Brad Thomas is back and he's brought with him a tax loophole that he says regular Americans can begin using as early as September 10th.

He calls it “Amazon's Secret Royalty Program” and it's one of Wall Street’s most closely guarded secrets.

The Teaser

Amazon is one of the most profitable companies on the planet, grossing more t67 billion dollarslars in profits last year. But what does this have to do with a tax loophole and “royalty payouts?”

An investor with over three decades of direct experience, Brad Thomas has been through a couple of boom and bust cycles and now strives to help individual investors avoid some of the same pitfalls he encountered. We respect this and have previously reviewed his “Retail Riches” and SWAN Stock presentations here at Green Bull. Both were legit opportunities.

Right off the bat, we can rule out the following:

- Dividends – Amazon doesn't pay one

- Directly selling products on Amazon

- Becoming an Amazon Associate and earning affiliate commissions

Brad says it is none of the above and drops this hint:

“When we buy into “Amazon's Secret Royalty Program” we gain the legal right to collect “royalty” payouts when people shop on Amazon.”

Wall Street hedge funds and in-the-know billionaires have been raking it in with Amazon “royalties” for years now.

This is because with this “program,” we’re legally mandated to get paid…even if Amazon stock goes down!

At this point, all these quotation marks are making me a little uneasy like I'm missing out on an inside joke.

Alas, the answers to some of our questions lie in a FORM 8-K document filed with the SEC in September 2021.

$2.4 Billion Paid Out Last Year

The filer of the document is Prologis Inc. (NYSE: PLD), a REIT.

Inside it discloses that it paid $2.4 billion in dividends to shareholders last year, as it was mandated to do by federal law. It hasn't missed a single dividend payment over the last 20 years, which explains away much of what Brad has teased thus far.

See, ever since 2000, Prologis has been Amazon's landlord in 19 markets across four countries.

But the kicker is, there is also a second Amazon partner company that can double the annual dividends we receive.

The Pitch

All of this and the name of the second Amazon partner company are revealed inside a free special report called “Amazon’s Secret Royalty Program”: The Easiest Way to Collect Up to $28,544 Per Year From Amazon.

The report is ours if we take a 60-day risk-free trial of Brad's Intelligent Income Investor newsletter. Normally, it would cost us $199 per year, but Brad has lowered this to just $49 for a limited time.

Included in the offer is a brand-new investment recommendation every single month, full access to a model portfolio, and two other special reports titled The President’s Top Secret Energy Royalty and The Ultimate “Royalty” Play: Better Than Gold.

Why Amazon's Secret Royalty Payouts Will Keep Going Up

In 2022, U.S. e-commerce sales topped $1 trillion for the first time in history.

One company – Amazon, was responsible for nearly 50% of this figure.

Thanks to a growing global internet penetration rate and increased mobile use, e-commerce sales are expected to continue to grow by 9-10% annually over the next five years and by more than 20% in some fast-growing markets like Southeast Asia.

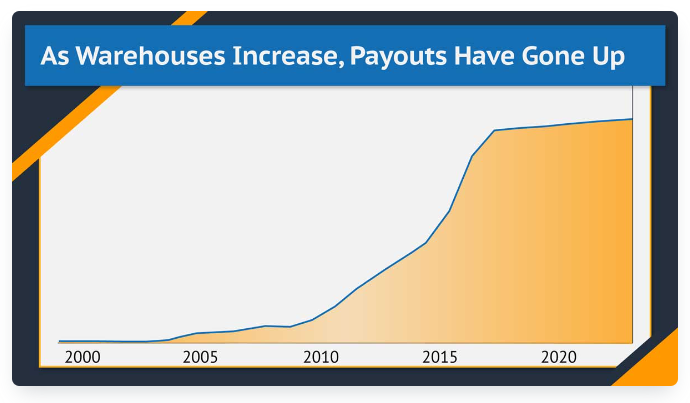

All of this means more warehouse space will be needed to keep pace with the growing demand and it seems reasonable to expect industrial property values and “payouts” to increase as well.

So far, this has been true

As the number of warehouses has gone up, so too have REIT dividend payouts.

Biggest Dividend Ever

Amazon is building its largest warehouse ever in Ontario, California as I write this.

A massive 4.1 million-square-foot, five-story facility that is the size of 22 Walmart Supercenters put together!

The project is finally set to open later this year after more than four years of construction. This is on top of the 50 other warehouses the company plans to open over the next few years.

For us as investors, it means the biggest industrial REIT payouts are yet to come.

We already know the name of one of Amazon's largest warehouse owners – Prologis Inc. (NYSE: PLD), now let's find out the name of its biggest data center partner.

Exposing Brad Thomas' Amazon Royalty Stock

Amazon has over 40 subsidiary companies.

The most successful of these is Amazon Web Services (AWS), which is a secure cloud platform that generated $80 billion in revenue last year, no big deal.

But AWS doesn't own its most critical asset – data centers. Amazon does own some of its own properties, but just like warehouses, most of these are leased from third parties.

So, who is the e-com leader's preferred data center partner?

No clues are provided, except for one…

“The REIT owns over 300 data centers worldwide, from Culpeper, Virginia to Melbourne, Australia.”

This one clue was enough to reveal Brad's second Amazon Royalty Stock as Equinix Inc. (Nasdaq: EQIX). Of course, I can't be 100% sure from just one clue, but this is what clinched it for me:

- Equinix owns data centers in Culpeper, Virginia, and Melbourne, Australia, where it is the largest data center owner in the country.

- AWS lists multiple Equinix data centers across several countries on its list of interconnected locations.

Collect up to $28,544 Per Year in Payouts?

Brad says “When we combine both secret “royalty” plays, we will be collecting $28,544 per year.”

Let's do the math on this.

The Prologis and Equinix REITs carry annual dividend yields of 2.9% and 1.7% respectively.

When combined, these would yield us 4.6% annually or $4,600 on a $100,000 investment.

To get to $28,000 per year, we would need to invest no less than a cool $600,000.

It could be reasoned that dividends will grow by 9-10% per year, about the same rate as e-commerce itself. But even at this rate, we're talking about investing a minimum of six figures in order to passively make anywhere near $28k per year.

Besides Brad's bad math, are these pair of REITs a good investment?

Both are already huge companies, with generous price/book multiples.

But asset and dividend appreciation are just about assured, which makes taking a small stake in each a logical play on the industrial property sector.

Quick Recap & Conclusion

- Brad Thomas is teasing something he calls “Amazon's Secret Royalty Program”, which could net us $28,544 in annual payouts.

- This is a sneaky way of teasing a pair of Real Estate Investment Trusts (REITs) that own warehouses and data centers which are leased back to Amazon and its subsidiary companies.

- The name of one of these REITs is Prologis Inc. (NYSE: PLD) and the name of the other is only revealed in a special report called “Amazon’s Secret Royalty Program”: The Easiest Way to Collect Up to $28,544 Per Year From Amazon.

- No clues are provided about the second REIT, except for one. Thankfully, this single clue was enough for us to be able to reveal Brad's second pick for free as Equinix Inc. (Nasdaq: EQIX).

- In order to make $28,544 per year in payouts as Brad suggests, we would need to invest six figures in this pair of REITs given their yields as of today. But this doesn't disqualify them as investments, especially if you're looking for income and exposure to the fast-growing industrial property sector.

Are you invested in industrial REITs? Tell us down in the comment section below.