Is Rosland Capital gold a scam?

The actor William Devane doesn't think so. In fact, he encourages people to invest in gold and silver through the company.

In an October 2021 commercial, he starts his pitch by talking about the country's huge debt. While the figure itself is already shocking, he adds that it still grows by the millions daily.

For Devane, this should worry you. That amount is not just the problem of politicians, but everyday people. Since it has a direct effect on the economy, it also weakens your investments and retirement.

So what is the solution? According to the actor, you should buy precious metals from the company he trusts, Rosland Capital.

With gold and silver, you will feel more secure about your finances. Paper money, he adds, does not have the advantages of precious metals. This is especially true at a time like this, with ballooning national debt.

When you engage with Rosland, he says it adds another layer of protection. The company employs a WYSISYG policy: what you see is what you get. “No gimmicks, no-nonsense, no hassle”, he adds.

Devane ends with a final warning: This is your wake-up call. A voice-over, then, dictates the number to call if you want to talk to Rosland Capital representatives.

Is the commercial convincing? For the running time of one minute, it did manage to provide a sober context and a concrete call to action. The presence of William Devane also gives substantial clues as to the target demographic.

But should you believe him and his pitch? With so many precious metals companies around, what makes his firm particularly reliable? Can you trust Rosland Capital with your future?

We will tackle all of these one by one in this review, so stick with us until the end.

Overview

- Name: Rosland Capital

- Website: www.roslandcapital.com

- Founder: Marin Aleksov

- Location: Los Angeles, California

- Service: Precious metals IRA and physical form

- Cost: You need to call them to know the price of their products and services

What precious metals companies usually say is that these are the safest investments out there. Gold and silver have their unique value system. Because of this, the claim is that these are safe-haven products.

This is also the pitch of Rosland Capital.

It claims that the economy, especially right now, is at a decline. If you are not careful with your investments, you could end up losing huge amounts. There are just too many factors that point to market uncertainty.

This is why buying precious metals from the company is in your best interest. Their value goes up even in economic turmoil. This is the complete opposite of your traditional investments.

When the market is doing well, gold and silver maintain a steady price. No matter what the state of the economy is, Rosland claims that these hold up pretty well.

This is the reason why they sell gold, silver, platinum, and palladium. If you have these, you own stable investments that you can use when you retire.

The company also offers precious metals individual retirement accounts (IRA). You may open a new IRA or transfer from an existing one to fund purchases of gold, silver, platinum, or palladium.

In a nutshell, what Rosland offers is the opportunity to put your investments in various forms. This is what a diverse portfolio looks like. Such a strategy will help ensure that you will always have funds when the time comes that you would already need them.

What is Rosland Capital?

“Your Precious Metals Firm”

This is what Rosland Capital wants you to remember. The company is not just any firm offering various services involving gold, silver, platinum, and palladium.

According to its claims, you can entrust to Rosland your investment because it is your go-to firm. It puts your interests front and center and will take care of your needs, it adds.

Apart from the quality of its products, the firm emphasizes that what makes it stand out are the values it has. Rosland says it stands by “honesty, high-quality customer service, and public education”.

One evidence that strongly shows this, it says, is the number of informative articles on the website. The firm offers not only articles about its products.

If you are interested in learning more about precious metals in general, you may browse through all the write-ups. The topics range from up-to-date news on such investments, steps on how to acquire gold and silver, and the like.

On this note, we do find its efforts commendable. When companies provide such service, we believe they should be commended, in the same way that we call out bad practices.

We all know how investing in gold and silver can be tricky and even intimidating for some. What such consumers need are not over-the-top sales pitches or exaggerated claims. People want to learn more so they can make wise decisions.

The good thing about it is if they feel that a firm is genuine in helping them, the company builds a genuine connection with them. This may even translate to goodwill. If a customer feels that s/he can trust the company, s/he may even avail of its products and/or services.

So such efforts are rarely wasted. Even if a reader just goes to the website to learn more about precious metals and purchases from somebody else, it's still positive news. Overall, this is good for the industry.

Rosland says it offers such information because of what it wants to ultimately accomplish. It does not just want to sell. The company wants to educate people so they can strengthen their assets and protect their wealth.

In its opinion, acquiring precious metals will help diversify your investments. As an advocate of diversification, it wants more people to learn about what it is and how to maximize its benefits.

This is why it offers two main services: precious metals in physical form and precious metals IRA.

Rosland believes that it is a must, you need to allot a portion of your investments to gold, silver, and other metals. This ensures that your assets are protected no matter what.

It offers various products in many forms, which you can buy on their own. There are exclusive items and special edition pieces that are both pretty to look at and valuable.

Aside from this, the firm allows you to create a new one or rollover an existing IRA to one based on such metals. Rosland provides all the steps on their website. However, you need to call its numbers to get things started.

According to the company, its customer service representatives are well-trained to assist you with all your needs. This is a hallmark of the firm since it knows transactions are made or broken with these interactions.

Aside from its headquarters in Los Angeles, California, Rosland has other centers. It also has offices in London, Hong Kong, Munich, and Sweden. This ensures that it can better serve its international clients interested in the trade.

In addition, the precious metals dealer also acknowledges the power of social media. Nowadays, more and more people rely on them for information. If a company wants to reach potential clients where they are, this is a strategic move.

So Rosland is available on Facebook, Twitter, LinkedIn, Instagram, and YouTube. Aside from these, they are also on Crunchbase and Bloomberg.

For us here at Green Bull Research, we think such access is a strong sign of the firm's confidence. We all know how vicious, raw, and honest social media interactions can be. People can freely give their feedback instantly.

So if there are complaints about its services and irate customers pile on, it's not gonna be pretty. As of now, we checked some of these accounts and there are no significant interactions yet.

Recently, we have also reviewed a company that is similar to Rosland Capital. In our Goldco Precious Metals article, we asked if it is a ripoff. It extensively discussed various aspects of the firm and its services.

On our website, we also have a Neptune Global Holdings review. It is a metals dealer that caters to both small retail and large institutional investors.

If you want to know more about these, read our reviews. Comparing different companies side by side can help you determine which one is best for you. You may use our objective assessments as resources before deciding where to invest.

Who is the Founder of Rosland Capital?

Marin Aleksov, a Swede, is the Founder and CEO of Rosland Capital. He started the company in 2008 after a nine-year stint with Lear Capital. When he left that company, he was already a Vice President.

Before that, he was a Comptroller at Merit Financial.

As the head of the company, he oversees around 70 employees who facilitate the buying, selling, and trading of precious metals.

As a trader and advocate for precious metals for about 20 years, various media outlets turn to him for crucial updates. Aside from the value of gold, silver, and the like, he also talks about the importance of diversification.

He strongly believes that an astute investor must seriously look at precious metals if s/he wants added protection. According to Aleksov:

Historically, when governments or the Fed implement policies that cause the dollar to decline, these same actions tend to increase the value of gold. This is why many use gold as a hedge against inflation, and for wealth preservation.

In 2015, he even wrote a book about the matter. Together with John Watson, he wrote The Rosland Capital Guide to Gold.

According to The Rosland Capital Guide to Gold's page on Amazon, the book talks about the history and evolution of gold coins in different civilizations. In addition, it discusses important gold and silver coins in various regions.

If you are looking to find out how to start buying, selling, and trading precious metals, you may find valuable information in his work.

Right now, the company sends this book as a free primer when you sign up on its website.

We also want to mention that as of this writing there is only one review of the book on the page. In November 2015, a verified account gave it one star out of five.

The reviewer commented that s/he lost about 33% of his/her investments with the company. This is when s/he sold back to the firm his/her investments. The commenter also said that the company engages in predatory practices.

We are aware that this is not a review of the book per se. Also, we always say that comments do not often reflect a true, objective assessment of any product or service.

But since it talked about Rosland Capital and its services, we feel it would be best to mention it here with the necessary disclaimer. We believe it would serve you best if you know these things so you can make your own determination in the end.

But Aleksov firmly stands by his company and its products and services. Six years after starting the company in California, he initiated expansion activities to serve more people across the globe.

He opened Rosland Capital UK to cater to the European market. Eventually, the CEO also opened affiliates in Germany and Hong Kong.

In addition, the firm says it donates $10 to the American Red Cross for every book it sells.Such a gesture is central to the practices of the company, its website claims. Aleksov has even participated in the American Red Cross’s Holiday Mail for Heroes campaign. He also organized a fund for veterans at UCLA.The firm also states that they regularly collaborate with philanthropists and nonprofits to come up with exclusive coin collections.

In fact, a prominent portion of the company's website talks about its charity partners.

One such partner is Michael Schumacher’s Keep Fighting Foundation. It is a “nonprofit initiative dedicated to promoting the idea of perseverance and resilience”.

Rosland, in close coordination with Formula 1, featured Schumacher's portraits in gold and silver coins. Not only do these serve as a tribute to the athlete, but the sale of these coins also goes to Keep Fighting to fund its projects.

Other partners and beneficiaries include:

- Providence Saint John’s Health Center

- Chase Child Life Program at the UCLA Mattel Children’s Hospital

- Race Against Dementia

- UCLA’s Veteran Resource Office

- New Directions for Veterans

- Fisher House Foundation

- Valour Place

- Red Cross’ veteran services

- Ayrton Senna Foundation

- The People Concern

- United Way

Aleksov is directly behind all these efforts, as he believes his company needs to “give back and make a positive impact” in its community.

Such information, we believe, is a relevant aspect of the company and the man behind it. Because of the kind of world we live in today, we know more people appreciate such gestures.

More consumers now factor in companies' humanitarian and charitable efforts. While we understand that this is not significant for all, we want to present it to those who may look for this kind of information.

What are the Precious Metals Sold by Rosland Capital?

Why Buy Gold and Silver?

One of the articles on the website discusses why gold and precious metals should be among your investments.

Gold, Rosland says, has stood the test of time in terms of reliability and stability. If you have such metals, you would not be as worried in tumultuous economic times.

In addition, the 21st century provides valuable lessons for investors. The company cites that “the price of gold has risen 300%, while the purchasing power of the dollar has declined by more than 25%”.

Further, while paper money loses value during inflation, precious metals have remained steady. They retain their value.

Rosland also calls precious metals a “borderless currency”. This is because almost all countries and cultures recognize their value. In extreme times, if you have gold and similar metals, you can still move around.

Another case for precious metals is that throughout history, appreciation for their beauty and rarity have been consistent across the world.

In other words, you should buy gold, silver, platinum, and palladium for diversification and security.

Of course, there is always a pitch included that you should buy these from Rosland.

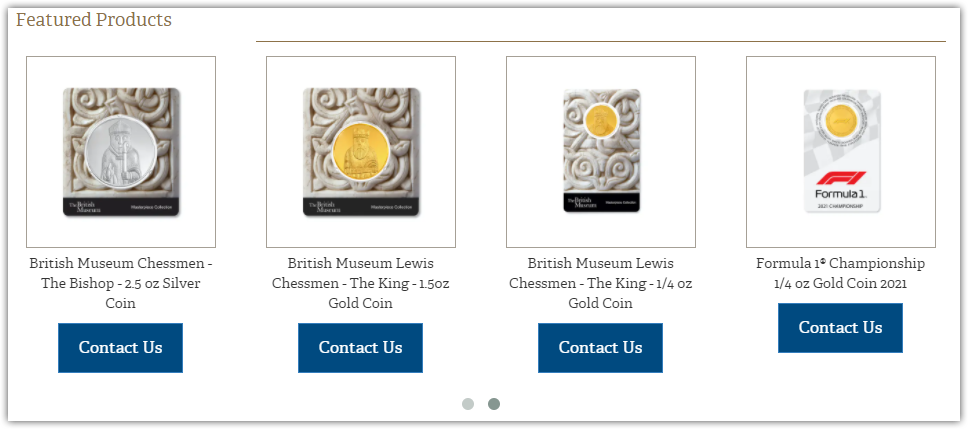

When you go through the list of products it has, the company shows you this information for each one:

- Photos

- Includes the front and back of the coin with and without the protective packaging

- Number to call

- As we have mentioned, the call to action is always to call the company

- Product description

- Physical description (e.g. 22mm diameter gold coins are 999.9 fine gold)

- Distinct features (e.g. 22mm diameter gold coins are 999.9 fine gold, bear a portrait of Her Majesty Queen Elizabeth II, only 5,000 of these 2022-issue coins are available worldwide)

- History (e.g. About the Davis Cup, About the International Tennis Federation)

- Payment terms

- Instructions on check and wire payments

- Customer agreement

- Terms and conditions between you and Rosland Capital

- Specifications

- Specific details on the coin (e.g. Fineness, Weight, Diameter, Depth, Edge)

- Information sheet

- Your contact details so the customer service representatives can call you (e.g. Name, Phone number, Email address)

We commend the company for the vast information it provides for its products. Any consumer, new or old, will benefit from all these.

However, we were hoping Rosland would also provide information about their prices. We think this is the most important information, which the firm missed out on.

If it is worried about the fluctuating prices of such coins and other items, they could at least have a range and a disclaimer even. We are certain consumers would understand if this caveat is explained clearly.

So what are its products? Here are some on the list as of the time we publish this review:

Gold

- British Museum Lewis Chessmen – The King – 1.5oz Gold Coin

- PLAYERS CHAMPIONSHIP 2019 1/4 oz Gold Coin

- British Museum Greek Helmet 1.5 oz Gold Coin

- PLAYERS CHAMPIONSHIP Kilo Gold Coin

- 2016 UNITED STATES GRAND PRIX™ 1/4-oz. Gold Coin

Silver

- British Museum Lewis Chessmen – The Queen – 2.5 oz Silver Coin

- Formula 1® 2.5 oz Silver Coin 2021

- Michael Schumacher 2020 Kilo Silver Coin

- British Museum Greek Helmet 1.5 oz Silver Coin

- 2016 ABU DHABI GRAND PRIX™ 5-oz. Silver Coin

Platinum

- Platinum Bullion Bars

Bars

- Palladium Bullion Bars

- Gold Bullion Bars

- Silver Bullion Bars

Bullion Coins

- Canadian Maple Leaf Palladium Coin

- Austrian One Ducat Gold Coin

- Sovereign Gold Coin

Premium Coins

- British Museum Lewis Chessmen – The Queen – 2.5 oz Silver Coin

- Arnold Palmer 1/4 oz Gold Proof

- Formula 1® Championship 1/4 oz Gold Coin 2021

Exclusive Specialty Coins

- Davis Cup 2022 1/4 oz Gold Coin

- Arnold Palmer Gold 1-Kilo Proof

- Sir Jackie Stewart Kilo Gold Coin

IRA Eligible Products

- American Buffalo Gold Coin

- Canadian Maple Leaf Silver Coin

- Austrian Philharmonic Gold Coin

PGA Tour

- PLAYERS CHAMPIONSHIP 1.5 oz Silver Coin

- Presidents Cup 1.5 oz Gold Coin

- PLAYERS CHAMPIONSHIP 1/4 oz Gold Coin

Formula 1

- Formula 1® 1000 Kilo Silver Coin

- Michael Schumacher 2020 1.5 oz Gold Coin

- Formula 1® 1000 2.5 oz Silver Coin

What are the Services of Rosland Capital?

Put a gold-backed IRA in your golden retirement:

Worried about protecting your hard-earned financial assets? Here’s an idea that might help: a gold-backed IRA, or a precious metals-backed IRA, is an IRA that holds precious metals instead of paper-based assets.

This is the pitch of Rosland for its precious metals IRA. It says it is pushing for the service because paper assets will not protect you like gold and silver.

According to its website, precious metals IRAs protect you better because these are not based on stocks and bonds. The problem is, when the economy tanks, these take a significant dip as well.

An example of this happened in the Great Depression. In a short time, many people lost substantial amounts of money.

With metals, you will be protected from “inflation, economic fluctuation, and unfavorable legislative policies”. Your investments will be safer.

According to Rosland, these are the main benefits to this type of IRA:

- Diversification

-

Gold and silver IRAs allow you to hold assets that are rarely found in employer-sponsored 401(k)s and conventional IRAs.

-

- Protection against the volatile stock market

-

Diversifying your asset portfolio with precious metals can help protect your retirement money by shielding it from the volatility associated with stocks and other paper assets.

-

- Safeguard against the declining dollar

-

By placing precious metals in an IRA, you can thus preserve your buying power and safeguard your money from the effects of inflation.

-

- Tax benefits

-

The biggest difference (between precious metals and conventional IRAs) is that you can maintain those tax benefits while experiencing all the other benefits of purchasing precious metals.

-

The company processes these IRAs with the help of its customer service representatives.

How it Works

Precious Metals For Sale

If you want to buy gold, silver, platinum, and palladium products, you just need to call them. The person who receives your call will tell you the price of each item. S/he will also process your orders over the phone.

Precious Metals IRA

1. For the IRAs they offer, the first step is to talk to a representative as s/he will explain in detail how everything works. At this time, you may ask any question you may have before making a decision.

2. This is where the formal process begins. Rosland will send you its Customer Agreement that you need to sign. It also includes forms from their IRA administrator-partner, Equity Institutional.

3. Once signed and the office has received these forms, the customer service agent will call once again. S/he will open an account for you and discuss what you can do with your IRA. This step also includes a conversation about coins eligible for your account.

4. At this point, you need to send funds to Equity. This can come directly from you or it can be a rollover of an existing IRA. Once done with this step, Rosland asks Equity to store your precious metals in their secure storage facility in Delaware.

5. This step makes you a formal client of Equity. You will then pay them the necessary fees (more on this below).

6. When you reach the age of 72 years, you may already receive distributions. These can be in physical gold, as long as the IRA has precious metals of the same value.

Costs & Fees

Precious Metals For Sale

The way it works with the company is that you have to call them to know the price of their products. While the website does provide plenty of information on each, it lacks the most important one.

The price of gold and silver indeed varies, but the firm can also exert efforts at giving even estimates of the products. This way, potential investors will at least have a ballpark figure.

Even if prices change, an estimate will better serve customers. There are lots of products on the website. If a client wishes to have a range of products, imagine the time it will take to get the prices of each one.

If the products a caller is interested in are not within his/her price range, then everything goes back to zero.

Since we always side with the customer, we think this is a missed opportunity at better service. For someone who has zero knowledge of precious metals, this makes the process all the more intimidating.

If someone is just checking his/her options and does not want to engage the company just yet, s/he may just not proceed. Talking to a company representative may just be too big a first step for some people.

Precious Metals IRA

According to Rosland Capital, you do not have to pay a single centavo when you open a precious metals IRA.

What you need to pay, though, are the fees of their IRA administrator and partner, Equity Institutional.

You need to pay Equity a one-time set-up fee of $50 and an annual maintenance fee of $80. The company also requires you to pay either a $100 or $150 storage fee, depending on the storage type.

An optional feature is a paper copy of your statements, which Rosland provides for an additional $40. E-statements, meanwhile, are completely free.

Track Record & Reviews

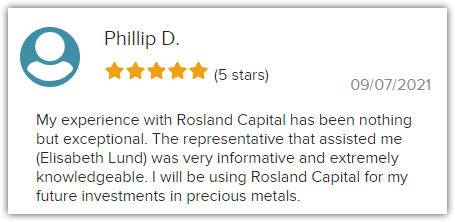

The firm puts its customer service representatives front and center to the point that the reviews mention specific names. When you click on the review page, the format is like this:

Mike S. recommends Sr. Account Representative Heather HoOctober 12, 2021

Carolyn B. recommends Sr. Account Representative Frank NeroSeptember 29, 2021

Todd W. recommends Sr. Account Representative Chase GreenichSeptember 15, 2021

Under each subheading is a testimonial directly praising the representative. In fact, Rosland refers to them as company experts.

First, this is clearly consistent with what they preach. Since they say that they are proud of their staff, such prominence on their website affirms this. It's not too often that you see the spotlight on customer representatives.

Second, this is a strategic sales tactic because it adds a human touch to what the company is selling. Here is an example:

I rolled over three accounts to Rosland with the help of Chase Greenich. His assistance and availability were instrumental in making the process simple. I highly recommend Chase and Rosland Capital.

In addition to these, the company is also proud of its Better Business Bureau rating. Rosland Capital has 3.82 out of 5 stars from about 70 reviews. As of this writing, there have been 20 complaints in the last three years, two of which have been resolved in the last 12 months.

The comment below is a typical positive comment on the website. It seems that the company experts really leave a good impression on clients. As a result, customers trust Rosland with their investments.

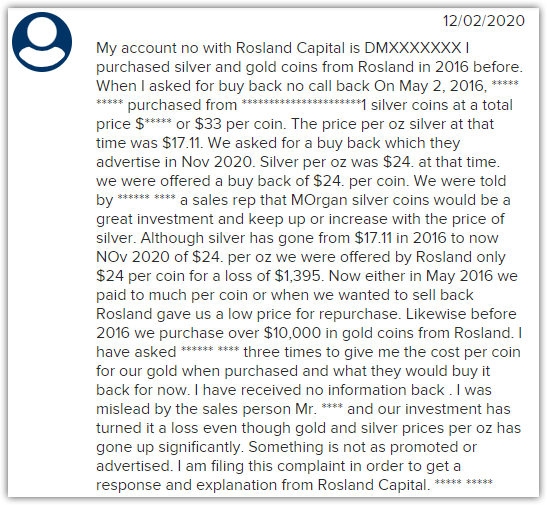

A typical complaint against the company is about the real value of the coins. This is a common complaint against dealers as there always is a discrepancy between actual and projected value. Here is an example:

Meanwhile, there are only two reviews for Rosland Capital on Trustpilot as of this writing. One gave it a 5 and another gave it a 1, making its rating 3.5/5 stars.

The positive review commended the firm's responsiveness and the representative's knowledge of the coins.

Karl Mullowney did not have the same pleasant experience. According to him, when you deal with them, “you lose most of your money”. He also did not appreciate the follow up calls he received:

My experience is that they will pester you on and on and on and tell you anything, any lie to make a sale! Their prices are a crime.

So you see, there are good and bad reviews. In this case, though, there just are more positive comments overall. Are all of them accurate? Well, that's always a question with reviews.

That's why you need to weigh how you would like to factor them in on your decisions. Remember, these are very subjective.

Pros v Cons

Pros

- A lot of informative and educational materials on the website

- Precious metals have been proven to be historically stable

- Good variety of products

Cons

- You need to call them to get an idea of their prices

- Negative comments about the actual value of the coins

Conclusion – Is the Company the Real Deal?

You might be reading this because you are looking for safe-haven investments. According to precious metals dealers, investing in them will give you stability.

Unlike conventional investments that rely on the dollar, these have their own system. When the economy goes down, gold and silver do not necessarily depreciate.

This is why the pitch of Rosland Capital is that you must buy gold, silver, platinum, and palladium from them. It does not only concern itself with selling, but it has a team of industry experts willing to assist and educate you.

When you go through its website, you will find numerous pieces of content that will enlighten you on these types of investments. The firm has also made available extensive information about all the products it offers.

One hiccup here, though, is that it does not disclose the price of the coins on the website.

On this note, our website's editor did some digging to provide you with information you will find useful.

We found out that with Rosland, the bid-ask spread is 10% for coins and 15% for bullion as of this writing. This is steep.

Just as a review, the bid-ask spread is the difference between the bid price (the highest price by which you can sell) and the ask price (the lowest price by which you can buy).

So the bigger the percentage, the more money you lose.

Normally, most people would already complain about 5% as being too high a spread. But with Rosland, though you get a better spread for coins compared to bullion, it's still very high at 10%.On top of this, the company charges high commissions (up to 20%), at least according to this Rosland Capital review.Pretty expensive, but we did find out that if you buy gold worth $20,000 or more you would get a better deal as Rosland says you can save 6% on these transactions.In addition, upon inquiry, a customer representative said that shipping costs $43.To be fair, these prices and spreads could change, depending on gold's performance, so it would be best to ask what their current rates are.

So, is Rosland Capital gold a scam? After everything we have deeply discussed so far, what do you think?