One small county about an hour's drive from Washington D.C. is about to become the wealthiest area in the United States.

That's because it's at the heart of an $85 Trillion global economic consolidation and one firm supplying it with an essential product could be the “last retirement stock” we'll ever need, giving us “AI income for life.”

The Teaser

Another day, another AI teaser. However, we're told this goes “much deeper” and “involves a side of AI we haven't heard of before“.

Regular readers will recognize Dylan Jovine's name.

He's the Wall Street outsider who previously teased a “UFO Weapon Company” for a 35,000% return and a “little-known” Taiwan invasion laser stock. Dylan is an interesting guy.

So far, this teaser doesn't disappoint either, with Dylan saying the Loudon County investment “sits at the crossroads of technology and global demand.”

Data Center Alley

Dylan piqued my interest, so I had to look up what was so important about Loudoun County.

It turns out, that Loudoun is a global data-processing hub known as “data center alley” handling as much as 70% of the world's internet traffic.

Now the $85 Trillion math is starting to make more sense.

This amount is the annual value of US equities turnover as of last year. A crazy number considering the entire economic output of the world was $105 Trillion.

Since all markets now operate electronically, Dylan is rightly implying that they largely depend on data center alley and the thing it depends on in turn…energy.

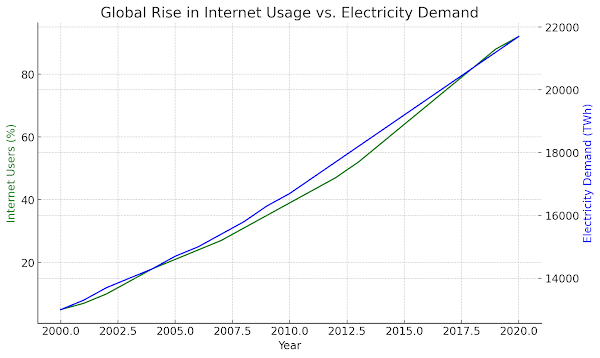

At its core, every tech revolution has been an energy boom.

From the gas-powered car, which caused global energy demand to soar by more than 1,000% to the internet, which led energy demand to spike by even more

Now, we’ve created the single biggest energy-consuming technology in history – artificial intelligence.

AI’s insatiable need for energy is at the center of the last retirement stock we’ll ever need that Dylan is teasing.

The Pitch

Dylan has put all the details on this particular stock in a special report called The Last Retirement Stock: AI Income For Life.

This report is only being made available to new members of the Behind the Markets research service.

Membership costs $49, an 87% discount off the regular retail rate of $399 a year and it comes with a six-month money-back guarantee, two bonus reports, a new investment pick every month, access to a model portfolio with a 75% win rate over the last 6 years, and more.

The Most Efficient Form of Energy

Energy is critical to over 6,000 products we use daily.

Everything from electronics to cosmetics to medicine. Without it, innovation doesn't happen and factories stop working.

But because of AI, we are now on the brink of an energy crisis.

Think about this, artificial intelligence already uses as much energy as a country like Germany or Saudi Arabia.

This is expected to double within the next 2 years, with The International Energy Agency anticipating it to grow 1,000% globally and ultimately consume 25% of the U.S. electric supply within this decade.

Dylan confides that this demand alone is enough to “send the company he is teasing screaming higher.”

However, there’s also another factor at work…

The Innovation Paradox

At this point, you're probably thinking “Why not simply increase the energy supply?”

Well, wind and solar won't get it done and to meet the projected energy demand of AI, we would need to build roughly 40 nuclear power plants within the next 5 years. The average time it takes to build a new, approved plant is 6 to 8 years.

This leaves us with “the most efficient form of energy” oil.

America is sitting on 80 billion barrels of “technically recoverable” oil, enough to power the United States without a drop of foreign energy needed for at least 10 years at current demand.

The problem is that the extreme policies of governments around the world pushing “Net-Zero Emissions” by 2050 have paralyzed the energy sector.

Drilling for new oil and gas has dropped to 500 active rigs as of the end of 2023. The all-time low is 400.

This artificially engineered government shortage in the middle of escalating demand by new technology has created an investment opportunity Dylan believes is on the cusp of a 2,000% breakout.

Revealing Dylan Jovine's Last Retirement Stock

Here is everything divulged in the teaser about this play:

- It’s not a driller, but a “toll booth” oil has to pass through.

- It is a royalty trust that distributes 90% of its profits back to shareholders.

- The trust is a major player in the energy field, controlling more than 750 million barrels of oil a day, and 2.2 million barrels of natural gas liquids.

Pretty generic clues all around, but they led me to the largest pipeline owner by daily volume, Enterprise Products Partners L.P. (NYSE: EPD).

- It is a natural gas and crude oil pipeline company, not a driller.

- Enterprise Products is one of the largest publicly traded partnerships.

- The last point about “controlling more than 750 million barrels of oil a day” is a typo by Dylan's copywriters, as EPD's pipeline processes the equivalent of 7.4 million barrels per day (bpd). Tops in the U.S. and close to the 7.5 million bpd figure likely meant in the teaser.

Make 2,000% Over The Next 12 to 24 Months?

I like Dylan's pick and his thesis about the demand for energy increasing is on the money.

However, the short-term return projections are far removed from reality.

A 2,000% gain would make Enterprise Products a $1.3 Trillion business, a ceiling that only eight other companies have managed to break through thus far.

But even without this extreme projection, EPD is a quality business that is likely to produce above-average returns. Here is why…

First, about 60% of electricity generation comes from fossil fuels, be it coal, natural gas, or petroleum, so it's an upstream way to play energy demand, that even by conservative estimates, will grow at a 3-4% annual rate going forward and possibly much more.

Second, pipelines transport roughly two-thirds of the petroleum shipped in the United States, which is how it gets to the energy retailers supplying business customers such as AI firms, data centers, and enterprise crypto miners.

Lastly, Enterprise Products is the largest and most diversified pipeline business in the U.S., in other words, a market leader available for only 11x current earnings with an outsized 7% annual yield.

Debt is a slight concern at more than $30 billion, but midstream companies have to spend pipeline capex 10-18 months in advance of newly planned wells being drilled, which explains the need for it.

The limited partnership is already growing its transportation volume by about 14-15% annually, which should increase going forward, and the quarterly dividends are a nice bonus while we sit and wait for energy demand to inevitably accelerate.

Overall, EPD is a good resource play, with stable cash flow, since 98% of revenue comes from long-term contracts, above-average growth potential, and available for an attractive price.

Quick Recap & Conclusion

- Wall Street outsider Dylan Jovine is teasing an $85 Trillion global economic consolidation and a “last retirement stock” that gives us “AI income for life.”

- We discover that $85 Trillion is the annual value of US equities turnover, which is virtually all transacted electronically and this along with AI’s insatiable need for energy is at the center of the last retirement stock Dylan is teasing.

- All the details on this particular stock are in a special report called The Last Retirement Stock: AI Income For Life. The catch is, that it's only available to new members of the Behind the Markets research service, which costs $49 for the first year.

- Based on the generic clues provided, Enterprise Products Partners L.P. (NYSE: EPD) is Dylan's “last retirement stock.”

- Enterprise Product Partners has most of the markings of a quality retirement stock, steady cash flow, well-funded payouts, increasing demand for its services over the long term, and is available for a good price.

Are midstream pipelines a good way to play the surge in energy demand? Let us know your thoughts in the comments.