Expert financial advisor Tim Melvin has gone on the record with a bold market prediction.

He says one “dirty” fossil fuel stock will mint fortunes thanks to Biden’s radical trillion-dollar renewable energy policies, but we only have until November 28th to get in for maximum profit.

The Teaser

The estimated cost of shifting the U.S. power grid to 100% renewable energy over the next decade is an estimated $4.5 trillion and major shifts like this have always minted countless millionaires.

Tim Melvin started out selling vacuum cleaners door-to-door, but over the past 30 years, he's mastered the market and become a financial advisor to millions. I respect it.

This is my first time reviewing a pitch by Tim, a momentous occasion worthy of celebration. I have however covered plenty of energy-related teasers in the past, including Ian King's “AI Energy” Pitch and Brian Perry's “Energy Giant” play. Let's see how this one stacks up.

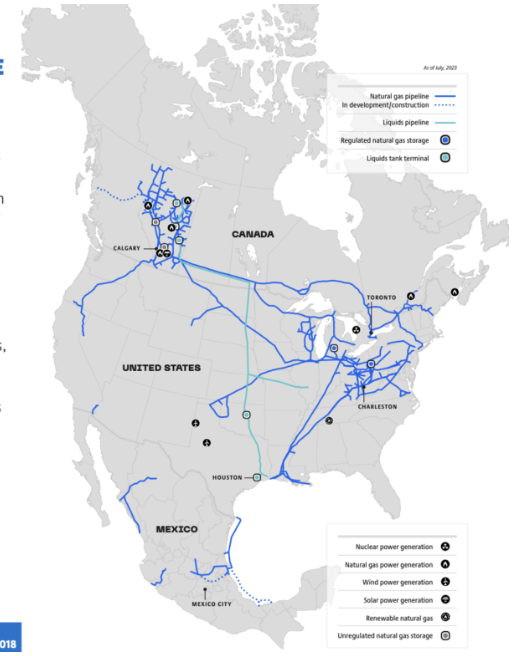

If we take a look at the map, one thing stands out.

The blue lines we see are owned by America’s most HATED stock that is in full control of Biden’s $4.5 trillion energy revolution.

Tim says if we follow the instructions in this presentation by November 28th, we could generate $91,761 per year simply by holding this one stock.

What is Tim getting at here?

Despite mainstream news headlines to the contrary, the best opportunity right now to grow an energy investing fortune (and lifelong income stream) is not with green stocks, but with oil and gas.

All of Tim's research points to a brand new trillion-dollar energy surge that will cause oil and gas stocks to skyrocket.

As trillions are pumped into new energy infrastructure, just like an oil well, this “dirty” stock will continue gushing more cold-hard cash.

It's all because of an upcoming announcement set to be made in the coming days and weeks.

An Ultra-Rare Quick Income Window

By midnight on November 28th, the company that owns the blue lines on our map is set to make its next major announcement.

It is due to be the much-anticipated launch of their newest billion-dollar pipeline expansion, connecting the entire North American continent.

This has opened a “quick income window” that could trigger a buying frenzy in the stock and help mint a new round of energy millionaires.

So, what is this stock?

The Pitch

The name and ticker symbol of the stock are only revealed in a brand-new report called The #1 Energy Income Stock to Buy and Hold Forever.

It, along with a couple of other bonus reports is ours if…we take Tim's 20% Letter for a subscription spin. Every month Tim publishes his best recommendations in the newsletter and he claims they have generated 20% total returns every single year.

Besides the bonus reports and monthly picks, the newsletter comes replete with weekly video updates, a white-glove concierge service, and a 12-month money-back policy. All of it is ours for only $79 for the first year.

Three Big Reasons Why America Can't Ditch Oil and Gas

Regardless of how much hate politicians and the media spew against oil and gas, the reality is we need pipelines to gather, process, and move it from point A to point B.

These are the three primary reasons why:

Reason #1: We’re almost out of copper

Electric vehicles, solar and wind power, and batteries for energy storage all use enormous amounts of copper.

According to an S&P Global report, “to meet the demand for energy in 2050, we'll need more than all the copper consumed in the world between 1900 and 2021.”

The exact opposite of sustainable.

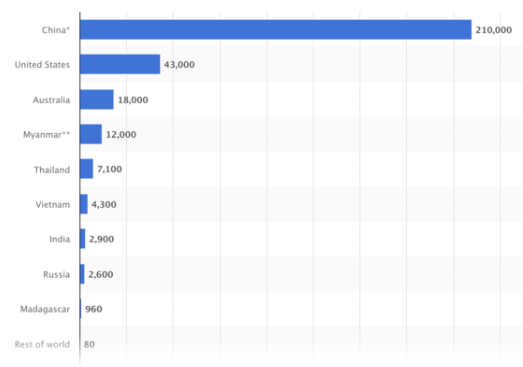

Reason #2: China’s block on rare earth metals

There have been plenty of alternatives pitched, but as of today, rare earth metals (REM) are needed for everything from wind turbines to smartphones.

The problem with this is that about 85-95% of REM processing takes place in China.

Only one rare earth metal facility currently exists in the United States and despite the Department of Energy (DOE) launching a program to develop America's first critical minerals facility, such a facility is still years away.

Reason #3: U.S. energy grid can’t keep up

One of the goals of Net-Zero is to reach 100% electric vehicle usage.

All that is required we're told is a not-so insignificant 25% capacity increase to the US energy grid.

It would be difficult if the U.S. had just one grid, but the country has a total of 13 grids. To accomplish a 25% capacity increase in 30 years, nevermind only a few years, the nation's transmission network would require a trillion-dollar overhaul. Something tells me higher utility bills and taxes would be part of this equation.

Given all of the above, natural gas and oil are going to be with us for a good while longer, setting up Tim's #1 stock to continue to profit from our dependence on “dirty” fossil fuels.

Revealing Tim Melvin’s “Dirty” Fossil Fuel Stock

We get a few telling clues about what this stock could be:

- The stock has an 8.1% dividend yield and we will collect that amount into 2024 when a spinoff is accomplished.

- The CEO of the company has been quoted as saying: “We can move gas from Northeast British Columbia, and when [this new project] is completed, all the way down to the Yucatan Peninsula. No other company can deliver that type of service.”

- It has already been making headlines: “International demand for [Hated Energy Company’s Product] is on the rise, as countries around the globe seek out reliable long-term supplies.” – MSN.

These quotes proved to be enough and led me directly to Tim's pick – TC Energy Corporation (NYSE: TRP).

- TC stock has had a good run over the past month and as a result, the dividend yield now stands at 7.3%.

- The first quote is from a December 2022 press release, in which TC President and CEO Francois Poirier said “We can move gas from Northeast British Columbia, and when Southeast Gateway is completed, all the way down to the Yucatan Peninsula.

- The last quote is from the Gas Exporting Countries Forum's 2022 Global Gas Outlook and the “hated product” is natural gas.

Best Chance to Mint a Fortune in 3 to 5 Years?

Let me start by saying I agree with Tim's fundamental premise about oil and natural gas demand continuing well beyond 2030.

The supply of natural resources simply won't be able to keep up with the demand needed to sustain an all-renewable energy grid. It will need to be subsidized, at least in part, by fossil fuels unless there is a major fusion energy breakthrough or something of that nature.

As for his statement about not needing TC to expand much in order to see significant gains because it throws off so much income, this is the ideal type of resource investment. One where you just sit back and collect income rather than hope and pray for capital appreciation.

Nonetheless, the company does have plans for expansion, as Tim noted earlier.

TC's spin-off of its crude oil pipeline business has also been approved by shareholders. Under this transaction, TC Energy shareholders will retain their current ownership in TC Energy's common shares and receive a pro-rata allocation of common shares in the new liquids pipelines company.

Shareholders still need to vote on this transaction, which won't happen until mid-2024 at the earliest, so expect the deal to be done by the end of next year. This will unlock some value.

Nothing is ever guaranteed in terms of annual growth, especially when pipeline approvals and the like are involved, but the current 7% dividend yield is a solid foundation to start with. Even if the major planned expansion doesn't materialize on the timeline everyone expects.

I like this play if you already have an established portfolio and are after capital preservation and income, instead of explosive growth. It can add to and pad your fortune, instead of make it.

Quick Recap & Conclusion

- Tim Melvin says one “dirty” fossil fuel stock will mint fortunes thanks to Biden’s radical trillion-dollar renewable energy policies, but we only have until November 28th to get in for maximum profit.

- The facts on the ground say America won't be able to ditch oil and gas anytime soon, which means this fossil fuel stock's income stream isn't going anywhere and could even grow if its expansion plans pan out.

- This stock's name and ticker symbol are only revealed in a brand-new report called The #1 Energy Income Stock to Buy and Hold Forever.

- A couple of quotes were enough for us to reveal the stock for free as TC Energy Corporation (NYSE: TRP).

- TC is an established energy infrastructure company with a 7.3% annual dividend and a major planned pipeline expansion on the way, making it an ideal candidate for capital preservation, income, and maybe even some growth as an added bonus.

Is Tim right about the world continuing to be dependent on fossil fuels long after 2030? Leave your thoughts in the comments.