Anybody interested in Investment Advisory Services will find pictures of Nomi Prins plastered all over the internet. The featured image above can give you an idea about how bad it is.

Very few people have been “Everything, everywhere, all at once” more than her. An exercise of self-promotion and hype that borders the bizarre.

That’s probably one of the reasons why we find negative articles about her.

And adverse reactions from readers, followers, and clients who feel betrayed, mostly by unending and obsessive up-selling, lousy customer service, and problems with her guarantees.

All of these seem designed to confuse the customers, thus making them invest too much of their money in services that are not worth it.

Therefore, if you are curious on whether Nomi Prins is a fraud, you will find your answer in this Profile Review: Is Nomi Prins a Fraud? Her Iffy Reputation as Journalist, Writer and Stock-Picker.

For someone who jibber-jabbers 'til the cows come home, she has never published a comprehensive and chronological CV, and doesn't speak too much about her private life. She said somewhere, she is a private person who does not write or speak about her parents, siblings, marital status, or children.

How does she deliver or perform? It is entirely possible that she is legit and looks good as an economist and/or investigative journalist. What about Nomi as a writer and investment advisor? I back up all information with facts as far as possible.

I will look at performance with eagle-eyes and in detail, and avoid subjectivities and personal bias.

At the end of this piece, you'll have a better view and more criteria to decide if:

- you want to follow her as an economic journalist/investigative reporter.

- you want to read any of her books.

- you want to buy any of the Investment Advisory Services she offers.

Keep walking.

WHO IS NOMI PRINS ?

Upbringing

What follows is some stitching I did with information all over Google, and Nomi´s own Wikipedia page. Not all Investment Advisers have their own Wiki page, only those that have been in the market longer. Or those who did the best job at tooting their horn. She has done that. Very well.

In Wikispro, I found a date of birth: July 16, 1951: No way, because she looks much, much younger. I found a different date and place of birth elsewhere: September 26, 1963, in NY City.

When I sum up her professional activity (24 years) and estimate she ended her studies as Ph.D. with 26 years of age, that would make her 50 years old. That is how she looks to me.

Nomi was born in Poughkeepsie, upstate New York, and is her family’s oldest child. Her Father, Jack, worked for IBM after having taught in the local college as a mathematics professor. According to Wikispro, she has a net worth of one to five million. To be taken with a grain of salt.

Studies

- Bachelor´s Degree (BS) in Mathematics from the State University of NY in Purchase, with a Minor in Music.

- Master in Science in Statistics from NY University (MS) at Stern School of Business.

- Ph.D. in International Strategic Studies with a specialization in International Political Economy from the Federal University of Rio Grande do Sul in Porto Alegre, Brazil.

No data on time range.

Professional Background

After graduation, she became an Analyst at Chase Manhattan Bank. She was there from 1989 to 1990.

Then, Senior Strategist at Lehmann Brothers Jan.1991 to March 1993. Remember Lehmann? They went bankrupt in the financial crisis of 2008.

Next stop, Senior Managing Director at Bear Stearns in London, where she led the International Analytics Group from February 1993 to February 2000.

To go back in time, Bear Stearns also failed in the Subprime Mortgage Crisis of 2008. Nomi left in her path lots of cadavers (this is me, being a little mean).

Her last step before quitting, Managing Director at Goldman Sachs from March 2000 to April 2002.

Here I would like to tell you a bit more about what being a Managing Director in a prominent financial outfit means:

What a Managing Director Does – Investopedia:

Virtually every business student dreams of life as the managing director (MD) of a major investment bank.

Because top investment banking directors can earn millions of dollars per year, travel all over the world, and get to see their names in print in publications such as The Wall Street Journal.

In terms of respect, lifestyle, and prestige, managing directors are in the upper echelons of the finance world.

Managing directors are at the highest levels in the corporate structure of an investment bank except for the top executive positions, such as CFO, COO and CEO.

Managing directors are typically the heads of the various divisions of a group. For example, a managing director could be the head of the credit risk department, overseeing the department's day-to-day activities and reporting to the chief risk officer (CRO).

So, why did she leave all that?

She says, in “Inside Wall Street with Nomi Prins”, of March 15, 2023:

The problem is that institutions can’t always be trusted. I had the dubious pleasure of learning about that firsthand during my 15 years working for Wall Street. That’s essentially why I left in 2002. These institutions were involved in many questionable dealings, like Word.com and Enron.

In December of 2021, she launched Distortion Report, her flagship entry-level (monthly) newsletter. Distortion Report is part of Rogue Economics, a publishing company owned by…. keep reading to get this information further on.

During 2022 she included (as most of her colleagues do), other advisory services which are mentioned farther down.

She devoted herself to public speaking, writing, journalism and some politics since her disappearance from the banking system and launching her service.

After that, information is much scarcer. My source is mainly LinkedIn. Her profile presents her as a “Former Wall Street executive, entrepreneur, keynote speaker, bestselling author, and journalist.” (No mention Rogue Economics). The subjects she is said to usually comment on, are:

- Finance

- Economics

- Wall Street

- Central Banks

- The Federal Reserve.

Political Activities and Public speaking

Active in Advocacy Groups such as Occupy Distinguished Senior Fellow at the US Think Tank DEMOS (July 2002 to Sept. 2016).

Geo-political Economist, Multimedia Journalist, and TV Commentator at Hachette Book Group. Author featured at The Nation, The Guardian, NYT, Forbes, Fox, and MSNBG (2004 to present – 19 years).

Wall Street and Public Banking Institute, which works to improve the financial system and make banks more accountable.

She was a member of Senator Bernie Sander's panel of expert economists, formed to advise on reforming the Federal Reserve. She has been quite vocal as a public speaker in many places, including Congress.

She also championed for the reinstatement of the Glass-Steagall Act of 1932. This act obliged banks to be either investment or commercial/retail banks.

The mandatory separation of retail/commercial banking and investment banking was repealed in 1999, and congressional efforts ever since to reinstate it have yet to be successful.

Nomi in Social Media

Twitter: https://twitter.com/nomiprins with 43.2 k followers.

Instagram: www.instagram.com/realnomiprins/ with 4,4 k followers.

She has her own Official YouTube channel.

Facebook: www.facebook.com/realnomiprins with 7,2 k followers.

WHAT DOES NOMI PRINS OFFER ?

BOOKS

Let's delve into Nomi's stint as a writer.

The ratings are very good (equivalent to four and a half stars). This is why I provide some excerpts of favorable and unfavorable reviews:

2006. Rating 4.4/5 by Amazon

2009. Rating 4.6/5 by Amazon

“Those who made off with hundreds of billions of tax dollars were virtually all Democrats. Takes a solid left turn after a brief intro of objectivity.”

“Good on detail, bad in style. Grating quirkiness of a gossipy NY socialite who´s had a few too many drinks at a cocktail party. Flippancy of writing detracts from the seriousness of the subject. Poorly written.”

2011. Rating 4.1/5 by Amazon

2014. Rating 4.5/5 by Amazon

Everybody knows that Presidents have always been chummy with the big bankers. So, nothing new in this side of the road.

2018. Rated 4,6/5 by Amazon

“Dull – boring – repetitive.”

“Too much detail, never brought back to a central point” (the one mentioned below – my note)

“Author-informed collusion without substantiating anything more than collaboration.”

2022 Rated 4,5/5 by Amazon

What Nomi calls the “great”distortion is the disconnect between the bankers/financial markets/rich men’s economy, and the “Real Economy” of the every-day citizen who only gets the spoils below the table.

Nothing disruptive here. The divide between rich and poor has been an issue for eons.

Are the books best-selling?

Next, to the buzzword “bestseller”: I pulled up an “Amazon Book Sales Calculator”, which estimates monthly sales for all six books and claims accuracy.

Drum rolls for…292 books per month! You must sell between 3500 to 5000 copies in order to be considered a best-seller.

Here's the press, stroking her hair.

Formats and cost

Amazon offers the books as Audiobooks which come with the written text to download.

So, you could immediately listen to or read the first book and the remaining five in the following months five times for $13,45. The books are thick, the listening long, so, cheers!

For those who are ready to learn about the intricacies, players and “powers that be” in the financial markets, these are instructive and informative readings and the public value them.

ADVISORY SERVICES

Early Beginnings

Dylan of Affiliate Doctor claims that Nomi worked for The Agora (Bill Bonner), infamous in the investment advisory space. The image above proves he is right about that.

I asked Google “Who owns Rogue Economics” and was taken to this webpage https://www.crunchbase.com/organization/rogue-economics.

Under “about” at RogueEconomics, Crunchbase shows Rogue's website to be this one: https://www.bonnerandpartners.com. Click that link and you will be taken straight to www.rogueconomics.com.

Hmm. You can't get more Bill Bonner/The Agora than that.

Want to know more about the guy and his empire? Check what our editor has said here.

Back to Nomi.

In her beginnings as an investment advisor, she ran an expensive service under the name of the publisher Paradigm Press called 25 Cent Trader, with options trade alerts. It underperformed and was under-reviewed (2,6/6 star rating) by Stock Gumshoe (263 votes):

“When you receive the email/text advice, even with lightning reaction time, your probability to buy at the directed price point is slim – if any. At times, the price has already skyrocketed above the sale price point. You’re participating in a high risk environment with little up side. Oh, no refunds either. My recommendation – Don’t subscribe “.

The first entry about this was in 2018.

Hmmm. First bell and losing. Already?

Rogue Economic’s Distortion Report (monthly) Newsletter

In late 2021, she became editor at Rogue Economics. Having flunked with 25 Cents, what made Nomi think she was prepared to give it another go?

Beats me.

Affiliate Doctor’s owner and editor Dylan recently published two articles:

- Rogue Economics Review: Scam or legit Products? of Jan. 9, 2023, updated in March 2023.

- Distortion Report Review of March 2023.

They are excellent and complement each other and I will talk about his most interesting findings below. I have followed Dylan for some time now, and he is a diligent and serious guy. In short, he already did great research on Nomi, much of which I have been able to confirm with my own sleuthing. I owe him for that.

Other reviewers I have read are:

Affiliate UNguru, with:

- Distortion Report Review (I joined, here’s what happened), updated Nov. 11, 2022, by Tim McKinlay.

Our own Green Bull Research, with:

- Nomi Prins’ Stock Picks Revealed (updated 2023) by Anders, Jan. 30, 2023.

Stock Gumshoe with:

- Rogue Strategic Trader, by Travis Johnson, Aug. 11, 2022.

Below, I mix paraphrases of Dylan’s work with experiences and de-teasers made by our other colleagues. Because I'm the writer, I threw in my two cents.

Mind you: I stay with performance reviews and keep away from more subjective opinions, including Dylan's. All names I publish here are taken from free services, pitches and presentations on the net; some of them by Nomi herself.

Marketing Practices

Much has been written about Agora and its “successor” Market Wise, by ourselves at Green Bull Research and by many others. No need to repeat it here. It tastes like “cold coffee”, anyway.

Some of Nomi's brilliant recommendations

Number One: “The # 1 stock for America´s Great Distortion” is Charge Point (CHP), one of the largest US companies manufacturing Charge Stations for EVs.

| Date | Price |

|---|---|

| April 4, 2022 | $20,54 |

| January 9, 2023 | $10,08 |

| March 14, 2023 | $9,44 |

Boooooh!

Number Two: “A Fintech company, the bank of the future, which could become one of America´s first government-accepted stable coin networks. The virtually unknown firm transforming the 11 TR financial industry in the next 12 months”.

| Date | Price |

|---|---|

| April 5, 2022 | $143,18 |

| January 9, 2023 | $11,08 |

| March 14, 2023 | $2,21 |

Well, this is Silvergate Capital (SI). A bank founded in 2013, with Coinbase as an important shareholder. Nomi promoted it at the same time she pitched Charge Point.

You all know what happened with that bank.

Booh, Booh and Booh. That was awful. And to make matters worse, Nomi advised to sell when the stock had lost most of its value.

Number Three: “The # 1 stock for America´s new Era”

A payment processor: Block (former Square SQ) owner of Cash App)

| Date | Price |

|---|---|

| July 13, 2022 | $62,87 |

| January 9, 2022 | $69,87 |

| March 14, 2023 | $73,63 |

Not so bad. Could have some future.

Number Four: “Liquid Energy stock”. Iron flow batteries, cheaper alternative to Lithium batteries. It is ESS Tech (GWH)

| Date | Price |

|---|---|

| August 24, 2022 | $4,48 |

| January 9, 2022 | $2,50 |

| March 14, 2022 | $1,08 |

OMG!

Number Five: “Amazon is Running on Empty: the tiny firm saving Amazon”.

Lion Electric (LEV)

It has only gone down ever since March 29, 2022 (at 8,95) to March 15, 2023 (at 2,04). Note: This warranty recommendation was under the banner of Rogue Strategic Trader, not Distortion Report.

Another 77 percent crash.

Yikes!

5 pitches. All with bad results, except one decent at its best.

There's more.

The Portfolio and its Performance

This is from Dylan’s Jan. 9. 2023 review. There are four different categories.

- Transformative Tech: Three stocks. All down (-12,4 to – 47,5 percent).

- Infrastructure: Five stocks.Two losing (- 9,3 to – 34,3 percent). Three gainers, biggest + 11 percent).

- New Energy: Eight stocks. Two are Charge Point and ESS Tech, already de-teased. Four winners (+ 6,9 to + 17,5 percent) far outweighed by the four losers (- 16,3 to -53,8 percent).

- New Money: 3 stocks. One is Block/Square, up 11,7 percent. Two down (- 1,8 and – 56,8 percent).

Oh, bummer.

Tim McKinlay from Affiliate UNguru holds that the date of the launch has not helped Nomi, and in the longer term, things might look better.

On the contrary, Dylan feels that we should not give Nomi that benefit of the doubt. I rather agree with him. Nomi swears she wants to help the small, everyday investors. But, they cannot wait for the trades to play out in the long term. They need results pronto. She simply doesn't deliver.

Subscription Process

Dylan, and Tim McKinlay of Affiliate UNguru, both subscribed to Distortion Report. This is what they say:

Signing up was horrible

You are sent through a series of upsells (some under $100 and others several thousand dollars) that are extremely aggressive and confusing and make you wish you had never signed up in the first place (7 in total).

An infuriating process. They try to convince you to become a lifetime member of Distortion Report ($ 299, renewal “maintenance fees” $ 24). If you upgrade later, you will not get a refund for the first order and will not get another 60 days money-back guarantee!

Confusing on purpose. The people running the show appear only to want to squeeze every penny they can out of you. The sign-up process proves this.

The refund policy is bad, and there is a continuous history of complaints.

Ratings and complaints

Dylan believes that Eoin Treacy, who runs the Rogue Portfolio, does not have the best reputation. He previously worked for a newsletter called Frontier Tech Investor for the publisher Southbank Investment Research, which did not do well. All his stocks lost 50 percent.

So, are Nomi and her buddies legit? For Dylan and myself: The only thing that matters is if they pick good stocks and if they're serious honoring refunds and such.

Read on. I have the juice to claim that she is, at best, devious.

Inside Rogue Economics

Better Business Bureau had this on its website.

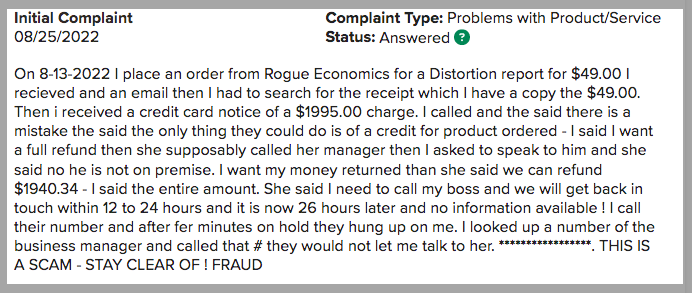

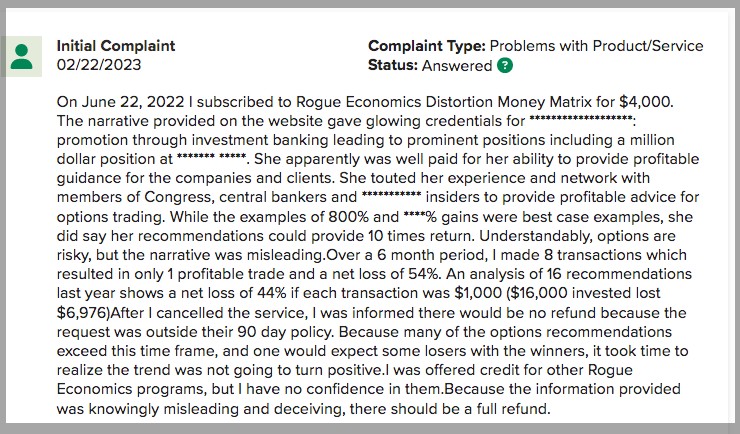

Distortion Money Matrix, A lot like the options alert service 25 Cent Trader. The complaints in BBB shows you why you might not want to knock on that door. They all smack you in the face as scam. Keep going.

Rogue Strategic Trader has John Pangere as the guru: he dropped the following: