Venture capitalist Matt Milner is teasing a way to get a pre-IPO stake in one of the world's most valuable private companies – ChatGPT maker, OpenAI.

History shows that insiders always pocket the biggest gains and now, we too can get actual Pre-IPO Shares in our hands.

The Teaser

Matt isn't talking about a backdoor way to invest or buying a stake in a secret partner, but direct pre-ipo stock in OpenAI…or so it seems.

Crowdability is an equity crowdfunding platform and Matt Milner is its co-founder.

Matt spent some time on Wall Street before starting, selling, and investing in several technology companies.

Now he's in the investment newsletter business and we have covered Matt's “Pre-IPO Cheat Codes” teaser and done a deep dive on the man himself as well.

OpenAI's ChatGPT is the fastest-growing consumer app in history, going from 0 to 100 million monthly users in just two months and a $500 billion valuation in less than three years.

According to Matt's analysis, the generative AI leader's revenue could surge by as much as 46,000% over the next five years.

If this happens, OpenAI will become one of the most valuable companies in the world and one of the most valuable investments in the process.

But how is it going to make the leap from startup unicorn to global powerhouse?

Matt lists off three ways:

Project Stargate

Besides being the thing that is supposed to turn America into the world's dominant artificial intelligence superpower. It also doubles as OpenAI's infrastructure platform.

OpenAI, along with it's partners, Oracle and SoftBank, have committed to investing $500 billion to create 10-gigawatts of data center capacity over the next few years.

The flagship site in Abilene, Texas is already up and running, and when all is said and done, it won't just be the world's largest data center hub. Project Stargate will also provide OpenAI with more computing capacity than any other business in the world.

AI Brain Chips

Matt doesn't mean this literally.

He's talking about the specialized microchips designed specifically to handle AI-related tasks.

Up until now, OpenAI has relied on third-party suppliers like Nvidia for its chips. But as a matter of necessity, it has started building it's own custom AI chips to be able to scale its generative AI models.

Mass production could start as early next year and the move is expected to produce as much as $56 billion in annual cost savings.

The Mega-IPO

Matt believes Sam Altman could announce that OpenAI will be going public as early as October 6th.

This means that there's still time to buy pre-ipo shares, but the window is closing fast.

The Pitch

Matt is teasing a step-by-step guide showing us where to go, what to do, and how to lock in our stake in OpenAI, before an inevitable IPO.

The way to do so is with a subscription to his pre-ipo research newsletter, Private Market Profits.

A one-year membership is not cheap. It costs $1,500 upfront, but it comes with a 30-day money-back guarantee and research on one high-potential company before it goes public each month.

The Major Benefits and Negatives of Investing in Pre-IPO Shares

On average, are investments in private, pre-ipo companies more profitable than investing in the stock market?

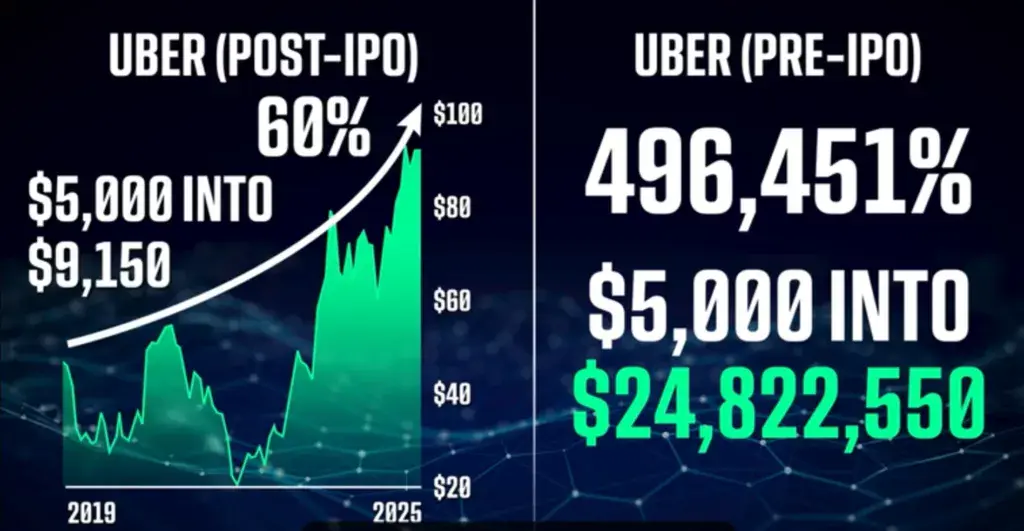

Matt makes his case by citing the gains of early investors in major IPOs, such as Google, which netted some of the earliest investors as much as 240,000%.

Also cited is Facebook, which gave pre-ipo investors returns of up to 200,000%, and Uber, with gains of almost 497,000% going to some of its initial investors.

All one would need is just one of these in a lifetime to be swimming in cash like Scroog McDuck.

However, these are extreme outliers.

There's no reliable figure for average pre-ipo investment returns, like we have for public markets with the S&P, but some studies show that investing in late-stage pre-IPO companies tends to yield higher returns than post-IPO investments.

This isn't saying much when the median annual return for IPOs from 2014 to 2024 was only 6%. Lower than the market average by more than 7 points.

So, the stock market prevails, on average, not to mention that it's liquid and doesn't have any arbitrary investment minimums.

However, if there ever was a major IPO and potential outlier, its OpenAI.

By most accounts, it's the second or third most valuable ‘unicorn' in the world and if it were a public company, it would be solidly in the top 50 by market cap.

The only question is, can we as individual investors get our hands on scarce pre-ipo shares in one of the most hotly anticipated public listings ever or is there a catch?

How to Get Pre-IPO Shares of OpenAI

At several intervals during Matt's 1 hour and 7 minute long video presentation, he says:

Through my network, I've found a special way to grab a pre-ipo stake in OpenAI

Much later, around the 41-minute mark to be precise, Matt confesses that only qualified investors, who meet certain wealth and income standards can get accredited to buy pre-ipo shares.

This means having a minimum net worth of $1 million, excluding your primary residence, or annual income of $200,000 in each of the past two years.

I also checked Crowdability's deal section and OpenAI isn't listed anywhere, so Matt must mean access to shares through his extended network.

Instead of direct pre-ipo stock in OpenAI, what we end up with is a backdoor way to invest in the generative AI giant.

Matt recommends SuRo Capital Corp. (Nasdaq: SSSS) as his preferred way to get exposure.

SuRo is a publicly traded investment fund that invests in venture-backed, private companies, including OpenAI, which it in-directly owns via it's stake in ARK Type One Deep Ventures Fund LLC.

This is nice and all, but the investment version of Kevin Bacon's six degrees of separation is not what we were promised at the outset.

A blatant investment newsletter bait and switch, but how much can we really make by investing in OpenAI?

Make 10x Our Money?

We have seen how much we can potentially make with pre-ipo shares of outliers as well as the median pre-ipo return.

Where on this spectrum is buying into OpenAI likely to fall?

In 2024, OpenAI made $3.7 billion in revenue, while posting a $5 billion net loss. Turns out, running hundreds of thousands of servers is expensive.

The silver lining is the company's explosive growth.

It is expected to report fiscal year 2025 revenue of about $12.7 billion, more than triple last year's total, with a corresponding growth in red ink.

At this pace, it could live up to it's $500 billion valuation in under five years.

Additionally, it could also turn a profit within the same timeframe, which would give it's stock a further boost.

A ten bagger return is definitely on the table, plus a whole lot more if OpenAI maintains its lead in generative AI.

As for SuRo, it's stock trades at a slight discount to net asset value (NAV), making it a decent value buy to get exposure to privately-held startups.

Quick Recap & Conclusion

- Private company investing enthusiast Matt Milner is teasing a way to get pre-IPO shares in one of the world's most valuable private companies – ChatGPT maker, OpenAI.

- We were promised a direct way to buy shares in OpenAI, no extra steps like backdoor ways to invest or buying stakes in secret partner stocks.

- Matt pitches a step-by-step guide showing us where to go, what to do, and how to lock in our stake in OpenAI, before an inevitable IPO. The only way to get it is with a subscription to his pre-ipo research newsletter, Private Market Profits, which costs $1,500 upfront per year.

- In the end, we find out that the only way to directly buy pre-ipo shares in OpenAI is to be an accredited investor. A classic bait and switch, but besides this, Matt also recommends SuRo Capital Corp. (Nasdaq: SSSS) to get in-direct exposure to OpenAI.

- OpenAI is growing at a blistering pace, 3.5x'ing it's revenue year-over-year making it an easy ten bagger candidate and possibly much more. SuRo is also a decent pick up to get exposure to private startups in general, selling for less than it's NAV.

Will OpenAI live up to the hype and its potential? Leave your thoughts in the comments.