“Few things are more certain than death, taxes, and Nvidia.”

This is how dominant the chipmaker has been, however, demand for its chips is so great that Nvidia cannot get the job done by itself.

Instead, it's relying on a group of “Silent Partner” Stocks, and Martin Weiss is teasing three of the very best.

The Teaser

Some of Nvidia's partners have already been big winners.

Dr. Martin Weiss has been investing for more than 50 years. He's best known as the founder of Weiss Ratings, which independently grades everything from stocks to mutual funds and cryptocurrencies. FYI, it is bullish on DeFi and AI coins.

We have previously reviewed Weiss Ratings right here on Greenbull and also covered Martin's “Next Bitcoins” teaser.

When it comes to this teaser, Martin gives all the credit for it to his Director of Tech Investing Strategies, Michael Robinson.

From an investing standpoint, I see the logic.

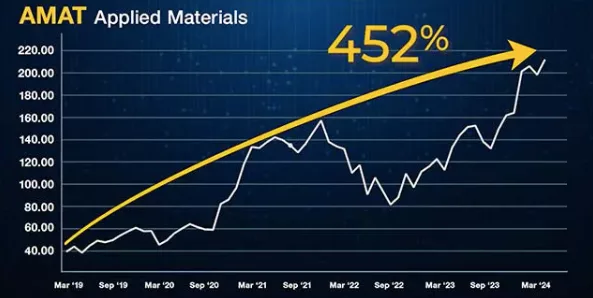

ASML Holding NV, which works closely with Nvidia on its graphics processing units (GPUs), has seen its shares go up as much as 471%.

Similarly, Applied Materials, which helps Nvidia with wafer fabrication components, had its stock go up 452%.

Finally, there's TSMC, the final boss of Nvidia suppliers, which manufactures its AI chips. TSM’s stock has performed best of all since partnering with Nvidia:

This is the kind of impact working with Nvidia has.

However, Michael isn't just counting on history repeating itself.

Revolutionizing AI…again

Compute and networking may be Nvidia's bread and butter, but it's been quietly expanding and pivoting into another lucrative business.

Michael predicts it has “an equal or even bigger potential” than its chips franchise.

What is it?

Nvidia’s CEO, Jensen Huang, says over $1 trillion will be spent on it…

He's talking about cold, hard data.

Without data, or more precisely, the ability to process and store data, there is no artificial intelligence (AI).

Consider this, the first version of ChatGPT, which was the first consumer AI application, used 175 billion data points.

90% of all data has been generated in just the last two years.

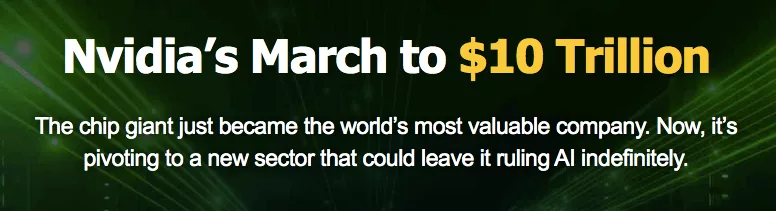

This is Nvidia’s big trillion-dollar pivot, from a business dedicated to chips to a business that’s dedicated to chips and mega data centers that it calls “AI Factories.“

Except Nvidia isn’t building these next-generation AI data centers alone, it’s leaning on a new set of “Silent Partners” to get the job done.

The Pitch

The names of these critical suppliers are in a series of three special reports called:

- “Nvidia’s Silent Partner with 5.6 Billion Users”

- “Nvidia’s Silent Partner That Conquered the Fortune 500“, and

- “The Silent Partner that Nvidia calls 1 Million Times Better.”

All three reports are ours with a subscription to the Disruptors and Dominators monthly newsletter.

It costs $49 (normally $109) and comes with a one-year money-back guarantee, a pair of bonus reports, and one year of unrestricted access to Weiss Ratings.

Specialized AI Architectures

Like many industries, data centers are going through a period of massive change.

It boils down to hardware powerful enough to process petabytes…the thing that comes after terabytes.

See, more than half of all data centers today have been in operation for more than 10 years.

This means they most likely run on standard hardware like Central Processing Units (CPUs). These are sufficient for most needs except the heavy-duty data workloads of AI.

For this, specialized AI architecture like GPUs, which Nvidia produces, and Tensor Processing Units (TPUs), like the kind Broadcom makes, are required.

So Nvidia's pivot is to become vertically integrated across the value chain and own the entire AI tech stack. From data centers to hardware and software. A smart play.

How far along is this pivot?

Several partners have already stepped up to build “AI Factories” alongside Nvidia, with the first of these expected to be online by the end of the calendar year.

Martin and Michael have zeroed in on three stocks that they predict will be Nvidia’s new “Silent Partner” winners. Let's find out what they are.

Revealing Nvidia's “Silent Partner” Stocks

A few general clues are dropped about each pick. Here is what we know:

1st Silent Partner

This company’s stuff is used by more than 5 billion people around the world.

A tad generic, but if we go down the rabbit hole, only one technology is used by more than half of the world's population – mobile phones.

If we follow this logic, the only confirmed “Silent Partner” building solutions for the global mobile networks market is Amphenol Corp. (NYSE: APH).

The company is also a key supplier of copper cable cartridges for Nvidia's upcoming AI factories.

2nd Silent Partner

- This company’s customers aren’t average consumers. They’re big companies.

- It is one of the only companies in the world that can give Nvidia the specific support it needs to keep all its massive new AI data centers humming.

Not much to go on here either, but if we're talking about major Fortune 500 suppliers that are also Nvidia AI factory partners, then Vertiv Holdings Co. (NYSE: VRT) could be the pick.

Vertiv supplies three-fourths of Fortune 500 companies with their IT data center inventory, and it is a confirmed Nvidia partner.

3rd Silent Partner

- The only company of its kind, it uses AI to predict the economy or the stock market. It’s dedicated to simulating the results of nearly everything engineers have created or might want to create.

- Oracle, Porsche, Medtronic, BMW, Panasonic, and nearly 20,000 other customers depend on them.

This is likely Ansys Inc. (Nasdaq: ANSS).

Ansys has developed multiphysics-based structural analysis software for engineering design and testing.

As the global leader in engineering simulation, Ansys is the Official Technology Partner of the Porsche Formula E Team, and it is also an Oracle Cloud Infrastructure partner, among many others.

Win Big with Supplier Stocks?

Michael's investment thesis is fundamentally sound.

If we turn the clock back and look at the early performance of Internet supplier stocks, we wouldn't be disappointed. From the beginning of 1995 to early 2000, shares of Cisco Systems returned 4,000%.

Another Internet infrastructure darling, Intel, appreciated by 1,600% over the same timeframe.

How likely are the current batch of AI infrastructure picks to repeat such performance?

Amphenol: For a provider of a commodity product, APH has an above-average net margin of 17%. However, at 33x current earnings, we would be paying too much for such a business.

Vertiv Holdings: Its stock is down nearly 40% year-to-date, but it still trades at 57x earnings. I like Vertiv because it provides a diversified array of critical power, thermal management, and monitoring products for data centers, but I would wait for a better entry point.

Ansys: The simulation-modeling software leader, holding somewhere around a 40% market share. It trades for 26x forward earnings with a solid profit margin of over 20% and a decent Return on Equity (ROE) of 10.

It could be cheaper, but for a large-cap, market-leading business, it would be a challenge to find better.

Overall, all of Michael's picks are already mature businesses trading at healthy premiums. So they aren't likely to match the returns of early Internet infrastructure stocks from this point forward.

However, given that we are just at the first phase of the AI buildout, they are likely to still provide returns that beat the market.

Quick Recap & Conclusion

- Nvidia is in the middle of a major pivot, but it's relying on a group of “Silent Partner” Stocks, and Martin Weiss and Michael Robinson are teasing three of the very best.

- The big pivot is Nvidia going from a business dedicated to chips to a business that’s dedicated to chips and mega data centers (“AI Factories”).

- The names of Nvidia's “Silent Partners” are in a series of three special reports called: “Nvidia’s Silent Partner with 5.6 Billion Users”, “Nvidia’s Silent Partner That Conquered the Fortune 500“, and “The Silent Partner that Nvidia calls 1 Million Times Better.” All three reports are ours with a subscription to the Disruptors and Dominators monthly newsletter, which costs $49 (normally $109).

- Despite some basic, generic clues, we were able to reveal all of the “Silent Partner” stocks for free as Amphenol Corp. (NYSE: APH), Vertiv Holdings Co. (NYSE: VRT), and Ansys Inc. (Nasdaq: ANSS).

- All of the picks are large-caps trading at healthy premiums. So they are likely to provide good, although not incredible, returns going forward.

Are you all in on AI infrastructure? Drop a Yes or a No in the comments.