Somehow, someway, sleuth James Altucher has gotten his hands on a top-secret leaked Google memo that reveals an uncomfortable truth.

The memo reveals that the search giant is admittedly falling behind in the Artificial Intelligence arms race and an “Urgent AI Buyout” could be their next big move.

The Teaser

What do you do when you're a cash-rich, multi-billion-dollar business that is short on innovation?

Serial entrepreneur, author, and poodle haircut aficionado James Altucher is a well-known name in tech circles. We have previously reviewed his Altucher Report and “Secret Income” service and discussed whether either is worthy of your attention.

Right now big tech is doing like Fry from Futurama and telling any generative AI startup that will listen to just shut up and take their money.

In opening their war chests in this way, it has created an opportunity for all of us to profit from their acquisition sprees.

We have already seen one of the big five tech giants – Microsoft spend $10 billion for a 49% ownership stake in OpenAI earlier this year. The company behind the fastest-growing web application of all time, ChatGPT.

This may have been the deal that broke the dam wide open, leading to many more deals to come as entrepreneurs flood into AI, chasing above-average returns.

The Race for AI

One (outdated) report has noted that there have already been 635 AI acquisitions since 2010, with Apple leading the way with 20 acquisitions.

This was back in 2020 and the AI acquisition wave has accelerated since then.

Call it hype, FOMO, or just chasing the newest, shiniest thing. But more than 1,000 companies mentioned AI in their quarterly reports this summer. Not tech companies, but companies across all industries.

I even received an email about the U.S. military making major moves in AI as I type this.

Even racing legend Michael Andretti is getting in on the AI craze. So James is on to something here with his AI M&A arbitrage.

He mentions that some of the top historical buyouts have handed out gains like 1,167% in 11 days and nearly 1,800% in 13 days.

This may be pre-public announcement deals, but nonetheless, James' indicator is signaling that one small, little-known company could be on the cusp of a multi-billion dollar buyout offer and this is our chance to get in on it.

The Pitch

Wall Street brokers are quietly placing massive bets on this small AI company, meaning a buyout could be imminent and James reveals its name in a special report called How to Stake Your Claim in the Next Big Tech Buyout.

The report has step-by-step instructions on how to trade the stock and it is only available to subscribers of James' new project The Altucher Buyout Trader.

Plenty of bonuses are being thrown in too, besides regular M&A arbitrage opportunities on a monthly basis, like free video tutorials on how to trade these plays, a model portfolio, and a monthly Zoom call with James. All this will cost $995 for a limited time, which is 80% off the regular price of $4,995.

The Most Powerful Indicator in the World

Aside from leaked internal Google memos, James identifies potential buyouts in two ways:

- With a “powerful tool” that detects unusual buying activity in a company's stock

- And via his own expertise

In regards to the “powerful indicator tool” mentioned above, it isn't James' concoction. It actually comes from a “leading deal expert” with whom Paradigm Press has partnered up.

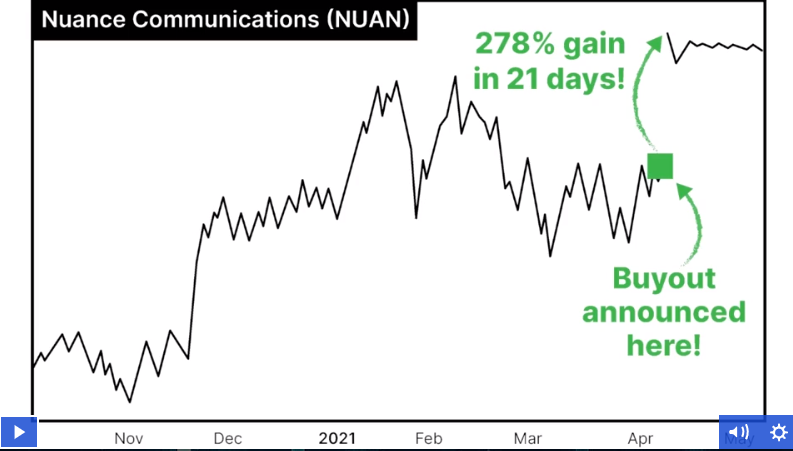

Pitched as the only tool to spot deals before they are announced, its claim to fame is identifying some huge acquisitions in the past, prior to them being announced to the public.

Like Microsoft's acquisition of Nuance Communications for $16 billion in 2021:

And the pending Broadcom/VMWare mega-deal:

What is this tool and how reliable is it?

Sadly, this isn't revealed. However, it is supposedly powered by AI technology to find massive bets in the derivatives market and comes from a secretive quant trading firm.

Will it turn us into Wall Street insiders or market timing wizards like Nancy Pelosi? Not likely, as despite retail investors' share of total equities trading volume now approaching 25% (the most ever), 90% still lose money on average and some of these traders very likely use buyout indicators similar to the one mentioned here.

What we do know for sure is that the indicator has been right at least on a few occasions in the past and it is now flashing green on James' little-known AI company as the next likely buyout target. Let's try and find out what it is.

Revealing James Altucher's Urgent AI Buyout

James' video presentation (with no playback) may have set a new Green Bull record for the least amount of clues found in a teaser.

All we got was this blurred-out chart:

Desperate times call for desperate measures, so I took to the internet to see what I could and came upon some speculation that James' urgent AI buyout candidate is UiPath Inc. (NYSE: PATH).

If we place a one-year chart of PATH over the blurred-out one we were provided, we see that they are nearly identical.

Based on this and the fact that the company provides a robotic process automation platform that helps businesses streamline their operations, there is a better-than-good chance that UiPath is the buyout candidate.

Legit Opportunity to Make 1,000% in a Matter of Weeks?

I may have said it before, but I will say it here again as it is highly relevant to this presentation.

Arbitrage of mergers and acquisitions is the best way to make uncorrelated market returns.

But the kind of M&A arbitrage I'm talking about differs greatly from the speculative kind James promotes here. Allow me to explain.

By M&A arbitrage, I mean arbitraging a small group of already-announced deals. Ideally, collecting a few percentage points on each for an above-average overall return, while taking on below-average risk.

As James rightly points out, there are about 57 mergers and acquisitions made every single day on average, so there is no shortage of opportunities if time is taken to go through them and identify the best ones.

On the other hand, speculating on unannounced deals carries above-average risk and could get you stuck holding stock you would never otherwise buy.

Is UiPath getting bought out? No way to know for sure and I'm not looking to own the business at its current valuation either.

Quick Recap & Conclusion

- Entrepreneur and angel investor James Altucher is teasing an “Urgent AI Buyout” that could net us quadruple-digit gains in the coming weeks and months.

- This *potential buyout was identified using a “powerful AI quant tool” that detects unusual buying activity in a company's stock and James' own unique expertise.

- James reveals the name of this acquisition candidate in a special report called How to Stake Your Claim in the Next Big Tech Buyout. The report is only available to subscribers of his new project The Altucher Buyout Trader, which costs $995 for the first year.

- Only a blurry chart was supplied as a clue, a new Green Bull record for the least amount of clues in a teaser. Fortunately, not even this was enough to stop us. Following some more digging on the internet and matching up the charts, James' urgent AI buyout candidate is… UiPath Inc. (NYSE: PATH).

- The kind of unannounced M&A arbitrage James is teasing carries above-average risk and could leave you holding the bag on stocks that never end up getting acquired. Buying a small group of already-announced deals that still trade below their buyout price is a much safer and more reliable alternative.

Are there better ways to make uncorrelated market gains than announced M&A arbitrage? If you know one, name it in the comments.