as a former Paratrooper, Special Operations veteran, and a professional investor for nearly two decades. He backs it up with values of focus, honest work, and discipline, which underly the fail-safe system. We have previously reviewed several of the Renaissance man's teasers here at Green Bull, including his Biden Rapture Stocks and EV Charging Company for a 1,450% gain.

If we're being honest, most people's fail-safe plan is cashing out all their holdings and going to cash…after the market has already crashed.

This isn't much of a plan and requires something more “safe” if you will. Enter the “fail-safe” emergency alert system, which sounds like a disaster preparedness scheme and in many ways it is.

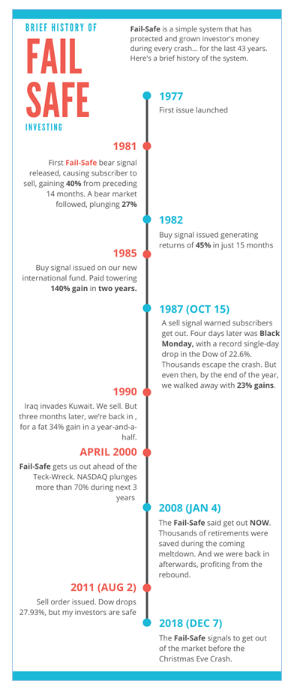

In 1977, the world’s top stock market strategist created a similar Fail-Safe system to save your nest egg should the unthinkable happen.

For 14 years, Jim worked side-by-side with this man and when he retired, the system was entrusted to Jim.

Since that time, this system has persisted and posted some impressive results over the years.

How the Fail-Safe System Works

Like most trading systems, fail-safe is technical in nature.

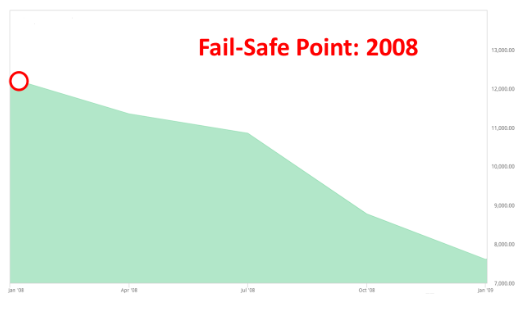

It pinpoints what it calls a “fail-safe point” when the market is about to crash based on several factors, including volume and volatility indicators.

Fail-safe also tells us when all is clear to get back in the market based on the same indicators.

For example, shortly after the 2009 market bottom, the fail-safe signaled green. From there, the Dow rocketed 26% in less than a year.

If we take this system and apply it to the market today, we will see that money is flowing into one particular sector…Exchange Traded Funds, or ETFs.

The Pitch

Jim has three turbocharged ETFs that combine into a powerful cash machine and they are all revealed in a special report called Triple Your Retirement Savings in Five Years.

The report is “free” if we agree to a 30-day no-strings-attached preview of the Successful Investing website. The cost is relatively low at $49.95 and includes a bundle of six “premium” investing guides with promotional names such as Top 5 Stocks to Buy Right Now and How to Grow Wealthy with ETFs, among others.

Making the Case for ETFs

Exchange traded funds have been called “one of the most important and valuable products created for individual investors in recent years” by Fidelity Investments.

To me, the case for ETFs over mutual and index funds is simple.

While all are pooled investment vehicles, ETFs on average are:

- Lower cost

- More liquid

- And more accessible

They are also far less risky than trying to pick individual stocks and less time-consuming too.

Given all this, it should come as no surprise that ETF trading now makes up a record 31% of all U.S. equity trading.

This figure may continue to grow.

As of the end of 2022, there were 2,893 listed ETFs, up 9% over the prior year. Meanwhile, the number of stocks listed on major exchanges continues to decline. Just over 4,000 are listed today on the NYSE and Nasdaq, compared to more than 8,000 at the peak in the mid-90s.

The Investment Landscape is Changing

This headline is a bit misleading, as it should read the trading landscape is changing.

Investing is and always will be buying a fractional ownership in a business, hopefully for a price less than it is intrinsically worth. Trading on the other hand is all about exploiting short-term inefficiencies in the market and in this regard, ETFs lend themselves well to Jim's fail-safe trading system.

As the Wall Street Journal pointed out a few years ago, the biggest ETFs now boast more trading volume than the largest members of the indexes to which they are linked.

This burgeoning trading volume and volatility make ETFs a perfect fit for the fail-safe system's technical entry and exit points and Jim has three that he says “combine into a powerful cash machine.”

Exposing Jim Woods' ETF Picks

First, a word of warning.

The clues provided are extremely limited. How limited? One paragraph and nothing more.

Despite this, we will do our best to reveal each pick and offer an educated guess wherever this isn't possible. Let's get started.

Tech ETF Pick

- This “Undercover Tech ETF” is Wall Street’s biggest secret, quadrupling in the last five years.

Based on performance alone, this has to be the Invesco Nasdaq Internet ETF (Nasdaq: PNQI). This ETF comprised of Internet-related businesses such as Microsoft and Adobe is up more than 500% over the last decade.

Defense ETF Pick

- Jim's defense ETF is an essential tool, with a track record to match.

One thing going in our favor here is that the universe of aerospace and defense ETFs is tiny, with only seven listed. The best-performing of these has been another Invesco ETF, the Invesco Aerospace & Defense ETF (NYSE: PPA).

Healthcare ETF Pick

- This healthcare sector ETF specializes in an area where triple-digit returns of its assets are no surprise.

Can't be sure about this one, without further elaboration. But my gut says it is likely the ARK Genomic Revolution ETF (CBOE: ARKG). The ETF is in a fast-growing niche of the healthcare industry – genomics, that could realistically deliver the kind of gains Jim hints at here.

Triple Your Retirement Savings in Five Years?

To be clear, Jim isn't saying his trio of ETF picks will triple our money.

He's saying trading these ETFs with his fail-safe system will yield such results. I'm not so sure.

Jim himself admits the fail-safe system has only been applied to the Dow Jones Index so far in its 45-year history. So there's no telling how the strategy will fare with a new volatile asset class like ETFs. I'm not keen on being the guinea pig that finds out first either.

If this wasn't bad enough, we also have to take into consideration the two things that make almost any short-term trading strategy an inferior alternative to long-term investing – brokerage fees and capital gains taxes. When these two costs are added in, you really have to outperform the market by a large margin to make it worth your while.

Buying into some low-expense, diversified ETFs makes sense, just don't trade in and out of them or necessarily expect them to triple your money over the short term.

Quick Recap & Conclusion

- Jim Woods is pitching a “fail-safe” trading system that has protected investors' money during every market crash over the past 45 years.

- Like most trading strategies, the “fail-safe” system overweighs factors like volume and volatility and is most profitable when applied to the highest volume securities in the market today – ETFs.

- Jim has three turbocharged ETFs that combine into a powerful cash machine when paired with his “fail-safe” trading system and they are all revealed in a special report called Triple Your Retirement Savings in Five Years. The report is “free” if we agree to a 30-day no-strings-attached preview of his Successful Investing website for $49.95.

- Clues were extremely limited, but Jim's three turbocharged ETFs could be Invesco Nasdaq Internet ETF (Nasdaq: PNQI), Invesco Aerospace & Defense ETF (NYSE: PPA), and ARK Genomic Revolution ETF (CBOE: ARKG).

- Owning a diversified basket of low-expense ETFs makes financial sense, actively trading those ETFs to try and time the market will likely just lead to more expenses instead of profits.

Have you had success investing in ETFs? Share your experience in the comments.