Many are asking if Goldco Precious Metals is a ripoff. Since most reviews online are positive, they want to know if these are legit. People also want to know what its services are and if these are of good quality.

Are questions like these an overreaction?

We believe such concerns are warranted. In these times, it is easy to manufacture both negative and positive feedback on the Internet. Both are unfortunate since they defeat the purpose of reviews.

Positive comments can be bought to prop up a company's profile among the online community. In the same vein, there are nefarious elements also whose goal is to destroy a firm's reputation.

This is the reason why we always add a caveat to our reviews whenever we feature comments. Truth is, reviews online do not represent the overall experience of all subscribers.

Going back to Goldco, there is another reason why many are extra careful about the company.

Since those who seek its services are looking to diversify their investments, it most likely means that they are looking for safety nets. Naturally, their profile is that of a skeptic or careful investor.

One who fits such a mold would not take at face value everything s/he sees online. People like these look for secondary sources to verify claims.

So if you have also been asking the same question about the company or similar firms, read on. Our goal is not to bash legit service providers.

But expect us to be objective, fair, and balanced. Since Green Bull Research is independent, we will look at key aspects of the company to provide you with vital information.

With this, we believe you can make an honest assessment after reading the article. Let's begin.

Overview

- Name: Goldco Precious Metals

- Website: www.goldco.com

- Founder: Trevor Gerszt

- Location: Woodland Hills, California

- Service: Precious metals provider, precious metals IRA

- Cost: Precious metals IRA – $260 or $310 / Precious metals – varies (more on this in the next sections)

Goldco Precious Metals is a company that offers two main things.

First, they directly sell precious metals like palladium, platinum, and the two most popular: silver and gold.

Second, Goldco facilitates precious metals individual retirement accounts (IRA).

Now, what are the advantages of these kinds of investments compared with more traditional forms?

According to the company, these are more secure. Unlike the others who are dependent on the dollar's value, these exist independently. The claim is that even if the economy is at a downturn, precious metals investors are not as worried.

In fact, the value of gold and silver can even go up during hard times. During steady economic times, their value remains steady.

Since its founding in 2006, Goldco advertises that it has given consistently great customer service. As a result, the firm has received various accolades in the industry.

But it is most proud of the feedback it has received from customer-based review sites. This is a prominent part of their marketing strategy and online projection.

So, if you are looking to diversify your investments through precious metals, should you avail of Goldco's services? Is their online posturing as the holy grail of customer service legit? Read further to find out.

What is Goldco Precious Metals?

According to its press release, Inc. 500 has named Goldco as the number 1 gold IRA provider in America.

In 2021, the firm announced that it has been put on the Inc. 5000 list anew, for the fifth time. The list ranks the country's fastest-growing independent small businesses. Goldco debuted on the ranking system in 2015.

As a company, Goldco's main objective is to help its clients be wealthier. How does it accomplish this?

One word: diversification.

According to the company, your best route towards prosperity is if you do not rely solely on one investment. Always put your money in two or more portfolios.

When you do this, you will be better protected against economic downturns. Imagine if you put everything in just one company, and suddenly the market tanks. The company goes down in flames. What will happen to you?

So this is where Goldco comes in.

This company offers physical “gold, silver, platinum, and palladium bullion coins and bars”.

In addition, it also offers precious metals IRA. You can either start one with them or roll over existing accounts to theirs.

You may check also out our Neptune Global Holdings review since the company offers similar services. It would be good to compare the two so you can have more information.

Also, a prominent feature of Goldco promotions is their customer service. This is what they emphasize on their website and constitutes the bulk of the feedback they get.

Clients refer to the customer service representatives by name. Most recount how friendly and helpful they are as they set up their accounts with the company.

There was even an instance where the Founder himself called the customer to sort things out. There was supposedly an unaddressed complaint and the CEO himself talked to the client.

We will talk about the reviews later, but if they are true, it is a commendable strategy. Such stories are refreshing to hear since we are always reading negative feedback from advisory subscribers who say publishers take them for granted.

In fact, one previous review has the title: Is Alexander Green (The Oxford Club) a fraud? – Complaints Galore. The article talked about the barrage of negative feedback from subscribers. Many felt that the company and its services did not deliver on their promises.

Who is the Person Behind Goldco?

The Founder and CEO of Goldco Precious Metals is Trevor Gerzst. Before joining the financial investments industry, he was into real estate.

His area then was the commercial and residential properties in the San Fernando Valley region of Los Angeles.

However, when the economy took a deep dive in 2008, he looked for other opportunities. During this time, Gerzst discovered how resilient precious metals are. This interest resulted in Goldco.

His company now, where he also sells valuable coins, is sort of a full circle for him. When he was in South Africa, he collected silver coins growing up. He just found them fascinating even at a young age.

Ironically, that is part of what Goldco is doing now. He provides opportunities for other people to experience what it feels like to have such coins.

What makes it even more fulfilling for him is that currently, he offers a lot more than nostalgia. With the range of service he provides, his customers can also experience wealth stability and preservation.

Putting up Goldco is consistent with his investment philosophy. He believes that one must “hedge against any economic factors, global pandemics, or market volatility”.

For him, the ideal division for your investment money is 20-40-40.

You must set aside 20% for savings, which you must leave in cash. 40%, meanwhile, should be invested in the traditional markets. For the remaining 40%, he strongly recommends that you put it in gold and silver.

His point of view on precious metals is clear: it's always a good time to invest in them. During economic hardships, these rise in value. When the economy is doing well, gold, silver, and the like still grow consistently.

Because of these, it is only logical for people to buy them. He cites this as an example:

On the day after Trump won in 2016, the price of gold surged nearly 5%. When Obama was elected in 2008, the price of gold skyrocketed 17.8% by the end of the year.

The key to such investments is patience. Once you invest in them, you must forget about them for a while and not get carried away by fads and trends.

Aside from this, he also encourages people to always do their research. When you invest, it should ultimately be because of what you have learned, not what you have been told.

We think this is valuable advice and we agree with Gerzst. This is something that needs to be said more often, especially by financial companies.

The reason why we take the time to research and digest vast information is to provide objective assessments. We advocate that you take your time. Read many sources. Talk to people. Subscribe to reliable reviews.

Since we are talking about your money here, it is always a good thing to be deliberate and careful.

What Services Does Goldco Offer?

Its website advertises four major offers and services: physical gold and silver and gold and silver IRA.

There is also an important disclaimer.

The company reiterates that it “cannot provide tax or legal advice” to its readers and customers. This rule applies to “purchasing or selling precious metals or opening a Precious Metals IRA”.

Despite its assertions, Goldco also clarifies that all the information it provides is general. Its team members are not financial advisors and therefore do not give financial advice.

First, A Free Guide

But before you avail of any of these, Goldco encourages you to first register for a free kit.

Once you have given your full name, number, and email, they will already send you mountain-loads of spam mails.

Oh, wait, sorry about that. This is not what's officially on their offer page.

The free kit contains information on how as an investor, precious metals actually give you more control. This is because you can “directly invest your retirement portfolio with safe-haven assets”.

It also explains in detail why you should diversify through gold and silver. When you invest in them, you are growing your retirement fund.

Goldco will also tell you “how to invest in precious metals tax & penalty-free”. The company knows that a lot of people are intimidated by the process. Since this is the case, it will explain the easy-to-follow steps that you can follow.

In two to three days, they will deliver it to you in print, audio, and video formats. Both the kit and the shipping are free of charge.

In addition to this, you will also get a silver treat. For a “qualified purchase”, Goldco will give you “10% back in free silver”.

So if you open a precious metals IRA with $100,000, the company will give you $10,000 worth of free silver. It is up to you how you want it to be delivered. Once you avail of it, even the shipping is free.

I. Gold Self-Directed Investment Retirement Account

According to its website, there are two main reasons to choose gold.

First, it's stable. As per Goldco, since 1971, the dollar has already lost 98% of its purchasing power. Gold has remained consistently valuable until today.

Second, if recent trades would serve as a gauge, your gold IRA will do better than the S&P 500 and the Dow Jones.

Once you are all set with your IRA, you may now purchase various types of gold from the company.

II. Silver Self-Directed Investment Retirement Account

Silver continues to be an in-demand metal, according to the company. One factor for this is that more and more industries are using it for various purposes.

With silver, you also get the sense that your investment is safe and secure. First, it is a tangible product. Second, there is a lot of information about it that's available so you will never be in the dark.

III. Buying Physical Gold

Aside from buying gold and silver for your self-directed IRA, you may also buy them for other reasons. The company can ship it to you, your depository, or store it for you.

According to Goldco, it works with reputable mints to source only gold coins with the best quality. The thing is, to qualify for a precious metals IRA, the minimum fineness requirement of coins is .995.

So the company makes sure that it only offers its customers top-notch gold coins.

Coins Eligible for Gold IRA:

The website offers valuable information for each coin they offer. The goal is to give clients all the data they need to make wise financial choices.

Here is an example:

- Gold American Eagle – Type 1

The 2021 Gold American Eagle is struck from 22 karat gold and is the official gold bullion coin of the United States of America. First minted in 1986 and issued by the US Mint, this coin comes in four weights: one ounce, half an ounce, quarter ounce, and tenth ounce. From 1986 to 2021, the reverse depicts an eagle carrying an olive branch flying above a nest containing a second eagle and hatchlings. Since mid-2021, the reverse shows a portrait of an eagle.

-

Producer: US Mint

-

Face Value: $50

-

Weight: 33.931 g

-

Content: 1 oz.

-

Purity: 0.9167 fine

-

Diameter: 32.70 mm

-

IRA Eligible: Yes

We think this is a commendable move from Goldco. It is evident that its team members are aware of people's apprehensions about their services. So they took the necessary steps to provide clarity.

We appreciate and welcome this, as information like this educates potential customers. Even if they do not purchase from Goldco, the company has already helped them. So overall, this is good for the industry.

These are the other gold coins on the company's website.

- Gold American Eagle – Type 2

- Gold American Eagle Proof

- Gold Maple Leaf

- American Gold Buffalo

- Gold American Bald Eagle

- Gold Military Guinea

- Gold Freedom Coin

- Gold Freedom and Hope

- Gold Lucky Dragon

- Gold Australian Saltwater Crocodile

- Gold British Lunar Series

- Gold Bars

IV. Buying Physical Silver

For silver, each coin must meet a minimum fineness requirement of .999 to be eligible for silver IRA.

There also seems to be an indication on the webpage for silver that palladium and platinum are for sale. However, the company gives no other details for these.

Coins Eligible for Silver IRA:

- Silver American Eagle – Type 1

- Silver American Eagle – Type 2

- Silver American Eagle Proof

- Silver American Bald Eagle

- Silver Maple Leaf

- Silver Lucky Dragon

- Silver 20th Anniversary Britannia

- Silver Great Barrier Reef

- Silver Freedom & Hope

- Silver Military Guinea

- Silver Freedom

- Silver Australian Saltwater Crocodile

- Silver World War I

- Silver World War II Victory

- Silver Britannia Lunar Series

- Silver Bars

So again, Goldco offers four major services:

- Gold for sale

- Silver for sale

- Gold IRA

- Silver IRA

How it Works

Steps to Take To Own a Precious Metals IRA

Once you have decided to open either a gold or silver IRA, the steps Goldco presents are easy. It's important to understand that a customer representative will guide you throughout the process. Therefore, this is not something that you can just do alone online.

Step 1:

The first thing you need to do is read and understand the company's terms and conditions. Once the document is signed, you can then open your precious metals IRA.

Step 2:

To fund your new IRA, you may choose to roll over assets from your other existing retirement accounts. These can be from 401(k), 403(b), 457, Pensions, TSP, savings, or IRA accounts. The good thing about this process is that it is tax-free.

The process usually takes two weeks, but it varies for each specific case.

Step 3:

As a final step, once you already have funds, you may now choose which specific metals to include in your IRA.

It is important to note that all your precious metals will remain in a depository as they are under IRA. When you turn 59 and 1/2 years old, you will already be eligible to take distributions. It will just be up to you if you prefer to get them in the form of your metals or cash.

We admit that these do look convenient. For people who do not know much about these types of investments, it helps a lot that there are no major complicated steps.

Coupled with excellent customer service (if true), then this is a win-win proposition for investors.

Costs & Fees

If you are only looking to buy gold and silver coins, there are no other fees involved. You just need to check the price of the coins themselves.

For gold and silver bars, though, you need to directly get in touch with them as the prices are not on the website.

For the self-directed precious metals IRA, there are one-time and annual fees. As you set up your account, you need to pay the IRA set up fee of $50 and the wire fee of $30 just once.

Meanwhile, you also need to pay the annual maintenance fee of $80. In addition, you will pay the yearly storage fee of $100 for non-segregated accounts and $150 for segregated ones.

Here is the summary:

- Non-segregated IRA

- $260 for the first year

- $180 the following years

- Segregated IRA

- $310 for the first year

- $230 the following years

There is a minimum investment, though.

For precious metals IRA, you need to invest at least $20,000. The minimum for non-IRA transactions, meanwhile, is $3,500.

These are substantial amounts. If you are looking at these kinds of buffers for your portfolio, it obviously requires a financial commitment.

This makes your research all the more valuable. Since you will be setting aside this hefty sum, you need to make sure it is safe and reliable.

So reading what others say about the company and its services is crucial. But what exactly are the experiences of subscribers?

Track Record & Reviews

On its website, Goldco heavily promotes its high marks on various sites. These include lifted comments from Better Business Bureau (BBB), Consumer Affairs, Google Review, Trustlink, and Trustpilot.

Most of the reviews revolved around its supposed outstanding service. Some mentioned how professional the team is. Others also added that the company was honest with them in their transactions.

Some featured comments highlighted what they said was a smooth process. The services, others said, were comprehensive and uncomplicated.

On BBB, the company has an almost perfect score of 4.9 stars from around 170 reviews. As of this writing, there were also just nine complaints, and six of these were closed in the last 12 months.

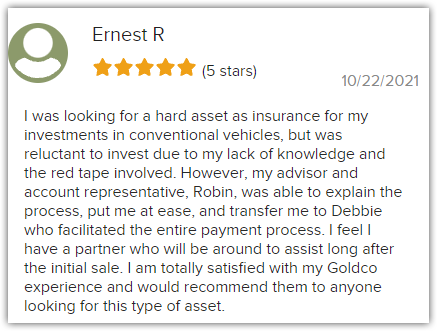

As we have mentioned, the usual comments were about how excellent the customer service is. See one example below:

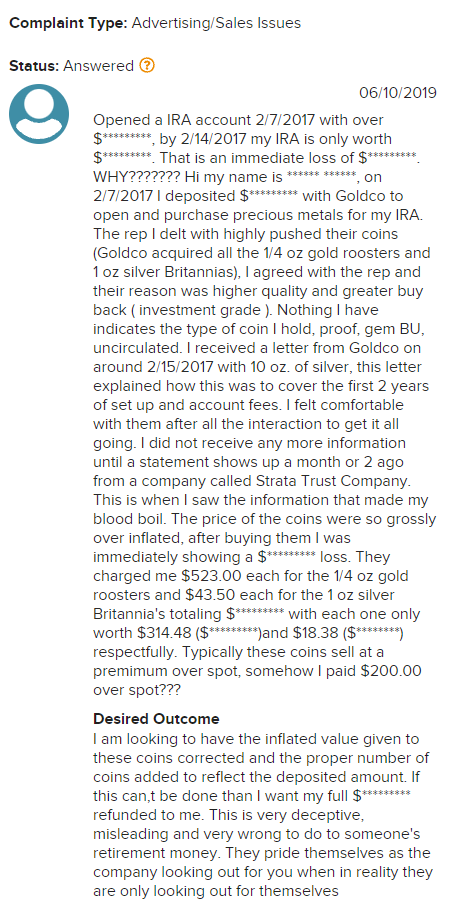

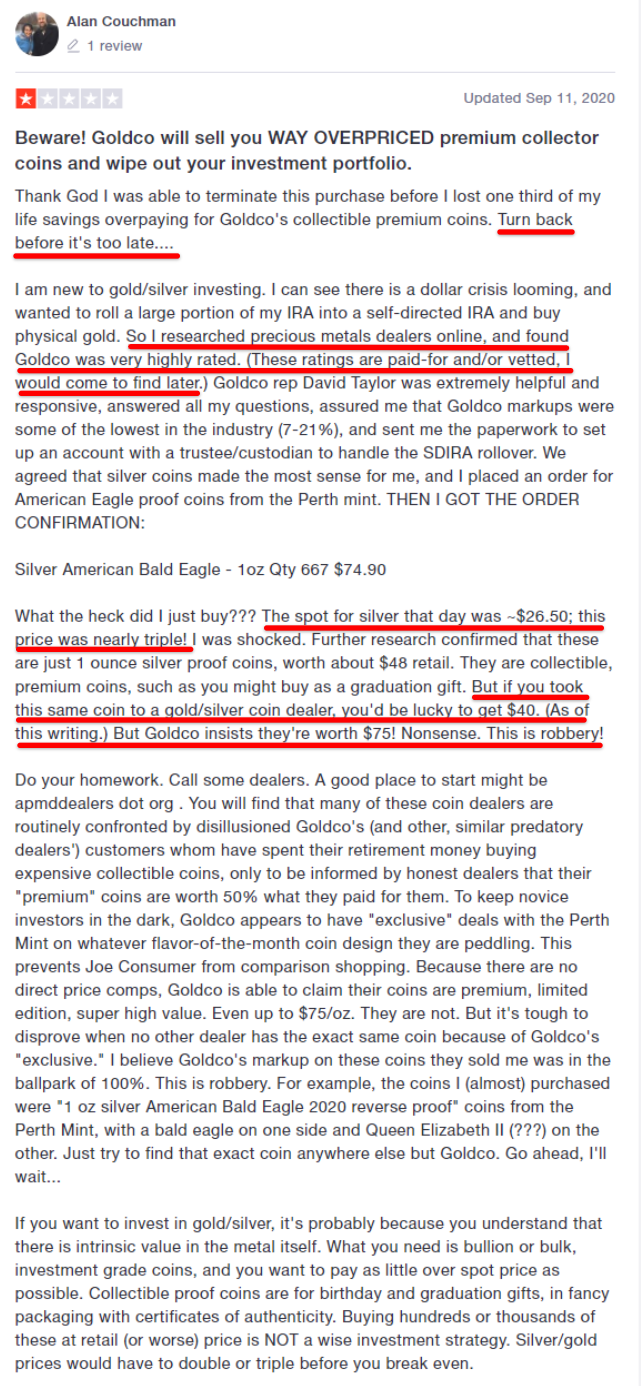

An example of a complaint, meanwhile, is on the discrepancy between the actual and projected value of the coins.

Goldco responded by saying that they wanted to discuss the issue via phone but could not reach the customer.

Meanwhile, we saw one negative comment from Trustpilot that also talked about the value of the coins. When we checked Sitejabber and Pissed Consumer, there was only one complaint on each site as of this writing.

The same person is behind the reviews that we found on the three sites.

Basically, he alleges that Goldco's products are overpriced.

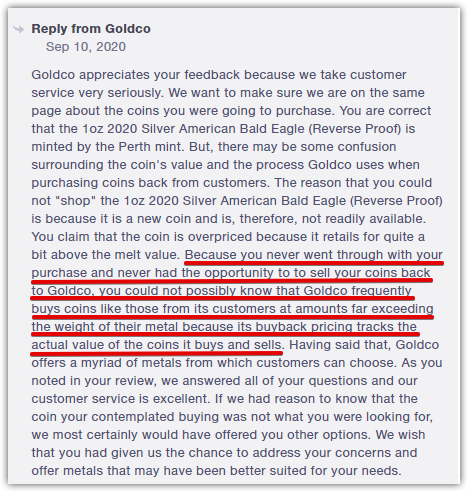

The company responded, as they typically do with complaints, and explained its side.

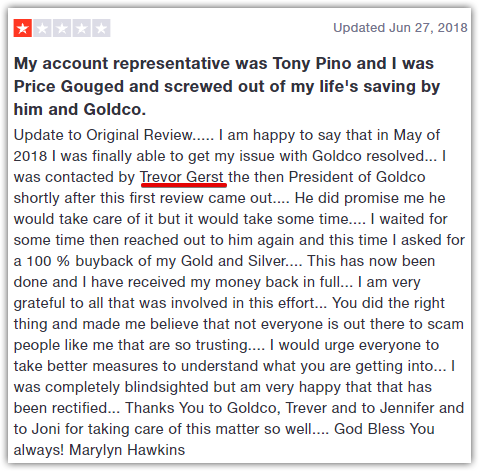

Moreover, we also found this interesting update from a negative review. According to the commenter, the company head himself stepped in and resolved her issue.

The reason why we find this noteworthy is because it takes customer service to a new level. Such a gesture is a strong signal that the company is serious about resolving the complaints of their clients.

Again, we want to remind you that you should only use reviews as supplementary sources. These are limited and do not reflect all user experiences.

Pros v Cons

Pros

- High ratings and positive feedback on review sites

- The website contains a lot of informative materials

- Responsive customer service agents

Cons

- Controversy on the market value of the coins they sell

- Minimum investment requirements are quite steep

Conclusion – Is This the Gold Standard?

So, will you trust the recommendation of the iconic Chuck Norris? According to the star, he trusts Goldco so you should too.

When you think about it, the proposition does make sense. To protect our wealth as we grow it, we must indeed diversify. We are sure you have already heard of the saying that we are not to put all our eggs in one basket.

Gold, silver, and other precious metals, according to Goldco, are the most ideal second or third basket. It is optimal for long-term security, it says. Even Gerzst says that these are good hedges against volatility and fluctuations.

This is because their value is not dependent on the dollar. In good times, the prices are stable and consistent. When times are hard, their value even increases.

But the question is, when you do invest in them, which company would you trust?

Since it has an aggressive marketing campaign, people often wonder if Goldco Precious Metals is a ripoff. In this review, we have given you perspectives that show the positives and negatives. After all these, would you personally trust them? Tell us below.