Have you ever played a game with your siblings when you were younger where you had to name the brands the commercials on TV are promoting? I did. That was what got us through boredom while we wait for our favorite TV program to come back on. But that’s all there is to it. We didn’t care about the TV ad per se, nor would our knowledge of the brand names translate to sales.

Why am I telling you this, though? You’ll understand in little while.

I stumbled upon this teaser about an apparently ‘cord-cutting’ stock pick by Motley Fool. We will go through it bit by bit, see what it is all about, check if it lives up to the hype, and evaluate if it really is worth investing in.

THE TEASER:

The image below is from a more recent teaser Fool had published about this stock. I am saying this because the Motley Fool had been teasing this stock for years already. There are other variations of this teaser. However, we will be talking about the one I stumbled upon which you will find here.

The team behind this is The Motley Fool, founded by brothers David and Tom Gardner in 1993. The name Motley Fool was taken from a Shakespeare comedy, “As You Like It”. According to Nasdaq, the firm is a “multimedia financial-services company dedicated to building the world’s greatest investment community”. In 1996, the brothers authored The Motley FoolInvestment Guide. The book, designed to provide investment advice to both novice and adept investors alike, got to the bestseller lists of both The New York Times and Bloomberg Businessweek. Then in 1997, they created their own domain, Fool.com, after three years of being a content partner of America Online (AOL). They provided free investing advice until on February 14, 2002, the Virginia-based company decided to transform into a subscription-based service. The Motley Fool, or simple Fool, boasts of businesses in the UK, Australia, Hong Kong, Canada, Singapore, and Germany. Aside from their headquarters in Alexandria, Virginia, the company also has satellite offices in Denver and Sydney, Australia.

Now, on to the teaser.

The teaser was published by a Motley Fool tech stock analyst Erik Bleeker in Nasdaq. He started by remarking that 2018 marked the 25th anniversary of the firm. He delightfully reminisced about the humble beginnings of the Fool, from an investment newsletter from a shed behind founder David Gardner’s house for around 300 subscribers into an organization that can serve millions of investors around the world.

As per the article, the founding fathers (brothers?) have the ability to point to investors the “most life-changing investment returns the market has ever seen”.

Bleeker enumerates some of the companies Fool recommended to investors:

- Amazon (up 12,257%)

- Netflix (up 19,537%)

- Nvidia (up 1,586%)

- Baidu (up 1,242%)

- Salesforce.com (up 2,241%)

The Garner brothers’ portfolio seems to be really astounding, and as it turns out, they independently research for their own stock picks. Now we get to the interesting part. Apparently, this specific stock our teaser is all about is actually both David and Tom’s pick. They landed on the same stock that is a “rare and historically profitable stock”.

On the rare times that the Motley Fool founders agree on a pick, which they call the “All In” buy sign, the results have been said to be spectacular. For example, Tom and David both agreed that Netflix and Tesla are good investment picks and well, we know how big Netflix and Tesla are today.

Fool described this “tiny little Internet company” as:

- 1/100th the size of Google

- It stands to profit as more and more people ditch cable for streaming TV

- The CEO called it a ‘ticking time bomb” and “the most exciting in the history of advertising.”

Hmm. Does it ring a bell yet? No? Okay, let’s add another clue to the list above. This is not the next Netflix, Amazon Prime Video, or Hulu, nor will it compete with those mentioned. It’s actually in the advertising industry.

Remember our intro, it’s slowly making sense, right?

THE SALES PITCH:

To those who have been following us for a while now, we all know where this is heading. To those who are new, guess what, this teaser ends in a sales pitch.

Fool will only share the name of the company and all the other details if you are a member of The Motley Fool’s flagship investing service, Motley Fool Stock Advisor.

The membership normally costs $199 per year but new members can register for $99 for the first year. As of writing, this 50% discount is still available. The Stock Advisor membership also comes with a 30-day 100% money-back guarantee if you aren’t impressed with their report or service.

THE “ALL IN” OPPORTUNITY

I’ll tell you what kind of company the teaser is promoting. It’s a demand-side platform.

A what now?

For us to be able to understand it, let’s go back to our intro. When an ad is shown in the television, can you relate to it? Let’s say you’re a kid, you are watching a cartoon show when an ad about power tools shows up. Will you be interested in it? Will you want to buy it or convince your parents to do so? You’ll probably answer no. That’s because it’s not meant for you.

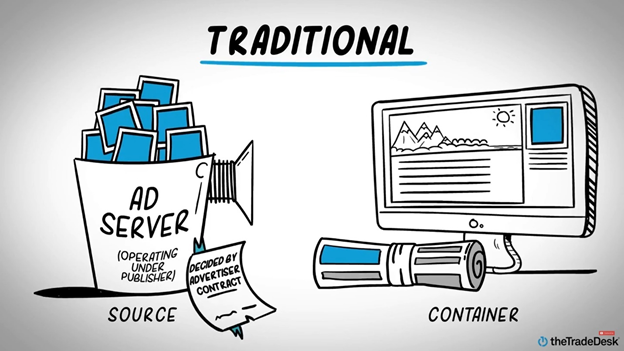

You see, in the traditional model of advertising, advertisers and companies of the brands decide which media platforms their ads will be available in, and when it will be shown.

In layman’s terms, the company hires an advertiser who in turn enters into contract with a publisher (source) to place it on platforms (container).

Everything is predecided. This usually applies to television, newspapers, and magazines. Anyone from all ages, locations, and lifestyles can see your ads. Basically, demographics don’t play as much part as it should.

In the perspective of the advertisers, it can be a waste of money since it may not reach their target market.

This is a dilemma programmatic advertising can solve. Programmatic advertising (to be called PA for the rest of the article) is a system in which advertisements that appear on a certain online platform are tailored according to the profile of the audience.

To explain it in the simplest way possible, PA works like this:

- Company “A” hires advertiser “X”.

- The advertiser uses a demand-side platform (kinda like a broker).

- When an ad request from the container (media platform) is made through the ad exchange (think stock exchange) aka the source, the demand-side platform (DSP) will sift through their data to look for a relevant ad creative for the container.

- If the DSP deems advertiser X’s ad creative for company A relevant to the container’s audience, the DSP will get into a bidding war with other DSPs to win that spot in the container.

Here’s a video that briefly explains how PA goes:

Since more and more people are turning away from cable TV (Motley Fool did call this pick a “cord-cutting” stock in an older version of the teaser for a reason) and are leaning towards online streaming services, advertisers, with the help of DSPs, know that digital advertising through the use of PA is the way to go if an advertiser wants their ad creative to reach the right people at the right time.

By this time, we understand how demand-sales platform fits in all of this, so what company is this?

STOCK EXPOSED

Maybe by now you would have noticed it since it’s right under your noses. But if not, I’ll tell you what it is. The company Fool is teasing is The Trade Desk, (surprise, surprise).

Let’s go over the details we know so far and verify.

- As of the third quarter of 2019, The Trade Desk (TTD) had 1,200 employees while Google had 114, 096. Yep, 1/100th the size of Google.

- Jeff Green, the CEO really did say TTD is cable TV’s “ticking time bomb” and the transition to a better relationship between brands and ad agencies during the programmatic media era is “the most exciting in the history of advertising”.

- It’s not a competitor of Netflix, Amazon, and Hulu.

- It is a programmatic advertising firm.

IS IT WORTH IT?

Since its IPO in 2016, stock price for TTD rose by 1,423%. It is quite a promising rise if you look at it from a long-term perspective. However, based analysis from both CNN and Yahoo, it’s not yet high time to buy such stocks. When the trend dropped around March because of the pandemic Covid-19, analysts had recommended that TTD stocks to be put on hold for now.

Quick Recap & Conclusion

- Motley Fool teased us about the ‘cord-cutting’ stock that received their “All In” buy signal.

- The stock pick both Tom and David Gardner recommend is an advertising agency.

- The company is called The Trade Desk.

There you have you it. Is TTD stock worth all the hype? Will you buy it? Or have you already invested in it? Let us know in the comments below.