I have seen and heard a lot in my time covering investment pitches, but this is the first time I have ever heard of a physical “Money Mountain.”

Jason Williams says this isn't just any mountain, it's bursting at the seams with over 40 million tonnes of a proven commodity and it may also be Elon Musk's “Next Great Buyout” target.

The Teaser

There may be something to this outrageous intro, as the proven commodity being teased is required for making electric vehicles (EVs) and the batteries that power them.

Jason Williams took the traditional path through the finance world – business school, investment banking job, own family office. That is before taking a sharp left turn and starting an investment newsletter. I have reviewed some of his newsletter teasers here previously, including his “Plug-In Payouts” and “Newton Battery” Company.

We're told this commodity isn't lithium, cobalt, or graphite. It’s much bigger than all of that.

I say so because many countries today are dead-set on ditching fossil fuels for clean energy over the next few decades and there's no way to do that without one essential commodity.

It's been called the key to electrifying society’s most critical sectors like transportation and infrastructure. Everything on the following list relies upon it to one extent or another:

- Power Grids

- 5G Networks

- Electric Vehicles

- Charging Stations

- Solar Panels

They all need this metal like our bones need calcium. They simply won’t work without it.

Supply/Demand Imbalance

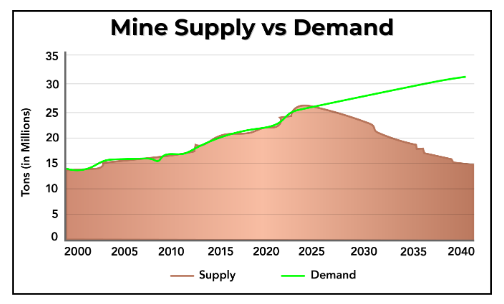

If there's one thing the price of any commodity hinges on, it's the demand for it and where that sits about the current supply.

In this case, the former (demand) far outweighs the latter (supply). Bank of America is warning that demand for this particular commodity could eclipse supply starting in 2025. And the shortfall could grow to a historic 10 million tonnes by 2035!

In fact, in a fitting bit of irony, to meet the world’s net-zero emissions target by 2050, we need to mine a staggering amount of this metal.

Over twice the amount that’s ever been mined in human history. Good luck with that.

The metal is Copper and one tiny firm could be behind the largest source of it in America.

The Pitch

Jason has all the details on how to profit from this tiny American copper mining juggernaut in his brand-new special report called “Elon Musk’s Next Great Buyout: The New King of Copper”

This report is a bonus for subscribing to Jason's new research service Future Giants. It’s all about small disruptive companies that could dominate entire industries and costs $1,999 for one full year with a 90-day money-back guarantee. Notably, there is also a quarterly auto-bill payment option of $599 for those that do not wish to pay the full amount upfront.

The perks of membership include two bonus reports, immediate access to all past and present trade recommendations, and weekly email alerts.

A Second Industrial Revolution?

The second industrial revolution is perhaps a more appropriate name for the so-called “clean energy” revolution.

Once one looks under the hood and learns the dirty details about how battery-powered energy is made possible, you will draw the same conclusion.

I mean, your average EV contains up to 10 times as much copper as a gas-powered car?

Tesla alone gobbled up 45,000 tonnes of this metal last year. But to meet Elon’s ambitious goal of producing 20 million electric vehicles per year, he’ll need over 40 times this amount, year after year.

A single wind farm uses around 7,800 tonnes of copper.

Renewable energy generation as a whole, namely solar, hydroelectric, and wind power uses far more copper than oil or coal-driven power, as much as 12 times more.

Bottom line: Demand for copper is increasing by more than 575,000 tonnes each year and accelerating quickly.

While this doesn't do much for cutting carbon emissions, it does mean a boom for natural resource investors.

Higher Prices for Eternity?

Experts argue that global production of copper will never exceed today’s amount.

It's set to fall.

If they are correct, this makes the “money mountain” located in Nevada incredibly valuable.

At an estimated 40 million tonnes, this alone is worth $17.2 billion at today’s prevailing market price. Not only is it the largest copper mine in the US, but one of the ten largest in the world, with more reserves than some entire copper-producing countries.

Depending on the market cap of Jason's pick, the potential upside here could be significant regardless of what happens in the economy over the short term.

The timing isn't bad either, with the Biden administration continuing the Trump Admin's initiative of incentivizing mining companies to kick-start production for national security purposes.

Revealing Jason Williams' New King of Copper Stock

For this one, we got plenty of clues to work with, which is a welcome change of pace.

- The entire “money mountain” is owned by one tiny company that has a market cap of only $6.6 million.

- It's sitting on a massive deposit of copper, just miles from a Tesla Giga factory in Nevada.

- The company’s CEO says that he’s “ultimately targeting over 1 billion tonnes of copper mineralization.”

- After completing countless tests and drilling hundreds of meters of exploratory holes, the company is finally ready to have these results validated by a third party.

What American copper mining company is Jason talking about?

Based on everything we know, he has to be talking about the Majuba Hill project owned by Majuba Hill Copper Corp. (OTC: JUBAF). Here is how the clues stack up:

- JUBAF is currently valued at about $6.6 million.

- The project is located just 120 miles northeast of the Tesla Giga factory in Nevada.

- CEO David Greenway recently said, “The exploration corridor of the project outlines what we believe will ultimately contain over 1 billion tonnes of copper mineralization.”

50-fold Share Price Jump or More?

After pouring over Majuba Hill's drilling results and technical reports, I'm finding Jason's claims to be rather inflated if you will.

Majuba clearly states its high-grade copper (0.40-0.80%) exploration target as containing 10-20 million tonnes. Not 40 million tonnes like Jason mentions here.

As far as “a billion tonnes of copper” worth over $100 billion, this is the *potential mineralization of the entire exploration corridor. A figure that will always be highly speculative, since it falls outside of the scope of the exploration target.

There is also no indication that Tesla or Elon Musk are interested in the project. So this is another potential with a huge asterisk.

Having gotten that off my chest, what isn't highly speculative is Majuba Hill's most recent Technical Report from June, which outlines a copper deposit with robust mineralization and geologic characteristics.

Next up is a planned drilling program in the second half of the year to convert the mineralization of the project from an exploration target category into the inferred and indicated resource categories.

At the end of the day, this is still an exploration stage project and caution is needed, but Jason is right about one thing…this is the best entry point we will likely ever get for JUBAF stock.

Quick Recap & Conclusion

- Newsletter writer, not basketball player Jason Williams is teasing a physical “money mountain” that could hold over 40 million tonnes of a proven commodity critical to the move away from fossil fuels.

- The commodity is Copper and one nano-cap company owns the entire “money mountain” deposit in Nevada.

- Its name is revealed only in a brand-new special report called “Elon Musk’s Next Great Buyout: The New King of Copper.” The report is ours if we subscribe to Jason's new research service Future Giants for $1,999 for the first year.

- Fortunately, we were furnished with enough clues to reveal the name of the company for free, Majuba Hill Copper Corp. (OTC: JUBAF).

- Majuba Hill is still an exploration-stage junior miner, but its planned drilling program in the second half of the year could change this and send the stock materially higher. A nice little speculation that could pay off big over the long term.

Is copper the world's most critical metal? Let us know your thoughts in the comment section below.