Our review of Wealth Megatrends from Weiss Ratings will attempt to assess if it delivers on its promises.

According to its press releases, the newsletter's editor is “America’s #1 Gold Stock Analyst”. Aside from this, the company also claims that Sean Brodrick is the “Indiana Jones of Natural Resources”.

Together, let us dissect if subscribing to this investment research advisory will be worth your time and money.

Overview

- Name: Wealth Megatrends

- Founder: Martin D. Weiss

- Editor: Sean Brodrick

- Company: Weiss Ratings

- Publisher: Banyan Hill

- Website: www.issues.weissratings.com

- Service: Monthly investment research advisory

- Cost: Standard – $29, Deluxe – $119, Premium $59 (from $496)

Weiss Ratings, through Wealth Megatrends and its editor Sean Brodrick, wants to simplify stocks for you.

Without a doubt, the topic can be intimidating. There seem to be too many terms to memorize and understand. Also, the stereotype of a “stocks” person is that of a math and finance whiz.

In addition, being involved includes risking huge amounts of money. For someone to succeed, one has to have deep pockets.

The hesitation and confusion stem from these kinds of perceptions. Obviously, not everyone is adept at financial accounting or has truckloads of cash to invest.

So Brodrick aims to reach out to people who feel this way. According to the editor, he can help newbies and even seasoned investors understand the stock market better.

Wealth Megatrends breaks down complex concepts and explains them in its monthly research advisory.

When you use its service as a guide, you will not only understand the markets better. You will also earn enough money for your retirement, with much left for your wants and needs.

What is Weiss Ratings?

Wealth Megatrends is under the banner of a popular research and rating agency called Weiss Ratings.

It boasts of being number one in terms of coverage and independence. Included in its assessments are about 55,000 financial institutions like credit unions, banks, and insurance companies. They also rank ETFs, stocks, crypto, and mutual funds.

Since it opened, Weiss has pioneered several services in the country:

- 1989 – first to rank insurers

- 1994 – first to rate HMOs

- 2001 – first to issue stock safety ratings

To do its task, the firm has created a system so they can best study everything they rank and assess. Under this system are Weiss Investment Ratings and Weiss Safety Ratings.

The former covers mutual funds, ETFs, and stocks. Meanwhile, the latter focuses on insurers, banks, and credit unions.

Under the investment ratings, they will help you decide whether to buy, hold, or sell. The assistance they provide makes sure you will maximize your gains while minimizing your risk exposure,

Meanwhile, safety ratings give a different service. The goal is to help you find trustworthy institutions for your savings and retirement funds. Its purpose is similar to that of credit ratings.

They use letters A to F for their grading scale. “A” means excellent while “E” is very weak. An “F” signifies a failing grade.

Who Leads Wealth Megatrends?

Editor

The face on the Hollywood-style headshots and poses above is Sean Brodrick's.

Weiss Ratings lists him as the editor of Wealth Megatrends. The man is a Senior Editor at the company and he specializes in cannabis, commodities, and stocks.

Aside from Wealth Megatrends, Brodrick is also in charge of Gold & Silver Trader, Supercycle Investor, and Marijuana Millionaire. The editor is also the author of “The Ultimate Suburban Survivalist Guide”.

A former journalist, he claims to be among the first to inform the public about the commodity supercycle. He further says that he is among the pioneers in resource and tech megatrends.

His interests include “precious, industrial, and energy metals such as gold, silver, palladium, lithium”.

All in all, he has 30 years of experience as an investment analyst. What sets him apart from others is his boots-on-the-ground approach. This gives him a unique perspective on investing.

As a result, he says that he can discover opportunities and dangers before anyone else. It is also the reason why he claims to be best known as the “Indiana Jones of Natural Resources”.

Right.

It is not clear who exactly gave him this moniker, but we reached page 5 of Google and found no credible evidence. All of them were from his marketing materials.

In a promotion for one of his other services, there was also a statement about Brodrick being “America's number 1 gold stock analyst”. Again, no third-party confirmation for the title.

Forgive our skepticism because self-given titles are so common in this industry. It's as if it is the primary reason why people subscribe to their services. We doubt if readers actually believe them anyway.

To publishers and editors: if you want more subscribers, show clear proof of success and track record. Do not hide behind ambiguities that do not really mean anything.

We have already reviewed bazillions of newsletters here. Sadly most drown would-be subscribers with meaningless verbiage that are neither useful nor helpful.

Of course, in this case, we want to give Brodrick the benefit of the doubt. If you have authoritative references to his titles, tell us below.

Founder

Even if Brodrick is the editor of the said newsletter, the firm's founder figures prominently in all marketing materials.

The rating agency is headed by its founder, Dr. Martin Weiss. Forbes, he claims, gave him the title “Mr. Independence” due to the agency's reliable and objective assessments.

He has a political science degree from New York University and a cultural anthropology Ph.D. from Columbia.

The philanthropist and education advocate is a well-known investment resource speaker. He has already appeared before Congress and speaks in schools and business TV programs.

He opened Weiss Research in 1971 to help consumers, agencies, and the media assess the risks of various companies.

What is Wealth Megatrends?

The Internet has democratized our access to more knowledge. Nowadays, both a student from Southeast Asia and an executive in Canada can research the latest investing trends.Despite the growing number of resources on financial education, people still need more reliable information. We say this because along with credible news, there has also been a spike in misleading data.This is especially prevalent in anything and everything related to money. Obviously, everyone wants to make more of it. As a result, investment research newsletters are born periodically. Publishers want to make the most out of people's incessant drive to be rich.

Wealth Megatrends, as a service, says it aims to be a credible source of investment news. The editor is aware of the fact that there is already a lot of existing information out there.

But Brodrick maintains that he can still contribute to the conversation.

His newsletter basically wants to simplify earning, spending, saving, and investing money. With his three decades of experience, he has a lot of insights on stock market news that he is willing to share.

Subscribers can also expect high-yielding investment recommendations from the service. You can trust him and his analyses, Brodrick says, because he is among the best in the business.

The monthly newsletter will provide in-depth research on big trends with highly liquid stocks and growing dividends.

The megatrends he looks at include public and private debt, electronic payments, and marijuana legalization. According to the editor, you may also cash in on our increasing reliance on robots and electric vehicles.

In a nutshell, expect to hear advice on companies of the future. They may not look like profitable investments now, but they will be soon. According to Brodrick, just trust his predictions and you will see a high ROI.

So how reliable is he? What is his track record? Does he have solid examples that display his so-called expertise? What is his specific process?

We will discuss these in the next sections.

How it Works

When you study Brodrick's style as an investor, it will be clear to you that he is primarily a small-cap guy. He also mostly invests in, but is not limited to, opportunities in the natural resources sector.

There is indeed a huge earning potential in small-cap companies. Under the guidance of a smart investor, you can make a lot of money.

An article on Business Insider reported that small-cap outperformed large-caps in 2020.

If the editor can indeed spot small companies who will make it big in the future, you can invest before anyone else. This is similar to spotting Amazon or Apple before they became big.

Just imagine how high the current returns are for the early investors in these companies. They were able to buy their shares when they were sold at cheap prices.

However, this is route is not easy. While it is true that small-cap outperforms large-cap, you should still consider their volatility and risks.

In fact, we already mentioned this in our review of Ian King's New Era Fortunes. Read that article first if you want a newsletter to compare Brodrick's with.In addition to his small-cap strategy, Brodrick also relies on his deep understanding of the K-wave. This pertains to cycles where the market adjusts and corrects itself as a result of technological developments.

A January 13, 2021 article on Bloomberg says succinctly what this means for the economy.

The headline and sub-headline read:

A Dead Soviet Economist Has Bad News for StocksIf we’re in the early stages of a Kondratieff wave for commodities, that suggests the outlook is bearish for equities.

According to Weiss Ratings, the K-wave is indeed already underway. The question is if you can maximize this to your advantage. When you subscribe to its newsletter you can protect and still grow your wealth.

Even gains of up to 2967% are possible under the expert guidance of Brodrick. You can achieve this through:

- the editor's predictions that will result in multiplying your money

- advice on whether to buy, sell or hold particular stocks

- guidance on currency and commodity movements around the globe

- gold market trends and updates

According to him, this no-fail strategy has worked for him and his clients since 1987.

So far, this is all the information he has to explain his process. If you were to entrust your investment decisions to Brodrick, will the explanation above suffice?

This is the perennial question we pose on editors who claim expertise in investing. A lot of them could not adequately explain their methods. It seems like they rely more on the instincts they have developed through the years.

Investors like George Gilder and Jim Rickards fall in this category. They seem to bank on their names and the reputations they have built to sell their newsletters.

Read the following reviews to learn more about what we mean:

- Is Jim Rickards Credible? We Have All The Info You Need

- The George Gilder Report Review – Tech Trends Crystal Ball?

- Ultimate Guide: Jim Rickards’ Strategic Intelligence Review

The lack of specific details may (conditional, not automatic) be excusable if (and only if) the expert has unparalleled credibility and track record. But among the current crop of newsletter editors, who can pass this test?

Besides, even established names disappoint subscribers. Though they will acknowledge the ideas or writing style, they will still give a thumbs-down rating. Why?

Well, at the end of the day, it's still about the money. No one cares if the editor they subscribe to has celebrity status. If his/her recommendations make you lose money, the fee will not be worth it.

What you get

When you subscribe, you will get immediate access to the reports and special add-on features.

First on the list is the monthly newsletter containing Brodrick's analyses and recommendations. You will find the meat of your subscription here.

In addition to the dispatch every thirty days, he will communicate via email. This will arrive more frequently so you can be updated on urgent news.

He also adds online VIP briefings so you can interact with him on a more personal basis. Through this, you will better understand his views on current market trends.

To sweeten the deal, he also has a special offer.

Brodrick and Weiss Ratings are making available to you one of their more in-demand services. You will get a free three-month subscription to Weiss Stock Ratings Heat Maps.

According to the editor, this is the “number one stock-rating system in America”.

Right.

Anyway, Brodrick claims that this “high-powered computer program sifts through more than 12,000 stocks to find the strongest, top money-makers”.

In addition to this, he also offers a special report, the Stock Market Tsunami: Catch the Crest and Escape the Crash. It will further explain what the K-wave is.

Along with this information are his strategies so you can make your investments grow by 300% up to 500%.

In summary, here are the available annual membership plans:

- Standard – $29

- Digital-only subscription to Wealth Megatrends and Weiss Stock Ratings Heat Maps

- Additional five bonuses

- Deluxe – $119

- Digital and print subscription to Wealth Megatrends and Weiss Stock Ratings Heat Maps

- Additional five bonuses

- Premium – $59 (from $496)

- Digital and print subscription to Wealth Megatrends and Weiss Stock Ratings Heat Maps

- Additional five bonuses

- Guaranteed Income Special Report

- Global War Investment Dossier Special Report

- Swing For the Fences Special Report

The website does not specify what the five bonuses are. But if we are to look at the most recent promos, they could be among the following:

- Boom, Bubble, Bust

- Bloodbath in Bonds

- The New Precious Metals

- Welcome to Cannabis Country

- Better Than Bitcoin

- How to Go for Wild Gold Profits

- The Final Reckoning

- Your Best Defense

- The World’s Best Privacy Havens

- The Windfall of a Lifetime

Cost and Refund Policy

Cost

- Standard – $29

- Deluxe – $119

- Premium $59 (from $496)

Refund policy

According to Brodrick, all that he offers you in Wealth Megatrends is a “risk-free, trial subscription”. This is because he has a one-year money-back guarantee.You may cancel on the last day of your subscription and he will return your subscription fee. What's great about it is you can keep all that you have received by that time.Truth is, we know better and are aware there is no such thing as a risk-free subscription.First, we know that any investment automatically comes with risks. You may eventually lose your money.Second, even if you do get your money back, they already have one of your most precious possessions. Your email address.In this information economy, data is king. People buy personal details for thousands and millions of dollars.So the risk here is that you will expose your inbox to a barrage of promotional spam mails.

But if you find him and his service credible, it is a good deal.

Track Record and Reviews

We are aware that online reviews are only snapshots of experiences. At the same time, we also give value to user experiences that's why we feature them in this space.

On Stock Gumshoe, Better Business Bureau, and Trustpilot, there are no reviews of Wealth Megatrends yet. What we did was we looked at comments on Weiss Ratings and Brodrick's other services.

We hope that through this, you will get a sense of how this specific newsletter will fare as well.

Brodrick's $10 Trigger Alert got 3.1 out of 5 stars from around 50 votes on Stock Gumshoe. This is an old service from the editor when he was still with The Oxford Club. It focuses on stocks that are under $10.

Meanwhile, his other service with this previous publisher got 2.4 stars as of this writing. This was the Oxford Resource Explorer that he co-wrote with David Fessler. The newsletter covered stocks on natural resources.

These are pretty decent ratings from subscribers, even if the commenters complained about the excessive spam emails of The Oxford Club.

For his part, Stock Gumshoe's Travis Johnson found Brodrick's claims to be exaggerated. He said this when he wrote about the editor's teaser on “Gold for $287 per ounce”.

To us, this is not surprising as hyperbole is a usual tactic investment research companies use to lure customers.

When you hear about this, how does this affect your trust in the editor and/or his/her publisher?

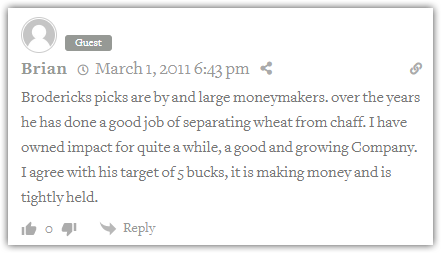

Despite this, we also saw a positive comment regarding Brodrick's overall track record.

The review page for Weiss Ratings on Better Business Bureau shows a 1-star rating from less than 10 users.

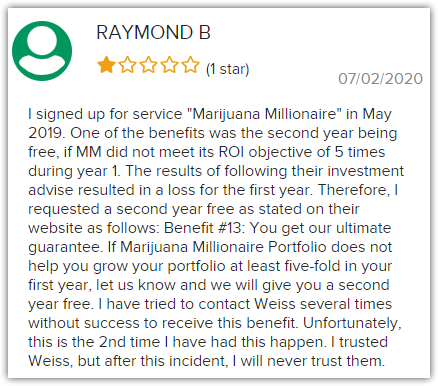

As you can see in the comment below, one user was not impressed with Brodrick's Marijuana Millionaire. For Raymond B, the recommendations and customer service were subpar.

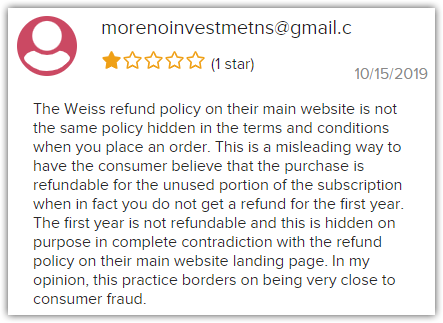

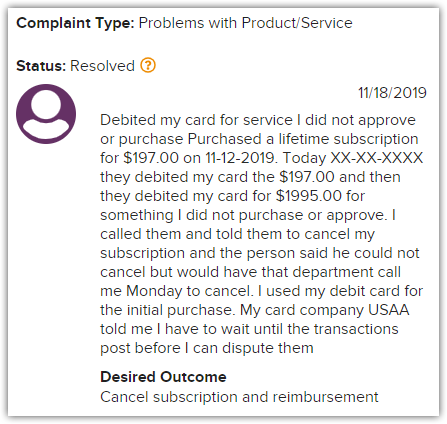

The two comments below decried the policies of the rating agency. One even said that the company does not follow the refund policy they advertise.

Meanwhile, Weiss received 1.5 out of 5 stars from around 70 reviewers on Trustpilot.

Both the company and Brodrick were put in a bad light in the comments below.

As we try to be comprehensive here, we also looked at a pitch for the editor's other newsletter, Wealth Supercycle/Supercycle Investor.

We looked at the supposed subscriber reviews and randomly picked one of them.

Norm seems like a regular fellow, right? We cannot pinpoint what it was, maybe call it our Bull Detector, but something was off.

So we reverse-searched the image. Well, it seems like Norm is not so normal after all. He is apparently a popular celebrity who has a lot of online engagements.

Wow, what a fortunate company Weiss Ratings is. It got a review from an Internet sensation involved in various industries. It's nice to know that Norm or Robert or Romeo is satisfied with Brodrick's services.

Very nice.

Pros v Cons

Pros

- The newsletter has the backing of a rating agency

- Small-cap companies have the potential for a good profit

Cons

- Negative reviews for both Weiss and Brodrick

- Allegations of plagiarism for the newsletter's mother company

- Complaints on credit card charges and refunds

- Fake reviews/photos

Conclusion – Will You Get Mega Wealth?

We have discussed a lot already.

In this article, you were able to get a glimpse of the newsletter, its editor, and its mother company. We also walked through both the good and bad feedback.

Did our Wealth Megatrends (Weiss Ratings) review help you decide if you will avail of their services? Tell us what you think!