Toxic politics, a widening wealth gap, culture wars. According to financial publishing entrepreneur, Porter Stansberry, these are just the symptoms of a far deeper phenomena.

He calls it the “Parallel Processing Revolution” and a few stocks are the only way to profit.

The Teaser

According to the latest statistics, some 14% of all workers have already been displaced by this force.

Porter Stansberry is a name that will be familiar to many readers, he started Stansberry Research in 1999 and produced a mini documentary titled The End of America…in 2011.

We have reviewed his most recent teasers, including his Nuclear Energy Company, and “Trump's Secret Stocks.”

The force or phenomena Porter is warning about in this one is Artificial Intelligence (AI).

He calls it “The Final Displacement” because it will doom the vast majority to serfdom, while creating a new ruling class.

It sounds like a Mad Max-style society may be close at hand.

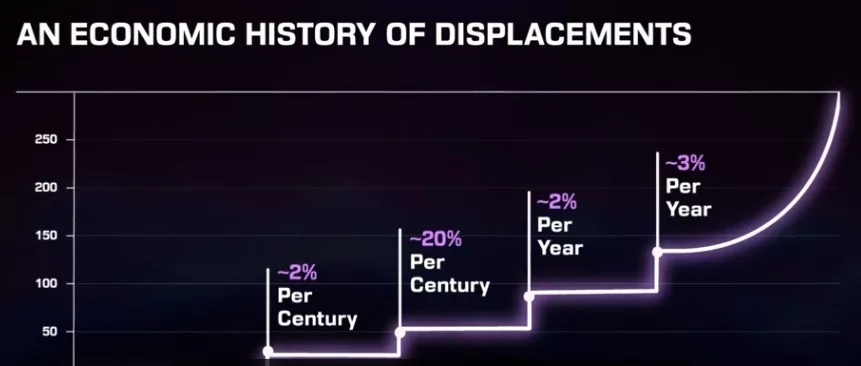

Porter continues, saying only four other events across the entire span of known human history have had anything close to the same effect (more on this later).

If AI does end up generating up to $23 trillion in annual economic value by 2040, as some like McKinsey are predicting, he could be right.

In response, some are calling for a universal basic income, others for a special AI tax.

Although there's nothing we can do to change the trajectory of such market forces, we can position ourselves to profit from them.

To this end, Porter isn't talking about any one stock, but six critical and potentially lucrative, companies that are leading this multi-trillion-dollar revolution.

The Pitch

Their names are only disclosed in a report called The Parallel Processing Revolution.

To get it, we'll need access to Porter & Co.'s flagship newsletter, which is being offered for a one-time payment of $199 (normally $1,425), with a 30-day money-back guarantee.

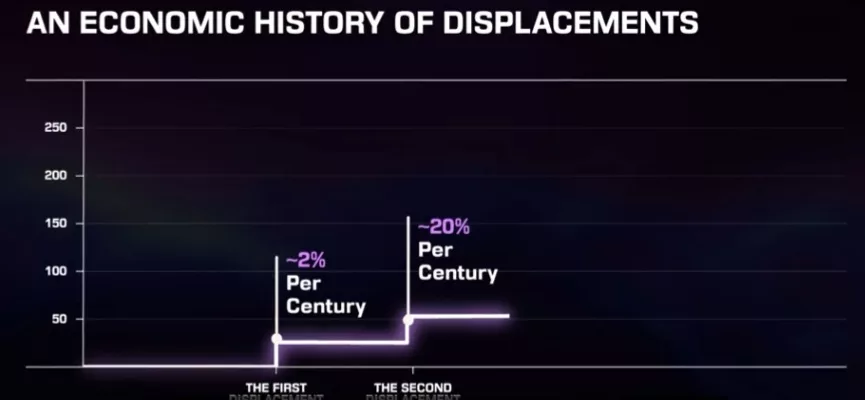

The Five Great Displacements

Before getting to the good stuff – information on his stock picks, we get a brief history lesson.

It starts with the first citizen of Athens, no not Hercules, Perciles.

The First Great Displacement

During Perciles time as Athens' preeminent statesman, he started ambitious projects such as the Acropolis, water wheels, and the ancient marvel of paved roads that pushed civilization forward.

For the first time, economic growth began to take place:

Although the pace was Japan-like, it was real sustained progress that eventually led to something more familiar.

The Second Great Displacement

We all know about the “Great Renaissance” and the art, science, and innovations that it produced.

But early navigation and something called ‘banking' drove explosive growth, at least by 16th century standards.

However, it wasn't until the industrial revolution that things really began to pick up.

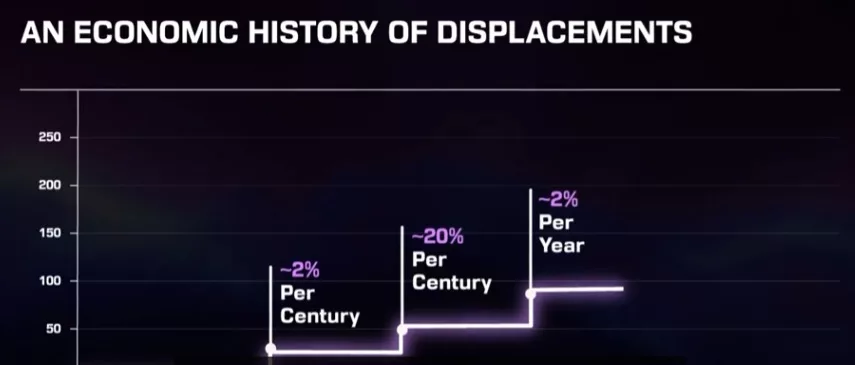

The Third Great Displacement

Railroads, steam engines, and electricity gave rise to industry, which brought growth closer in-line to what we are familiar with today.

Still, it was nothing compared to what was to come.

The Fourth Great Displacement

Computers and the internet made global communication instantaneous.

It didn't just move the needle, it enabled anyone to create wealth for themselves for a small fraction of the initial startup costs of yesteryear.

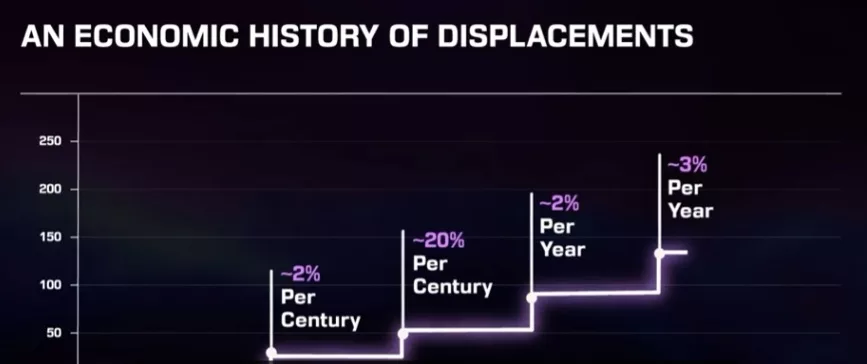

If you've been paying attention, each great displacement came about due to the arrival of a disruptive technology.

Some were more crude than others, but its been a common denominator throughout, and now Porter says a fifth and “final displacement” is upon us.

One that will be bigger than all the rest.

Revealing Porter Stansberry's Parallel Processing Revolution” Stocks

AI, robotics, quantum computing, all of it is powered by one thing…computer processing power.

Porter's picks revolve around it and more specifically, the parallel processing that advanced graphics processing units (GPUs) make possible.

Nvidia is at the head of this, given it's 80% GPU market share. That's why Porter's first pick is one of its strategic partners.

Nvidia's First Secret Partner

- It sells the only machines capable of manufacturing the sub-10 nanometer chips found in Nvidia's GPUs.

This was an easy one, it's ASML Holdings NV (Nasdaq: ASML).*

- ASML's extreme ultraviolet lithography machines are the only devices in the world capable of manufacturing the ultra-powerful sub-10 nm chips that power Nvidia GPUs.

Nvidia's Second Secret Partner

- This company makes 90% of the chips needed for GPUs parallel processing capabilities.

Another layup, Porter's second secret partner stock is Taiwan Semiconductor Manufacturing Co. (NYSE: TSM).

- TSM produces nearly 90% of the world's most advanced semi chips.

Nvidia's Third Secret Partner

- Unlike the previous two manufacturers, this company simply designs the blueprints for the world's top-performing GPUs and CPUs.

This sounds like Arm Holdings Plc (Nasdaq: ARM).

- Arm's low-power chip designs are what enable high-performance computing in cloud infrastructure applications.

The remainder of Porter's picks center around the energy sector, but the clues are kept shorter than Gen Z's attention span.

Respectively, a “King of Coal“, coal industry consolidator, a buyer of a $735 million Marcellus Shale operation, and a company that has “already won the Small Modular Reactor (SMR) arms race” are teased.

Can't be sure about the first, but I'll guess Core Natural Resources (NYSE: CNR) as the king of coal, which is the product of a merger between coal industry heavyweights Arch Resources and Consol Energy.

As for the second, I'm fairly certain its EQT Corp. (NYSE: EQT).

The natural gas provider bought out Chevron's Appalachian business for $735 million in 2020, which included its Marcellus Shale acreage.

No clue about the third without any more info, it could be NuScale Power Corp. (NYSE: SMR) or Rolls-Royce Holdings Plc (LSE: RR), which just won a major bid to build the UK's first SMRs.

The Greatest Wealth Transfer Ever?

If history is any indication, and it usually is, AI is going to mint plenty of new millionaires, billionaires, and maybe even a trillionaire or two.

The question is, will any of Porter's picks help make us richer too?

We have already given our thoughts on ASML, TSMC, and Arm in previous reviews, as they have been popular picks this year.

Nothing has materially changed, except that their market prices are a bit better following the recent market sell-off.

As for Core Natural Resources, it's an unloved stock, in a despised industry, selling for 8x forward earnings. This reeks of opportunity.

The company has as much cash as it does debt on its balance sheet and operational challenges will likely persist until the end of the year, but with a recovery expected and diversification into rare earth minerals, next year could mark a turnaround.

EQT looks even better.

With a current P/E under 20x, profit margins above 20%, and growing natural gas demand, EQT is well-positioned.

Interest on its $8 billion debt load is a downer on earnings over the near-term, but growing energy demand will take care of this over the long-term.

Quick Recap & Conclusion

- Financial prognosticator Porter Stansberry is teasing something that he's never covered before or seen covered anywhere else and a few “Parallel Processing Revolution” Stocks may be the only way to profit.

- It turns out the “final displacement” Porter talks about is artificial intelligence (AI) and six stocks are the best way to profit from it.

- Their names are only disclosed in a report called The Parallel Processing Revolution. To get it, we'll need access to Porter & Co.'s flagship newsletter, which costs a one-time payment of $199 (normally $1,425).

- Fortunately, we were able to reveal most of Porter's Parallel Processing Stocks for free. They are ASML Holdings NV (Nasdaq: ASML)*, Taiwan Semiconductor Manufacturing Co. (NYSE: TSM), Arm Holdings Plc (Nasdaq: ARM) and most likely Core Natural Resources (NYSE: CNR) and EQT Corp. (NYSE: EQT).

- ASML, TSMC, and Arm are all solid long-term growth picks, while there is value to be had in buying Core and EQT at their currently prevailing prices.

Will AI have a bigger impact than all previous technologies? Tell us how you see it in the comments.

*The writer owns shares in ASML Holdings NV (Nasdaq: ASML).

Shorter than Gen Z’s attention span. Thanks for an early morning smile, Anders.