Is Monument Traders Alliance a scam?

A lot of people have been asking this question. Aside from the fact that such is a common query among research firms, the company is not without fault here.

In one promotional video, founder Bryan Bottarelli makes wild claims. He confidently asserts:

Do you want to make fast profits consistently? Day after day, year after year, no matter what direction stocks are moving?There's only one chart pattern you need to know. It generates tens of millions in profit opportunities and the gains could come in 15 minutes. Sometimes, even less.

Obviously, this kind of language is a common marketing tactic. But this is particularly enticing and sweeping.

If the claim is indeed true, you will never have a bad day in your trading life again. Imagine a life without experiencing another loss ever. All that you need to do is follow his advice.

This will automatically put you above the world's best-known and most reliable investors. So how can you even resist such a proposition, right? It's not at all outrageous, right?

But before you quickly dismiss the firm as another dirty company out to deceive gullible noobs, read our full review.

Mind you, there are subscribers who can attest that the firm is legit. We will discuss in the next sections how readers say that Bottarelli's advisory helps them in their investments.

In addition, Monument Traders Alliance also introduces an element of innovation in their scope of services. So this is definitely a plus for the firm. Learn more about it later in our article.

In our review, we will present what you can expect if you subscribe to the company's three banner services. Expect also a thorough discussion on positive and negative reviews for the advisory.

As with all our in-depth blog posts, we will also tell you what we really think about each aspect of its services. So do read until the end, we have all the details you need, both clean and dirty.

Overview

- Name: Monument Traders Alliance

- Founder and Head Trade Tactician: Bryan Bottarelli

- Co-Founder and Head Fundamental Tactician: Karim Rahemtulla

- Publisher: Monument Traders Alliance

- Website: www.monumenttradersalliance.com

- Service: Investment research advisory and online sharing platform for traders

- Cost:

- The War Room: One-year subscription – $2,500, Two-year subscription – $3,500

- Trade of the Day PLUS: One-year subscription – $79

Monument Traders Alliance is an investment research publisher from partners Bryan Bottarelli and Karim Rahemtullah. Its particular focus is on trading and speculating.

What's uniquely attractive about this advisory is its online platform. The firm offers this feature on what they call The War Room. We will discuss this premium service in greater detail below.

Aside from The War Room, the research firm also has a free electronic letter, Trade of the Day.

An upgrade to this traditional newsletter would be Trade of the Day PLUS. The paid service provides updates, reports, and videos from the publishing team.

The investment advisory firm is part of The Agora, an umbrella group of companies. We have extensively written about it here on this website.

Read The Agora – Scam Company or Legit? to have a fuller appreciation of the company. Another good accompanying piece would be our article on its founder, Bill Bonner.

These would give you a long view of Monument Traders Alliance and what you may expect from them.

Some may wonder why we need to mention such an association. For sure, this firm could stand on its own merits. At the same time, others' faults do not necessarily reflect on this particular advisory.

We do agree with such sentiments. However, we do not place any malice when we give additional objective and verifiable information. We are merely adding critical links would-be subscribers might find helpful.

It is true that Monument Traders Alliance has its own team and experts. But it is also true that it is associated with The Agora.

Whether we like it or not, there are people who have valid complaints about the firm. There are legitimate reasons why some would reasonably stay away from allied groups.

You can read about these in the articles we just mentioned. These are objective and fair reviews that present legit details.

The decision to trust them is all up to the consumers. They alone can make such a determination. But people can only make informed choices when armed with enough data.

This is all that we provide, information that you can use. If you know about such links and still deem Monument Traders Alliance as credible on its own, great.

At least you were able to see all angles before you decided to subscribe. Mind you, you are not only letting go of your hard-earned money. You are also giving them your personal details.

If you do not read the fine print properly, you can be subjected to spam mails. Some also experience unauthorized credit card charges.

So it is always better to be extra careful when it comes to these things.

What is Monument Traders Alliance?

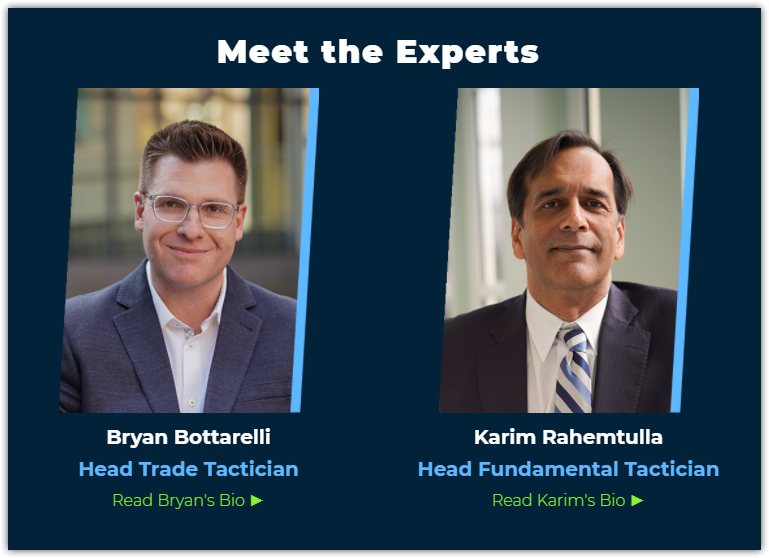

Two individuals who claim to be experts head the investment research company. Bottarelli is the Head Trade Tactician, while Rahemtulla serves as Head Fundamental Tactician.

Website

When we looked at its website, we could not help but admire its interface. This is noteworthy because compared to most, it is a standout.

The color schemes are attractive and clean. Also, the interface is user-friendly. We deem these relevant because such features make the firm appealing to both the young and old.

Often, some websites look traditional and dull, losing the interest of younger crowds. To most, this is a non-issue because a lot of advisory services usually cater to older people.

But being in a saturated market, it always helps to expand one's appeal. We believe that, in general, making investing appealing to more people will benefit everyone.

Aside from the aesthetics, a website that's easy to navigate will be helpful to those who do not consider themselves techies.

We often read that older people complain about how complicated some websites can be. It can be troublesome when they are confused about which page to go to or which buttons to click.

Sometimes, they unknowingly subscribe to newsletters they are only superficially curious about. These instances lead to long-winding and unfortunate complaints and refund requests.

So a functioning and user-friendly website is crucial in any research company. On this specific note, Monument Traders Alliance passes with flying colors.

Speculation

Front and center on its website is its mission statement: Restoring the Lost Art of Speculation.

What exactly does this mean? According to the firm, it wants to demystify the process of speculation. By giving its subscribers the tools necessary, more people will understand the practice.

In addition, company leaders would supply their readers with the market intelligence they can use. Using such information will enable them to make better investing and trading decisions.

In an apparent push for its flagship program, Bottarelli and Rahemtulla also advertise what makes their firm special. They say that they provide “real-time actionable advice.”

This service, according to them, will send subscribers' “daily profit-making potential into the stratosphere.”

You may once again be rolling your eyes with such a claim. Let's examine the last sentence. Can you really have sky-high profits every day?

Sure, the word “potential” suggests tentativeness. At least there is an apparent attempt at tempering subscribers' expectations.

However, we think it is a tiny attempt compared to the kind of promises they dish out.

Before we go further, we deem it best to talk about what speculation is first. Our website has also covered this type of investing in the past.

You may refer to our articles on Alex Koyfman's Microcap Insider and The Casey Report to learn more. These services pretty much operate on the same principles.

Basically, a speculator is one who makes investment decisions based on market uncertainty. They recognize and embrace this fact. Speculators then assess the future and invest based on their projections.

Because of this, it is essential for them to know always what's happening around the world. In the case of Doug Casey, he travels the world to understand the economic effects of political events.

When governments intervene in the markets, “dislocations” occur. Such are opportunities for profit for a speculator.

For Casey, not all speculative investments are high-risk. As the foremost authority on rational speculation, he believes predictions must have a basis.

Financial decisions need to be anchored on solid research and analysis. This is what responsible speculators do: look at the big picture. It's not about pure luck.

For its part, Monument Traders Alliance believes in setting aside a portion of one's portfolio in speculative investments. It is a wise way of diversification.

The firm's key leaders advise people to allot 90% to 95% of their wealth to safe and steady investments. This way, you would have no trouble sleeping at night.

If you play this strategy well, you could still outperform the S&P 500.

But they also advise that you invest the remaining percentage in something with higher rewards. Apart from giving you more profit, it is also more exciting.

In fact, proponents of the strategy claim that this portfolio can even exceed your gains in your safer investments.

The key is to execute the tactic well. Bottarelli and Rahemtulla say you have nothing to worry about.

They have consistently proven how good their methods are, they claim. Since they are smart in their projections, you can rely on their recommendations.

They guarantee that you will be able to invest ahead of others so you can reap your rewards early. What good will it be for any investor if they learn about income opportunities late in the game?

Guide for Speculators

So how do speculators work their magic? Doug Casey's article, How to Speculate Your Way to Success, provides answers.

Since Monument Traders Alliance brands itself as speculation experts, we believe you need to know this information.

Casey is a “best-selling author, world-renowned speculator, and libertarian philosopher.”

The line is his usual press release introduction. Apparently, the titles supposedly give him the authority on the subject.

So how does he evaluate which companies to invest in? Casey uses what he calls “The Eight Ps of Resource Stock Evaluation.”

For him, the most crucial element of all is People. A company must have competent, reliable, trustworthy leaders. Its leaders must have a solid track record of success.

Another critical characteristic of a successful business is its Property. Casey seeks the help of geologists and engineers in this item.

The author-investor also deeply examines the Phinances of stocks he would invest in. It must have enough resources to fund its next goals.

The company's Paper, meanwhile, refers to a company's share structure. This is also crucial for a speculator to see.

In addition, investors need to see how a business does its Promotions. People must be aware of its projects to attract buzz and attention,

Casey also factors in Politics in his calculations as these affect the market. Most speculators, his team included, avoid problematic investments that have government interventions.

Another significant P is Push. This refers to milestones that can push share prices higher.

Of course, speculators closely watch the share Price.

Given all of this, you would see that there is more to speculative investments. It is not just about making predictions out of thin air.

After absorbing all available information, these investors weigh all options. They look at the big picture, then make the necessary projections.

Of course, this applies to responsible and intelligent speculators. The question is, can we classify Bottareli, Rahemtulla, and their colleagues as such?

Leadership Team

Wild claims and sky-high promises notwithstanding, the company's leaders seem to be credible. At least based on its website.

Monument Traders Alliance boasts that it has various experts on its roster. It includes Chicago Board Options Exchange (CBOE) traders, hedge fund managers, and retired CEOs.

There also are technical charting and volatility experts, as well as researchers and analysts.

But the most prominent faces of the company are Bottarelli and Rahemtulla.

The former is the Founder and Head Tactician of the group. A graduate of Indiana University Kelley School of Business, he's the moderator of The War Room.

Bottarelli's claim to fame is his on-the-ground training at the CBOE. During the technology boom, he was right at the center of all the action.

As a result, he says he got first-hand training from the best in the industry. To apply all his learning, he created Bottarelli Research in 2006.

His company catered to an exclusive clientele who wanted to take advantage of his expertise. It was operational until 2018.

As a trader, the Founder classifies himself as a “play tactician.” He uses his technical know-how and actual experiences as bases for his actions.

Such a combination, he says, guarantees growth and profit. Due to his skills, he also claims that he can minimize all possible risks.

Meanwhile, Rahemtulla is the group's Co-Founder and Head Fundamental Tactician. He has over thirty years of international markets and options trading experience.

According to the company's website, he is an investment research veteran. The trader is the Co-Founder and was the Chief Options Strategist of Wall Street Daily,

In the past, he served as the editor of Automatic Trading Millionaire.

Press releases also say that he was among the youngest CFOs of a “brokerage and trading firm that cleared through Bear Stearns in the late 1980s”.

How this is supposedly an exciting or relevant trivia escapes us at the moment. But you know how these profiles usually are. Editors use and abuse any superlative they can hold on to.

So at least now, you know Rahemtulla more because of this information.

Aside from that, he claims that he uses a proprietary volatility and probability modeling system. This supposedly accurately predicts risks and rewards.

Unfortunately, we were not able to see adequate information about this in our research. This is unfortunate since it does sound promising.

We are not expecting to see a detailed explanation of his process since it may be his secret weapon. However, we do need to see a measure of proof so we can be convinced.

As we all know, talk is cheap among editors and publishers. Even if most people accept such claims right away, our goal is to increase their skepticism.

We are not doing this to destroy any company's reputation. All that we want is for publishers to be more responsible with their claims. Since they are service companies, they must take care of their customers.

For Rahemtulla, he says he uses a variety of methods and investments to help his clients. These include small-cap investing, spread trading, put selling, and LEAPS trading.

As a speculator, he does seem to be aware of global events and trends. His book, “Where in the World Should I Invest?”, is about which parts of the world it would be best to invest in.

Services

The War Room

Judging by the cost of the services, it's evident that the flagship program is The War Room. We have a detailed review of the advisory on this website.

Go check that out before deciding to subscribe. Keep in mind that the annual fee is substantial.

A one-year subscription costs $2,500. If you want to save money, you may avail of the two-year subscription package. You can get the service for $3,500 in this special deal.

The War Room introduces a unique innovation to investment research. We know that most deliver their services every month. There are a few who send weekly reports.

But with Bottarelli's service, you get real-time trade advice every single day. So this means that you may get multiple prompts daily.

Instead of sending you regular reports, the publisher asks you to enter their online platform. Inside, you will see the updates that you need.

Aside from investment recommendations, the program allows members to interact with each other. The goal is to foster a community of traders who share additional insights and analyses.

Sounds cool, right?

If legit, subscribers will get timely reports they can act on. The thing is, often, subscribers receive investing recommendations late. By the time they act on the given data, a lot has transpired already.

Also, it is promising because unfiltered conversations can mean immediate feedback also. Readers can quickly comment on what they think about the editors' recommendations.

So, should we take at face value the publisher's claims? In a while, we will be examining if this is what subscribers actually experience.

According to its website, the service has had over 900 winning trades since 2019. Phrased like this, it does seem impressive.

However, we were not able to see verifiable details on this number. First, anybody can just come up with any random number. Second, we do not see enough convincing proof for the claim.

How can we verify that Bottarelli or Rahemtulla indeed made such calls?

In addition, being a relatively new service, it cannot claim a long, reliable track record. So we still need to verify if it indeed performs as well as advertised.

The War Room categorizes its recommendations into three.

Overnight Trades are all about options. According to the publisher, this is your chance to make money even when the markets are closed.

Meanwhile, Sniper Trades are based on stocks poised to “quickly gap up or gap down”. These are options trades designed to capture the price movements.

Using a special play on Nasdaq, Market Swing Trades will allow you to profit on an upswing or downswing.

To entice you further, Bottarelli even offers a guarantee. The trader will give you free lifetime access if you fail to get 300 winning trades in a year.

To be honest, it is a risky and bold move. If hundreds or thousands would claim it, he stands to lose a lot. By his estimate, he would end up losing around $10 million with the proposition.

Trade of the Day PLUS

In this service, you will get the team's best-timed plays every week. The publisher will also provide you with strategies on timing when you buy or sell.

Once you avail of the service for $79 per year, you will receive weekly video trade updates. These include top plays on large- and small-cap stocks and LEAPS.

You will even receive specific ticker symbols and what actions you need to take.

Monument Traders Alliance will also give you access to their library. In it, you will be able to see its research on their winning strategies.

As a bonus feature, the company will also give you access to Wall Street’s Most Treasured Secrets… UNCOVERED! It is an eight-part series that will help you gain more insights on investing.

Trade of the Day

The third and last service of the firm is a free newsletter. You will receive this every 5 pm during weekdays.

The report will supposedly give you updates and analyses. Even if this is free, the company promises to provide you with high-quality content.

You will even receive special video episodes that talk about how markets behave.

So the question is, will you really get valuable information from the two services? Or do they just serve as promotional materials for the pricier premium platform?

Track Record and Reviews

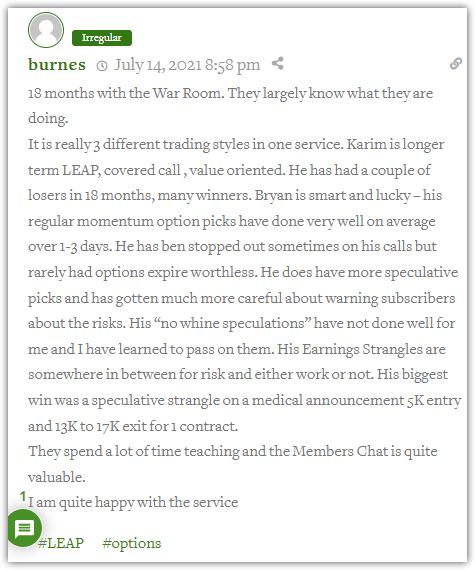

Stock Gumshoe only has a review page for The War Room. The platform has a 3.9/5 rating from less than 15 subscribers.

According to the only comment as of this writing, Bottarelli and Rahemtulla provide a good balance to the service. Each has his own strengths, which benefit readers on the platform.

In addition, “burnes” says that the chat room for members is a plus.

This is something that we have anticipated early on. If the team can maximize it the way Stock Gumshoe has, the comments themselves would be a come-on for subscribers.

If the members are indeed free to talk, they would indeed be helpful to other subscribers.

First, they can give tips and tactics that others can learn from. A free-flowing exchange of ideas will encourage even those who are new in the trade.

Second, if members are allowed to be honest, they can even comment on the quality of the service they receive. We have tried to research this very issue, but we could not find materials.

That said, we are also aware that this is risky for the publishers. However, if they can build a healthy atmosphere early on, this would be a home run.

We have also taken a look at the feedback on Better Business Bureau. From about 20 reviewers, Monument Traders Alliance got 4.5/5 stars.

The review section is where it gets interesting. 15 reviewers gave 5 stars, while the remaining gave 1, 2, and 4 stars.

Here are just some of the statements from the reviews:

Traders of options learn the true safe way to be in the options trades. Every member learns how to profit in both an up or down market.

This is an unselfish site for traders that understand, or can learn, the risk and discipline needed to be profitable.

Not only does the Alliance come up with winning trading opportunities, but it enables the user to learn by asking questions of an advisory staff on how to go about it.

My review is based on results. Results mean that I don't make money on every trade but overall, combined with my self-acquired trading skills, the gains outweigh any losses, even deducting the costs of the services.

So you see, based on just a tiny sample, you would see its positive aspects. They seem to answer all the apprehensions potential subscribers might have. Again, this is only just a small sample.

The question is, are these comments legit?

One reviewer with the username Anthony W does not seem to think so:

That's quite a take, right?

According to him, his experience was far from what was advertised. It also is nowhere near the narrative of other reviewers. He says that as he followed the investment recommendations on the platform, he lost money.

Well, this is a bummer, especially if you were expecting to receive sky-high gains. If you invested a significant amount of money, losing them despite assurances is really troublesome.

This is the reason why we encourage people to read more. If you would evaluate claims more thoroughly, there's a lesser chance that you would be put in such a situation.

Unfortunately, there still are those who immediately believe even outrageous promises. It is not entirely their fault, since we know there is poor implementation of existing regulations.

Based on our learning from our article on the Raging Bull fraud case, there are limits to claims companies can make. Sadly, there are very few examples where we see actual accountability.

Another thing that makes the situation worse is the comment about blocking. According to “Anthony W”, the platform will block you once you confront them.

Well, this is counterproductive, if true. It goes against the very idea of a vibrant community. Of course, we do not also know the specific circumstances in the case.

So are we saying that we are taking the side of one commenter? No, we are not.

The value in the comment, we believe, is the skepticism it gives us. It gives us a reason to pause.

Such hesitation is healthy, in our opinion. We must not immediately believe wild claims. Remember, with investment research firms, it's not just about the annual costs.

It is also about the money you will invest based on a publisher's recommendations. So do take that into account before you subscribe.

As always, you know that we present good and bad comments to be fair and balanced. A few comments online do not automatically reflect the quality of a publisher's service.

Some comments may be because of spite. It's also true that some may be from those connected with the companies themselves. It's hard to verify which is which nowadays.

So the solution is to present all sides and let you decide. It would also be great if you could research on your own as well. This way, you can weigh for yourself how you wish to proceed.

Pros v Cons

Pros

- User-friendly, easy to navigate website

- The War Room provides daily real-time advice on its online platform

- Subscribers get to interact inside the platform

Cons

- Limited services

- Tendency to overpromise

- Subscribers' feedback that other services are merely pitches for The War Room

Conclusion – Should You Be an Ally?

Bottarelli and Rahemtulla promise you a lot of benefits when you subscribe to their services. With their compelling arguments and their sleek website, it's easy just to say yes.

However, we have presented reasons why you need to think this decision through first. This way, you will not have regrets when you do avail of their services.

So, is Monument Traders Alliance a scam? Well, we hope that at this point, you could determine that on your own based on our in-depth discussion.