We will carefully and fairly talk about the Raging Bull fraud case in this space.

To maintain fairness and accuracy, we will quote court documents verbatim as much as we can. We acknowledge that this is a sensitive case.

Just to get it out there, we want to disclose that Green Bull Research is in no way connected with Raging Bull Trading. In fact, our leader is much more handsome than their founders.

Okay, enough “bull” talk. Let's begin.

Overview

- Name: Raging Bull Trading

- Founders: Jeff Bishop and Jason Bond

- Website: www.ragingbull.com

- Service: Stock trading research advisory

The company is a publisher that offers subscription-based services. Raging Bull provides training materials so their readers can learn strategies when they trade on their own.

Examples of such materials include commentary, analysis, and real-time trading demonstrations.

Aside from Raging Bull, we have reviewed similar companies on this website. Check out our articles on Three Founders Publishing, St. Paul Research, and WealthPress.

What is Raging Bull Trading?

How it Began

Jeff Bishop and Jason Bond opened the company in 2010.

It was a result of their earlier collaboration where Bishop mentored Bond on trading. Since they both learned so much, they wanted to share their techniques with more people.

In 2012, professional trader Kyle Dennis joined the two after a milestone. He became the first to earn $1 million from Millionaire Roadmap. As a token for his performance, Bond gifted him with a Porsche 911.

The trio then joined forces to replicate this success to others outside their circle. Then, they created various advisory services to cater to different kinds of investors.

Among the topics they covered at the time were swing trading and biotech stocks.

Company Profile

According to their website, the roster of Raging Bull millionaire traders is the best in the business. Due to this, it is effortless to assist others in improving their trading talents.

They also claim to have coached thousands of investors through the years. Many of these, according to them, have been successful in increasing their income potential.

Moreover, they make sure their staff can provide expert analysis, recommendations, and tactics. In fact, both new and seasoned traders can benefit from RagingBull.com's services.

Day and swing traders will also find all they need to know about small and large companies alike.

In addition, they offer information on options trading, exchange traded funds, and biotech, among others. Their message is clear: to be the go-to source for day trading.

According to them, their expertise is unmatched by their competition. As of their last update, they have already helped more than 10,000 individuals.

The group also trumpets on their website a company highlight in 2019. Raging Bull was included in Inc. 5000 list as one of the fastest-growing privately held companies in America.

According to them, they were only two spots behind Uber and they were number one in New Hampshire that year.

Who are the People Behind Raging Bull?

Legendary professional trading gurus.

This is how the website introduces its founders, Jeff Bishop and Jason Bond. Let us learn more about what makes them legends.

Bishop, with his 20-year background in the stock market, is an entrepreneur and industry leader. He also claims that his expertise is on options and ETF.

His initial services include Weekly Money Multiplier, High Octane Options, Total Alpha, Bullseye, and Bishop Bundle.

Meanwhile, Jason Bond was a high school teacher before entering the financial education industry.

Because of his low salary, he realized he does not even have enough to pay off his debts. This prompted him to shift careers.

After offering Jason Bond Picks, he also came up with Monday Movers, Rooster Report, and Weekly Windfalls. These mainly revolve around penny stocks and small-cap stock trading.

Although not a founder, the website also prominently features Kyle Dennis. It states that he has a background in biotechnology, finance, and technical charting.

Dennis' main program on Raging Bull is Biotech Breakouts, of which he is the founder.

The Headlines: FTC Versus Raging Bull

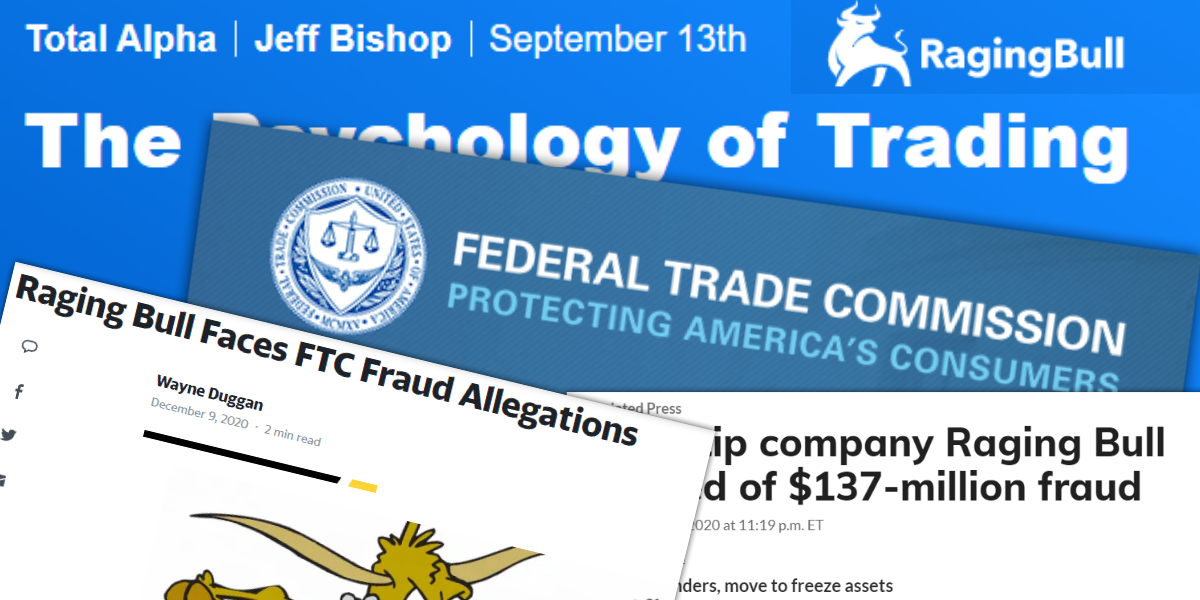

On the second week of December 2020, the following greeted the business pages of publications:

- CBS News: Raging Bull stock-trading site accused of $137 million fraud

- ABC News: Company offering pandemic stock tips accused of $137M fraud

- Yahoo! Finance: Raging Bull Faces FTC Fraud Allegations

- Baltimore Sun: Founders of Raging Bull, a company with Hunt Valley ties that offers stock tips, are accused of $137M fraud

- Market Watch: Stock-tip company Raging Bull accused of $137 million fraud

The introductory paragraphs reveal that the Federal Trade Commission (FTC) sued RagingBull.com LLC. According to the complaint, its founders defrauded customers of over $ 137 million.

This went on for three years, federal regulators allege. They even add that not even the pandemic could stop Jeffrey Bishop and Jason Bond from their schemes.

FTC lawyers also sought to freeze the company's assets. To protect their customers, they also want the company to offer refunds and restitution.

These are the big-ticket ideas in these news reports. But what exactly is included in the actual court documents?

Let us investigate.

Background on Operation Income Illusion

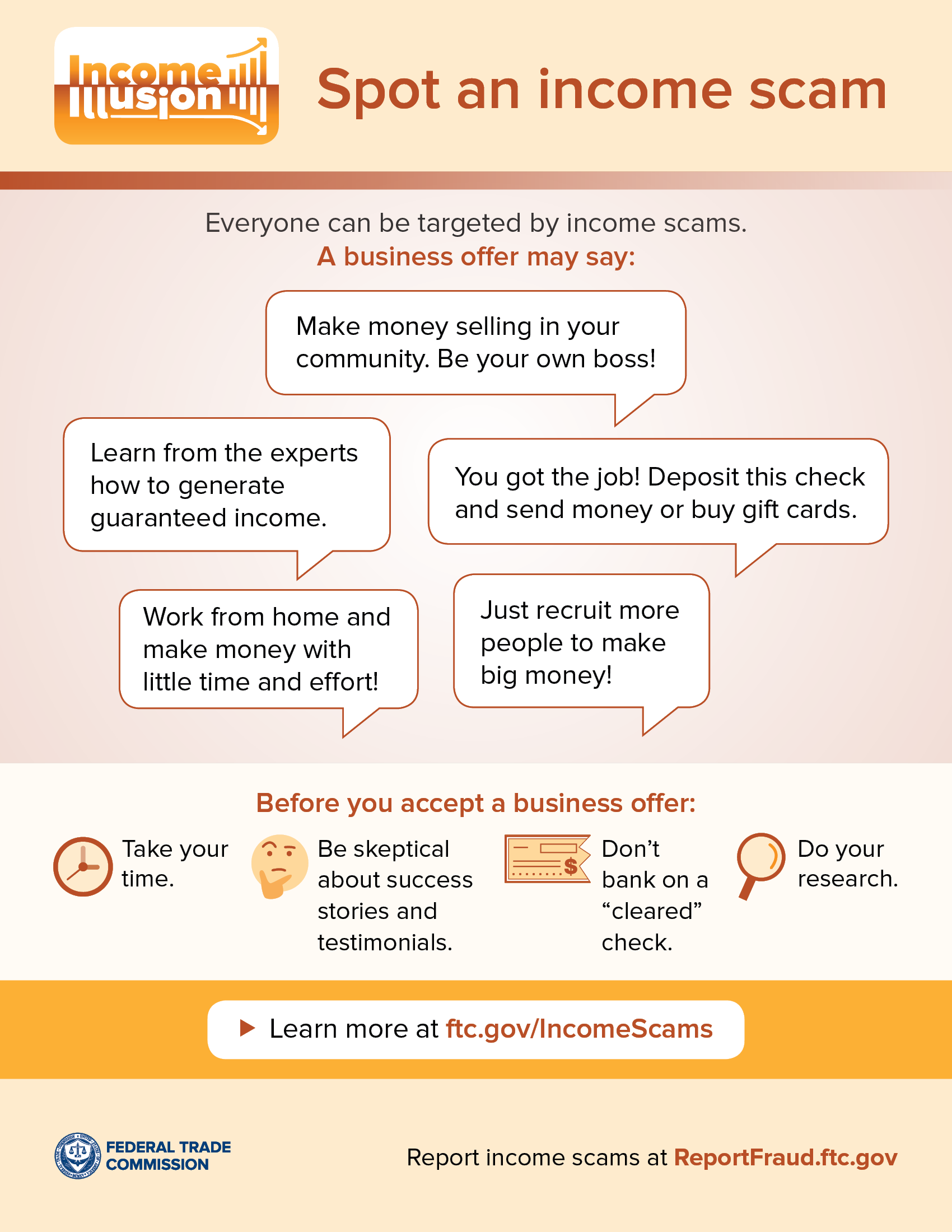

When we look at the big picture, we can see that Raging Bull was not singled out by the FTC. According to the agency, it was only one of many suspicious groups and activities they looked into.

Here is what they said in their Operation Income Illusion press release:

The Federal Trade Commission, along with 19 federal, state, and local law enforcement partners today announced a nationwide crackdown on scams that target consumers with fake promises of income and financial independence that have no basis in reality. The impact of these scams has intensified as scammers take advantage of the COVID-19 pandemic and financial crisis.

The crackdown was against various work-from-home, employment, and investment scam operators. They also investigated pyramid schemes and bogus coaching courses.

Since 2019, scammers defrauded the complainants of over a billion dollars via their shady businesses. They even took advantage of people's vulnerabilities during the pandemic.

All in all, 19 federal, state, and local law enforcement agencies worked together on the case.

According to their report, some people groups were highly vulnerable to scammers:

- students

- military families

- people on a limited fixed income

- immigrants

- Black Americans

- Latinos

- the deaf and hearing loss communities

- older adults

In the said press release, the FTC reported four new cases. These involved Digital Income System, Moda Latina, RagingBull.com, and Randon Morris.

Additionally, they announced that 8 Figure Dream Lifestyle settled FTC's charges against them. The company targeted senior adults, selling them fake money-making opportunities.

In addition to these cases, the commission also released educational materials to help people spot and avoid scams.

Details: FTC Complaint for Permanent Injunction

Overview

The Federal Trade Commission was the plaintiff in the case they filed in a District Court in Maryland.

The defendants are as follows:

- RagingBull.com, LLC f/k/a LighthouseMedia LLC, a Delaware corporation

- Jeffrey M. Bishop

- Jason Bond, f/k/a Jason P. Kowalik

- Kyle W. Dennis

- Sherwood Ventures, LLC

- Jason Bond, LLC

- MFA Holdings Corp.

- Winston Research Inc.

- Winston Corp.

Based on their investigation, all the defendants and their companies are closely intertwined. Thus, all of their inclusion in the case.

Now, there is a lot to unpack in the complaint filed by FTC General Counsel Alden Abbot.

He and the organization believe that the defendants violated the law. Based on their findings, since the company misrepresented their services, they are guilty of “unfair or deceptive acts or practices in or affecting commerce”.

Through their promotions, Raging Bull's claims of earning substantial amounts were misleading and not substantiated.

In addition, the commission also found the following false or misleading claims.

Consumers will or are likely to earn substantial income using Raging Bull’s services even if they:

- have little to no experience in securities trading.

- spend only a short amount of time each day using the service

- start with a very small balance in their brokerage account.

This next one is interesting.

The complaint says that the company violated the Restore Online Shoppers' Confidence Act (ROSCA). Under this, companies cannot charge customers through a negative option feature.

What does this term mean?

“…in an offer or agreement to sell or provide any goods or services, a provision under which the consumer’s silence or failure to take an affirmative action to reject goods or services or to cancel the agreement is interpreted by the seller as acceptance of the offer…”

This is a practice of Raging Bull, according to the complaint.

Yes, true.

But don't all or most investment research firms have this feature? That when you do not cancel, your subscription is automatically renewed?

So why are the others getting away with this?

Going back, another issue against the defendants is their failure to adequately help consumers stop recurring charges.

It is primarily because of all these that the FTC wants a permanent injunction, it wants Raging Bull to stop its operations fully. Further, it also asked the court to freeze its assets.

Advertising

In the complaint, the commission mentioned marketing materials that include testimonials claiming profits.

However, there is also a fine print from the firm saying that those accounts of success have not been verified.

In fact, real consumers who subscribed either made less money or no money at all. There were even some who had substantial losses using Raging Bull's strategies.

Unfortunately, even if they wanted to, it was very hard for them to cancel their subscriptions.

The complaint also mentioned how Raging Bull spends millions of dollars on marketing. This includes paying affiliates to promote their services and placing ads on search engines.

They are also active in posting on various social media and websites.

Often, they also offer free webinars or e-books. Once a person enters his/her email address though, s/he is bombarded with non-stop marketing materials.

Another issue cited in the document is about customers' income potential. These are usually based on the defendants' expertise and include:

-

general claims about the kinds of profits consumers can make, which include statements like “consistentmoney,” “big money,” “double your money,” and various profit percentages

-

examples of specific, winning trades the instructors themselves claim to have made using their strategies,which purport to illustrate the income potential of the programs

-

testimonials that purport to illustrate the kinds of profits Raging Bull customers make

According to the commission, these are all misrepresentations.

Further, even if they have disclaimers, this does not absolve them of their fraudulent claims.

Cancellations and Recurring Charges

Another major focus of the complaint is the difficulty of canceling recurring billing.

Upon investigating, it seems that Raging Bull makes it difficult for customers to do this.

First, they offer limited means for cancellation requests. Second, each has its own complicated cancel scheme. Third, they seem to purposefully understaff customer hotlines that act on such requests. Finally, they have inconsistent and confusing instructions.

Also, the FTC pointed out how the company adamantly refuses to give refunds, citing internal policy. But when pressed on Better Business Bureau and other law enforcement agencies, only then do they oblige.

Do all of these sound familiar? Wow, by these standards, more companies should be charged. If these are the rules, it seems a lot are breaking them.

This is why we hope that agencies will be more proactive against other companies that appear to follow the same playbook.

Complaints

Another point that concerns us is that Raging Bull is fully aware of all the complaints. They know that their subscribers consistently do not see the results they promise.

They admitted this as much, as per the document.

In 2019, Bond even apologized to subscribers. He said in a video that the core team “overestimated their ability to mentor so many people and had failed to deliver the services as promised”.

As a way to make amends, they merely offered access to their other services and still refused to give refunds.

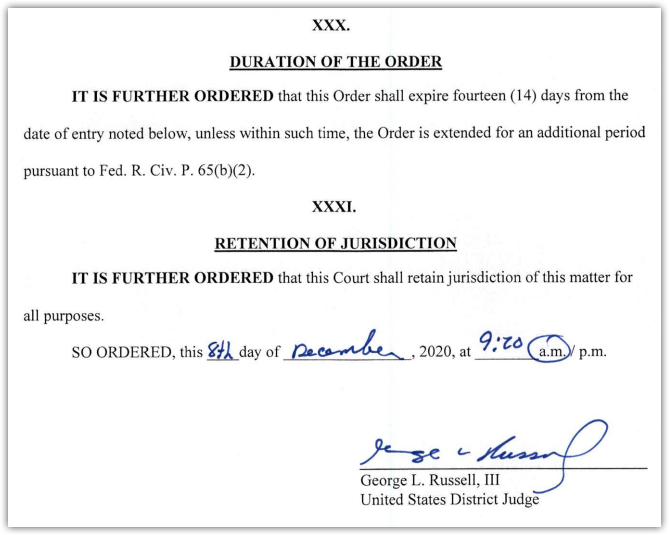

Details: Court Action on Complaint

The following day, District Judge George L. Russell, III released a temporary restraining order based on the FTC's complaint.

Even if the injunction was not granted the court believes it is in the public interest to issue such a TRO. It needs to stop Raging Bull from making further violations.

The court also appointed a receiver over the case.

In addition, the judge ordered that concerned agencies should freeze all assets of the defendants.

Why did it come to this?

Well, the court found merit in the points raised by the FTC.

First, it has reason to believe that Raging Bull “have engaged in and are likely to engage in acts” that violated the rules cited by the commission.

Second, the court says that the agency established that the defendants “made false or unsubstantiated claims” on potential income.

Additionally, there were misrepresentations in their promotional materials and they illegally charged consumers.

Third, if the court will not issue a TRO, the company will cause further harm due to its violations. Thus, this course of action is necessary.

We will continue to specify certain provisions in the court document. Learning about them is enlightening for regular investors like us.

Hopefully, as we know more about our rights, we can fight back against abusive companies.

We believe the judge laid out clearly why the court sided with FTC.

Prohibited Business Activities

Everyone connected with the company is temporarily restrained and enjoined from doing three main things.

First, Raging Bull must stop making earnings claims unless these are non-misleading. For any claim in the future, they must have a reasonable basis and evidence. The company must also be ready to provide proof when consumers and the FTC ask.

Second, it should also not claim anything based on consumers' experience, time, and capital for them to succeed. The same conditions above must be met should they still choose to make such claims.

Third, any direct or indirect misrepresentation must also stop. This applies to cost, refund policy, and performance, among others.

Negative Option Feature

The judge also ordered the company to provide “a simple mechanism” for the cancellation of services.

It should also give consumers easy ways on stopping recurring charges. The court also asked Raging Bull to stop using the negative option feature.

In addition, the company must ensure that their representatives will attend to calls and mails regularly. These must be accessible to their consumers.

Customer Information

Further, Raging Bull must protect the data privacy of anyone they had connections with in their business.

No one should sell or disclose the personal details of their customers. They may give this information only to law enforcement agencies.

Asset Freeze

Each defendant must also not withdraw from their accounts more than $25,000, unless approved by the court.

In essence, the judge indeed froze all their company and personal funds.

Receivership

To manage the affairs and finances of Raging Bull, the court also appointed a “Receiver”. S/he will be accountable to the court and will act to protect the interests of the company's subscribers.

Given this, Raging Bull must fully cooperate with him/her. Ultimately, the Receiver will be in control of the whole company moving forward.

Initial Response of Raging Bull

Court Response

Raging Bull gave its response to the court order two days after the TRO. It asked “the Court to stay or otherwise modify the TemporaryRestraining Order”.

According to the defendants, they were not allowed to address the concerns of FTC. Further, the result of the court's order will make it “impossible for the business to continue”.

In its motion, they maintained that their services are legitimate. They even have hundreds of customers who can attest to this. So they believe the case against them was without merit.

Further, they said that the commission's power to freeze assets and appoint a receiver is still pending in the Supreme Court.

But then, Raging Bull also recognizes and respects the decision of the court. It did see the importance of preserving assets. So the company proposed modifications instead.

The defendants want to omit and strike the asset freeze and receivership appointment. For them, these are contentious issues.

On another note, it is interesting to note that Kyle filed a separate motion from that of Bishop and Bond. Nonetheless, the content of their court requests is the same.

Letter to their Readers

We obtained from WealthVine a supposed email from the company eleven days after FTC filed its case.

We will publish this in full, as it is an instructive letter on how a company responds to such an issue.

Dear Raging Bull Subscriber,As you may be aware, this is an unprecedented time for all of us at Raging Bull.We have recently been served with a lawsuit by the FTC, without warning or an opportunity for any prior discussion with the FTC, that paints our business in a very bad light.We have not been able to get our full defense in front of the judge to argue our side of things. In our view, the FTC has taken a very aggressive approach to handling this.

The United States District Court for the District of Maryland, though, issued a temporary restraining order (which can be accessed here) on December 8. This order, among other things, appointed a temporary receiver and placed a freeze on the company’s assets.

In addition, the New Hampshire Bureau of Securities Regulation has initiated a regulatory action against the company. We believe that we will prevail in both matters, but with the extraordinary actions taken to this point our business has been virtually crippled overnight.This week was one of the saddest weeks of our lives. Due to these actions and the freezing of our assets by the FTC, we had to furlough many of our employees right before Christmas.

Many of them are in towns you live in and could even be your neighbors. Some of these people have been on our team for nearly a decade.We want to thank everyone who has shown us their support! Everyone who sticks with us through this time is truly an important part of the Raging Bull family — and we appreciate and love our family.All of us here have poured our heart and soul into this company to build what it is today, and you are a critical part of that. If you love Raging Bull as much as we do, then I have a special request today.Now more than ever, we are asking you to voice your support for Raging Bull.We want people who are willing to share their experiences and how much Raging Bull means to them.Simply email Kayla in the next few days (support@raginbull.com Attn: Kayla) and let us know.We have heard from literally hundreds of people already, but we really need to hear from you as well. Please take a moment to support our family.And as we move forward, we will continue to keep you informed of our status and of any major developments in the suit.

What is your impression of their letter given the court documents we have cited so far? Considering the weight of the allegations, are you satisfied with their explanation?

Tell us in the comments section below.

What's with the Business Plan?

In February 2021, Raging Bull submitted a business plan to the court. The defendants wanted to continue their operations while the case is ongoing.

Here is its stated purpose:

The Business Plan lays out how Raging Bull will operate lawfully and profitably during the interim time up to either a trial on the merits or other resolution of this matter.

Under the plan, the company laid out specific parameters.

On Operating Lawfully

Among the first steps for the company is to reconnect with its subscribers. It plans to win them back by fulfilling its obligations to them.

At this point though, it will not advertise to get new customers. Instead, Raging Bull will take its time in strengthening the company's internal mechanisms.

In addition, it will submit itself to a compliance monitor. This way, the court can independently verify Raging Bull's efforts at improving its processes.

On Operating Profitably

According to the company, it will also submit its financial projections. These will show that the owners can continue to operate and provide services to their paid subscribers.

In their own words:

Defendants are committed to saving their Company, which they have worked hard to build. By re-starting operations and committing substantial personal funds to do so, Raging Bull can be part of the solution in getting this matter resolved.

Raging Bull has a clear plan for operating lawfully and profitably, which will allow the Company to fulfil its obligations to its subscribers – most of whom, the evidence shows – are happy with Raging Bull and want their services to continue.

Servicing those subscribers, and building the business with new subscribers, will generate assets and reduce liabilities through the earning of deferred revenues and avoiding exposure to demands for refunds.

This will increase, rather than diminish, the cash available for consumers as part of any ultimate resolution of this matter.

It will also serve to employ or reemploy members of the public as well as provide a service to consumers who want to learn to trade stocks.

Back in Business

On March 2021, the court released an order.

In it, the judge stated that Raging Bull's business plan was a sufficient document. Further, the court has denied FTC's motion for a preliminary injunction.

As per the document, “the FTC has not satisfied its burden of demonstrating that the equities weigh in favor” of their motion.

In addition, the court lifted the asset freeze and receivership.

This does not mean that everything is back to normal for the company, though.

It is still under strict monitoring while the case is still pending. But then, as one would expect, they did trumpet this as a huge win.

The guy above is Bishop. And Bishop is riding what looks like a canon charging towards something. Or someone.

It is unclear who it is aimed at or why the imagery, but the photos send a strong message.

Two months after the court approved their business plan, they emailed their subscribers. They are back, they said.

Along with the message on the resumption of their services was some “good news”. They offered their loyal subscribers an all-access pass good for one month.

As expected, they clarified matters on their services. Since some team members did not return, they offered alternatives.

Conclusion – Is the Company Full of B.S.?

Before you raise your eyebrows, let us complete the question. Is the company full of Bull services, as in Raging Bull services? That is their name, right?

Kidding aside, we found reasonable arguments from the Federal Trade Commission. Based on the reviews we have written thus far, this case could be a major wake-up call for the industry.

As you know, we are always on the side of consumer protection. But if the court did see that the FTC lacked further proof, we also welcome developments in that regard.

Since the company is back in business, we hope it sufficiently addresses all the concerns of the court and the FTC.

In their letters and on their website, it is just unfortunate that they were not transparent with their consumers. There was no clear admission that there were glaring errors on their part.

So that's a negative sign.

But the case is still pending, so a lot could still happen.

So far, what has been your opinion on the Raging Bull fraud case? Let's discuss below.