There's a paradigm shift happening in the market.

Gold is the great harbinger of this change and Stansberry Research's No.1 Gold Stock for 2026 will show us how to turn a tiny $50 investment into more than $10,000.

The Teaser

After nearly a decade of disappointing performance, gold is finally breaking out.

This isn't your grandad's Stansberry Research.

It's still published by MarketWise (Nasdaq: MKTW), but Matt Weinschenk, a CFA charterholder and equities analyst with two decades of experience is now it's research director.

We have reviewed some of it's more recent teasers, including Trump's Secret Stocks and Self-Driving Car Company to 10x Your Money.

As the world's most popular safe-haven asset, don't even try to tell me about Bitcoin, gold's rise says a lot.

High debt, inflation, and dollar diversification are causing capital flight.

The world's biggest investors – central banks, which ironically are the underlying cause for much of the above, are buying gold by the pallets. They know what they've done.

In 2025, they collectively stacked 863.3 metric tonnes, which is on top of the 1,045 tonnes bought in 2024.

95% of central banks are expected to increase their gold holdings over the next twelve months, with Poland!? leading the way. We wrote about the Polish market last year.

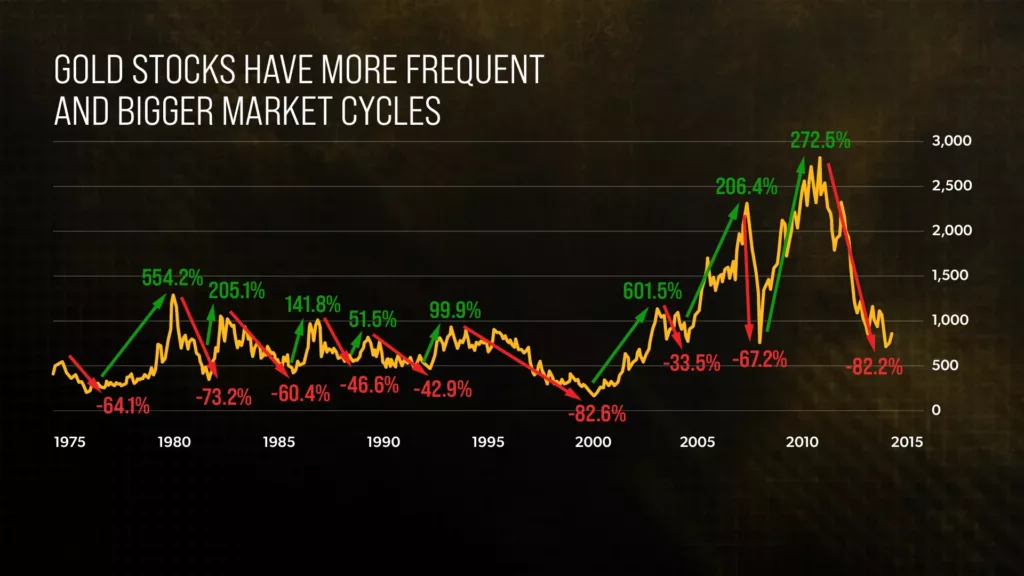

However, the Stansberry boys measured every gold bull cycle in recent memory (there have been eight distinct upcycles since 1975), and discovered something else that is interesting…

Only one gold bull market in recent history has returned less than an overall double.

This tells us that when the price of gold rallies, it soars!

So, buying gold is a no-brainer, but what should we be buying?

Matt says it's not miners, ETFs, or even bullion itself.

Instead, it's something that:

Maybe only 1 or 2 in 1,000 investors knows about

The Pitch

All the details on the stock that anyone can take a stake in for less than $50 are revealed in a new report called The No. 1 Gold Stock to Buy in 2026.

We can get it with a subscription to Stansberry's Commodity Supercycles newsletter for a special price of $79 (normally $499), with a 30-day money-back guarantee.

The Virtually Unknown Gold Investment

The origin story of Matt's gold play is straight out of a Hollywood script.

A French-Canadian engineer, a tiny ad he found in a small town Nevada newspaper, and $2 million dollars.

The French-Canadian was this guy, Pierre Lassonde.

The year was 1982 and he had only recently joined a money management outfit two years prior as a mining analyst and precious metal portfolio manager.

Because of his day job, Lassonde knew Nevada held huge amounts of untapped gold reserves that were just waiting to be exploited for millions of dollars.

However, experience also told him that the mining business was risky, expensive, and complicated due to government red tape.

That's when he saw an ad placed by a mine owner looking to raise cash to pay off an outstanding loan by selling an “interest” in his stake.

Lassonde used all the savings he had, borrowed all he could, and found a partner with some capital to collectively give the mine owner $2 million in exchange for 4% of it's future earnings in return.

In hindsight, the 4% figure was a little low, but nonetheless, the two men's lives were about to change forever.

That's because two years later, a large mining operation purchased the project and discovered one of North America's biggest gold deposits…the Goldstrike mine.

Lassonde's business was Mining Royalties, that is, the right to receive a percentage from the production of an operating mine.

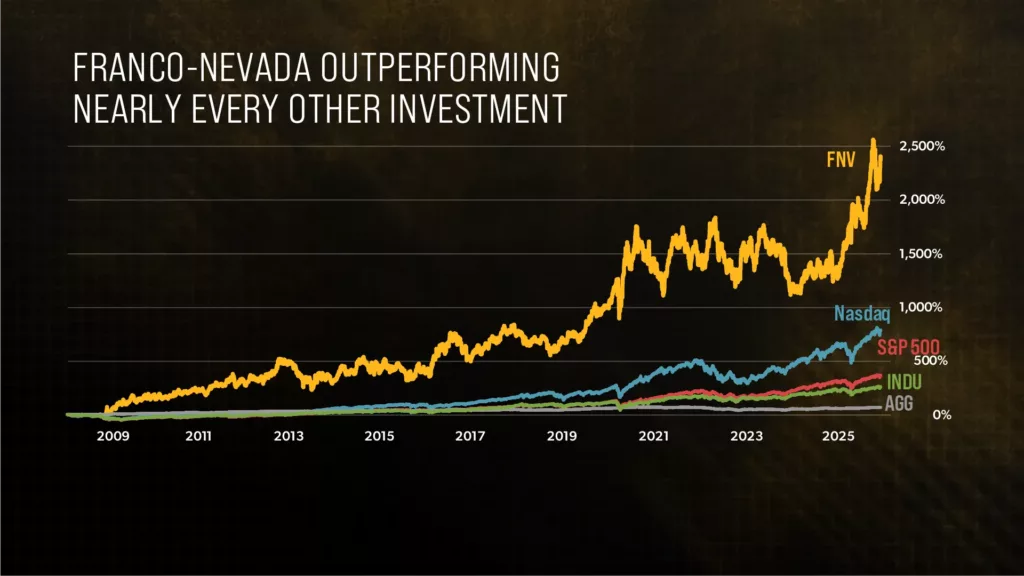

This is what Matt is teasing here and judging by the returns of the company Lassonde co-founded in 1982, Franco-Nevada Corp. (TSX: FNV), he's on the right track:

This would have been enough for early investors to turn a $5,000 investment into $1.6 million. Tech-like gains from a royalty on ditch diggers.

If gold continues to soar, Franco-Nevada will continue to outperform other assets and the overall market.

But Matt says “there's a small company that's even better than Franco-Nevada right now.”

It's far cheaper to get into and has more upside potential.

Let's try to find out what it is.

Revealing Stansberry's No. 1 Gold Stock for 2026

Franco-Nevada and Royal Gold are the two gold royalty heavyweights, but there's a smaller company that Stansberry believes is the best gold royalty investment we can make right now.

This is what we know about it:

- The company is helmed by a man who grew the world's largest silver royalty outfit into a multibillion-dollar company.

- It owns royalties on mines in Brazil, Turkey, Ghana, Argentina, Canada, and the United States, just to name a few.

- It is currently trading for less than $50.

Stansberry's #1 Gold Stock for 2026 is Sandstorm Gold Ltd.

- Sandstorm was co-founded by David Awram, who was previously instrumental in turning Silver Wheaton Corp. into a multi-billion dollar company.

- The company owns royalties on assets in Brazil, Turkey, Argentina, Canada, and the United States.

- Unfortunately, we can no longer directly buy shares of Sandstorm because it was acquired by Royal Gold, Inc (Nasdaq: RGLD) in an all-share transaction in October of last year.

Turn $100 Into $32,000?

Warren Buffett once said:

The best business is a royalty on the growth of others, requiring very little capital itself

Royalties are one of my favorite businesses too and we can still make plenty of money from them even though Sandstorm sold out to the big boys and the teaser wasn't updated.

Yes, five gold royalty giants make up roughly 95% of the total market cap of all gold royalty stocks.

However, the major upside still resides with the small guys, like Uranium Royalties (TSX: URC), which is the only pure-play uranium mining royalty company and newcomer Summit Royalties (OTCQB: SUMF), which is building a diversified portfolio of gold and silver royalties.

I have personally been invested in a few royalty stocks for years, including oil and gas royalties, and have done rather well. Both in terms of capital appreciation and steady dividends.

Not well enough to turn $100 into $32,000, but multibaggers for sure, which I'll happily take.

Given surging energy demand and the 100 million ounce annual supply deficits of silver and other critical metals, I expect royalties to keep on rolling.

Quick Recap & Conclusion

- Stansberry Research and publisher Matt Weinschenk are hyping a No.1 Gold Stock for 2026 that will show us how to turn a $50 investment into more than $10,000.

- What's being teased isn't miners, ETFs, or even bullion itself, but rather mining royalties, and one in particular is said to have more upside than any other.

- The company's name and ticker are only revealed in a new report called The No. 1 Gold Stock to Buy in 2026. We can get it with a subscription to Stansberry's Commodity Supercycles newsletter for a special price of $79 (normally $499).

- The good news is we were able to reveal Stansberry's No. 1 Gold Stock for 2026 for free as Sandstorm Gold Ltd. (NYSE:SAND). The bad news is that it was so good, it was acquired by Royal Gold Inc. (Nasdaq: RGLD) last year.

- Royalty stocks generally don't experience the kind of explosive growth to turn $100 into $32,000, but multibagger gains are in line given surging energy demand and the structural supply deficits of silver and other critical metals.

What is your favorite royalty play? Drop it in the comments.