According to Tim Plaehn, we already have enough money for retirement, we just don't know it yet.

It's all thanks to a new income investment he calls “Paycheck ETFs“, which could passively make us $5,000 per month or more on autopilot.

The Teaser

This is being touted as a brand new way to get more income without trading the market, buying complicated annuities, or borrowing against existing assets.

Tim has been a financial planner and stock broker since 2007, and now he's the lead analyst for income and dividend investing at the TIFIN-owned site, Investors Alley.

We have covered some of Tim's previous work, including his Daily Dividends, as well as other retirement-related teasers, like Bob Carlson's “Guaranteed Income Blueprint“, so we're ready to unpack the bold claims that often come with these.

The statement that starts this one may be the boldest yet.

Just about two minutes in, Tim says he's going to show us how to turn stocks like Tesla and Apple, which pay little to no dividends, into..

monthly income machines that pay 50% annually!

Such financial wizardry would even stump Enron's accountants, so how is he going to do it?

It's supposed to be as easy as buying a stock, generates monthly dividends just the same, and is made possible by a “freedom window.“

However, its so new, that most people don't even know it exists yet.

It's exchange traded funds (ETFs), which have been around for more than three decades, but not just any ETFs.

Tim calls them “Paycheck ETFs“, but what he's really talking about is Derivative ETFs.

As their name indicates, these use futures, forward contracts, swaps, and options to bet on the direction of an underlying asset like gold, an index such as the S&P 500, or a benchmark like a particular stock.

The income generated from covered call option premiums is then distributed to investors on a monthly basis.

A classic Wall Street concoction, the first of these emerged in the early 2000s, around the same time inverse and leveraged ETFs began to sprout up.

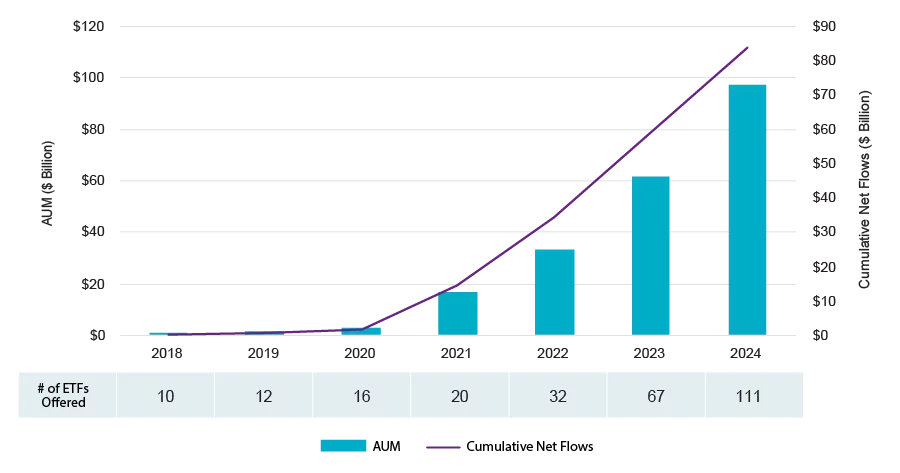

Now, more than 110 derivative ETFs exist, holding nearly $70 billion in investor funds.

Derivative ETFs are on the come up.

But do they make sense as a retirement investment strategy and which ones is Tim recommending?

The Pitch

All of this info has been compiled into a report called “The Freedom Number Blueprint: How to Speed-up Retirement with Paycheck ETFs.”

To claim it, we'll need membership to a premium research service called ETF Income Maximizer.

A trial costs $49 upfront for the first year (normally $99) and comes with a full 365-day money-back guarantee.

The Only Number That Matters for Your Retirement

Upon leaving the Air Force and becoming a financial planner, Tim's eyes were opened.

He realized that the financial system was designed to generate fees for Wall Street, not income for investors.

Can't argue with him here.

The 2/20 asset management model and short-term trading promoted by most brokerage apps definitely bring in a lot of money regardless of how well you do.

It's not much different when it comes to retirement planning.

Whether it's the vaunted 4% rule, that says withdraw money that could otherwise compound every year or needing a cool $1.5 million invested to make $45-$60k per year, assuming a steady 3-4% dividend yield and no significant capital depreciation during your retirement.

It's no wonder that most retirees biggest fear isn't a missing little umbrella in their Piña Coladas, but running out of money or a stock market crash.

Tim lives by a different set of rules.

He staunchly believes the only number that truly matters for retirees is a “freedom number” or the monthly income needed to live a comfortable life.

Whether this is $3k, $5k, or even $10k per month, derivative ETFs are one way to hit this number with far less money than a million bucks.

After all, some of these offer annual yields as high as 260%!

Is this the best way to earn income in the market?

Let's just say there are pros and cons, but before we get to those, let's find out specifically which derivative ETFs Tim is recommending.

Revealing Tim Plaehn's Paycheck ETFs

Tim has spent the last three years analyzing derivative ETFs, their payment histories, and owning them in his own portfolio.

Unfortunately, there was no information forthcoming about any derivative ETF pick in Tim's entire 41-minute video teaser.

However, some internet scuttlebutt proved useful.

We were able to find that Tim used to own and perhaps still does own, the following derivative ETFs:

- Global X Nasdaq 100 Covered Call ETF (Nasdaq: QYLD)

- Silver Shares Coverall Call ETNS (Nasdaq: SLVO)

- Virtus I Infracap U.S. Preferred Stock ETF (NYSE: PFFA)

- Infracap MLP ETF (NYSE: AMZA)

The YieldMax TSLA Option Income Strategy ETF (NYSE: TSLY) and YieldMax XOM Option Income Strategy ETF (NYSE: XOMO) are two other possibilities that have been suggested elsewhere, but no way to confirm these.

Make $5,000 Per Month on Autopilot?

This is the first time we have covered derivative ETFs and given their increasing popularity, it probably won't be the last.

The first thing we should all know about derivative ETFs is that they are completely synthetic – so instead of owning an underlying asset, we own exposure to derivatives that replicate an asset's performance.

So we are sacrificing ownership and upside for income.

But that's not all…

Unlike traditional ETFs, derivative ETFs have management and swap fees, which can bring their total expenses higher.

There is also no downside protection, so if an asset declines, so does the derivative ETF.

However, this isn't the worst part.

That honor goes to the counterparty risk that is inherent in every derivative ETF.

If you were in the market in 2008 or just watched The Big Short movie, you've heard this term before.

It's the distinct possibility that one party involved in a derivatives transaction will default on its contractual obligations.

In this instance, it would be the party agreeing to buy the ETF's assets at a specific price (strike price) by a certain date, and paying a premium (where the ETF gets the income to pay dividends) for this option.

The counterparties are all banks and hedge funds, which would all be materially affected if a market downturn were to take place.

Another thing we should be aware of is that the parent company of Tim's employer Investors Alley, TIFIN, has partnerships with companies that issue derivative ETFs, which are then promoted through sites like Investors Alley.

At the end of the day, using Tesla and it's derivative ETF as an example, this is what we would get for all the trouble:

The 4% alpha of course includes dividends.

If you have the capital to try out a new strategy, derivative ETFs may be worth looking into.

But if you're using funds earmarked for retirement, that you can't afford to lose, the overall returns of derivative ETFs don't beat an index.

Quick Recap & Conclusion

- Income investing proponent Tim Plaehn is teasing a new type of income investment he calls “Paycheck ETFs“, which could passively make us $5,000 per month or more on autopilot.

- What Tim is really promoting is Derivative ETFs, which he believes are the best option to hit our “freedom number” of monthly income we need to live a comfortable life in retirement.

- The names of the Derivative ETFs Tim is recommending have all been compiled in a report called “The Freedom Number Blueprint: How to Speed-up Retirement with Paycheck ETFs.” All we need is a membership to his premium research service, ETF Income Maximizer, which costs $49 upfront for the first year (normally $99).

- No Paycheck ETF clues were provided in the video teaser, but we did provide of list of names Tim teased and owned in the past, and perhaps still does.

- Derivative ETFs are synthetic ETFs that provide income and nothing else. Only you can decide if the trade-off is worth it for you, but the overall return (including dividends) of derivative ETFs don't beat an index.

Do you own any derivative ETFs? Share your experience in the comments.