The mainstream media is obsessing over Trump's every move, but the smart money is quietly positioning for what could be the biggest tech boom in history.

Eagle Financial has identified one under-the-radar company with a unique technology about to cash in on it.

The Teaser

The company is Mode Mobile Inc. and its stock could soar 1,200%, like Tesla the last time we had a pro-business, pro-tech president.

As you can already tell, this isn't your typical investment teaser.

Instead, it's a special email promo from one of Eagle Financial's sponsors. We've been seeing more and more of these lately and as soon as it came across, we knew we had to review it.

We have covered many tech-related teasers in the past, such as Jim Rickards AI Prediction and Apple’s Silent Supplier Stocks Exposed, among others. But this one will be different.

In Trump's first term, the S&P 500 gained nearly 68%.

Despite valuations looking stretched, as per the famous Market Cap-to-GDP ratio, the odds are good that the market will keep on rolling.

I say this because The Fed isn't likely to raise interest rates by much, if at all, and for the first time since the Reagan administration. The Federal government is actually being downsized. To quote South Park: The impossible has happened!

Combine this with less red tape and more investment in artificial intelligence and energy, and our magic Dollar Store Eightball says “The future looks bright.”

It may bode even better for speculative technologies.

This Time is Different

The four most dangerous words in all of investing.

Historically, micro and small-cap stocks have outperformed during bull markets.

They roared during the 80s deregulation boom and again during the dot-com bubble of the late 90s.

This time might not be any different, but the end results will hopefully be better.

The under-the-radar company promoted in the email we received falls exclusively in the micro-cap stock camp. Its technology is attempting to unlock the full potential of the world’s most accessible income-generating asset – the smartphone.

The Pitch

Unlike a typical teaser, where the pitch is an investment newsletter subscription. What is being promoted here is a direct investment in Mode Mobile's private stock.

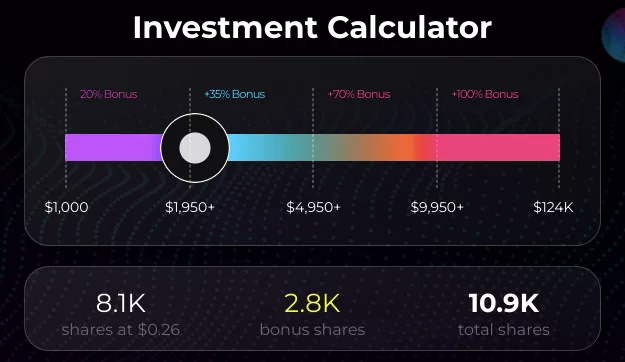

Shares are being offered directly to the public under an offering memorandum, with bonus stock of up to 100% being included for investments of $1,000 or more.

Per the company's investment portal, they are currently at about 75% of their fundraising goal of $30 million.

What in the World Is An EarnPhone?

Smartphones are the most ubiquitous technology in the world.

There are more than 7.2 billion in use and people spend a combined 4 trillion hours on them per year.

Mode Mobile wants to turn people’s phones into income streams, just like Uber and Airbnb did with cars and homes.

A big idea, but how does it work?

Well, the way the company describes it. Its “Earn App” gives users the ability to earn rewards for interacting with digital content on their smartphones. This includes doing things they already do, like playing games, listening to music, watching videos, and even charging their phones.

The earnings and savings for users come directly from advertising brands, with Mode sharing a portion of the revenue it generates with its users.

There is even a physical “EarnPhone” with all the specs of a regular smartphone and its own EarnOS operating system software for “an enhanced earnings experience.”

To date, the EarnPhone is only available at participating retailers in the U.S. such as Amazon, Walmart, and Best Buy.

Even with this limited distribution and the app being in beta, the company has still generated nearly $50 million in revenue from advertisers since launching in 2019.

So the fact that we're not dealing with a pre-operational, pre-revenue company means the promo already has more substance than most we've seen.

However, questions remain about Mode's valuation, management team, and growth prospects. Let's get some answers.

A Real $1 Trillion Opportunity?

This is plastered all over Mode's investment portal.

It simply refers to the $1 Trillion global mobile payments market and like most promo material, is misleading.

In its Offering Memorandum Supplement filed with the Securities and Exchange Commission (SEC), Mode makes no mention of any “$1 Trillion opportunity” and rightly refers to itself as a “rewards-based mobile app” instead of a mobile payments provider, like Apple Pay, PayPal, and others.

Now that we have cleared that up, let's get to the good stuff.

Valuation -Extremely Aggressive

In the same supplement document, it states that “the valuation for the Offering was established by the Company.”

Some simple math reveals that an authorized capital of 3,005,150,000 shares of Common Stock at the offering price of $0.26 each, equates to a going concern value of just over $781 million.

This is for a business that generated $6 million in revenue for the first six months of 2024 (the latest figures available).

Mode also reported a $2.3 million loss from operations over the same period.

If we extrapolate this out a bit and assume $12 million in revenue for the entire year. It implies a price/sales (P/S) of 65x.

Compare this to Rakuten Group Inc. (Japan: 4755), P/S of 1x, which Mode mentions as a competitor, and it is extremely aggressive.

The company did show 62% period-over-period revenue growth, so 100%+ annual growth. But even at this rate, it would take a long time for Mode to catch up to its lofty valuation.

Management – Selling Stock

Mode Mobile's founding management team and investors are all selling substantial stakes in the share offering:

- Dan Novaes, CEO: Selling 53% of 81% stake

- Kiran Panesar, CTO: Selling 11% of 18% ownership

- Garlund Fund, angel investor: unloading 18% of 47% stake

On one hand, it's great to see management minimizing the issuance of new shares and keeping dilution to a minimum.

On the other, this is a lot to give up before a potential future IPO, which is the stated goal, when additional shares will need to be sold.

Apart from this, there are no major red flags.

Dan Novaes and Kiran Panesar appear to have rolled their previous startup – MobileX Labs into Mode Mobile, but kudos to them for being able to pull this off.

Growth – One Step Back, Two Forward

Mode Mobile is growing, again.

From fiscal year 2022 to 2023, the business nosedived from $25 million in annual revenue down to $8.2 million.

This came about as a result of partners advertising less in financial services, consumer goods, and gaming, which traditionally had been major revenue drivers.

The good news is that this allowed Mode to cut out less profitable market segments and re-focus on improving its underlying economics.

The bad news is, that it shows how volatile the business is at this early stage.

Mode Mobile's new aim is to generate “$150 Million in revenue over the next three years.”

Rewards-based sites/apps have always been around in one form or another and they can be profitable businesses. Just look at Groupon as an example, which generates over $500 million in annual revenue.

However, paying the exorbitant sum of $780 million for illiquid shares in a private rewards app that hopes to generate $50 million in future annual revenue is a non-starter.

Quick Recap & Conclusion

- Eagle Financial is doing a paid promo for an under-the-radar company with unique technology.

- The company is Mode Mobile Inc. and its tech is a rewards-based mobile app that gives consumers cash-back and other rewards for performing various online activities, like playing games, watching videos, and more.

- It is pitching a direct investment in 115,384,615 shares of its privately held stock at $0.26 per share to raise $30 million.

- Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. However, there is no guarantee that an IPO will happen and a $780 million valuation for a private business currently doing under $20 million in annual revenue is plain crazy.

Would you use Mode Mobile's Rewards App or the EarnPhone? Let us know in the comments.

I think after reading your report, that i may buy the phone when it comes out but as for the investment before a possible IPO sounds good, I think i will wait.

Not knowing if going to IPO is something I dont like. If it was a guarantee it was going to a IPO i would soak my ,ast $40,000. into it. But without knowing for sure it is going is just not good.

I got a newsletter from Robinhood with the same message, and I fell for it. I thought the IPO was imminent and it was being recommended to me by Robinhood. This is embarrassing considering I work in advertising and should have recognized sponsored content, but I guess I thought Robinhood would have an ad more clearly identified. It was a very misleading tactic.

Anyway, the fact that I’ve seen more ads for the shares themselves than I have for their actual product they sell makes me feel like I totally wasted my money.

Thanks for sharing Erin,

We’re well aware of the aggressive advertising and sponsored posts. That’s why we try to bring some objectivity with these reviews.

my impression of Wallstreet; a pack of story tellers. There appears to be no ‘ground floor’. I learned what pump and dump means first hand. I would say that the small investor has almost no chance to grow a portfolio. Most stock advisors charge more money than I have to invest. So, good luck.

I’m in on the investment. This has a lot of upside potential and it “feels” like an early Uber, Tesla, AirBNB. Makes a lot more sense than the meme stocks like Gamestop and tracks with the future direction of consumerism.