What is Gold Bullion International and can the company be trusted with your money? There have been a number of precious metal trading platforms that have popped up over the years, and unfortunately some of them employ less than exemplary practices when it comes to getting investors to part with their assets.

We have covered a number platforms in the past, including some that turned out to be not so great, such as Lear Capital.

So, is Gold Bullion International one to be avoided or are they in fact the gold standard in precious metal trading platforms? This review will go over who GBI are, what services they provide, and whether or not they can be relied upon.

Overview

- Name: Gold Bullion International

- Type: Trading Platform

- Website: https://www.bullioninternational.com/

- Services: Buying, selling, and storing precious metals

What exactly is Gold Bullion International? Well the company was founded in 2009 and operates predominantly within the wealth management industry, as well as catering to private investors. Their purported aim is to provide a trading platform for precious metals, such as gold, silver, and platinum.

To this end, they offer buying, selling, storage, and delivery options for those looking to trade in such metals. They are based on Third Avenue in New York city. With their registered address as follows: GBI LLC, 750 Third Avenue, Suite 702, New York, NY 10017 The precious metal investment market is one that has had its own share of scammers and scandals over the years, with some devastatingly large losses for those who fall victim to them.

As recently as October 2020, some 1600 people were scammed out of a total of $185 million, according to this article by AARP. The AARP is an interest group for the over-50s which is appropriate as these scams often target pension or retirement funds. With that in mind, let’s take a closer look at GBI themselves. It is essential that you do your research and due diligence before you choose a company to invest your funds with, especially if it involves crucial savings that you have accrued over many years and would be left destitute without.

The People Behind the Name

Chief Executive Officer – Steven Feldman: The current CEO of Gold Bullion International is one of the co-founders and has occupied the top job since 2012. Feldman boasts quite the CV: he is a graduate of the Wharton School of Pennsylvania, holds a Juris Doctor from New York University Law School, and was a partner at Goldman Sachs for over a decade. His profile on the GBI website also states that he held a number of corporate board positions, although it does not specify in what capacity he was present. Regardless, this is an impressive set of credentials.

Chief Technology Officer – Peter Custer: The CTO is Peter Custer, someone who is quoted as having over 30 years’ experience in the financial technology industry. He has worked for companies including American Express, Wells Fargo Bank, and the Gates Foundation. Those are some pretty big names in the international finance world, although their website doesn’t mention in which capacity he worked for them. Nevertheless, as a fintech company, it’s important that the CTO of GBI has experience in the field, and it seems Custer has that at the very least.

President/Chief Operating Officer – Marc Scher: COO Marc Scher spent 18 years at Merrill Lynch, most notably as their First Vice President of Banking and Brokerage Business. He also held a number of other positions within the company, including other First Vice President roles. Following the two years as a FVP for Merrill Lynch, he’s been President of GBI for over a decade now.

Senior Vice President – Alex Daley: Their SVP is much lower profile than the previous three members listed above and boasts less of an internet presence. He is described as having a “long history in technology” across the financial advisory and alternate investment sectors. Other than that, there really isn’t much information out there on Alex Daley, other than he used to work for Microsoft.

Okay so they seem to have a lot of experience in their top positions, especially when it comes to big Wall Street names. However, that is no guarantee that they are providing a quality or worthwhile product, so it behoves us to keep digging to find out exactly what it is that they provide, and whether it’s worth your money.

What do you get with Gold Bullion International?

Gold Bullion International are not offering an advisory service or a simple subscription. What GBI offer is a trading platform. As you can imagine, this necessarily means that large amounts of money are being moved in single trades, so it pays (literally) to have a secure, reliable platform on which to make such deals. So, what does GBI bring to the table in this regard?Firstly, they assure all users that any precious metals purchased through GBI have been manufactured by refiners that have been recognised by the LBMA, the London Bullion Market Association. LBMA is the international trade association that represents the worldwide over the counter bullion market as a whole. Ensuring that any precious metals you buy have been approved by the LBMA is a good start for such a trading platform.

Settling for anything less can leave you open to being scammed for low-quality metals or even counterfeit bars, especially if you never come into contact with them yourself and instead have them stored remotely without appraisal. Scams involving counterfeit bullion are still very much a common occurrence – one such incident came to light not long ago and involved bars that were being used to fuel a $2.8 billion corruption scheme.

Four kinds of precious metal are available through GBI: palladium, silver, gold, and platinum. For the palladium, silver, and platinum, they offer a number of bars in various weights on top of a coin option for silver. When it comes to gold, they have many more options available; with bars ranging from 1kg to 1oz, and coins from various suppliers that begin at 1oz and range to 0.1oz.

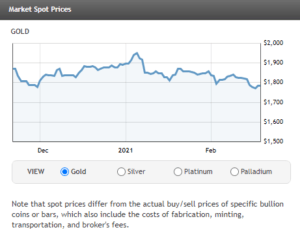

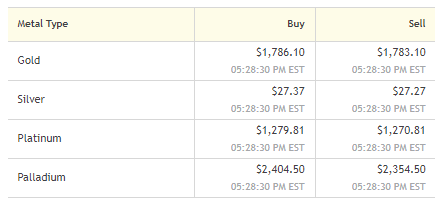

GBI claims to have established a “proprietary network of institutional dealers and refiners” in order to provide a competitive price for buyers. They have listed on their website a live graph of market spot prices for the four metals that they offer, which is an encouraging sign for transparency, however, they also note that due to cost of fabrication, minting etc. that this price is not a true reflection of actual buying/selling amounts.

GBI provides their own protected and secure vaults in a number of locations across the world that allows investors to store their purchases without having to arrange their own storage. The locations range from New York to Singapore, so they certainly seem to have a large amount of infrastructure in place. These vaults come with insurance guarantees to protect your assets.

There is also the option of having your assets delivered personally to a location of your choosing, although this would likely come with its own associated costs.

When it comes to creating a GBI account, their website lists a number of different options:

- Individual

- Joint

- Corporate

- Partnership

- Sole Proprietorship

- LLC

- Trust

So, they certainly have all their bases covered when it comes all of the different ways one might be looking to invest with them. In order to even create an account, you’ll need to provide your Social Security Number or Passport Number, along with other forms of ID and verifiable address. This is obviously a much more rigorous application process than a simple payment-subscription model that requires only an email address.

Given the nature of the scams associated with dodgy bullion purchases though, such as the one referenced above, it could be considered a positive that they require so many forms of identification before you are able to even open an account. Once an account is approved and open you can then begin to transfer money across to begin purchasing.

There are also IRA options available for those looking to set up retirement funds. The GBI website has a guide in the frequently asked questions section of their website that details many of the processes involved with setting up an account and transferring funds to the IRA. GBI uses Millennium Trust as the custodian and IRA administrator, so it would be worth looking into them separately if indeed an IRA is your intended goal with precious metal investment.

If you prefer a less hands-on approach to purchasing, then GBI can provide an automatic investment plan, based on parameters that you specify. This means that every month, GBI will take funds from your account and allocate you more precious metal that you have indicated you are interested in. If you are sure you can spare the money and you are looking for no-hassle investment, then this could be a time saving option for you.

Finally, you have the option to sell metals back to the company in order to make a profit. The best way to do so is, of course, to ensure that you sell when the market is performing well and that the rates are higher than when you originally purchased.

Initial Costs and Refunds

There is no price of entry to the GBI trading platform. As long as you have the necessary documentation, you can go through the application process and create your account for free.

The cost of entry of course comes from the nature of the assets themselves: at time of writing, a single 1kg gold bar is upwards of $55,000. However, this will come as no surprise for those of you already familiar with the precious metals market and the wealth it represents. If you wish to establish an IRA with GBI, making use of Millennium Trust custodial services will cost you an annual $100 fee.

There are other fees such as sales taxes and customs fees that may apply to the purchase, delivery, or sale of precious metals, but of course these will vary wildly depending on the context and the amount of metal involved, so it would be pointless for me to speculate about it.

There is no official refund policy listed on their site, which is probably due to the fact that goods with a fluctuating price, such as precious metals, are not necessarily covered by the requirement to provide refund policies.

In regard to the settlement process, they claim that if purchase or sale orders are placed that GBI cannot match due to a lack in supply from the supplier or retail client, that they will execute the transaction instead to the nearest exact dollar amount. This is the very least that one would expect to find as a back-up, but it’s good to know that it’s in place.

Complaints

So, Gold Bullion International doesn’t have much of a presence online when it comes to the typical review or complaint sites that one would check. Looking at Glassdoor, they only have four listed reviews and the last one is from 2016. However, all the reviews are largely positive, with a slight common complaint that the company feels particularly “corporate” to work for – this should come as no surprise when referring back to the employment history of the major figures involved.

They have no presence on BBB, Yelp, Trustpilot, or any other major review site that one would usually scour in order to help evaluate the legitimacy of a company.

So, does this mean they are not to be trusted? I would argue no. Let’s think about this for a second: with the amount of money involved in precious metal investment, the majority of people who create an account with GBI will be investing several hundreds of thousands, if not millions. If people had been scammed by them in the past it would not only appear on review websites such as this one but would likely be major financial news, akin to the article I linked earlier in the review.

Pros and Cons

As always, its helpful to quantify all the positive and negative aspects involved in putting your trust in a particular company to help you make a fully informed decision, so let’s take a look at the Gold Bullion International list now.

Pros:

- No upfront costs

- Expert advice and consultation is available

- Secure and reliable service

- The platform covers all aspects of trading

Cons:

- Lack of online presence and evaluations

- No live chat on their website

Conclusion

So where does that leave us after all has been said and done in regard to Gold Bullion International? Can they be trusted with your money or are they trying to scam you into buying price-gouged metals to make a quick buck for themselves? I would say that they can indeed be trusted in a similar manner to our review of Neptune Global.

Their platform has been founded and managed by a team with a staggering amount of investment and technology expertise and they seem to have created a platform in order to attract wealthy clients and private investors looking to make waves in the precious metal investment world. They are obviously not a scam.

The lack of online presence is a little discouraging; however, I do not believe that this is due to them being untrustworthy. The fact that they clearly display the prices on their platform for buying and selling at all times allows you to track and compare the ideal moments for you to buy and sell and won’t leave you left in the dark or ripped off as long as you are capable of doing your own research and being invested in the performance of your assets.