Several people still ask if George Gilder is legit. Some even wonder if the man is indeed a certified tech futurist or just another scam artist.

Well, such questions would be natural for someone who's had a career as long and colorful as Gilder. Imagine, he is now in his 80s.

He started his career in the 1960s and has seen all kinds of market movements since then.

Until now, he does not seem to want to slow down. Regarded as the world's leading thinker on technology, he still writes newsletters to this day.

Being in the spotlight for such a long time means everyone is familiar with both his successes and failures. People tend to amplify things more because these directly affect them and their finances.

So a triumph or a loss for Gilder is never just a personal matter.

For this reason, there will always be great comments as well as negative feedback about him. In this article, we will look at aspects of his life and career that we deem relevant for you.

As we've mentioned, he is still involved in investment research, as well as tech predictions. Our goal is to help you decide if subscribing to his services is worth it.

As always, this will be a no-holds-barred review. Let's begin.

Background

Born on 29 November 1939 in New York, Gilder grew up with his mother and stepfather in Massachusetts. His biological father died while on duty in the United States Army Air Forces in World War II.

As a young man, he attended Hamilton School, Phillips Exeter Academy, and Harvard University.

After graduating in 1962, Gilder went back to the university, but now as a Harvard Institute of Politics Fellow.

Early on, there was really no indication that the futurist would change the world. He was a regular kid. In fact, he was kicked out of Harvard as a freshman because of his grades.

After serving in the Marines for a while, though, he was readmitted.

Yes, he was smart and attended the best schools. But this is true of so many other people.

But not too many people have had the impact Gilder has on a global perspective on the economy, finances, and technology.

When he graduated from Harvard, he became a freelance writer and wrote speeches for prominent republicans. These include Richard Nixon, George Romney, and Nelson Rockefeller.

There was even a time when he served as a spokesperson for a senator. He has also already written four books by this time. These were his involvements for a large part of the 1960s and 1970s.

Such, in fact, was the natural trajectory of his career as his course at Harvard was B.A. in Government.

But despite some degree of popularity (or notoriety) and success, he still was not financially stable at this point.

Though his writing garnered attention, especially from those opposed to his worldview, such did not bring in the dollars. Headlines and chatter did not translate to more income for the guy.

Wealth and Poverty

But this all changed when he released the now historic Wealth and Poverty. His fifth book, released in 1981, became a bestseller in almost every measure.

Eventually, it sold more than one million copies.

Why did the book become successful? A lot of factors were beneficial for the author and his book.

Since he released it during the early stages of Ronald Reagan's administration, people took notice of its ideas.

The most basic thesis is that the best cure for poverty is to encourage regular people to be entrepreneurs.

The idea may not be thoroughly astute or original, but he built a convincing case for such a philosophy.

He argued that government control and intervention weakens economies. Instead of imposing crippling regulations for businesses, the state should allow them to experiment and flourish.

Such freedom builds innovation and technology as companies think of ways to improve their processes.

For Gilder, supply-side economics is the way to go as it has the unique power to reduce poverty.

Even President Reagan recognized his work. Aside from the Bible, he quoted Gilder's work more than any other book.

Up to now, the tech futurist would always say that he was Reagan's most quoted living author.

We do not fault him and his marketing team for this.

Until now, a lot of people regard Reagan and his policies well. Pundits and economists with different political ideologies agree that the administration accomplished much.

Physics

This is why it did not seem to make sense when he turned his sights into studying physics.

Why would someone who was already regarded as a foremost political and economic thinker suddenly shift gears?

At the time, he was already the go-to guy in economic matters. Major political players constantly sought his opinion and counsel. But he still devoted much of his time studying physics.

The reason may have seemed illogical for most, but it proved to be beneficial for him and his career in the long run.

It appears that he knew then that if he did not add something significant to his plate, Wealth and Poverty would be all he would be asked about.

So he turned to physics.

He was already interested then in silicon, semiconductors, transistors, and other materials of the future.

For him, it was studying the subject deeper would give him a deeper appreciation of computers.

For years, he read hundreds of textbooks, learned advanced calculus, and studied under the highly-esteemed physicist, Carver Mead.

From this man, he learned a mantra of sorts that will guide him for the rest of his career: “Listen to technology.”

Gilder used this as his guide in learning more about the future, including what technological advancements will be next in line.

His persistence on the subject led to two successful books, Microcosm and Life After Television. But we will discuss these more thoroughly in the following sections of this review.

His career as a newsletter editor started in 1995.

Two people helping him manage his finances proposed the idea. They wanted to package the author's work as research that will then be sold to investment banks.

However, the move did not prosper as there was no interest from the critical point persons they approached.

Alternatively, they looked at the prospect of marketing his writing as newsletters. This one looked like a much better proposition.

He approached Steve Forbes and struck a deal with Forbes Publishing.

Gilder also set up his own Gilder Technology Group who would be in charge of content. Forbes will be taking care of the marketing and distribution.

It turned out to be a success. People subscribed to the newsletter and gained a significant following among tech geeks because of its precise science.

At one point, he had about 10,000 people who paid $295 annually, which translated to millions of profit.

In addition, Gilder and the team also organized conferences where people paid thousands just to attend.

Initially, the vision and execution were not to become an investment newsletter. But eventually, because he had a portion in there about companies worth looking at, people took notice.

Subscribers started anticipating his stock picks and financial pundits praised him for his accuracy.

An article with the title The Madness of King George details his performance. It mentioned how he did well in 1998 and even better in 1999.

Apparently, he had “had six of the top nine stocks on the S&P, and four of the top eight on the Nasdaq.”

Another claim was that his picks had 247 percent returns in the past ten months. As one would expect, Gilder's ability to spot tech trends became the central selling point by this time.

The Gilder Technology Report became so popular it had about 70,000 subscribers by the end of 2000. Do you want to know how much revenue this translates to? $20 whopping million.

In addition, a single speech will give him between $50,000 to $100,000.

But not everything was rosy at that point. Due to issues with his business partners, he bought them out. Some of his predictions did not fare as well as he anticipated.

So people tuned out. Fewer people signed up for his conferences and subscribed to his newsletters. He was losing money fast.

But why did this happen? We will discuss possible reasons in our Feedback section.

Current Involvements

Gilder still has active roles in many organizations. His LinkedIn profile lists him as Founder-Fellow of Discovery Institute, Chairman of Gilder Publishing, LLC, and Owner of Gilder Technology Forum.

He also chairs the Gilder Forbes Telecosm Conference and the Advisory Committee of ASOCS. According to their profile, it is a developer of “on-premise cloud solutions” for various industries.

So the question is, with all his involvements, is he still able to focus and give valuable investment direction to his subscribers.

Even without factoring in his age, it is a valid question given his history and current workload. For sure, people who pay him such a premium would expect excellent, actionable advice.

Philosophy

Gilder has a lot of opinions, and he is not afraid to share them. Why should he? He can make a convincing argument for every position he takes.

Though not all of them have proven to be accurate or reliable, he is an astute debater.

Today, he believes that the world's economy is again at a crucial point. The Internet, he says, has become a giant jacking machine.

Even the global monetary system is in deep trouble. He argues that before, it was “a gold standard where money was a measuring stick.”

Now, it has turned into “a central bank standard where money is a magic wand for politicians.”

Currency trading is also now the world's most significant industry, according to the futurist.

On China

The investor believes that the United States must not treat China as an adversary. The two countries should instead collaborate and maintain friendly relations.

He does not even believe the assertion that China has stolen a total of $700 billion in intellectual property.

In an article discussing his opinion, he asserts that the communist country is merely learning from America.

It is just copying the systems that made the U.S. successful — including technology and business models.

Now that they are excelling, we should work with them and not be envious of their advancements. For him, the reason why the U.S. is hostile is because of its self-made failures.

Gilder cites the “obsession with climate change and government bureaucracies” as the reason why it is lagging.

He believes China is doing well because it has a “smaller government as a proportion of GDP than the U.S.”

As a result, they now have more startups and entrepreneurs. Its citizens “even have a higher average IQ than the U.S.”

We believe talking about this is relevant since it affects how he views the country and its investments.

Do you believe him in his point of view? He has consistently advocated for a free global market and against government intervention if you think about it.

So the push for more startups is understandable. But do you think he has factored in how the Chinese Communist Party is heavily involved in its currency and economy?

So on this point, there seems to be some cognitive dissonance. We believe this is the case, primarily because of his views about socialism and capitalism.

Capitalism versus Socialism

The Harvard alumnus gave his take on this debate in his Fox News interview with Mark Levin. For him, capitalism represents the very best ideals of human freedom.

Meanwhile, socialism is all about control and tyranny.

In a capitalist society, people are free to think outside the box. They can experiment with what works best in solving everyday issues. This paves the way for innovation and creativity.

The very core of this ideology is that people have minds that can create. Encouraging this notion emboldens citizens to improve society constantly.

Since we live in a world of uncertainty, people learn ways to adapt and thrive. This process of learning leads to an increase in knowledge.

As a result, people would be able to unlock the keys to economic growth.

The reason why he loves capitalism is the reliance on constant learning. You acknowledge and accept that you do not know everything. Thus, you must strive to understand more.

As we have discussed earlier, such is evident in his own life when he relentlessly pursued physics. His drive and determination bore fruit as he was able to write literature on technology and the future.

So we could say that he has been consistent with this belief. He demonstrated through his life that it is not just an abstract concept but an experience he has already lived.

In contrast, socialism stifles creative discovery. The worldview is based on the thinking that we already know everything we need to know.

Thus, people do not need to innovate anymore. It is no longer a necessity to discover new things that will improve humanity.

With such a point of view, all that needs to be done is to redistribute everything.

Obviously, he is against this kind of system. Wealth and Poverty is all about encouraging the entrepreneurial spirit of citizens and strongly against government regulations.

For him, capitalism is morally superior as it allows people to succeed according to how they work.

Socialism and redistribution will take from those who worked hard for what they have, which does not sit well with him.

Taking something that belongs to that person is essentially stealing, based on his perspective.

Wall Street

In 2016, CNBC published an article from Gilder with the curious title: The Fed ‘is a god that has failed'.

He asks a straightforward yet provocative question, “Why does Wall Street keep recovering after recessions, but the economy seemingly never does?”

What's odd about the situation is that after economic recessions, Wall Street recovers quickly. In contrast, the economy always lags.

According to him, this is because of the closed-loop system that the government and the Federal Reserve have established. The Fed generates money for S&P 500, Washington, and its cronies.

In such an economy, regular people and everyday investors are left out of the picture. Even if they try to change things, it would have no lasting effect because they are just small fish.

In the guise of encouraging economic growth, the Fed establishes the value of money. It also determines who receives it and how much they receive.

In addition, the Fed sets the interest rates at zero.

We know that when something is free, a queue forms. Unfortunately, those who get the freebies first are the ones who know people at the top.

The small guys get little, if they get anything at all.

This is saddening because these kinds of entrepreneurs are the ones who are actually driving economic growth.

This is proof, according to Gilder, that the economy is genuinely rigged against regular people. The Fed's original role was only to be “a lender of last resort.”

The very opposite is happening right now because it is essentially the one running the whole economy. However, it seems to be there only to serve the interests of Washington and big banks.

So his solution to this is to accept that the Fed is a god that has failed. People should demand to break the government's complete control of money.

To restore the role of “money as a measure of learning and growth,” we need a new perspective.

For Gilder, we should have a “combination of bitcoin for the internet and treating gold in tax terms as currency, not an investment.”

Economic Suicide

The tech futurist believes that the pandemic has been over since April 2020. He has boldly stated this in his pandemic commentary on Real Clear Markets.

According to him, the country's leading policymakers should have opened the economy sooner. Businesses and people have suffered enough already.

What the lockdowns have done is not flatten the curve but kill America's economy. He is apprehensive about its effect on the future, not just of the country but the global markets.

According to him, the overblown reaction of the leaders is “a gigantic botch of policy and leadership.”

If we were just to follow science and evidence, he says there would not have been a need for damaging lockdowns.

Because of this, we did not develop the herd immunity that would have been effective for the population.

He also questions why there was even a need to restrict the movement of students and other young people. They were not susceptible to COVID-19, he argues.

Whether you agree with him or not, one can't fault him for his views. His opinion has always been consistent with his earlier stances against such government restrictions.

Body of Work

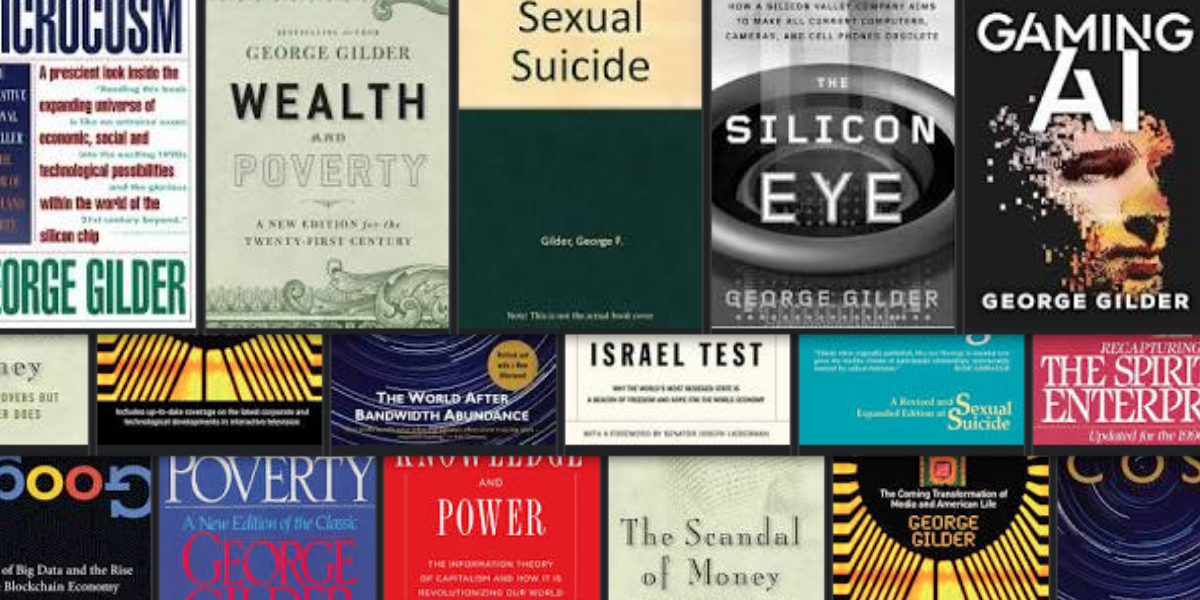

If there is still doubt about how prolific and hardworking Gilder is, one only needs to look at all the books he published, 19 in all.

- The Party That Lost Its Head Alfred A. Knopf; 1st edition (1966). With Bruce Chapman.

- Sexual Suicide (1973)

- Naked Nomads: Unmarried Men in America (1974)

- Visible Man: A True Story of Post-Racist America (1978)

- Wealth and Poverty (1981)

- Men and Marriage (1986)

- The Spirit of Enterprise (1986)

- Microcosm: The Quantum Revolution In Economics And Technology (1989)

- Life After Television (1990)

- Recapturing the Spirit of Enterprise (1992)

- The Meaning of the Microcosm (1997)

- Telecosm: The World After Bandwidth Abundance (2000)

- The Silicon Eye: How a Silicon Valley Company Aims to Make All Current Computers, Cameras, and Cell Phones Obsolete (2005)

- The Silicon Eye: Microchip Swashbucklers and the Future of

- High-Tech Innovation (2006)

- The Israel Test (2009)

- Knowledge and Power: The Information Theory of Capitalism and How it is Revolutionizing our World (2013)

- The Scandal of Money (2016)

- Life after Google: The Fall of Big Data and the Rise of the Blockchain Economy (2018)

- Gaming AI: Why AI Can't Think but Can Transform Jobs (2020)

We also mentioned this list in our review of The George Gilder Report.

In that article, we talked about what subscribers will get from his newsletter. There are also helpful insights from readers who have listened to his advice.

If you want to check out his entry-level advisory, it would be good to read that article.

A significant part of the discussion about Gilder's track record is an examination of his books.

While many do not agree with all his ideas in each literature he writes, Gilder makes compelling arguments. It is the reason why he wins many influential people on his side.

Aside from his skills at convincing others, his unique ability to spot future tech trends still wins him new fans.

In 2019, Forbes cited his book Life After Google in the article: 7 Technology Books Every Entrepreneur Should Read.

In the article which Tom Taulli wrote, he says that Gilder's book is among the standouts:

For the past four decades, George Gilder has written about the future of technology.As for his latest book, he has some interesting conclusions–that is, today’s tech giants like Google and Facebook may already be outmoded.Then what comes next?According to Gilder, the virtual world will become much more decentralized, and the driving force will be blockchain/crypto technologies, which he calls the cryptocosm.The result will be a much more secure and efficient network.

More often than not, his books have proven enlightening and prophetic, according to reviews.

We will not go through all of his books, but we will cite a few of them to give you an idea of his body of work.

His first book was a critique of Barry Goldwater, the 1964 presidential candidate.

The Party That Lost Its Head talked about how leading Republicans then held anti-intellectual beliefs and policies.

He also wrote books about his beliefs on the feminist doctrine, welfare, disintegration of the family, male-female relationships, and masculinity.

These are the topics of Sexual Suicide, Naked Nomads: Unmarried Men in America,Visible Man: A True Story of Post-Racist America, and Men and Marriage.

Since he held traditional (conservative) views on such topics, feminists pounced on him. Time magazine even reportedly named him “Male Chauvinist Pig of the Year” in 1986.

In the Amazon reviews, though, there were people who praised him. Some comments commended him for being brave enough to say his views out loud. Others also gave him props for his research.

Obviously, there will always be people who agree or disagree with an author, especially on controversial topics. So as you weigh such opinions, it would also benefit you to read about them on your own.

Recapturing the Spirit of Enterprise draws on his earlier Wealth and Poverty. It further emphasizes the need for “unrestricted entrepreneurship” by talking about people he esteems in the field.

He also makes a case against mere money managers and intellectuals. For the investor, they do not really create and do something, but only comment on what others built.

Meanwhile, in a review of Microcosm, a commenter, Manoj Ranchord, said that the book was the foundational text of all Gilder's works.

It lays the groundwork for the move from “the macrocosm of visible matter to the microcosm of the inner world.” The shift is the primary reason for the computer and communications revolution.

Such comments are typical of Gilder's works. He does seem to have a way with words and presenting his ideas in ways that make each book seem consequential.

A lot of his works have this feedback. While it would be easy to dismiss such comments as results of hype and marketing, we doubt this is the case.

This kind of feedback has been consistent throughout his career.

Even Life After Television has the same effect. Even if he wrote it in 1990, it correctly predicted that TV would soon be overtaken by a portable telecomputer.

Of course, we know that such a scenario is now a reality. All of us consider our mobile phones as an integral part of our daily lives.

So it's not a mystery why many people consider Gilder as an able futurist.

Meanwhile, in The Scandal of Money: Why Wall Street Recovers but the Economy Never Does, he sets his aim on the government, Federal Reserve, and Wall Street.

According to him, the collusion of the three led to “manipulated currencies and crises to stifle economic growth and crush the middle class.”

In Life After Google: The Fall of Big Data and the Rise of the Blockchain Economy, Gilder makes a case for blockchain technology.

According to him, this new technology will take over the age of Google.

Obviously, Wealth and Poverty remains to be the book Gilder is most known for. Despite the success of his other releases, this is his most impactful.

In fact, people credit this to be the basis of Reaganomics, as it advocated for supply-side economics.

Looking at the number of books and influence the futurist has, it seems like these would be enough to finally say that he is legit. Well, it's true. In this regard, he is a certified thinker and author.

But when it comes to his advisory services, can we really say that he has been effective? There is a difference between fans from your literature and subscribers who depend on your recommendations.

Yes, you may like his point of view. Or maybe you like how he argues for a position he takes. It could also be that you are a fan of his writing style.

But when you read him so you can grow your money, the criteria become different. Now you have to judge and evaluate if he is reliable and can deliver on his investment promises.

Services

Today, he is with Three Founders Publishing. He writes a new version of The Gilder Report that still looks at upcoming but little-known tech trends. A yearly subscription costs $299.He is also in charge of Moonshots, a newsletter helping people prepare for the new tech paradigm called “Cryptocosm”.

A subscriber would need to shell out $5,000 annually to receive his updates. If you think the fee for this is already steep, this next one costs $10,000 per year.

Called The Great Barrington Project, its publisher markets the quarterly report as an opportunity to invest alongside Gilder.The newsletter focuses on investing directly in what they call “the most exciting private tech companies in America.”Three Founders Publishing also offers a Gilder's Millionaire Circle. Subscribers will receive all past, current, and future services of the author-investor. In this particular case, the website does not indicate a selling price. However, it would be safe to assume that this would be really expensive.The publisher's website also says it offers a free newsletter called Gilder's Daily Prophecy. Although people do not need to pay for it, a drawback is that he is not its writer but Jeffrey Tucker.Well, some may point out that most editors do not really write their own materials. Most of the time, a team of copywriters and marketing professionals handle the daily grind. All that we would say for now about this specific issue is: no comment. This may be better discussed in some other future posts.

Feedback

The much-celebrated stock picker admits that in 2001, he was the worst in the world. He says this candidly in an interview with wired.com.

When the dot-com bubble burst in 2000, Nasdaq lost over 75% of its value. This practically annihilated a whole generation of tech investors in the country.

Such losses continued the following year, following the September 11 terrorist attacks. Between 2000 and 2002, the S&P 500 lost 43% of its value.

It was only in 2015 when Nasdaq finally returned to its 2000 peak.

Although he said he had foreseen the 2000 crash, he did not tell too many people about it. Well, if you were a subscriber that time, that sucks.

They were not able to feel any hint of warning, based on his “telecosmic” list of companies.

At that difficult economic time, most of those on his list lost more than 90% of their value. Some even went out of business. Again, that sucks, right?

In January of 2002, a company called Global Crossing filed for bankruptcy. This is significant because, at the time, it was the fourth-largest ever.

It is an important event as well because Gilder was all in on the stock. He even said that its plan of laying fiber-optic cables across the world would change the global economy.

For him, it was so “audacious and awe-inspiring” that it was his favorite stock in the world. Obviously, he was very wrong about it.

But since he recommended it to his subscribers, you know what happened next.

In a 1999 article, he said investors must consider Loral Corp stocks. In 2002, shares in the company were down 88% since his recommendation.

In addition, he told people to short Microsoft in 1997. An investor who would have followed his advice with $10,000 would have lost as much as $25,000.

Because of such examples, former Google CEO Eric Schmidt says this about Gilder:

I listen very closely to what George says and then automatically add five years.

But he was also quick not to dismiss Gilder's ability to see the future of technology:

As far as I know, George was the first to see that infinite bandwidth was going to have a similar kind of impact on our world as the microprocessor.On that fundamental point, he's been proven absolutely right.

CNET Founder Halsey Minor, who is a follower of the tech guru's writings, says this:

I think the guy has been a real visionary.He, more than anybody else, woke us up to this coming explosion in telecom. He wasn't right about everything, but he was right about a lot.

Of course, as we have already mentioned, he did perform well in 1998 and 1999. We have also already discussed how influential he has become because of the impact of his accurate predictions.

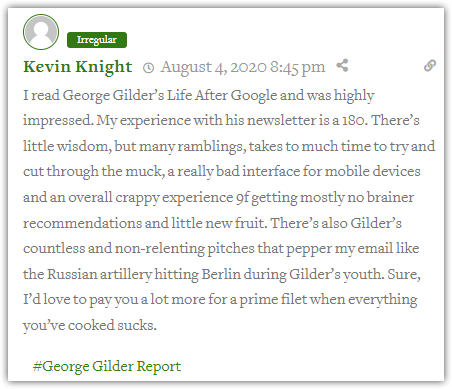

His newsletter, The George Gilder Report, got a respectable 4.2/5 stars in Stock Gumshoe. More than 110 subscribers reviewed the advisory.

We also saw one comment that did not have a positive experience with the service.

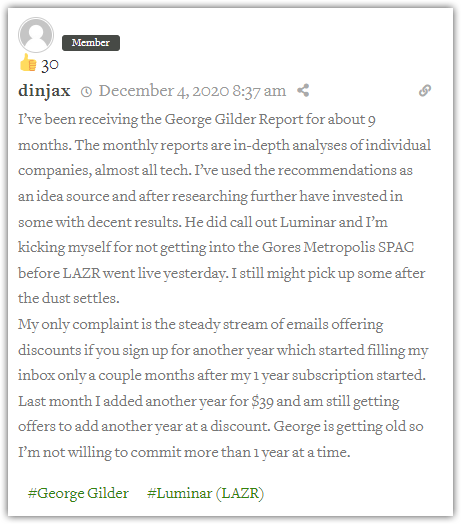

Another subscriber rated the newsletter positively. However, he did remark about the promotional emails.

These are only snippets of reviews and feedback about George Gilder. If you want to get a fuller picture, it would be best to supplement our material with your personal research.

This way, you can confidently act as you have already carefully studied all your options.

Conclusion – Is He For Real?

Three Founders Publishing, as we have mentioned in our past review, regards Gilder very highly.

It touts him as “the most knowledgeable man in America when it comes to the future of technology.”

The team also advertises that he is peerless when it comes to the potent combination of technology, economics, and investing.

Of course, there is also a mention of being the world's number one stock picker. According to his publisher, the futurist was the most prominent person in the 1990s because of the tech boom.

In addition, Gilder has also produced 19 books that have made an impact. Being around for years, his relevance remains up to this day because of his newsletters and his predictions.

Such longevity is not very common, so it speaks very well of his ability to get new subscribers. In this case, people are curious about his journey as an economic and investment thinker.

Many also consider how vast his experience has been in the industry.

He has practically seen it all, and subscribers rely on such a long view as they think he already gained wisdom through the years.

So, is he for real? Well, there is ample evidence that he is the real deal. But just like any prominent figure, the editor also has his hits and misses.

The question is, which among his predictions can you relate with the most? The right ones or the wrong ones?

This really depends on what you value as an investor, on how you would use his recommendations.

So is George Gilder legit? Can we consider the man a scam artist? Obviously, he is legit.

But since we are talking specifically talking about investments, his skills in other things do not necessarily translate into his abilities as an editor.

So you need to exercise diligence before you subscribe to him. We hope our review has been helpful as we presented his good and not-so-good side.