An amateur or expert investor would know the name. His hands seem to reach everywhere in the financial research industry. As more people get to know him and his ways, it is natural to wonder if Bill Bonner is a scam artist.

You know how we operate on this website. We give people the benefit of the doubt. Our team looks at all angles and researches deeply to provide a comprehensive assessment.

In this article, we will look at how he started his career in the investment advisory business. We will also look at his network, as well as the controversies surrounding them.

We hope to equip you with the necessary tools so that you can make an informed judgment in the end.

Background

William “Bill” Bonner is the Founder and Chairman of The Agora.

The man has a quite peculiar journey. At one point, he was just a regular law student. Today, he heads the largest independent financial research network in the world.

Its publications are in 10 countries and are translated into six languages. All in all, The Agora's annual revenue reaches almost $1 billion.

According to its reports, the company has more paid subscribers than The New York Times and Washington Post combined. About 2.5 million subscribe to the newsletters under Agora.

Moreover, it claims that half a million people all over the world read Bonner's e-letter, Bill Bonner's Diary, daily.

But things were not always this lucrative.

In The Beginning

According to Bonner, even as a law student, he wanted to do something else. As a freshman at Georgetown University Law School, there was no passion for the legal world.

However, since he was already there, he just committed to finishing the course. When Bonner was already working with the National Taxpayers Union, he learned about raising money through newsletters.

Two things about this fascinated him.

Number one, the idea of being an alternative source of information. People looked to newsletters because of what the mainstream news media were not able to provide. Number two, there was a potential for making money in the industry.

So his first venture into the publishing industry was a satire newspaper. Bonner thought this was going to be successful.

However, he realized that the clientele in Washington D.C. was not receptive to it. People in the area took themselves too seriously, so they were not amused at being the butt of jokes.

The next thing he tried was a magazine. His small team's goal was for it to be an alternative news source.

Soon, they realized people were not responding well to it either. As a result, they lost money and Bonner decided to close it.

At this point, he remembered about the potential in newsletters. According to the entrepreneur, it seemed like the perfect vehicle for a publisher who does not have enough capital.

This is because, in a newsletter, one does not need a large team of editors and staff. So it will be more cost-efficient.

Lost And Found

This resulted in another experiment as he founded Agora Publishing in 1978. It released its first product a year after, which was his newsletter, International Living. It is still alive today.

The subject was not related to anything about the law or money, even. He just found the idea of living in other parts of the world exciting.

Further, he then ventured into the investment research field. Bonner got into it because he encountered financial guys whose track records were questionable.

Before we proceed with his work history, don't you just find this sentiment eerily familiar? Questionable track record? Really?

Isn't this the same issue with quite a few of the publications under Agora's network? Anyway, we are getting ahead of ourselves, so let's go back to the topic.

Due to this observation, Bonner started tracking the performance of those newsletters. However, this proved to be more difficult than he initially imagined.

It was a task next to impossible because the advice was mostly ambiguous. If you were a subscriber, you could interpret the instructions any which way you want.

He even recounts that there was an astrologer who based his investment recommendations on astrology. Surprisingly, he did well, according to Bonner.

This became a challenge to him. The more he got involved, the more he became interested.

Eventually, it became a more serious venture to the point where he moved to Baltimore already.

The city then was giving away buildings to individuals who would open their businesses in the area. The company and the building are still there right now, a total of 40 years.

Big Break

For Bonner, the single biggest breakthrough for newsletters came in the late 1990s. The Internet pushed the industry beyond its limits.

In the past, acquiring customers was more expensive. You needed to reach out to them one by one. Also, you would need to print, buy postage stamps, and the like.

Today, sending them out is practically almost free because of the Internet. The potential market also soared due to increased reach.

So the small newsletter industry has this technology to thank.

One could say that Bonner really is the pioneer in this industry. People credit him to be the Godfather of sorts in investment research.

But he remains modest about it, he says he was just in the right place at the right time. He does not deserve the credit, Bonner insists. It was actually the Internet that revolutionized the advisory world.

Publishing Philosophy

For the publisher, health and wealth are the two biggest topics that people would be willing to pay for. He came up with this conclusion based on his years in the business.

Due to this, he has always been focusing on these two for all his business ventures.

In our comprehensive review of the company, we already noted this. We previously mentioned Agora's interests in financial research and health publishing and products.

Bonner knows that people are concerned about their overall physical and financial health. Even with only these two broad topics, there are a lot of opportunities for income and growth.

Moreover, he is proud of the fact that he and his newsletters are deemed as alternative sources of information. These days, it seems more people turn to them because of mainstream media's lack of credibility.

Bonner sees this as a role worth treasuring. For him, it is not even only about the number of information one can give. Being a newsletter editor is more than that.

As a publisher, he says what readers want is not more data to analyze. A subscriber is after someone who will look at all that's available out there and digest them for him/her. S/he is only after analysis s/he can use right away.

Truth is, one can get anything from the Internet. But what he and his editors provide is a trusting relationship where they give readers only what they need.

Bonner emphasizes trust whenever he explains this rationale.

The reality is, people are busy, he says. Everyone has personal, family, and work issues and problems.

So they need someone trustworthy who will do the work for them. Subscribers can research and process things on their own, but they just do not have time.

Since the guys at The Agora have the time, training, and experience, people just pay them for their work.

Subscribers understand this well, that's why they continue to support his publications, he says. In that kind of a trusting relationship, people willingly pay for a valuable service.

For him, what people need is not more information but more wisdom. And this is their primary service.

Books

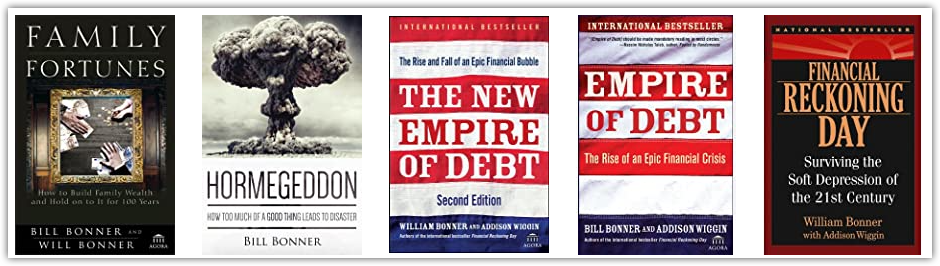

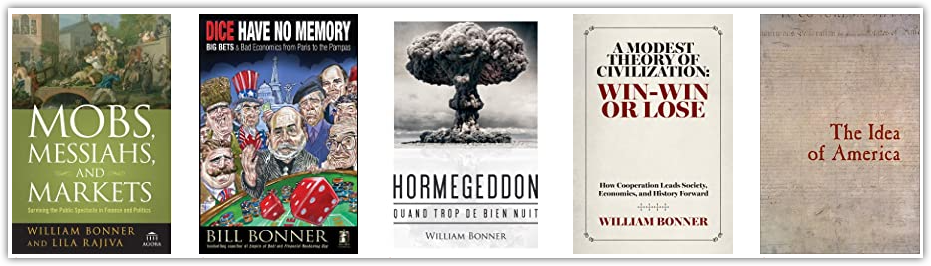

Bonner has 10 books under his name on the Amazon website. Among these are three New York Times bestsellers: Financial Reckoning Day, Empire of Debt, and Mobs, Markets. and Messiahs.

Through these and The Agora network, he has established himself as a thought leader in the investment research world. His books cover mainly financial topics with insights from history, economics, and political events.

Here are all of his books:

- A Modest Theory Of Civilization: Win-Win Or Lose, 2016

He asserts here that the Win-Win rule, where people cooperate, is the key to global progress.

- Hormegeddon: How Too Much Of A Good Thing Leads To Disaster, 2014

Bonner writes about a term he coined. The book discusses what happens how increasing “the good things” in public policy, economics, and business end up in a disaster.

- Family Fortunes: How to Build Family Wealth and Hold on to It for 100 Years, 2012

This is a book where Bonner shares personal insights on getting and maintaining generational wealth. Inside it are anecdotes from the Bonner family.

He also discusses how the rich can preserve the family's wealth and legacy.

- Dice Have No Memory: Big Bets and Bad Economics from Paris to the Pampas, 2011

Bonner compiles his insights and predictions from 1999 to 2010 in this book about America's economy.

- The New Empire of Debt: The Rise and Fall of an Epic Financial Bubble, 2009

Joining Bonner here is his partner, Addison Wiggin. They talk about how too much government control in the economy and business sector can be counterproductive.

- Financial Reckoning Day Fallout: Surviving Today's Global Depression, 2009

Authors Bonner and Wiggin advise on how investors can grow and safeguard their money even during turmoil.

- Mobs, Messiahs, and Markets: Surviving the Public Spectacle in Finance and Politics, 2009

This makes the case for going against the crowd by giving historical examples. The authors also discuss how you can apply this to your investments.

- Financial Reckoning Day: Surviving the Soft Depression of the 21st Century, 2007

It is an investment book that talks about the U.S. economy in light of global economic events.

- Empire of Debt: The Rise of an Epic Financial Crisis, 2007

Empire of Debt tackles how America has slowly shifted to become a country that gives the government too much control.

- The Idea of America, 2003

Pierre Lemieux joins Bonner in this primer on popular notions about America. They also discuss what aspects define the identity of Americans.

The Agora Network

Green Bull Research has already discussed Agora's web of companies. Check out our extensive review to get a more in-depth look at this.

Bonner was able to stick to his key topics in building this empire. Under The Agora are numerous financial publications. In addition, there are also health newsletters and even supplements in the network.

Clearly, these fall under his Health and Wealth portfolio.

Determining the exact number of entities under Agora is still a challenge. There seems to be a constant restructuring that happens in the company.

Here is a list we came up with in our previous Agora article:

- Agora Financial

- Banyan Hill Publishing

- St. Paul Research

- Palm Beach Research

- The Oxford Club

- Brownstone Research

- Money Map Press

- Stansberry Research

- Empire Financial Research

- Investor Place

- Three Founders Publishing

- Rogue Economics

- NewMarket Health

- NewMarket Publishing

- Health Sense Media

- Health Sense Publishing

- Health Sciences Institute

- Paradigm Press

In Agora, it is common to see new publications. However, upon closer inspection, we would see that the new one is just a repackaged old company.

There are other permutations of this as well. Some also migrate to other publications as the old one is dissolved.

An example of this is Seven Figure Publishing. All of its editors and newsletters are now under St. Paul Research. If you want to know more about the latter, you may read our inside look at the firm.

Another case in point is Choose Your Financial. This publishing house was the subject of various complaints in 2018. Most of them were about the services and marketing tactics of James Altucher.

A Yahoo! Finance article, Meet the man behind those ‘bitcoin genius’ ads all over the internet, discusses this in detail. We also talked about it in our Altucher's Secret Income review.

The article first started with criticism of Altucher's bitcoin ads. Then there was a discussion on subscribers' sentiments who felt deceived by overhyped promotional materials.

Also, there was feedback that some of the claims of Altucher and his publisher, Choose Your Financial, border on get-rich-quick tactics.

Naturally, both deny the allegations.

What we found interesting here is that a certain Doug Hill spoke in defense of the publishing house. It is also stated that the parent company of Choose Your Financial is Agora Financial.

Further, the article describes the parent publisher as having “a long history of newsletters that push investing ‘secrets' through blustery marketing”.

At that time, it also had a 9% positive customer rating on Better Business Bureau, as per the write-up.

Clearly, there was a serious reputation issue in Choose Your Financial and Agora Financial. Both mainstream media and user-centric sites view them unfavorably.

But next thing we know, Choose Your Financial no longer exists.

All newsletters of Altucher are now under a company called Three Founders Publishing. More details on this are in our Green Bull Research article on the firm.

Care to guess who the three founders are? These are Doug Hill, Addison Wiggin, and Bill Bonner.

So if these are just the same persons running the show, why the need to constantly move and change names?

Would it be reasonable to assume that it has something to do with the unsavory remarks thrown at the original publishers? Do they want to escape their low subscriber ratings?

If it is, though it would be legal, is this something that we can classify as an ethical move?

For us, it will be a non-issue if they have done two things.

First, they should have addressed previous complaints against them. There are serious concerns like false advertising and fraudulent credit card charges. We believe we should always side with and protect consumers.

Second, in setting up new companies, there should be dramatic improvements to their services. Since they know what their paid subscribers complained about, there can be no excuses not to implement reforms.

It would be futile to just keep on dissolving old ones and setting up new ones without improvements. This does not help Agora and certainly not the consumers.

Controversies

The biggest issue Bonner has probably confronted is the Federal Trade Commission lawsuit.

In a press release on 29 October 2019, the FTC announced that they were suing Agora Financial, LLC. According to them, the publisher was actively deceiving seniors in their promotions. The services mentioned were:

- Doctor’s Guide to Reversing Diabetes in 28 Days (The Doctor’s Guide)

- Congress’ Secret $1.17 Trillion Giveaway

To some, Agora promised a certain cure for type 2 diabetes that is in their books and newsletters. Others, meanwhile, fell for their false claims about cashing in on a government program.

The complaint mentioned how Agora said that the cure had a 100% success rate. Not only that, but they propagated the idea also that traditional treatments were even making them worse.

Further, the FTC noted that the ads claimed that electronic devices were the hidden cause of this diabetes type.

Upon investigation, they found out that the treatment was just supplements. There is no scientific evidence that these can cure or even mitigate the disease.

Moreover, in the case of congressional checks, all the marketing for them was false and misleading. It even included an automatic subscription to a $99 a year newsletter.

In a February 2021 follow-up to the complaint, the FTC announced a breakthrough.

Agora agreed to settle the case and pay over $2 million, which will be used for refunds. In addition, the settlement also prohibited Agora and the other defendants from making false or unsupported claims.

The latest update on the issue came out in September 2021. The press release gave instructions to the 35,000 people who purchased the two services in contention.

We are glad that the outcome of this case favored the victims. Imagine, there were 35,000 people defrauded. Most of them were seniors who are not well-versed on the Internet: the fine print, disclaimers, and cancel buttons.

This is a despicable act. Law enforcement agencies must continue to expose and punish those who deceive the vulnerable.

The amount is minuscule compared to the stress and hassle the victims went through. It certainly will not even put a dent in the billions of revenues Bonner and Agora have.

So while we laud the outcome, we continue to hope for more developments similar to this. We know that there are a lot more victims out there who have not been heard yet.

Similarly, we are sure there are a lot more companies that exist to exploit the elderly and other vulnerable sectors.

We even discussed people groups prone to scams in our article, “Raging Bull Fraud – Are They Outright Scammers?”.

What do you think about this issue? Would you consider this an ultimate deal-breaker for Bonner and Agora? Or is this an isolated incident and does not represent their other services?

Of course, this is not the only issue with Bonner's The Agora. Our past article on the company already details pieces of evidence on:

- Misleading claims

- Wrongful Charges

- Deceptive Charges

- Refund Hassle & Issuing Credits

- Spam Galore

Conclusion – Is Bonner Trustworthy?

People treat him as the leading expert in the investment research industry. Even more prominent and decorated experts willingly submit under his vast Agora network.

Objectively speaking, he was indeed able to build a solid career both as a publisher and investor. Forty years is not a joke.

If his claims are true and verified, these Agora stats are impressive:

- The largest independent financial research network in the world

- Publications in 10 countries and translated into six languages

- Annual revenue of almost $1 billion

- More paid subscribers than The New York Times and Washington Post combined

- Around 2.5 million subscribe to the newsletters under Agora

- 500,000 daily global readers of Bill Bonner's Diary

However, the allegations surrounding him and The Agora are also alarming, which can be classified into one strong word: fraud.

We have provided all the leads to these details in this article.

So, is Bill Bonner a scam artist or an investing expert? What say you?