Is Capitalist Exploits a scam? Can you trust the guys running it, Chris Macintosh, Brad McFadden, Jamie Keech, etc.?

Questions like these are what everyone should be asking before joining any investment services and following people's advice on what to do with their hard-earned money. And these are the questions I'll be doing my best to answer in this review.

Spoiler Alert: Capitalist Exploits is not a scam.

I've been a member of their Insider service for over a year now and have had a good experience overall. There are some things they could improve on, however, and I'll be going over these too… the good, the bad, and the ugly.

Let's begin this review with an overview, then I'll get into the guys behind it, track-record/performance of their recommendations, etc.

What Is Capitalist Exploits?

- Name: Capitalist Exploits

- Website: capitalistexploits.at

- Founder: Chris Macintosh

- Services: Investment newsletters & more

Capitalist Exploits is an investment advisory company led by Chris Macintosh alongside other industry professionals that provides services such as investment newsletters, actionable investment recommendations and ideas, model portfolio access, inside access to private investment deals before they're public, and more.

Of course this is a very broad level overview, but I'll break down each of their services and go over what they provide below.

In a nutshell, Cap Ex is “dedicated to finding asymmetric risk/reward investment opportunities”.

Additionally, the company is run by “globetrotting investors seeking out and investing in game-changing global trends”.

These are quotes from the men running things. The focus of their services differ, as well as the focus of different aspects within some of their services, but overall these quotes hold true. They look for asymmetric investment opportunities by digging deep into the macro economics and identifying global trends.

That said, you might be thinking they are chasing the typical trends… but you'd be dead wrong. They aren't chasing trends like 5G, AI, and so on. Their approach is very different, and what they invest in often includes things that most fund managers wouldn't touch with a 20 foot pole. I'll go over why in the following sections.

Additional Company Details:

- Founded in 2012

- Located in Singapore (I'll be discussing concerns surrounding this more in a bit)

- 38 North Canal RdSingapore059294

- Update 11/21/2023: Their business location has since changed to:

- Al Kazim Building 3Hor al Anz EastDubaiUAE

- Service prices range from $1/mo to $4,999/yr

- Offers 30 day money-back guarantees on most services

- Have services good for beginner investors all the way up to professionals and accredited investors

The People Behind It All

One thing that makes Cap Ex different from most investment advisory services out there is the lack of self aggrandizing.

Everyone on the team has loads of impressive experience and knowledge, but you won't hear them bragging and boasting about it all the time, as is becoming the norm in the investment newsletter world.

Chris is the founder and main guy behind it all, so let's go over him first.

Chris Macintosh (Insider, Resource Insider)

According to Chris' Linkedin profile, he started Cap Ex in 2012, although it wasn't until years later that he started up Insider. Since its inception, he has managed to build a following of more than 30,000 investors. However, this is likely a statistic referring to his free email list, because there certainly aren't 30k subscribers to the main paid services offered by Cap Ex.

What qualifies Chris to give investment advice?

Well, his knowlege levels are evident from the well-researched reports he sends out to subscribers, with arguments so good and evidenced that they'll likely even convert opposing viewpoints you have (I know some opinions of mine have changed).

But, as a reader you might not have joined any of his services yet, so let's give some background on the guy.

He takes a global investment approach and dives deep into the global macro economics in his newsletter services. This is because, according to him, he was “baptized into the world of business and travel at a young age.” I know he is always talking about his travels in his newsletters and he claims to have lived in multiple countries while investing globally, making a small fortune in the process thanks to his obsession with the markets and time spent studying them.

While he doesn't have top university education that is bound to impress on paper, he does mention in a self-written profile on TalkMarkets having learned more from self-education and real-word entrepreneurial activities that studying at any university.

He started out in the investment world at Invesco Asset Management, Lehman Brothers, JP Morgan Chase and Robert Flemmings. Later, Chris co-founded a venture capital firm that oversaw more than $30 million in investments going into 32 early stage companies. And, as legend has it, he also built his own real estate investment business that saw 60x returns in just 3 years.

Impressive indeed.

At the moment Chris manages money for high-net wealth clients through Genorchy Capital, a firm he founded in 2016 and, of course, runs Cap Ex and the services provided here (Insider Weekly, Insider, is involved in Resource Insider, and more).

What he looks for in an investment is different than most. As mentioned, he takes a global macro approach to investing. He dives deep into the macro economics and helps guide investors on what and where they should be investing in.

Chris looks at stocks in sectors that no body wants to touch… the ones that are extremely undervalued. This is what's called asymmetric investment opportunities, which is something you'll hear him say quite a bit if you join any of the services offered. He chases trends, just not in the way you'd think.

And besides relying on his education and life experience, Chris has expressed more than once the value he has found in making quality contacts at high levels in industries all over the globe. I suppose he's a pretty likable guy, because he has contacts all over and often pulls information from his rolodex to get inside information on what's going on in the markets around the world. This is something you'll notice quite often in his Insider Weekly newsletters.

Brad McFadden (Insider)

Brad's the head trader at Cap Ex (for the Insider service). You don't hear from him quite as much, but he does put together the investing Themes within Insider and is very active in the monthly webinars. What he's most involved with is finding the out-of-favor sectors offering deep value that you'll find in the Insider themes.

Brad has 20+ years of experience in the markets. His past includes working at Henry Ansbacher managing high net-worth clients' funds as well as managing a trading book for Rand Merchant Bank in South Africa, which is where both Chris and Brad come from by the way… and probably will never return to due to economical and political reasons.

Brad left South Africa after speculating against the Rand, which he turned out to be right about.

Besides working at Cap Ex, Brad is also the Chief Investment Officer at Right Path Investing, an investment community and education company.

Jamie Keech (Resource Insider)

Jamie Keech runs Resource Insider at Cap Ex, which is suitable based on his background.

In short, he's a mining engineer turned deal maker.

Keech started out on the path of mining. At the University of Toronto he obtained a bachelor's degree in Mineral Exploration, started working in the field in Southwestern US as well as Canada, and then went back to school in the UK at the Camborne School of Mines.

Post graduation, Keech worked as a Junior Engineer at Sparton Resources in Canada, a Junior Geologist & Logistics Coordinator in Canada as well, as a Geologist for GeoMinEx in Albania, a General Laborer where he was part of a pipe-laying crew in Canada. Later he was able to work his way up to higher-level positions as a Tunnelling Engineer and a Mining Engineer for Leighton Holdings (the largest mining contractor in the world) in Hong Kong as well as Mongolia, as well as at the global engineering firm Hatch Consulting where his work was focused on a $6 billion iron ore project in Canada. Working at Equinox Gold is also a past experience. Here he worked in corporate development and helped grow the company through a various merges and acquisitions, from $20M to nearly $1B (market cap).

Besides running Resource Insider and giving out free advice via podcasts, Youtube, etc., Keech has also helped educate people on mining through an intro to mining course taught at Nanjing University in China as well as through seminars for P.W.C. on some of mining's technical aspects.

And, at the moment, he also works at Ivaldi Ventures, a private investment firm he founded in 2018.

This is the type of guy you'd want to listen to when investing in the resource sectors.

Others

Above are the main people you'll see and hear from through the different services offered at Cap Ex. But, of course there are some others as well, whom I'll mention briefly.

- Nick D'Onofrio – Nick is part of the team at Resource Insider. You won't hear his name much, but he puts together much of the research for the service alongside Jamie Keech. He started out trading Eurodollar interest rates and later worked at Eldorado Trading Group after developing a trading strategy that worked based on the microstructure of the market. Later he worked at Mariner Wealth Advisors where he learned trading strategies focused on the global marcro market, followed by attending a Master's program at the Colorado School of Mines.

- Harris “Kuppy” Kupperman – He's a good friend of Chris' and a fellow hedge fund manager, which you might already be aware of if you follow Hedgies Uncut. Praetorian Capital is the hedge fund he founded, which has been wildly successful (26X returns in the first 5 years). Later he founded Mongolia Growth Group, a publicly traded company focused on acquisitions, property management, leasing, renovations and development in Mongolia. And I've also heard that he recently re-opened his global macro investment fund.

- Lucas Gianello – He's in charge of the marketing side of Cap Ex, which is very small and this is something I like (there products aren't heavily marketed). However, you'll also see him helping out with the monthly Insider Q&A webinars, with the introduction videos to Insider and some other things.

Services Offered

There are a handful of investment services offered by Capitalist Exploits. Let's begin by going over the free ones.

The free ones..

Our World This Week (OWTW) – Free

If you go to their homepage, capitalistexploits.at, you'll see something like that shown below. It's where you can sign up to their free weekly newsletter service called Our World This Week…

What it provides:

“Unique investment ideas””Global macro analysis””1 email per week, no B.S.”

By signing up for this service you'll get a very broad level overview of the market via email each week. And when I say broad level, I mean very broad.

The emails are short and don't discuss much in detail, but rather provide an overview of what you might want to know along with links to more information.

It's free so what can you expect?

For example, an OWTW email could talk about the ridiculousness behind the Dogecoin craze, the insane market evaluations of EV makers like Tesla, how oil majors continue to ditch oil…

… and maybe even talk about an interview Chris had with an industry insider – yes, these are some real examples from a random OWTW email I pulled up.

The point is that these emails can bounce around quite a bit in the market topics covered, and don't provided much information but do bring a lot of not very mainstream topics to light.

Although the emails come from Chris Macintosh, I don't believe he writes them, as at the end of each email it states “- The Team at Capitalist Exploits”…

Hedgies Uncut – Free

This is said to be: “NOT SAFE FOR WORK MARKET COMMENTARY FROM HEDGE FUND MANAGERS”.

Another way of describing it is a “fly on the wall service” where Chris Macintosh and some of his hedge fund buddies chat about what's going on in the markets… and there's usually a fair amount of political talk here too.

This is a Telegram channel. So you can easily download the Telegram app on your phone to follow along with the commentary. But first you'd have to sign up for the service.

Some of the other people you might find chatting on this include Harris Kupperman (Kuppy) and Tim Staermose.

*Note: This service isn't always very active. In fact, recently the activity has been extremely low. But, it's free, so..

The ones you have to pay for..

Insider Weekly – $35/mo

This is their least expensive paid service. It's a weekly newsletter service run by Chris that provides asymmetric investment ideas, in-depth market commentary and analysis, and really takes a deep dive into what's going on in the chaotic markets we find ourselves a part of, geopolitical events that are important to the global investment strategy Chris takes, some good old fashion humor, and more.

There is quite a wide base of subscribers to this service, with anyone from other professional money managers to normal retail investors signed up. Because of this, Chris does his best to present in-depth information in a way that everyone can understand.

While I mentioned that the free Our World This Week newsletter provided a very high level overview of things but didn't go into any depth, Insider Weekly doesn't shy away from topics and news that take quite a bit of research and explaining. Some of these weekly reports can be 40+ pages.

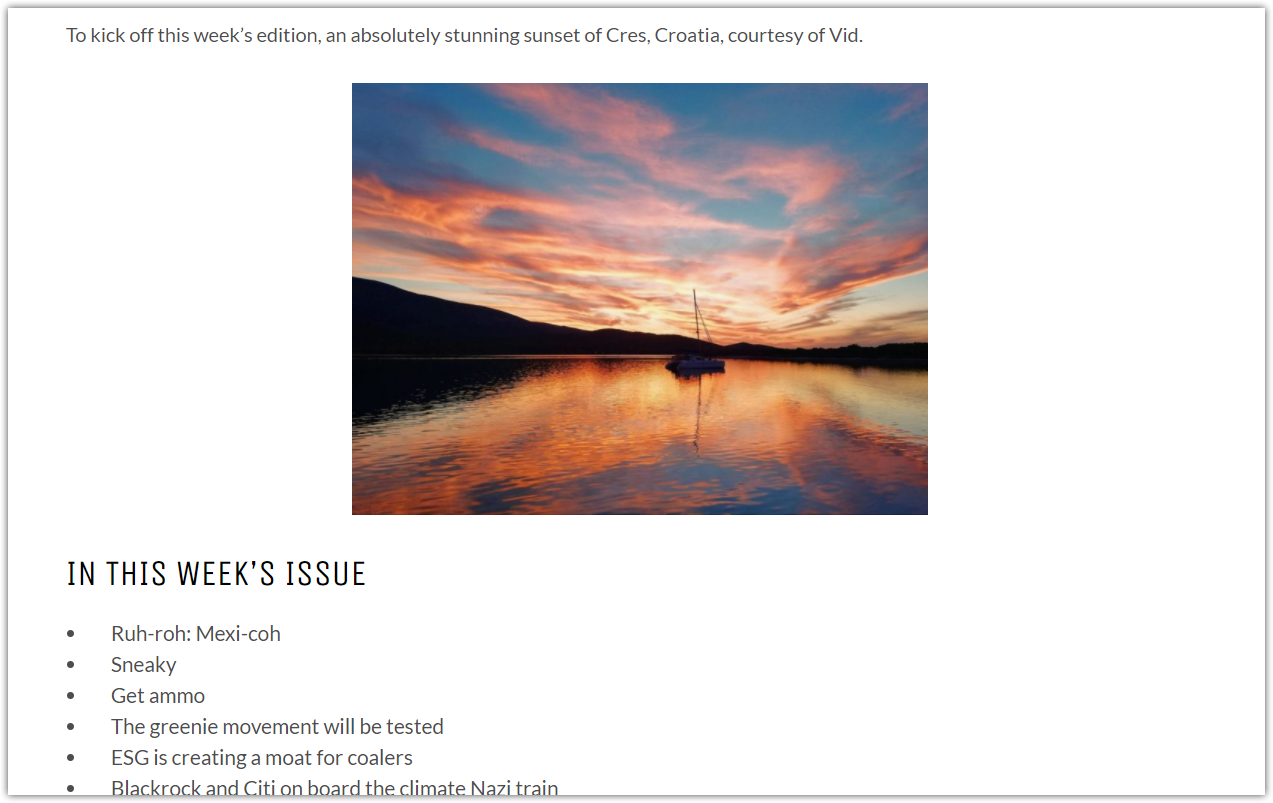

It's become a tradition for these newsletters to start out with some nice sunrise pictures that subscribers have sent in to Chris, followed by a list of what's to be covered…

What types of things are covered here?

Well, that all depends on what's going on in the world.

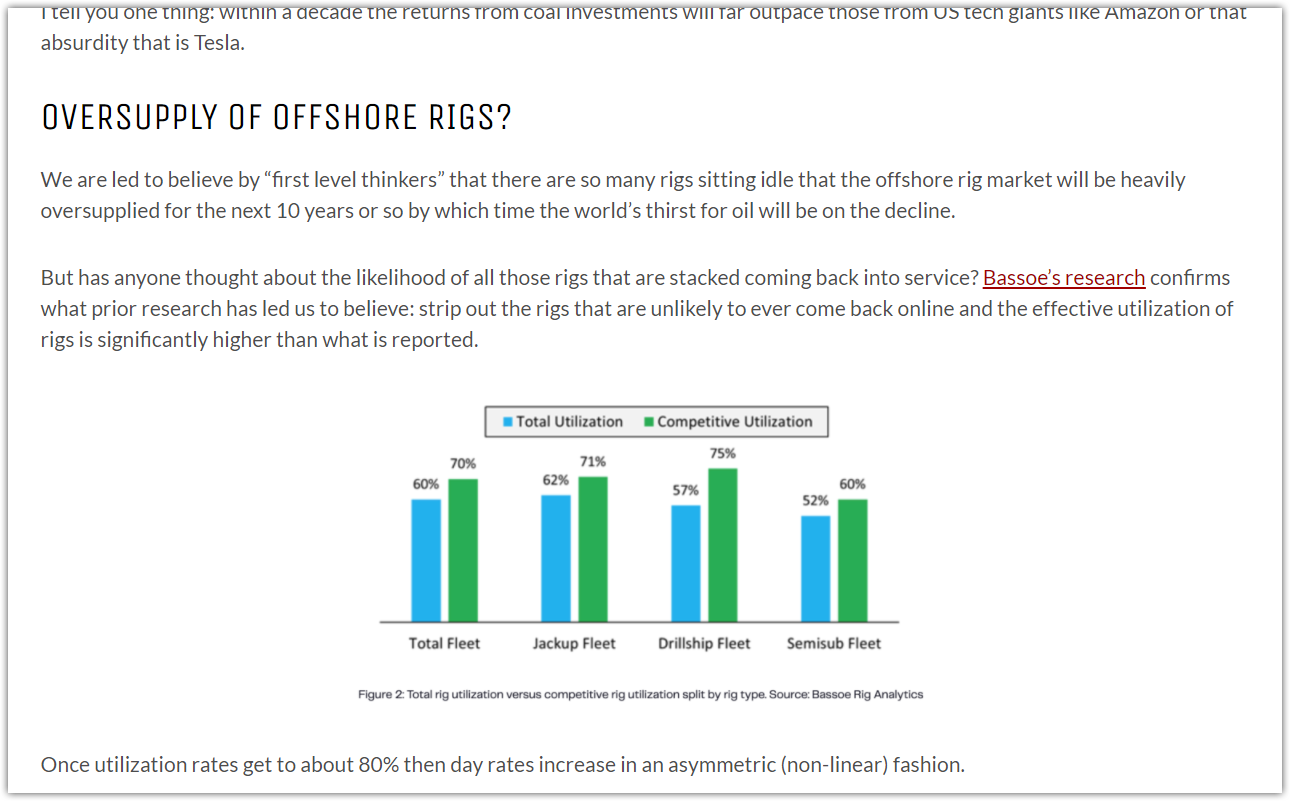

You could find Chris talking about why you should get ammo, how the “greenie movement” will be tested due to “greenflation”, the ESG movement making existing coal miners increasingly interesting for investment, that Blackrock and Citi have joined the “climate Nazi train” and are pushing to shut down coal plants early, and more, such as how there really isn't an oversupply of offshore rigs as some say…

These are all examples from a recent Insider Weekly issue, this one 27 pages – not too long and not too short.

The topics covered here can be broad, but are always in some way related to the sectors Chris and Brad invest.

You will often find these newsletters focusing on areas of tension and chaos, which there is plenty of in this world.. Profiting from the COVID hysteria, the largely unsustainable Marxist policies in the west and the shift in capital to the east, the increased political tensions around the globe and the fracturing of the EU, and so on – some examples of what Chris looks at and what you can expect.

What do they invest in? I'll go into more detail in the next section, but what they look for is deep value in sectors that are out-of-favor, yet vital for the functioning of society… extremely undervalued sectors that are near-guaranteed to bounce back.

You can join Insider Weekly for just $1 for the first month. Then, if you choose to stay a subscriber, you'll be charged $35/mo after that.

Insider – $2,499/yr

Insider is one of the main services offered by Capitalist Exploits. It's run by Chris and Brad, and Insider Weekly is actually a part of this service.

Insider Weekly was the weekly newsletter service, but if you subscribe to Insider you get access to the newsletter along with a lot more.

Here you will get access to the model portfolio. This shows exactly what Chris and Brad are invested in.

Chris and Brad not only go to great lengths conducting their own research, but also pull information their rolodex of industry contacts to get insider and on-the-ground info into various markets around the world. This is something that is invaluable and only obtainable from those who have years and of professional experience like they do.

When investing globally, they certainly aren't assessing the geopolitical tensions, supply issues, monetary debasement, capital shifts, etc. by reading Yahoo Finance articles.

Capital Gains Portfolio: Part of Insider, here you can find their core investments. These are the deep value stocks in hated and unloved sectors that are, as mentioned, out-of-favor yet vital for the functioning of society. The goal with these stocks is 3X returns at a minimum.

These investments are broken down into different Themes (sectors) and usually have a handful of stock recommendations under each.

And remember, Insider looks to invest globally. Not only do they look to invest in extremely undervalued and out-of-favor sectors, but they also look to avoid jurisdictions they believe are politically unsafe for investing (ex: Australia and New Zealand with their increasingly Marxist rules and regulations).

Here, the name, ticker symbol, and exchange are provided, along with some other stats such as the stocks' previous highs and recent prices just to give you a better idea of the deep value we're looking at.

Income Portfolio: This is somewhat of a bonus and was just added to the Insider service in 2021. In this portfolio, Chris and Brad have put together a bundle of stocks with good financials that pay out handsome dividends, often 10%+. These aren't the typical deep value stocks they look for, but offer another and very different revenue stream for subscribers.

Besides the portfolios and the Insider Weekly newsletter, Insider members also get:

- Trade Alerts – When they're investing in new areas, members will receive detailed trade alerts. These can be lengthy reports that go over a specific opportunity in depth.

- Monthly Q&A Webinars – These occur monthly and can be up to over 2 hours sometimes. Chris and Brad go over questions that members email in to them, which as a member you will be notified of prior to the webinar.

- Access to Private Chatroom – Members also get access to the private chatroom through Slack. With access to this you can communicate with other members about various topics. This is a great way to bounce ideas off of other members, who come from many different backgrounds, and see what other fellow members are thinking.

- Other Bonus Material – Every so often they'll also send out detailed reports that you could consider bonuses or supplemental material to what's the core of Insider. There is no schedule as to when these are published, and the topics covered can be broad. For example, their last two special reports at the monent are on “11 Ways to Trade Oil” (42 page report) and “Inflation – The Greatest Financial Risk” (20 min video).

>> You Can Join Insider Here <<

Resource Insider – $4,999/yr

This service is run by Jamie Keech along with Nich and Chris, but Keech is the main guy. Here they look to invest in things like battery metals, gold, copper, uranium, etc. The proposition is simple… to “Invest in the best opportunities in the mining and natural resource sector”.

During his research, Jamie:

- looks at the size and grade of a company to determine it if could produce real shareholder value

- does the technical and financial due diligence necesary to ensure a company is healthy and sound

- assesses the corporate structure and makes sure management is competent

- does boots-on-the-ground research, visiting mines, looking at the infrastructure, meeting the team, etc.

Again, this isn't researching coming from some guy sitting at his computer.

Membership is limited for this service (not always open to new members), and most investors won't be able to join due to the requirements.

Unfortunately, you must be an accredited investor to join. This is due to the nature of the investment opportunities, much of which are private placement opportunities that aren't available to the public.

*Note: To become an accredited investor you must have a net worth of at least $1 million (not counting the value of your primary residence), or have an income of at least $200k each year for the past two years (or $300k/yr combined if married) with the expectation of making at least this amount in the current year.

Private Placements: These are the deals that hedge funds, private equity firms, wealthy investors like Warren Buffet, etc. get access to when you buy stocks directly from a company, not through exchanges like the NYSE. This is why accreditation is needed.

What makes private placements so special?

Well, as you can imagine, being able to invest before opportunites are available to the public allows you to get in at lower prices, giving more potential upside.

Maybe a mining company needs to raise money to buy more equipment. Maybe exploration costs are more than expected and more capital needs to be raised. Etc., etc.

Of course these deals can also be more risky, but that's the reason you follow Jamie Keech & team's advice and research… to get in on the ground floor without investing in companies that are likely to go belly-up.

What you get as a member includes:

- In-depth independent research and education on the deals being targeted

- Updates on past, present, and future investment opportunties

- Access to the private investor forum

To give you a better idea of the research reports that subscribers get and the work that Jamie and the team put into this, we can take a look at a past report detailing the opportunity of investing in a copper mining company in Brazil.

This 19-page report goes over…

- Key project details – goes over things like name, key projects, financing size, projects stage and other important details.

- Investment Thesis that goes over why Keech & team think it's a good opportunity – the basics with details on the company's plan, price, risks, target returns, and more.

- Leadership Review – provides a review of the leadership team, giving background info on qualifications, education, etc.

- Property Ownership Details – in this case, this section went over the option agreement made by the company to aquire the mining project Keech & team find particularly interesting.

- Technical Review of the project(s) drill holes, element level estimates, land package details, permitting, metallurgy and recovery levels, and more.

- Capital Structure & Use of Proceeds – goes over how they use their money – in this case it was towards developing their copper-gold camp.

- Jurisdiction Analysis because the jurisdiction these projects are in is very important. The last thing you want to do is invest in a mining project in a country that has increasingly hostile policies towards what you are mining (coal and oil in the West for example).

- Discussion on important topics that weren't already covered or just not covered enough. In this example Jamie and Nick talked about various aspects of the upside potential of the project, the valuation and why they think it's a bargain, risks and the dilution potential of shares, liquidity, finders fees, conflicts, etc.

- Conclusion bringing it all together.

While these reports are rather detailed and will be a bit confusing at times for investors unfamiliar with the space, the team does a good job at laying things out in a way that the lay investor without experience can digest – just might take a bit longer to read.

Investment Strategy

The two main services that Cap Ex offers are Insider and Resource Insider, both of which have differing investment strategies.

However, it's worth noting that both of these have no quota to meet when it comes to investment recommendations. There are NO FIXED AMOUNT OF OPPORTUNITIES PRESENTED.

No Quota to Meet

While many, or even most, investment advisory services present their subscribers with 1 or 2 stock picks per month, or something along these lines, the Cap Ex services only present new recommendations when they see fit.

So, while it may be a bit disappointing that you won't receive regular investment recommendations, it's conforting to know that they aren't picking stocks just to meet some quota.

Skin In the Game

Something else I want to point out is that, unlike many other advisory services, the recommendations made with the Cap Ex services are ones that they are actually investing in themselves.

Now, there is some debate in the investment advisory world as to whether or not this is a good thing. Some people have concerns that the editors will buy in first, pump a stock by blasting out recommendations to subscribers, and then sell it at a profit.

While this is a legitimate concern, I have no reason to believe that Chris, Brad, Jamie, etc. are doing this. And if they are, well, then they certainly aren't very good at it because, for example, some of Chris' deep value picks take years to show any good upside price movement.

They invest in what they recommend. In my opinion this is also conforting to know.

The Investment Strategy Behind Insider

I already touched on this a bit, but I'll go over everything again.

Hated & Out-of-Favor Sectors Offering Deep Value

What Chris and Brad are looking for here are sectors that present deep value. They want to find industries that are hated, out-of-favor, and because of this extremely undervalued. And, at the same time, still vital for the functioning of society.

One good example I can give that they are extremely bullish on is uranium. Recently it's been gaining steam, but overall it's still an out-of-favor sector. The new trend is “green” energy. Fossil fuels, nuclear power, etc. aren't that well liked, at least in the Western world.

Chris and Brad first recommended stocks in this sector back in 2016 (I know… what a wait!) and now some subcribers who got in early are looking at 3X+ gains. And the run-up is just beginning.

Once Chris and Brad identify a sector that looks promising, they pick a basket of stocks in that sector, ideally looking for 3X returns at a minimum with these stocks. Now that's asymmetry.

Often companies in these out-of-favor sectors are going through rough times, and so Chris and Brad pick ones they think have the most potential to make it through.

Diversification Is Key

The Insider investment strategy also places a lot of emphasis on diversification. No one is right all the time with their picks and because of this you want to spread out the risk, not only in various stocks, but also in various sectors.

The Insider portfolio has stock recommendations in over a dozen sectors (themes), each of which they only recommend allocating no more than 10% of your portfolio balance… and no more than 2% for any single stock.

So, in a nutshell, they look for sectors that are extremely undervalued and offer deep value, usually due to being out-of-favor with popular opinion. Then they pick a handful of stocks in these sectors. Overall they have recommendations in over a dozen sectors for diversification purposes, and only recommend putting no more than 10% of your portfolio towards a particular sector, with no more than 2% towards a particular stock.

The Investment Strategy Behind Resource Insider

In some ways Insider and Resource Insider are similar. They both look for low risk, high value opportunities with tremendous asymmetric upside.

But there are obviously a lot of differences in their investment strategies as well.

With Resrouce Insider, as we know, Keech goes boots-on-the-ground. He meets with company leaders and visits their mining projects before investing. Again, this isn't just someone sitting at their computer reading public information on Yahoo Finance.

He digs up technical and financial details, and spends a good amount of time assessing corporate structure, management experience, etc.

The strategy here is easy to understand… to find companies in the natural resource sector that need financing for a project, assess their financials, management team, infrastructure, size, grade, and potential to create real shareholder value, and then buy into them via private placements (most of the time) – long-term hold time as well.

Track-Record

Everyone wants to see a flawless track-record with closed positions of 3-10x, but unfortunately this is a bit difficult to present. The reason is because with Cap Ex's services we're looking at long-term investments.

These aren't day trades or short swing trades that they enter and close out of shortly after, and because of this they aren't able to show clearly a track-record.

In fact, since Insider started back in 2016, most of the trades they've entered into they are still in. These are ongoing investments.

That said, since I am a member of Insider what I can do is show you my portfolio's performance at the moment. All of the investments shown below are Insider recommendations.

Besides the Unrealized P&L (profit & loss) that I've pointed an arrow to, the AVG PRICE (that I bought at) and LAST (price as of now) are helpful to gauge the performance here…

*Disclaimer: You shouldn't expect the same results as me if you join. Of course the performance greatly depends on when you buy into a stock. Not only that, but good past performance doesn't mean future performance will continue to be good.

Resource Insider:

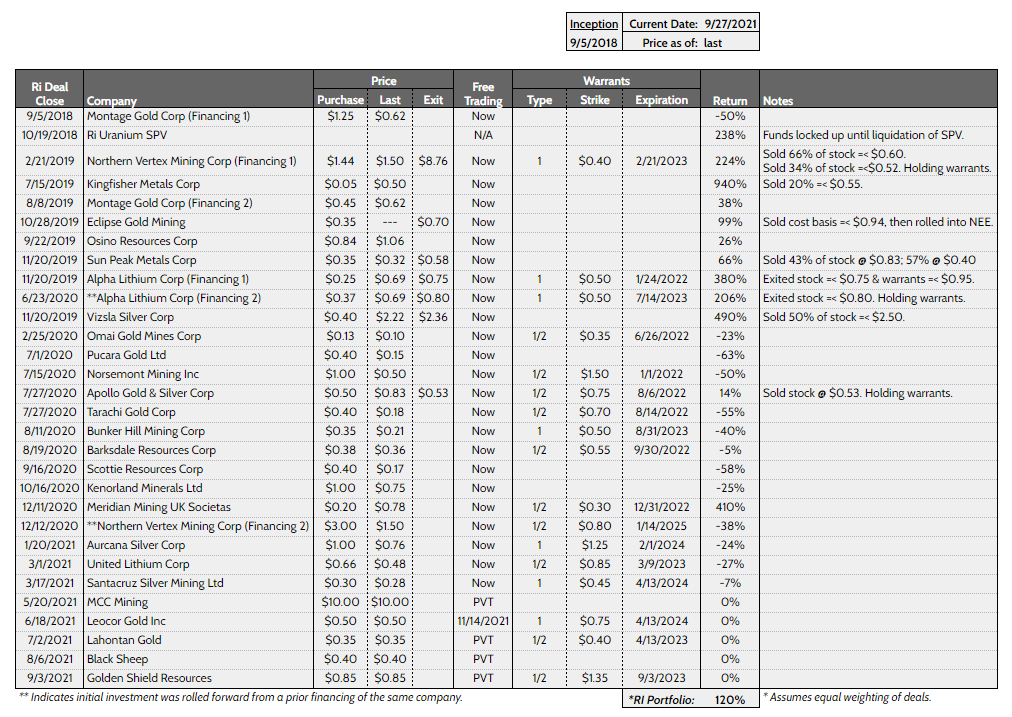

For Resource Insider, here are the deals and returns of each so far…

That's a 120% return on average, but this figure doesn't really tell us that much. These are long-term investments and investors certainly shouldn't expect to see high returns early.

Remember, the private placements that subscribers get the chance to participate in are occurring because these companies are looking to raise capital for one reason or another – could be developing a mine, financing more infrastructure, etc.

These projects can and will take a while to get going. So the returns from the chart above really don't give us that clear picture of a track-record.

Complaints & Subscriber Reviews

Capitalist Exploits is a rather small investment advisory company when compared to others that are out there (Motley Fool, Banyan Hill, etc.). So, there really aren't all that many public reviews of their services on the independent review sites I typically use.

However, they do have a Trustpilot page and you can read over a fair amount of subscriber reviews there.

Most are good.

This 5 star review comes from a person claims their “portfolio has grown wayyy more than the fee I paid”, and that it “hasn't been a year” since they joined.

*Note: We have no idea when they invested and how much, so this doesn't provide us with much substance.

Here's another recent 5-starer that mentions the lively community at Cap Ex Insider (talking about the private chat forum here) as well as how it's evident that they care about their subscribers and their “no-BS attitude”…

Below we can take a look at another 5-star review, but this one comes with a bit of a complaint: that “it isn't always clear what to buy”…

This is a bit tricky and Brad has mentioned in the weekly webinars that he doesn't know the best approach to displaying the model portfolio. There used to be “buy”, “hold”, and “sell” signals but they've done away with all of that. Now, if it's in the model portfolio, it's a buy if you haven't already bought it – simple.

They are also a bit slow to update things. For example, maybe there will be a concern about a certain stock and they'll say that an update is on the way for the portfolio, but this might not happen for a while. This is because Insider is a small-staffed operation.

Moving on, the next review is another 5-starer, yet the subscriber complains that “the monthly portfolio video Q&A's are not kept up to date, and the current buys need to be made clearer”…

I just mentioned that the they got rid of the “buy”, “hold”, and “sell” signals in the portfolio so that everything listed is a “buy” by default. So that is no longer a problem. However, I don't know what this person means by the monthly Q&A's (webinars) not being up to date. They information covered in them might be a bit lagging because of the time it takes to put one of these presentations together, but overall I think they do a good job here.

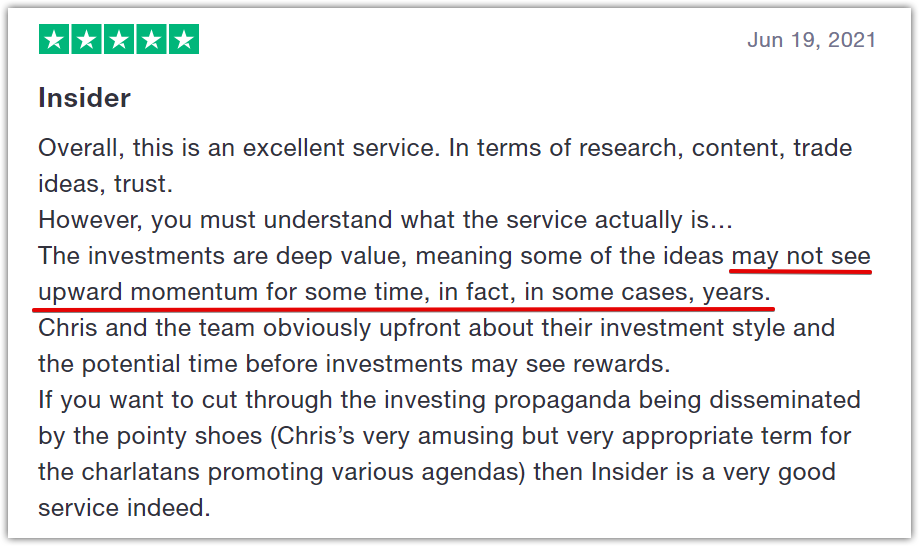

The next review, another 5-star, is good but does mention that you “may not see upward momentum for some time, in fact, in some cases, years”…

It's not really a complaint, it's just the way things are and it's something that all new subscribers should be aware of.

Insider is for long-term investing. They look for deep-value and it could take years to realize the profits from such investments.

And the last subscriber review I'll present you with states that they give “excellent researched opportunities”, yet complains that “the one thing I don't appreciate about Capitalist Exploits is the bad language used”…

Chris is probably who this subscriber is referring to, I'm sure. He certainly doesn't keep his thoughts PC, and sometimes he gets a bit carried away with the trash talk.

An example from Insider Weekly:

Now you may be thinking… all of these reviews are good so far. Even the ones with complaints are positive overall. Am I'm cherrypicking them?

The truth is no. They have a rating on Trustpilot in the high 4's and just about every review is a 5…

But, to be as unbiased as possible, let's single out the bad reviews and go over them.

The only 1 star review is from someone who was disappointed in the political opinions in the newsletter, stating that it's “more of a political opinion piece” and that “I don't see how 99% of the political commentary in these news letters are at all relevant to deep value analysis”…

While I agree that Chris' non-PC talk can become a bit much at times, I'd disagree with it being non-relevant. Politics is extemely important when it comes to the macro analyses in the newsletters, and it's true that just about every newsletter will have at least some political talk.

Here is Cap Ex's response to the above review:

Another negative comment (3-star) expresses dissatisfaction due to an “undercurrent of racial and cultural hostility”…

Here is Chris' response to it…

Here's my thoughts on this one…

Chris can be a bit hostile when it comes to discussing other cultures. Sometimes he even makes extremely un-PC comments that aren't really necessary, such as, for example, calling Afghanistanis “sandal wearing goat herders” in a weekly newsletter that had a section dedicated to the ramifications of Biden pulling troops out of Afganistan.

If you can't handle un-PC talk like this then I would suggest avoiding Insider and Insider Weekly. However, I do like the fact that Chris speaks his mind and if you can look past the occasional derogatory comments like this then you'll be pleased with what's given.

No Public Subscriber Reviews for Resource Insider..

There aren't any subscriber reviews that I can find for Resource Insider. This makes sense because of the very low number of subscribers, not only due to the cost but also because of the Accredited Investor requirement.

It's understandable I can't dig up any reviews, and I'd also say a good sign.

Why?

Well, because if there were upset customers paying $4,999/yr for an advisory service like this, they would likely make their negative opinions known. So the lack of reviews can be seen as a good sign here, I'd argue.

Concerns

But Cap Ex is located in Singapore Dubai..?

One subscriber to our free newsletter here at Green Bull Research told me that there was no way they would subscribe to a service offered by a company in Singapore.

Of course, I've already gone over that the business location has changed to Dubai. But now… Dubai? Why Dubai?

Cap Ex's listed address is:

38 North Canal RdSingapore059294

Al Kazim Building 3Hor al Anz EastDubaiUAE

Is this a real concern? Maybe for some people, but I certainly don't lose sleep over it.

We know that Chris is a globetrotter and, although I don't know for certain, I'm guessing registering the company in Singapore Dubai was a better business decision that he probably researched quite a bit (maybe better for tax purposes..?).

“Not intended to render investment advice”.. What?

If you've read the disclaimer on Cap Ex's website, you'd see that “This site is not intended to render investment advice.”

Say what? Isn't guiding investors and providing advice exactly what they do?

While this may seem alarming, don't worry about it. It's just a legal disclaimer so that no one sues them if they lose money on an investment. You'll see this type of disclaimer for all of the investment advisory services out there.

Refund Policy

So, what if you join and realize the service just isn't for you? It happens… and although I've been more than happy with my Insider subscription, I know that it isn't for everyone.

Luckily, both Insider and Resource Insider have a 30-day money-back refund policy. This means that you can sign up and pay for your membership, cancel within 30 days if you are not satisfied, and get a complete refund “no questions asked”.

And yes, they will give out refunds. This isn't one of those Agora companies that make it a headache to get your money back.

As for Insider Weekly, if you sign up for this $35/mo service then you can just cancel it at any time. I don't think this has the same refund policy, but I do know some people that have managed to cancel and receive refunds for previous months.

Are They Legit?

You can answer this question yourself, but I think it's clear that Cap Ex is indeed a legit investment advisory company.

- Solid, high quality, and unique investment research

- Run by highly qualified professionals

- No over-the-top marketing hype & sensationalist nonsense

I'd actually argue that they are one of the most legit companies of their kind out there.

Conclusion – Worth Joining?

As mentioned, I've been a member of Insider since Sep 2020. My opinion might be a bit biased, but I find the service to be very good and well worth the cost, as you have seen from the portfolio track-record I posted.

If you are looking for a no-nonsense investment advisory service that takes a long-term, deep value approach, then Insider might be for you.

You can join Insider here. Or, if you're on the fence about joining, I'd recommend trying out Insider Weekly for $1 ($1 for the first month and then $35/mo after that).

Resource Insider, although I'm not a member, seems to be equally as good… just subscribing to this service this isn't feasable for the average investor due to the requirement of having to be an accredited investor.

Both services are high quality, contain original and unique research, and don't spend their money creating ridiculous teaser promotions, but rather spend their time and money helping subscribers find great investment opportunities.

What You Need to Get Started

For Insider:

Created for your average investor with education and insight that even seasoned professionals will benefit from, Insider has subscribers from all over the world at different knowledge levels and financial situations.

You don't really need much to get started with the service. Of course you are going to need some money to invest in the recommendations, but they don't give you any minimum suggested amount.

If you're willing to pay the pricetag, hold stocks for possibly years before taking profits, and you like what I've went over above, then I'd suggest joining.

For Resource Insider:

Not for your average investor, Resource Insider is only for accredited investors, which most people won't qualify as.

Jamie also mentions that some subscribers invest as little as $2k in the private placement deals the team finds, while some of the more wealthy ones are investing over $100k in these deals. So maybe $2k per deal is the suggested minimum investment..?

If you do have the money to qualify for this service and are interested in getting into companies' private deals and holding for years, then I certainly wouldn't suggest against it. It's just that for the average investor this service is out of the question.

I hope this review has provided value to you. As always, let us know what you think about all of this in the comment section below…