Tech futurist George Gilder adamantly states that a Big AI Lie is attempting to cover up a harsh reality: NO computer on the market can deliver next-generation AI.

However, one “10x Graphene Stock” solves this problem and makes “Next-Gen AI” possible.

The Teaser

Artificial intelligence is currently stuck performing menial tasks like the kind ChatGPT churns out today.

Investor, author, and economist, George Gilder has been around a long time and has done a lot of things. He is now the Chairman of Gilder Publishing, which produces regular investment newsletter teasers such as “Convergence Play” Moonshot Stocks and Spectrum Millionaire-Maker Stocks, which we regularly review.

Although billions of dollars, $142 billion in 2023 alone, are being invested in the latest AI applications and models, not much of it is being allocated toward updating hardware to match the increased performance of the software.

This means AI advancement has hit a wall.

As George puts it “AI is the closest a machine will ever get to resembling a human brain, but it’s simply not possible using modern computers.”

What AI needs is a hardware breakthrough that equates to computers that are smarter and faster while also burning less power.

Disrupting The Hardware Market

The biggest roadblock to the development of AI is hardware, not software, but you won’t hear many Silicon Valley CEOs saying this publicly.

George is and he's convinced one tiny device is about to disrupt the $3.7 Trillion electronics market.

He even exclaims “The innovation behind this tiny device will make investors more money than any AI stock they are holding or thinking of buying because EVERY AI will soon require it.”

What is it?

Air conditioning!

See, it is simple physics, the human brain uses about 14 watts of power, equivalent to a small light bulb, and can handle complex tasks like thinking, remembering, and processing sensory information.

Meanwhile, the combined computer networks that make up the internet use much more energy, hundreds of gigawatts.

Despite this, such computer systems are far less complex and multidimensional than a single human brain, which is what AI is attempting to replicate.

Simply put, the more advanced AI becomes, the more the chips in today’s computers overheat and meltdown.

This is where the 10x investment opportunity comes in, as one “exceptional material” is solving AI's single biggest problem.

The Pitch

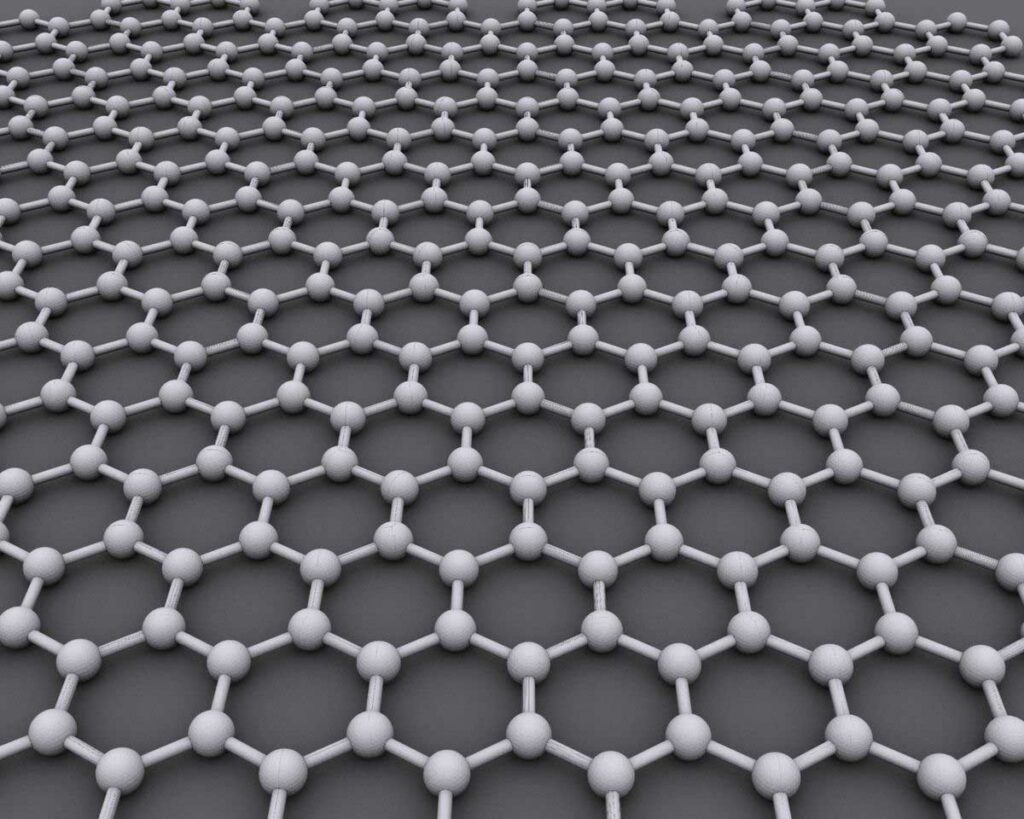

The “exceptional material” is Graphene and George shares a full analysis of its investment potential in his newest report: The 10x Graphene Stock.

As per the report's title, the name and ticker symbol of a $1-a-share graphene company is also revealed and it can be ours with a subscription to the premium investment research service, Gilder’s Moonshots.

The annual cost of the naughty-sounding proprietary research service focused on microcaps with disruptive technology, is $995.

This includes a 30-day money-back guarantee, three special reports in addition to the one already mentioned, weekly texts or emails with a full analysis of small caps and microcaps on the verge of breaking out, and a real-time Moonshots portfolio.

The Exceptional Material Solving the AI Crisis

Why are today's computer chips melting down while performing a fraction of the work a human brain can handle?

It’s because silicon is the core ingredient in computer chips, but this material is simply not strong or advanced enough to build a network of super intelligent AI computers.

What is, is “a single layer of carbon atoms called graphene, which is the thinnest, strongest, and most flexible material ever discovered.”

Walter de Heer, a Professor of Physics at Georgia Tech University has said the difference between a silicon semiconductor and a graphene-based one is “like driving on a gravel road versus driving on a freeway.”

The New York Times has even acknowledged that “Graphene could change the electronics industry, ushering in supercharged quantum computers.”

Powering Next-Gen AI And Beyond

Graphene opens up an entire new world of technology to us.

The material is flexible, strong, and thin, which are helpful properties for the shrinking size of computers.

Electrons also move through graphene quickly, leading to faster processing speeds and computation. But perhaps most importantly, the roadblock of overheating is solved because nothing cools off better than this material.

This makes graphene ideal for dozens of other uses beyond just AI, such as medical implants, more powerful batteries, and energy storage due to graphene supercapacitors being proven to store a hundredfold more energy.

All told markets worth a collective $5.3 trillion are seeing huge disruptions due to graphene, which is why George's graphene stock has 10x profit potential or higher.

Revealing George Gilder's “10x Graphene Stock”

Here is everything George's presentation disclosed about his #1 graphene pick:

- It’s building one standard platform so every gene therapy scientist does not have to build their own “supercomputer.”

- The veteran entrepreneur who is currently running the company sold her last startup for over $300 million.

- The company raised $50 million last year, at a $125 million valuation.

- This life-changing company trades for around $1 a share right now.

Based on these clues, George's “10x Graphene Stock” is Orgenesis Inc. (Nasdaq: ORGS). All the clues align like a cell therapy treatment:

- Orgenesis' POCare Platform is being built as a scalable onsite solution to expedite the development and production of advanced medicines for third parties.

- The company's CEO, Vered Caplan, previously founded and led over 15 companies, but no mention of any prior $300 million exit.

- Orgenesis secured $50 million at a pre-money valuation of $125 million from a private equity firm at the end of 2022.

- ORGS stock currently trades for just under $1 a share.

Make 10x Your Money Or More?

I have to admit, given the verbiage in George's presentation, I was expecting a far different stock pick than the one we got.

Orgenesis is a biotech company working toward unlocking the potential of cell and gene therapies.

The investment angle George is going for here is the use of graphene in tissue engineering, but this is non-material in the case of Orgenesis. It's so non-material that graphene isn't even mentioned in the company's latest annual report once.

Besides being a biotech, with a difficult-to-grasp value proposition if you have no medical expertise whatsoever, like your's truly. The development-stage company is pre-revenue, licenses its patented tech from a University researcher's private company, and is a perennial equity issuer – meaning highly dilutive to shareholders.

By nature, biotechs are high-risk, high-reward, so shares could theoretically surge 10x or more, but a much better bet to play the bull market in graphene is to buy some miners getting the stuff out of the ground and supplying it.

Quick Recap & Conclusion

- Tech futurist George Gilder adamantly states that NO computer on the market can deliver next-generation AI. However, one “10x Graphene Stock” solves this problem and makes “Next-Gen AI” possible.

- George makes the case for graphene by explaining that the more advanced AI becomes, the more powerful semiconductor chips will have to become and graphene is the “exceptional material” solving this problem.

- George shares the name, ticker symbol, and a full analysis of a $1-a-share graphene company in his newest report: The 10x Graphene Stock. The report is ours if we subscribe to the premium investment research service, Gilder’s Moonshots, which costs $995 for the first year.

- Greenbull readers got the pick for free, as we revealed George's “10x Graphene Stock” to be Orgenesis Inc. (Nasdaq: ORGS).

- Orgenesis is more of a speculative biotech moonshot than a smart way to play the graphene boom. Graphene miners are a much safer and better bet.

Is graphene the silicon-killing material of the future? Let us know your thoughts in the comments.