This review of Jay Soloff’s Options Floor Trader PRO will walk you through the newsletter's various claims. We will look at his approach so you could get a better understanding of this type of investment.

People are always curious about options. In fact, The Wall Street Journal even reports that options trading is hitting record levels. The headline reads:

Individuals Embrace Options Trading, Turbocharging Stock MarketsShort-term traders flock to the low upfront cost and potential quick gains in options markets, fueling bigger swings and many rallies

In the September 2021 article, it says that individual investors are enticed by the “small upfront investments and potentially quick payoffs”.

What this means is that more and more people are understanding options. In the past, many are intimated by it. People often think that the concept is beyond the reach of a regular investor.

It is this mindset that Soloff wants to address. He offers his advisory not just to earn from subscription fees but to teach people as well. Or at least this is what he claims.

So let us start, as we will tackle a lot of areas.

Overview

- Name: Options Floor Trader PRO

- Editor: Jay Soloff

- Publisher: Investors Alley

- Website: www.investorsalley.com

- Service: Investment Research Newsletter on Options

- Cost: $49 (discounted price from $199)

A Fox Business article's headline will make you think twice about being reckless when it comes to options. It reads:

How to avoid blowing up your trading account using optionsThe wrong bet can potentially lead to infinite losses

When you read the write-up, it is in no way discouraging investors to try out options trading. The article merely wants people to understand the risks better before diving in.

Soloff offers his newsletter as a guide to both inexperienced and seasoned options traders. Through his advisory, he aims to recommend a strategy that will give you high profits.

According to him, once you subscribe, you will not just be a follower. Since he exerts a lot of effort in teaching you, the goal is for you to be a pro trader.

What is Investors Alley?

As if there is a shortage of financial publishers, we have another one here.

Compared with the more sleek marketing of others, this looks more traditional. Although we are inclined to call it old-fashioned, if their target audience appreciates their style, so be it.

From the outset, Investors Alley claims that it is your independent source of investment advice. This statement is even prominently displayed on its official LinkedIn page.

For us here at Green Bull Research, we find this interesting. We know how publishers seem to be allergic to saying those two dreaded words: investment advice.

Most use other terms, even if we know what they really mean. If they say this outright, they will be subject to more scrutiny.

If you could recall, we discussed this in our article on the Federal Trade Commission's lawsuit against Raging Bull.

Relevant parts of the complaint touch on the very nature of being a publisher. The FTC claimed that Raging Bull, through its editors, “made false or unsubstantiated claims” on potential income.

It also discussed “misrepresentations in their promotional materials”.

Obviously, this will only matter if Raging Bull represents itself as an investment adviser. With this, it will be easy to verify if their advice performs according to expectations.

So the workaround here is to declare that they are not advisers. Despite the obvious, they only say they are publishers of opinion and analysis. This way, they have a defense against complaints.

Publishers merely use the company disclaimer for the sake of saying that they have one in place for their subscribers.

In fact, even the Terms of Use page of Investors Alley clarifies this. Here is what the company has to say:

Investors Alley Corp. (the “Company”) is a publisher of financial news, opinions and research and is not a securities broker-dealer or an investment adviser.

So, what is it, really?

Further, Investors Alley adds:

The information published by the Company is not a customized or personalized recommendation or solicitation to buy, sell, hold, or invest in particular financial products, and the Services are not intended to provide money management advice or services. The Services are intended to supplement your own research and analysis.

Well, the disclaimer seems to provide ample cover. Could it be that they just missed the wording on their LinkedIn profile? Maybe. But it is there and could spell trouble in the future.

Going back, they also claim that their advice comes from “the best and the brightest financial minds”.

This characterization is something we are used to by now. Every publisher says this about its team. But who are these top-notch investing experts?

We will talk about Jay Soloff later, but there are four other editors on the team. These are Tim Plaehn, Serge Berger, Rick Rouse, and Tony Daltorio.

Tim Plaehn

Plaehn is the group's “lead investment research analyst for income and dividend investing”.

He is in charge of four services under the company. These are:

- The Dividend Hunter

Plaehn says that this will provide you with “the very best dividend income opportunities.” Using his original system, you will get exclusive information on high-yield investments.

- Weekly Income Accelerator

This, meanwhile, is a collaboration between Plaehn and Soloff. Their goal here is to give you “instant extra income”.

- Automatic Income Machine

With this service, Plaehn will help you invest better in dividend stocks.

- Monthly Dividend Multiplier

This is a coaching program with a step-by-step system for investors who are serious about wealth generation.

Serge Berger

Meanwhile, Berger is an active trader with a unique methodology on trading setups. His expertise allows him to increase profits and decrease volatility.

Further, he offers one service to Investor Alley customers.

- 11-Day Trader

In the newsletter, Berger sets a “special 11-day trade” on stocks that are “set to make a big move”. With this, he claims you can collect 8-10% returns 82% of the time.

Rick Rouse

What Rouse claims is that he can deliver at least one 100% winner every month. He is confident in this claim because he uses “fundamental and technical analysis”.

His main service focuses on options.

- 30-Day Double Up

This newsletter aims to give its subscribers six to eight new trades monthly. Further, he guarantees that at least one of those will be a winner.

Tony Daltorio

Due to his background, Investors Alley considers Daltorio the veteran of the group. He edits the company's exclusive free newsletter, Premium Digest.

Have you heard of these guys before? Do you have any experience with their current or past services? Based on your assessment, are they really “the best and brightest” in the financial world?

If you have any feedback on them, do tell us below.

Who is Jay Soloff?

Education

Jay Soloff has a solid educational background.

In fact, the man has an economics degree from the University of Illinois, Champaign. In addition, he has an MBA and a Master's of Science in Information Management from Arizona State University.

Professional Experience

Moreover, a bulk of his investing savvy came from his stint with the Chicago Board Options Exchange (CBOE). He worked there as a professional options market maker.

Also, he was a pioneer in trading via electronic exchanges. At the time, Wall Street firms hired him to help them design software for options trading.

To give you a full scope of his profile, here are his previous affiliations:

- Argonath Financial

This was Soloff's own advisory company that catered to clients in the U.S. and Australia.

- Hyperion Financial Group

In his role as Managing Editor, he was in charge of financial and economic content for various websites.

- Healthways

Meanwhile, Soloff worked with Healthways as a Senior Financial Analyst for one year.

- NetWide Capital, LLC

In the hedge fund company, the investor worked as a Senior Analyst.

- Honeywell

His career highlight here is the company's partnership with the Aerospace division, which is worth $11 billion.

- Actant Inc.

As a Financial Software Consultant, Soloff provided tech solutions to Chicago and San Francisco clients.

- Blackhawk Financial

Here, his role as an Equity Options Trader exposed him to the best investing practices at the CBOE.

Investor Alley Projects

As an investor, Soloff believes his strategy for success is effective in any market situation.

Furthermore, his philosophy is to merge “income-generating, high probability” tactics with “targeted buying opportunities”.

The analyst brings this belief in his role as Investors Alley's Lead Options Portfolio Manager. In this capacity, Soloff teaches investors how to be astute options traders.

One of his main lessons is on how people can use volatility to their advantage. Under his guidance, anybody who is willing to learn can be a pro.

With two decades of experience, he offers three services in Investor Alley. These are:

- Options Floor Trader PRO

We will talk about this in detail below.

- Options Trading Mastery

This is a private course where Soloff reveals everything he knows about options trading. After the five-hour course that discusses seven strategies, he claims you can already begin trading like an expert.

- Weekly Income Accelerator

As mentioned above, this joint service from Soloff and Plaehn teaches subscribers techniques for getting extra income.

What is Options Floor Trader PRO?

In a nutshell, Options Floor Trader PRO is a newsletter on options. It is as straightforward as that.

What Soloff wants to do is give you Wall Street-level strategies. However, he wants to teach them in the simplest way possible. This way, you just “enter the trades with your broker”.

Among the information he provides are:

-

The little-known equation that reveals when a stock is ‘mispriced’

-

The #1 options trade to protect your portfolio if the market tanks tomorrow

-

How to buy a call and a put in 5 minutes

-

The ‘crystal ball’ indicator to signal the chances you make money or not

-

His live trade of Apple stock right in front of you

In the past, we have already written about another monthly advisory on options. Do check out our Jeff Clark Trader review here at Green Bull Research.

How it Works

Soloff can turn whatever money you have right now into hundreds or even thousands, or so he says. He also claims that you can see high returns in as little as 23 days.

How will you accomplish this?

Well, his system only involves making four trades. It is that simple, he claims.

In fact, he is aware of the reputation of options. Some people find it too complicated. Others, meanwhile, think that it is too time-consuming and risky. There are even those who believe options trading is a scam.

What he can provide you are impeccable market timing and simplicity. You just follow his advice, make a few clicks, and you are set.

Moreover, following his recommendations will not require you to alter your portfolio. You will not even have to sell your stocks or liquidate your 401k. Your retirement savings will also just stay where they are.

According to his process, just gather whatever money you have extra. This will be enough to create your new “slush fund”.

Then, he will teach you how to invest this in options. The advantages here include earning more profit and even spending less than stocks. Also, you can “win if the market goes up, down, or sideways”.

As per his computation, options are your cheap alternative to stocks. The example Soloff gave is for 100 shares of Amazon. This normally costs $160,000.

But a moderate to aggressive call option of this only costs around $8,000. However, he says the options he will pick for you will not even be near this number.

The range of contracts Soloff would pick is only between $80 to $200. This is where he is coming from that is why he says all you need is money you have lying around the house.

With your subscription comes two trades each month, minimum. But he will not just dictate what to do.

Along with his recommendations, the investor will explain in detail what the process is. As a result, you will also understand the strategies he is employing.

To succeed in the trade, he also says you must abide by certain rules.

First, you should be able to manage your risks. His advice is to “keep a tight lid on trade when it doesn't go your way. Do not hesitate to bail on losing trades.

Second, take the time to know your trading style. Compared to others, he does not impose on just one way of doing things. Options, he says, allows for much flexibility.

What he will encourage you to do is study the principles he teaches. Then, as you apply them, you get to know yourself as a trader as well.

Third, Soloff wants you to trade like the institutions. We think this is a smart piece of advice.

According to him, people outside Wall Street usually go to the fundamental and technical analysis first and the options last. Savvy institutions do the opposite. They look at “on-sale” options first before the analyses.

Soloff makes a relatable analogy here and uses investing in art pieces as an example.

Usually, what someone would do with options is this. S/he would look at what's hot in the market right now. Then, s/he would find these trendy art pieces and check if it is worth the price.

The hope is that the value of the art pieces would continue to go up. This way, the investor will make a profit.

However, if the value plummets, s/he will end up losing money.

That is the regular strategy.

For Soloff and reputable institutions, this is not smart. What he does is ignore the market first. Instead, he looks at art pieces that have been valuable in the past but are currently being sold at a lower price.

Once he sees these art pieces, he will then look at the market to see if they have the potential to increase in value. Then he buys them.

If their value goes up, he makes a lot of money because of the sale price. But if it goes down, he only loses a little, again because he bought them at low prices.

So his strategy is to buy low and sell high, instead of just timing the market.

If only for his explanation here, we could say that he and his service do make sense. The difference he has with other editors is the effort he puts into explaining his process.

What about you, our readers, does this make sense to you? Does he make a convincing argument?

What You Get

The annual subscription fee is $49. According to Soloff, this is already a steal, considering that the original price is $199.

Here are the features of the Options Floor Trader PRO:

- Bi-weekly newsletters (valued at $499)

- Around-the-clock updates on positions (valued at $349)

- Weekly Mailbag Videos (valued at $299)

- Bonus #1: Special Reports (valued at $249)

- Top Sectors to Trade This Year

- 7 Common Options Trading Mistakes Costing You Money

- The 10-Step Options Trading Checklist Every Trader Needs

- Bonus #2: Advanced Training Videos (valued at $199) including:

- How to Trade Options Skew For an Edge

- Bonus #3: Extras

- The Extra Cash Masterclass for Options (valued at $199)

- 26 Places to Locate “Extra Cash” in the Next 30 Days (valued at $49)

According to the editor, the overall value of the offer is $1,843.

Again, you will receive a minimum of two trades every month using his strategies.

Cost and Refund Policy

Cost

$49 (discounted price from $199)

Refund Policy

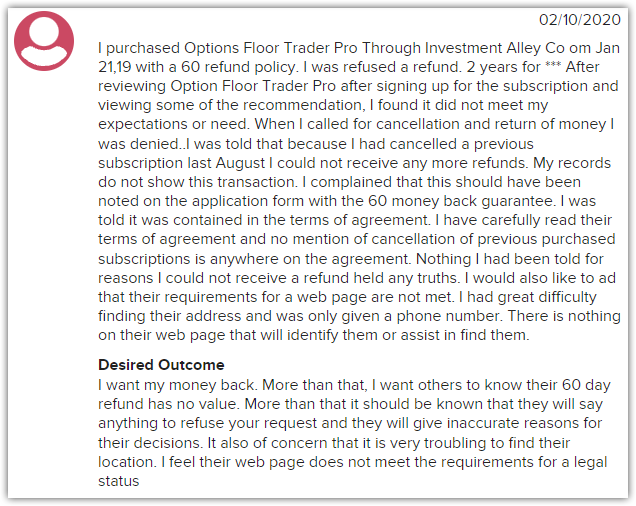

Options Floor Trader PRO offers a bold refund policy. Investors Alley will return your money when you ask within a year.

In addition, Soloff says he guarantees that you will make five times your membership fee within 12 months. That's about $245 in a year.

If this fails, you will get a second-year subscription for free.

Track Record and Reviews

Based on Soloff's marketing promotions, his system has produced profitable returns.

This is not unusual for newsletter ads, but he does try to add details useful for potential subscribers. Here are his exact words. We are presenting this here so you may see if these are convincing numbers.

Take a look at some of my trades from 2019 and 2020 (even during the crash):

-

VXZ = 367% gain.

-

XLY = 170% in just a few days.

-

WMT = a 178% score.

-

DISH = 109% without breaking a sweat.

-

FAST = 233% as the market fell.

-

GLD = 156% in the bag.

-

XLB = a 222% profit.

-

ARNC = a fast 70%.

-

And…1,421% home run on ETFC.

Of course, this information is from Investors Alley. So we want to look at other sources, especially feedback from subscribers.

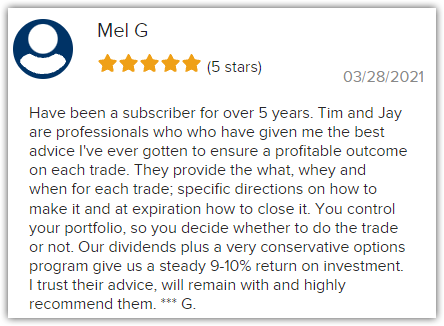

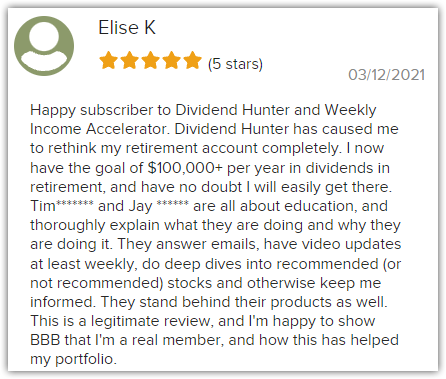

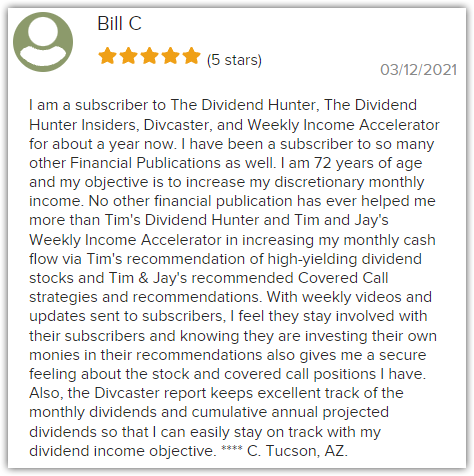

On the Better Business Bureau website, the publisher has received an impressive 4.75-star rating from about 80 reviews.

As of this writing, there are also nine complaints on its record. Seven of these have been resolved in the last 12 months.

However, we would like to clarify one thing. Most of the comments are about Tim Plaehn and his newsletter, The Dividend Hunter.

Even if this is the case, we still deem it relevant since it reflects how the publishing house conducts business. It is logical to conclude that it will also handle its other services in the same manner.

Also, we were able to see positive feedback for Soloff's joint service with Plaehn, the Weekly Income Accelerator.

In the comments you will read below, there is a common thread. They say that the two editors are thorough and responsive. In fact, the feedback is that they teach their subscribers patiently.

As a result, users feel confident about their strategies. The commenters say that they understand the concepts better.

These observations are also consistent with our comment about Soloff. If you can recall, we mentioned that he takes the time to explain his process in his ad.

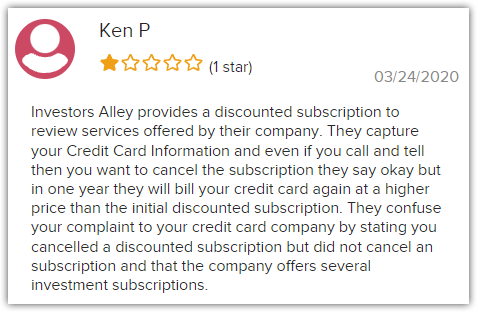

Meanwhile, the negative comments we saw were about the charges.

Meanwhile, the negative comments we saw were about the charges.

Pros v Cons

Pros

- Explains the process and performance thoroughly

- Jay Soloff has a solid real-world experience

Cons

- Credit card and refund complaints

- Options can be risky

Conclusion – Is This Your Best Option?

After everything we discussed, what is your verdict?

For sure, there are pros and cons with options trading. That is why picking the right tools is the key.

So, based on our review of Jay Soloff’s Options Floor Trader PRO, will you take the chance and subscribe?