Nick Giambruno is introduced as a “renowned speculator” who knows the secret to earning outsized Bitcoin profits.

That's why he's about to dispatch what could be the most important presentation we read all year on “the #1 Bitcoin stock for 2024.”

The Teaser

As the name implies, this isn't a crypto teaser, rather it's about a small group of stocks that have the potential to outperform Bitcoin, by orders of magnitude.

Nick is the Founder of The Financial Underground, an independent research provider, and Editor-in-Chief of its main investment publication Financial Underground: SPECULATOR, which I have a hunch we will hear about a little later.

This is my first time reviewing one of Nick's pitches, but we have covered plenty of Bitcoin-related stuff here at Greenbull. This includes Bitcoin's Fourth Halving and Martin Weiss' “Next Bitcoins.”

If Nick's presentation could be summed up in one chart, it would be this one:

In a matter of months, Bitcoin went up around 11x, so those who bought it did well.

But the big profits went to those buying a select number of small stocks tapping into the Bitcoin megatrend, which can be purchased from an ordinary brokerage account.

The best Bitcoin stock delivered an eye-popping return of 10,118% in a little over a year, a gain of over 100x.

That's enough to turn every $5,000 invested into more than $500,000 in just a matter of months.

The Key to the Biggest Bitcoin Gains

Although past performance is no indication of future results for any investment, the biggest Bitcoin gains have tended to accrue over just ten days each year, following a downturn in the price of the biggest cryptocurrency in the world.

Nick thinks Bitcoin is poised to soar imminently once again, due to the upcoming halving event, and Bitcoin stocks are an obvious choice.

Yet few know they even exist because they are so small and obscure.

This could be our last chance to profit from the Bitcoin megatrend and Nick is going to show us how to find the biggest winner.

The Pitch

All of the details, including the name of Nick's top stock pick and its ticker symbol, are in a special report called The #1 Stock To Multiply Your Profits From Bitcoin’s Next Upside Explosion.

We can get immediate access to the special report if we join Nick's premium investment publication, Financial Underground: SPECULATOR.

Usually, the price of The SPECULATOR in all caps is $2,499 per year. But Nick is offering a one-time discount of $700, which comes out to $1,799 per year. This includes 12 monthly issues, a weekly briefing, full access to a model portfolio, and five bonus reports.

Everything We Need to Know About the Bitcoin Megatrend

Nick says for us to understand the enormous profit opportunity before us today, it's essential to understand what most people don't know about gold, money, and Bitcoin.

For over 5,000 years, gold has been mankind's most enduring form of money. No lies are told here.

The metal didn't become money by political decree, it became money because the market chose it as the best way to store and exchange value.

So why have countless individuals throughout history selected gold over other forms of currency?

A few characteristics make it attractive – it's divisible, scarce, and most importantly, hard to produce.

This resistance to inflation is what makes gold a superior currency.

Think about it like this, would you put your savings into something somebody else can create without effort or cost?

That would be like storing your life savings in Chuck E. Cheese arcade tokens or airline frequent flyer miles. Unfortunately, putting your savings into government-issued fiat currencies isn't that much different.

Now, for the first time ever, gold has a serious competitor.

Digital Gold

Bitcoin shares many of the attributes that make gold attractive, which is why it has been dubbed “digital gold.”

Namely, Bitcoin does not have counterparty risk, and nobody can arbitrarily inflate the supply. It takes human error out of the equation.

Even if Satoshi Nakamoto, Bitcoin’s anonymous creator were to show up after disappearing in 2011, he could not alter Bitcoin.

None of the other 20,000 cryptocurrencies are genuinely scarce, like Bitcoin.

They all have founders, insiders, and development teams that can inflate the supply or change the rules if they choose to.

The bottom line, all other cryptocurrencies have artificial scarcity and are not hard assets.

The Stock-to-Flow (S2F) Ratio

S2F measures an asset’s hardness or resistance to debasement.

A high S2F ratio means that annual supply growth is small relative to the existing supply, which indicates a hard asset resistant to debasement.

A low S2F ratio indicates the opposite.

Bitcoin’s S2F ratio today is about 57x, slightly below gold’s 60x. But this is about to change in a BIG way.

A key feature of Bitcoin is that the new supply gets cut in half every four years, which causes its hardness to double every four years.

The next time Bitcoin’s supply growth will be cut in half is April 2024.

However, this coming halving will be very different. That’s because Bitcoin’s hardness will be almost twice that of gold’s after it happens.

Soon Bitcoin will become the hardest money the world has ever known.

We now have a rare chance to front-run major investors, large multinational corporations, and governments by getting in on this trend before they do.

The way to do this is by buying a select number of tiny stocks that have outperformed Bitcoin in the past when the crypto has accrued its biggest gains.

Revealing Nick Giambruno's Bitcoin Mining Stock

Nick reveals that publicly traded Bitcoin mining companies are one group of companies with eye-popping potential.

His proprietary system has identified one Bitcoin miner that stands out against all others and we got only one single clue about its identity:

- The company mines Bitcoin with 100% renewable energy

Fortunately, one clue was enough, leading us directly to Nick's pick – Gryphon Digital Mining Inc. (Nasdaq: GRYP). Gryphon is the largest Bitcoin mining operation running on 100% renewable energy.

But is it the best stock to multiply our profits from Bitcoin's upside?

The #1 Stock For Bitcoin's Big Move Up

Last year, Gryphon mined 739 Bitcoin at a median cost of $18,217 per coin.

Given that the average price of one BTC was just above $28k for the year, it netted $10k per coin or over $7.3 million in total. Despite being one of the most efficient Bitcoin miners in the market, its stock is down 90% over the past year.

What gives?

The company's profits were less than 2022's and a look at its balance sheet reveals that Gryphon is currently underwater – it has fewer assets than liabilities, thanks to its $19.4 million in Bitcoin-denominated debt.

How likely is this to turn around?

As per its latest investor presentation, Gryphon’s forecast “all-in” cost-per-coin will be about $36k/BTC post-halving. Based on an average price of Bitcoin of $70k for the year, profits will more than double and the digital miner can begin paying down its debt.

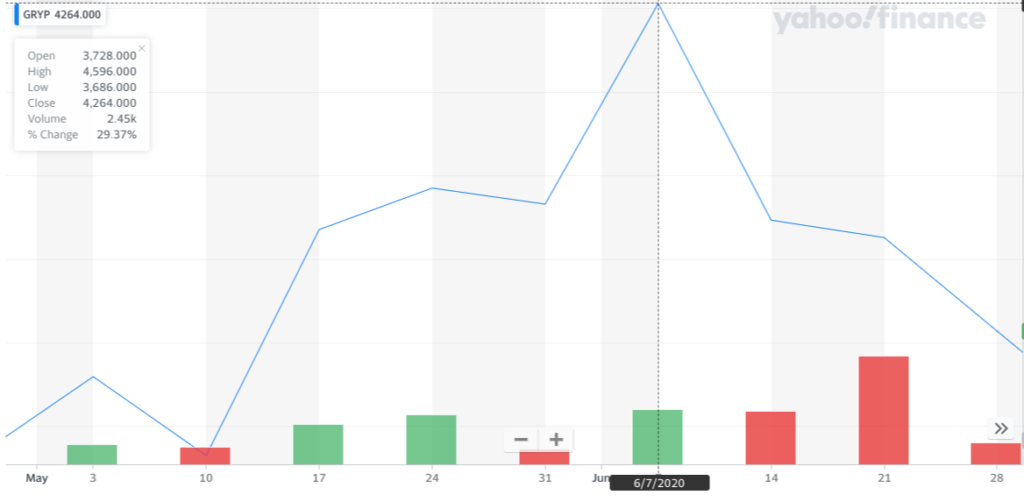

When it comes to the stock, if we pull up a chart of GRYP, we can see how it performed during the last Bitcoin halving event in May 2020.

The stock went up by 35.5% in the month following the halving, before coming crashing back down to reality.

Will history repeat itself? Who knows, but it makes for an interesting little side speculation around Bitcoin's upcoming halving event.

Quick Recap & Conclusion

- Nick Giambruno says he knows the secret to earn outsized Bitcoin profits, which includes a “#1 Bitcoin stock for 2024.”

- The big reveal is that publicly traded Bitcoin mining companies are one such group of stocks with above-average potential following Bitcoin halving events.

- All of the details on Nick's top Bitcoin mining pick and its ticker symbol are in a special report called The #1 Stock To Multiply Your Profits From Bitcoin’s Next Upside Explosion. We can get immediate access to the special report if we join Nick's premium investment publication, Financial Underground: SPECULATOR for $1,799 for the first year.

- Despite receiving only a single clue, we were able to reveal Nick's pick for free as Gryphon Digital Mining Inc. (Nasdaq: GRYP).

- Gryphon's fundamentals are not good, but the stock did go up by 35.5% in the month following Bitcoin's last halving event in May 2020. Nick is betting on a repeat performance this time around, which may or may not materialize.

Is Bitcoin becoming the best store of value in the world? Drop a Yes or a No in the comments.