Google has made early investors extraordinarily rich, with its stock up more than 5,000% since debuting in 2004.

Colin Tedards says Google's founders are now trying to do it again with “Project Gemini”, the company's new AI project, and the stock of one secret technology supplier is set to skyrocket.

The Teaser

Google CEO Sundar Pichai has said that “AI may end up being “bigger than the internet itself” and the search leader has put its mountains of money where its mouth is.

Colin Tedards has been operating online businesses for almost 20 years, which he brags gives him the ability to get into big, profitable tech trends before the masses catch on. I have previously reviewed his “Next Nvidia“ teaser and a similar presentation – Andy and Landon Swan's “Microcap A.I. Moonshot“, here at Green Bull.

To date, Google has spent over $200 billion on AI. That’s more than any other company.

This ungodly sum of money is justified when considering the fact that AI could be a $2 trillion market by 2030.

Gobs and gobs of money is up for grabs and that's where Project Gemini comes in.

Google's ChatGPT Killer

In Google's own words, Gemini is their most capable AI model yet.

What is it exactly?

Put simply, Gemini isn't any one thing, but rather the system or brains behind a variety of tools. This includes the Bard chatbot, AI-assisted search, and YouTube text-based video editing, among other things.

According to Techradar, Google has claimed that Gemini beat OpenAI’s GPT-4 model in almost every test the two systems took. Although in many cases, the difference was only a couple of percentage points.

So plenty of work remains to be done before it can be called a full-fledged ChatGPT killer.

Nonetheless, Gemini would not be possible without a key piece of technology made by one Google supplier.

Colin is confident in saying that anyone who snatches up shares in this company will be richly rewarded, as he believes it gives Google the technological edge it needs to dominate the AI market.

The Pitch

All of the information we need to know about this key supplier has been put in a special report called My #1 AI Stock: Google’s Secret Supplier.

This is the part where Colin asks for a favor in return for this “free report.” Right on cue, we are asked to try out The Near Future Report monthly research service.

The retail price of The Near Future Report is $199 per year. However, for a limited time, we can sign up for only $49. Included are 12 months of Colin's best investment ideas, two bonus reports – Retire Rich as AI Goes Mainstream and AI Losers, as well as access to a model portfolio.

The Biggest Profit-Making Trend in History?

Some believe Artificial Intelligence could usher in The 4th Industrial Revolution.

When I first heard this, it sounded like pure hype. But after digging into the numbers, it becomes more plausible. Here is what I mean.

- From 1700-1800 during the first industrial revolution, GDP grew 40%.

- During the second industrial revolution from 1800-1900, it grew 100%.

- And the third industrial revolution from 1900-2000 grew GDP by 300%.

Per capita GDP grew bigger with each industrial revolution and this trend is expected to continue with AI.

Makes sense if AI doubles productivity in the next decade, as some are predicting.

Combine this overarching macro-trend with the micro-trend of Google suppliers having a history of cashing in big when they help the company capitalize on a massive trend, and Colin could be on to something.

Winning with Supplier Stocks

Here are a few examples of what I am talking about.

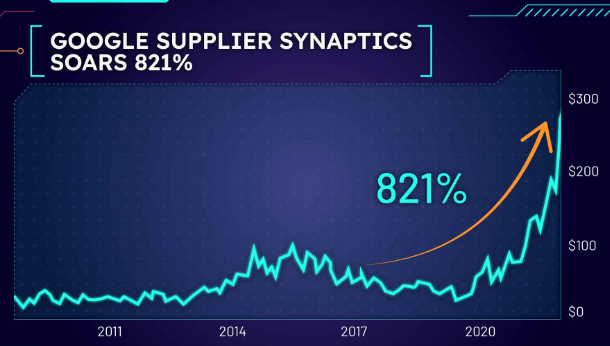

When Google decided to break into the cell phone market in 2008, it tapped tech company Synaptics to supply the touchscreens. Next thing you know the stock soared 821%.

It happened again in 2020.

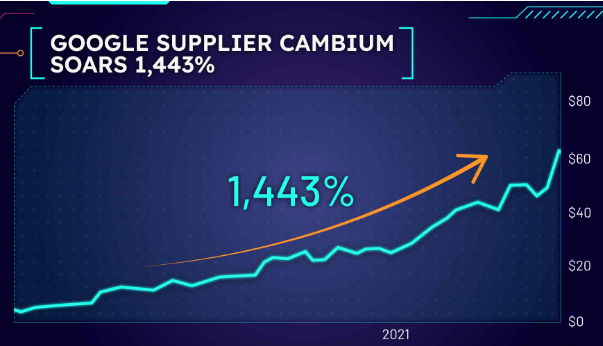

When everyone started working from home, Google partnered up with WiFi experts Cambium to deliver better internet speeds, sending their stock soaring 1,443%.

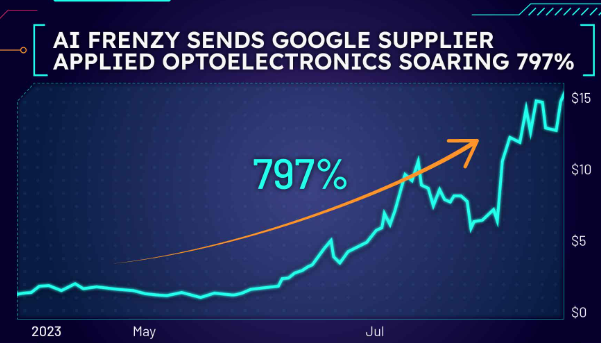

This year alone, with the AI frenzy in full swing a slew of Google partners and suppliers are soaring in value, like AI hardware vendor Applied Optoelectronics, as the most prominent example.

AI is packing decades' worth of gains into less than a year.

There is also somewhat of a catalyst in place here, with Google on code red alert because of ChatGPT, so the company has an urgency to ramp up and release Gemini as quickly as possible.

This means more money going to one little-known supplier. Let's find out what it is.

Revealing Colin Tedards’ Secret Google Supplier

Data is just one side of the equation. AI needs a lot of computing power to make sense of all the data.

That’s what makes this supplier critical to Google. Here is what we know about it:

- They’re not building computer chips. They’re building out a broader infrastructure specifically designed to unleash the full power of Google’s tensor processing units (TPUs).

- Its revenue has grown nonstop every year for the last 12 years.

- The company also has other strategic partnerships in place with Apple and Facebook, among others.

Looking at a list of Google's AI infrastructure and platform partners, only three are publicly traded companies, and out of these one closely fits Colin's description – Broadcom Inc. (Nasdaq: AVGO).

- Broadcom's tech is basically the foundation of next-generation servers, which AI is being built on. Specifically, its PCIe interface is the standard for connecting various components like chips, storage, and more.

- The company's revenue has increased each year for the last 12 years.

- It announced a multi-billion dollar deal with Apple in May and Meta used Broadcom's custom chips to build its metaverse hardware.

Getting Rich at the Cutting Edge of AI

AI is the real deal and is already minting young whiz kid billionaires.

Is Broadcom stock the next Google supplier to skyrocket?

I'm not so sure it hasn't already, as the stock is up almost 50% over the past year and currently sits at a $480 billion+ valuation as I write this. A jump to a trillion-dollar market cap (which only six other companies in the entire world have reached) means only a two-bagger.

I believe there are better ways to play AI.

First, purchase a broad ETF like the Global X Artificial Intelligence & Technology ETF, which is up nearly 50% YTD and provides exposure to a broad array of stocks in the sector.

Second, invest directly in generative AI by buying OpenAI (via Microsoft stock), and other pure-play AI stocks like C3 AI among others.

Lastly, and this is the most understated way by far, buy into businesses that are mission-critical to AI and which it cannot operate without.

I'm talking about water, with ChatGPT alone using the equivalent of a 500ml bottle of water for just a conversation of 20-50 questions and answers, specialized hardware, and data storage.

Only you know which approach is best for you, but covering all your bases instead of buying individual stocks, such as Broadcom, seems like a better way to capture above-average gains.

Quick Recap & Conclusion

- Colin Tedards says Google's new AI project “Project Gemini”, could be bigger than its lucrative search advertising business, and one of its secret technology suppliers is about to skyrocket.

- Gemini isn't any one thing, but rather the system or brains behind a variety of tools, including the Bard chatbot, AI-assisted search, and YouTube text-based video editing, among other things.

- All of the information we need to know about Gemini's supplier has been put in a special report imaginatively called My #1 AI Stock: Google’s Secret Supplier. We need a membership to Colin's Near Future Report monthly research service to get a copy, which costs $49 for a limited time.

- You can skip this step, as we were able to reveal the name of Colin's #1 AI Stock right here for free as…Broadcom Inc. (Nasdaq: AVGO).

- Broadcom is merely one of a myriad of options we have for investing in AI and there are better ones out there.

How are you investing in Artificial Intelligence? Tell us in the comments.